重要なバーフィルタリングに基づくブレイクアウト蓄積戦略

概要

この戦略は,K線の意柱のを判断してトレンドを予測し,突破信号と組み合わせて取引信号を発信する.戦略は,過小のK線をフィルターして,意柱ののみを分析し,過度に頻繁な小落によって干渉されないようにし,信号をより平坦に安定的に信頼できるようにする.

戦略原則

現在のK線の実体長bodyを判断すると,過去6つのK線bodyの平均値の3倍以上である場合は,意柱線であると考えます.

連続3根意柱線が陽線であれば,多頭信号と判断する.連続3根意柱線が陰線であれば,空頭信号と判断する.

判断信号と同時に,価格が突破する前に高点または低点があれば,追加取引信号も生成されます.

SMA均線をフィルターとして使用し,価格がSMAを突破したときにのみポジションを開きます.

ポジションを保持した後,価格が再びエントリーポイントまたはSMA平均線を突破した場合,平仓する.

優位分析

の意味の柱のを使ってトレンドを判断し,不必要な干渉を過濾して信号をより明確にする.

トレンド信号とブレイク信号を組み合わせることで,信号の質を高め,偽信号を減らすことができる.

SMA均線フィルタは,高殺低の追尾を回避する.Closing以下で買い,Closing以上で売り,信号の信頼性を高める.

ストップ・ストップ・損失の条件を設定し,早期にストップ・損失を止めることができ,資金の保存に役立ちます.

リスク分析

この戦略は,より激進的で,3つのK線判断信号を使用し,短期的な振動をトレンドの逆転と誤判する可能性があります.

検査データは不十分で,種や周期によって効果が異なる可能性があります.

夜盤の夜間ポジション管理が加入されていないため,夜間ポジションのリスクがある.

最適化の方向

意義柱線のパラメータは,判断されたK線の数,意義の定義など,さらに最適化することができる.

異なる周期パラメータによる効果の影響をテストし,最適な周期を探します.

ATR ストップを追加してリスクをコントロールできます.

夜間ポジション制御ロジックを追加することも検討できます.

要約する

この策略は,意味の柱線フィルター波動とトレンド判断を利用し,突破形成取引信号と組み合わせて,不要な小さな波動を効率的にフィルターし,信号をより明確に信頼できます.しかし,判断周期が短いため,一定の誤判リスクがある可能性があります.パラメータ最適化と風力制御手段によってさらに完善することができます.

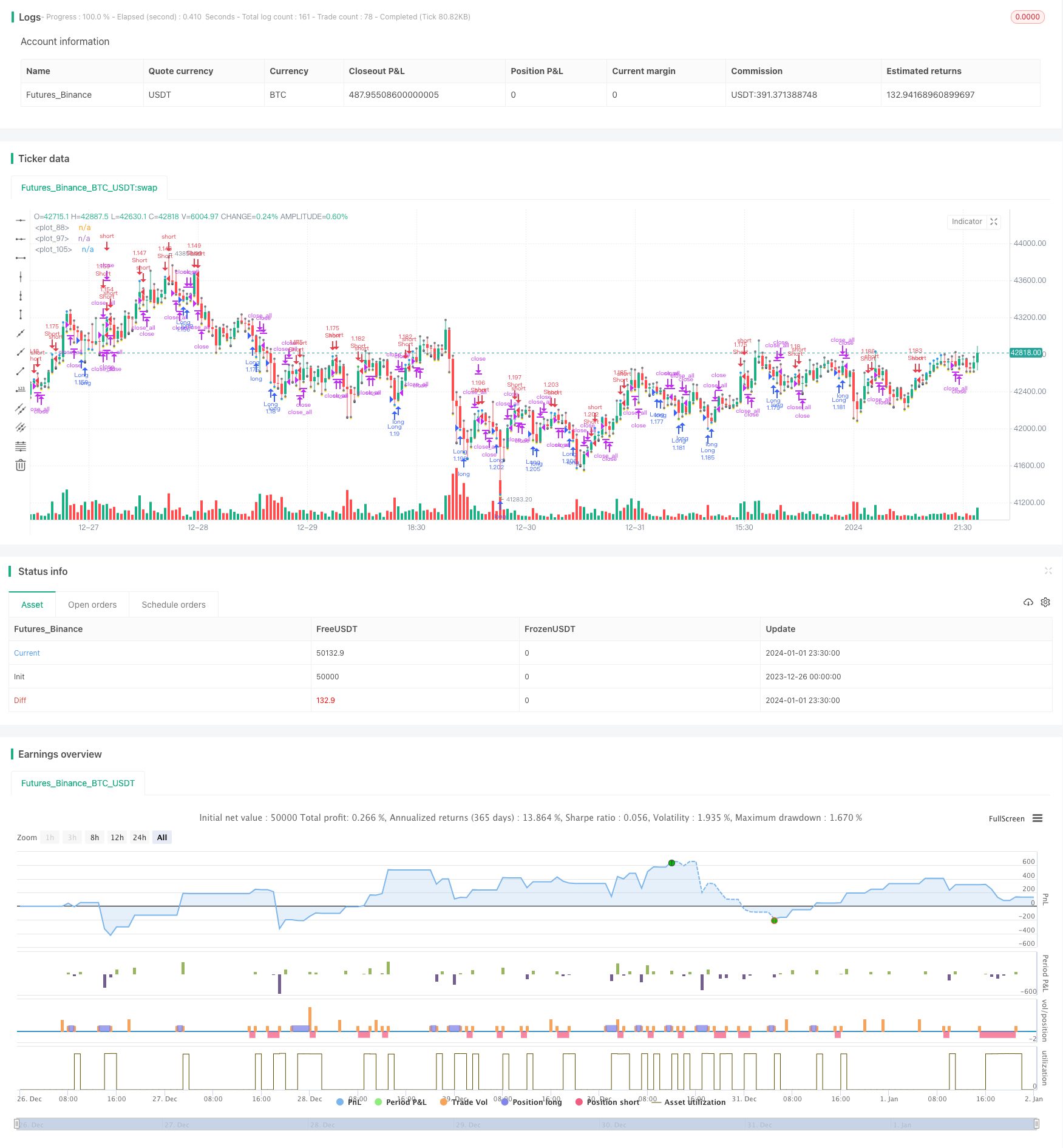

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-02 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//AlexInc

//2018

// закрытие - вычислить и в течение скольки-то баров его добиваться

// если нет, то по первому противоположному

// по стоп-лоссу в любом случае - стоп вычислить

//@version=2

strategy(title = "AlexInc's Bar v1.2", shorttitle = "AlexInc Bar 1.2", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

tryprofitbars = input(6, defval = 6, minval = 1, maxval = 100, title = "Number of candles to take profit anyway")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

useSMAfilter = input(false, defval = true, title = "Use SMA filter")

SMAlimit = input(10, defval = 10, minval = 1, maxval = 30, title = "SMA filter limit")

bodysizeMlt = input(3, defval = 3, minval = 1, maxval = 10, title = "Body Size Multiplier")

meanfulbardiv = input(3, title = "Meanful Bar size Divider")

showarr = input(false, defval = false, title = "Show Arrows")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//SMA #

index = 0

index := barstate.isfirst ==true ? 0 : nz(index[1])+1

buyindex = 0

buyindex := barstate.isfirst ==true ? 0 : buyindex[1]

sellindex = 0

sellindex := barstate.isfirst ==true ? 0 : sellindex[1]

//predictprofit = barstate.isfirst ==true ? 0 : predictprofit[1]

smafilter = sma(close, SMAlimit)

//Body

body = abs(close - open)

range = abs(high - low)

abody = sma(body, 6)

max3 = 0

if body >= body[1] and body >= body[2]

max3 := body

else

if body[1] >= body and body[1] >= body[2]

max3 := body[1]

else

if body[2] >= body and body[2] >= body[1]

max3 := body[2]

prevmax3 = 0

prevmax3 := nz(max3[1])

bar = close > open ? 1 : close < open ? -1 : 0

firstbullishopen = 0

firstbullishopen := bar == 1 and bar[1] != 1 ? open : nz(firstbullishopen[1])

firstbearishopen = 0

firstbearishopen := bar == -1 and bar[1] != -1 ? open : nz(firstbearishopen[1])

meanfulbar = body > abody / meanfulbardiv

meanfulbearish = 0

meanfulbearish := nz(meanfulbearish[1])

meanfulbullish = 0

meanfulbullish := nz(meanfulbullish[1])

if meanfulbar

if bar == 1

meanfulbullish := 1 + meanfulbullish

meanfulbearish := 0

else

if bar == -1

meanfulbearish := 1 + meanfulbearish

meanfulbullish := 0

plot(min(low, high)-10, style=circles, color = meanfulbar ? yellow:black, linewidth=3)

//Signals

up1 = (meanfulbearish >= 3) and (close < firstbullishopen or 1) and (strategy.position_size == 0 or close < strategy.position_avg_price) and body > abody / 5 and (useSMAfilter == false or close < smafilter)

if up1 == true

predictprofit = sma(body, 3)

up2 = sma(bar, 1) == -1 and body > prevmax3 * bodysizeMlt and (strategy.position_size == 0 or close < strategy.position_avg_price) and body > abody / 5 and (useSMAfilter == false or close < smafilter)

if up2 == true

predictprofit = body * 0.5

plot(min(low, high), style=circles, color = up1?blue:up2?green:gray, linewidth=3)

dn1 = (meanfulbullish >= 3) and (close > firstbearishopen or 1) and (strategy.position_size == 0 or close > strategy.position_avg_price) and body > abody / 5 and (useSMAfilter==false or close > smafilter)

if dn1 ==true

predictprofit = sma(body, 3)

dn2 = sma(bar, 1) == 1 and body > prevmax3 * bodysizeMlt and (strategy.position_size == 0 or close > strategy.position_avg_price) and body > abody / 5 and (useSMAfilter==false or close > smafilter)

if dn2 ==true

predictprofit = body * 0.5

plot(max(low, high), style=circles, color = dn1?blue:dn2?green:gray, linewidth=3)

exit = (((strategy.position_size > 0 and bar == 1 ) or (strategy.position_size < 0 and bar == -1)) and body > abody / 2 )

// or index >= buyindex (or sellindex) + tryprofitbars

//Arrows

col = exit ? black : up1 or dn1 ? blue : up2 or dn2 ? red : na

needup = up1 or up2

needdn = dn1 or dn2

needexitup = exit and strategy.position_size < 0

needexitdn = exit and strategy.position_size > 0

plotarrow(showarr and needup ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needdn ? -1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needexitup ? 1 : na, colorup = black, colordown = black, transp = 0)

plotarrow(showarr and needexitdn ? -1 : na, colorup = black, colordown = black, transp = 0)

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

if up1 or up2

if strategy.position_size < 0

strategy.close_all()

buyindex = index

sellindex = index

if strategy.position_size == 0

buyindex = index

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot )

if dn1 or dn2

if strategy.position_size > 0

strategy.close_all()

buyindex = index

sellindex = index

if strategy.position_size == 0

sellindex = index

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot )

if exit

strategy.close_all()