ダブルファクターリバーサルバンドブレイクアウトコンビネーション戦略

作成日:

2024-02-01 10:45:12

最終変更日:

2024-02-01 10:45:12

コピー:

0

クリック数:

667

1

フォロー

1664

フォロワー

概要

この戦略は,逆転因子と波段通路因子によって共同で駆動される二要素組み合わせ戦略であり,多要素の重複を実現し,異なる市場環境で戦略的優位性を発揮することができる.

戦略原則

この戦略は以下の2つの子戦略で構成されています.

123逆転策略: 2日連続で下落した終盤価格が,今日の終盤価格が前 2日連続で最低値を破り,同時に9日にランダムな指標の快線で遅線を突破した場合,多めに; 2日連続で上昇した終盤価格が,今日の終盤価格が前 2日連続で最高値を下破し,同時に9日にランダムな指標の快線で遅線を突破したとき,空にする.

波段フィルター:特定の周期内の価格の波段指標を計算し,波段指標が特定の値より大きいときは多し,波段指標が特定の値より小さいときは空にする.

組み合わせ信号は:123反転策と波段フィルター策が同多多の信号である場合,多多のポジションを取ります.両方が同空の信号である場合,空のポジションを取ります.そうでない場合は,クリアポーズを取る.

戦略的優位性

- 2つの要因に駆動され,市場の適応性があり,様々な状況で利益を得ることができます.

- 逆転戦略は,振動盤の整形時に逆転の機会を捉える

- 波段フィルターは,トレンドが明瞭な状況でトレンドを追跡します.

- 組み合わせ信号の検証により,誤った取引の確率を減らす

リスク分析

- パラメータの設定を間違えた場合,取引が頻発する可能性があります.

- 震災で複数の損失が発生する可能性がある

- 取引手数料の影響について

最適化の方向

- 波段フィルターのパラメータを調整し,波段指標の計算を最適化

- 123の逆転策のパラメータを調整し,多空の逆転判断を最適化

- 単一損失を抑えるための止損メカニズムへの参加

要約する

この戦略は,反転因子とトレンド因子を総合的に使用し,多因子駆動の定量取引を実現する.双因子の検証により,誤取引の確率を減らすことができ,多種多様な市場で戦略の優れたパフォーマンスを得ることができる.その後,パラメータ調整と止損設定によりさらに最適化することができ,戦略の安定性と収益性を向上させることができる.

ストラテジーソースコード

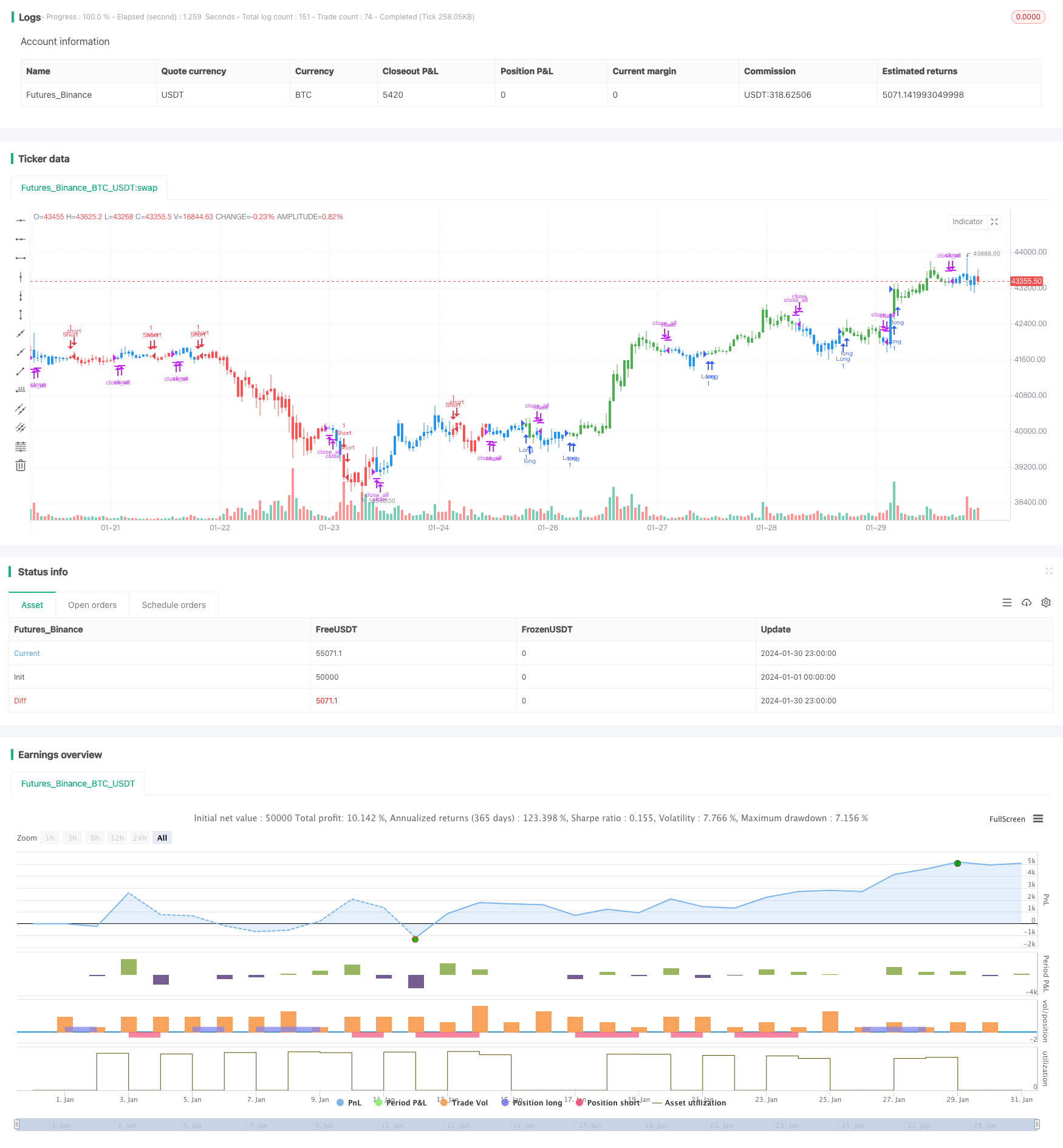

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/05/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Bandpass_Filter(Length, Delta, TriggerLevel) =>

xPrice = hl2

beta = cos(3.14 * (360 / Length) / 180)

gamma = 1 / cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - sqrt(gamma * gamma - 1)

BP = 0.0

pos = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos := iff(BP > TriggerLevel, 1,

iff(BP <= TriggerLevel, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bandpass Filter", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthBF = input(20, minval=1)

Delta = input(0.5)

TriggerLevel = input(0)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBandpass_Filter = Bandpass_Filter(LengthBF, Delta, TriggerLevel)

pos = iff(posReversal123 == 1 and posBandpass_Filter == 1 , 1,

iff(posReversal123 == -1 and posBandpass_Filter == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )