PPO 価格に敏感なモメンタムダブルボトム方向性取引戦略

概要

PPO価格感知動量双底定向取引戦略は,価格感知動量指標を用いて価格双底形成のトレンドを追跡する取引戦略である.PPO指標の双底形成判断と価格動量特性の判断を組み合わせ,価格双底逆転点の正確な位置を実現し,取引信号を生成する.

戦略原則

この戦略は,PPO指数を使用して価格の二重底の特徴を判断し,価格の最低点と組み合わせて判断し,PPO指数に底の特徴が現れているかどうかをリアルタイムで監視する.PPO指数に下から上へと逆転する二重底の形が現れるときは,現在購入のチャンス点にあることを示している.

一方,この戦略は価格の最小値判断と連携し,価格が低いレベルにあるかどうかを判断する.価格が低いレベルにあるとき,PPO指標が底の特徴を示した場合,購入シグナルを生成する.

PPO指数反転特性の判断と価格位置の確認による二重判断により,価格反転の機会を効果的に識別し,いくつかの偽信号をフィルタリングし,信号の質を向上させることができます.

優位分析

PPO指数の二重底形を利用して,購入タイミングを正確に決定できます.

価格位置判断と組み合わせて,高点から発生する偽信号をフィルターして信号の質を向上させる.

PPO指標は,価格変化の傾向を素早く捉え,トレンド追跡に適しています.

双重確認メカニズムは,取引のリスクを効果的に軽減します.

リスクと解決

PPO指標は偽信号を発生しやすいので,他の指標で補足して確認する必要がある.均線指標または波動指標で補足することができる.

双底反転が一定に持続しないため,再び下落するリスクがある. ストップ・ロスを設定し,ポジション管理を最適化することができる.

パラメータ設定が不適切である場合,漏えいや誤購入のリスクが生じます.パラメータの組み合わせを繰り返しテストして最適化する必要があります.

コードが大きいので,モジュール化が続けられ,コードの重複が少なくなります.

最適化の方向

ポジション管理戦略の最適化.

平均線指数または波動指数の補助確認を追加する.

コードをモジュール化して,判断の論理を繰り返さないようにする.

安定性を向上させるため,パラメータを最適化し続けます.

試作品種によるアベレージメントの応用について

要約する

PPO価格感受性の動力双底定向取引戦略は,PPO指標の双底特性を捉え,価格位置の判断による二重確認を組み合わせて,価格逆転の有効な定着を実現する.単一の指標判断と比較して,判断の正確さ,フィルターノイズの優れた優位性を有する.しかし,この戦略には,一定の偽のリスクシグナルも存在し,指標ポートフォリオの最適化を継続する必要があり,厳格なポジション管理戦略に付随して,実質的に安定した利益を上げることができる.

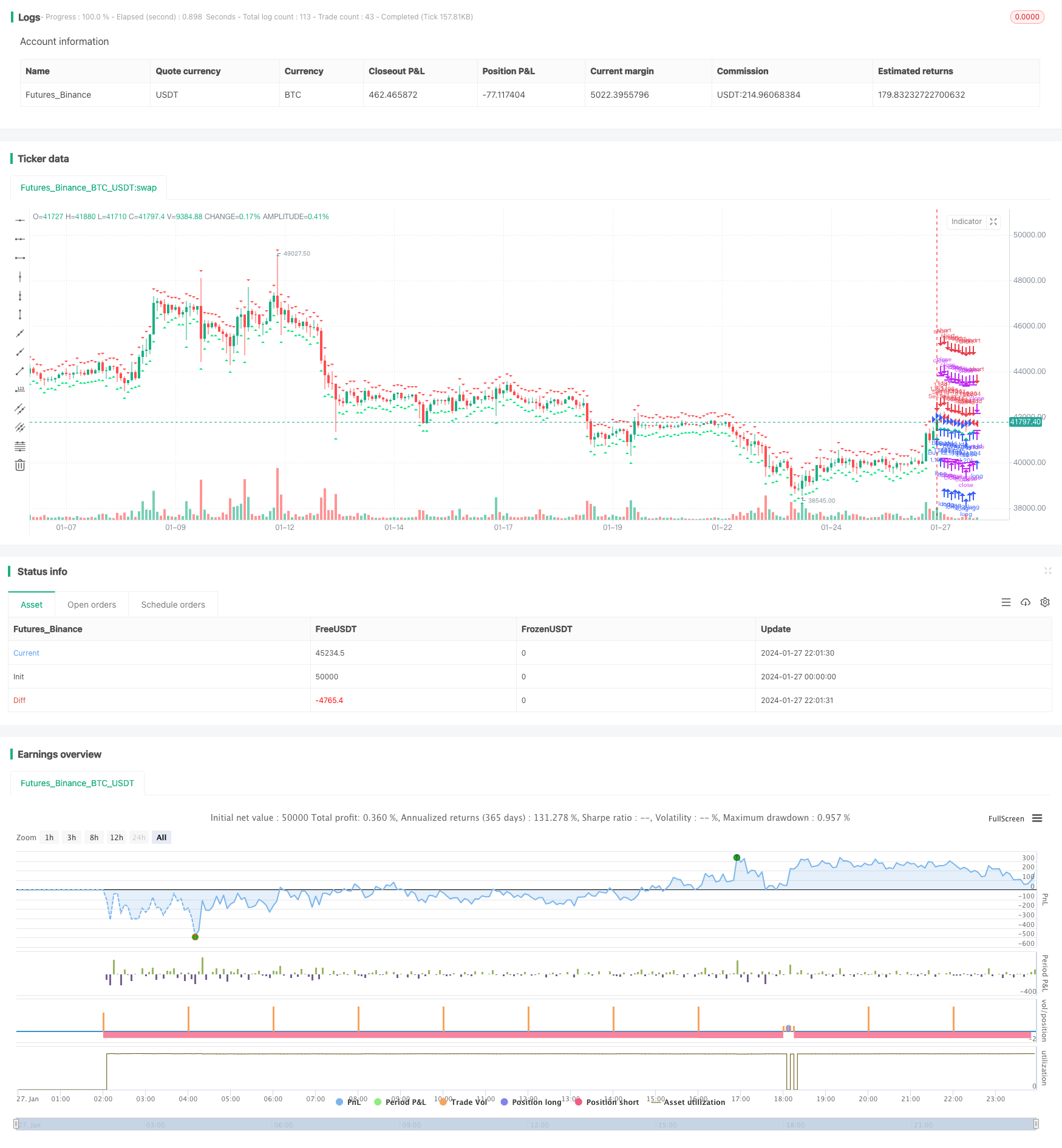

/*backtest

start: 2024-01-27 00:00:00

end: 2024-01-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © luciancapdefier

//@version=4

strategy("PPO Divergence ST", overlay=true, initial_capital=30000, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// time

FromYear = input(2019, "Backtest Start Year")

FromMonth = input(1, "Backtest Start Month")

FromDay = input(1, "Backtest Start Day")

ToYear = input(2999, "Backtest End Year")

ToMonth = input(1, "Backtest End Month")

ToDay = input(1, "Backtest End Day")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false

source = close

topbots = input(true, title="Show PPO high/low triangles?")

long_term_div = input(true, title="Use long term divergences?")

div_lookback_period = input(55, minval=1, title="Lookback Period")

fastLength = input(12, minval=1, title="PPO Fast")

slowLength=input(26, minval=1, title="PPO Slow")

signalLength=input(9,minval=1, title="PPO Signal")

smoother = input(2,minval=1, title="PPO Smooth")

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

macd2=(macd/slowMA)*100

d = sma(macd2, smoother) // smoothing PPO

bullishPrice = low

priceMins = bullishPrice > bullishPrice[1] and bullishPrice[1] < bullishPrice[2] or low[1] == low[2] and low[1] < low and low[1] < low[3] or low[1] == low[2] and low[1] == low[3] and low[1] < low and low[1] < low[4] or low[1] == low[2] and low[1] == low[3] and low[1] and low[1] == low[4] and low[1] < low and low[1] < low[5] // this line identifies bottoms and plateaus in the price

oscMins= d > d[1] and d[1] < d[2] // this line identifies bottoms in the PPO

BottomPointsInPPO = oscMins

bearishPrice = high

priceMax = bearishPrice < bearishPrice[1] and bearishPrice[1] > bearishPrice[2] or high[1] == high[2] and high[1] > high and high[1] > high[3] or high[1] == high[2] and high[1] == high[3] and high[1] > high and high[1] > high[4] or high[1] == high[2] and high[1] == high[3] and high[1] and high[1] == high[4] and high[1] > high and high[1] > high[5] // this line identifies tops in the price

oscMax = d < d[1] and d[1] > d[2] // this line identifies tops in the PPO

TopPointsInPPO = oscMax

currenttrough4=valuewhen (oscMins, d[1], 0) // identifies the value of PPO at the most recent BOTTOM in the PPO

lasttrough4=valuewhen (oscMins, d[1], 1) // NOT USED identifies the value of PPO at the second most recent BOTTOM in the PPO

currenttrough5=valuewhen (oscMax, d[1], 0) // identifies the value of PPO at the most recent TOP in the PPO

lasttrough5=valuewhen (oscMax, d[1], 1) // NOT USED identifies the value of PPO at the second most recent TOP in the PPO

currenttrough6=valuewhen (priceMins, low[1], 0) // this line identifies the low (price) at the most recent bottom in the Price

lasttrough6=valuewhen (priceMins, low[1], 1) // NOT USED this line identifies the low (price) at the second most recent bottom in the Price

currenttrough7=valuewhen (priceMax, high[1], 0) // this line identifies the high (price) at the most recent top in the Price

lasttrough7=valuewhen (priceMax, high[1], 1) // NOT USED this line identifies the high (price) at the second most recent top in the Price

delayedlow = priceMins and barssince(oscMins) < 3 ? low[1] : na

delayedhigh = priceMax and barssince(oscMax) < 3 ? high[1] : na

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away

filter = barssince(priceMins) < 5 ? lowest(currenttrough6, 4) : na

filter2 = barssince(priceMax) < 5 ? highest(currenttrough7, 4) : na

//delayedbottom/top when oscillator bottom/top is earlier than price bottom/top

y11 = valuewhen(oscMins, delayedlow, 0)

y12 = valuewhen(oscMax, delayedhigh, 0)

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away, since 2nd most recent top/bottom in osc

y2=valuewhen(oscMax, filter2, 1) // identifies the highest high in the tops of price with 5 bar lookback period SINCE the SECOND most recent top in PPO

y6=valuewhen(oscMins, filter, 1) // identifies the lowest low in the bottoms of price with 5 bar lookback period SINCE the SECOND most recent bottom in PPO

long_term_bull_filt = valuewhen(priceMins, lowest(div_lookback_period), 1)

long_term_bear_filt = valuewhen(priceMax, highest(div_lookback_period), 1)

y3=valuewhen(oscMax, currenttrough5, 0) // identifies the value of PPO in the most recent top of PPO

y4=valuewhen(oscMax, currenttrough5, 1) // identifies the value of PPO in the second most recent top of PPO

y7=valuewhen(oscMins, currenttrough4, 0) // identifies the value of PPO in the most recent bottom of PPO

y8=valuewhen(oscMins, currenttrough4, 1) // identifies the value of PPO in the SECOND most recent bottom of PPO

y9=valuewhen(oscMins, currenttrough6, 0)

y10=valuewhen(oscMax, currenttrough7, 0)

bulldiv= BottomPointsInPPO ? d[1] : na // plots dots at bottoms in the PPO

beardiv= TopPointsInPPO ? d[1]: na // plots dots at tops in the PPO

i = currenttrough5 < highest(d, div_lookback_period) // long term bearish oscilator divergence

i2 = y10 > long_term_bear_filt // long term bearish top divergence

i3 = delayedhigh > long_term_bear_filt // long term bearish delayedhigh divergence

i4 = currenttrough4 > lowest(d, div_lookback_period) // long term bullish osc divergence

i5 = y9 < long_term_bull_filt // long term bullish bottom div

i6 = delayedlow < long_term_bull_filt // long term bullish delayedbottom div

//plot(0, color=gray)

//plot(d, color=black)

//plot(bulldiv, title = "Bottoms", color=maroon, style=circles, linewidth=3, offset= -1)

//plot(beardiv, title = "Tops", color=green, style=circles, linewidth=3, offset= -1)

bearishdiv1 = (y10 > y2 and oscMax and y3 < y4) ? true : false

bearishdiv2 = (delayedhigh > y2 and y3 < y4) ? true : false

bearishdiv3 = (long_term_div and oscMax and i and i2) ? true : false

bearishdiv4 = (long_term_div and i and i3) ? true : false

bullishdiv1 = (y9 < y6 and oscMins and y7 > y8) ? true : false

bullishdiv2 = (delayedlow < y6 and y7 > y8) ? true : false

bullishdiv3 = (long_term_div and oscMins and i4 and i5) ? true : false

bullishdiv4 = (long_term_div and i4 and i6) ? true : false

bearish = bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4

bullish = bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4

greendot = beardiv != 0 ? true : false

reddot = bulldiv != 0 ? true : false

if (reddot and window())

strategy.entry("Buy Id", strategy.long, comment="BUY")

if (greendot and window())

strategy.entry("Sell Id", strategy.short, comment="SELL")

alertcondition( bearish, title="Bearish Signal (Orange)", message="Orange & Bearish: Short " )

alertcondition( bullish, title="Bullish Signal (Purple)", message="Purple & Bullish: Long " )

alertcondition( greendot, title="PPO High (Green)", message="Green High Point: Short " )

alertcondition( reddot, title="PPO Low (Red)", message="Red Low Point: Long " )

// plotshape(bearish ? d : na, text='▼\nP', style=shape.labeldown, location=location.abovebar, color=color(orange,0), textcolor=color(white,0), offset=0)

// plotshape(bullish ? d : na, text='P\n▲', style=shape.labelup, location=location.belowbar, color=color(#C752FF,0), textcolor=color(white,0), offset=0)

plotshape(topbots and greendot ? d : na, text='', style=shape.triangledown, location=location.abovebar, color=color.red, offset=0, size=size.tiny)

plotshape(topbots and reddot ? d : na, text='', style=shape.triangleup, location=location.belowbar, color=color.lime, offset=0, size=size.tiny)

//barcolor(bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4 ? orange : na)

//barcolor(bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4 ? fuchsia : na)

//barcolor(#dedcdc)