개요

이 트렌드 추적 전략은 이중 반전 신호를 결합한 트렌드 추적 전략이다. 123 반전 전략과 성능 지수 전략을 통합하여 가격 반전 지점을 추적하여 더 신뢰할 수 있는 트렌드 판단을 가능하게 한다.

전략 원칙

이 전략은 다음의 두 가지 세부 전략으로 구성됩니다.

- 123 역전 전략

14일 K선으로 역전 신호를 판단한다. 구체적인 규칙은:

- 다단계 신호: 지난 2일 종결 가격 하락, 현재 K선 종결 가격 전날 종결 가격보다 높다, 9일 Stochastic Slow 50 이하

- 허공 신호: 지난 2일 종결 가격 상승, 현재 K선 종결 가격이 전날 종결 가격보다 낮다, 9일 Stochastic Fast 50 이상

- 성능 지수 전략

지난 14일간의 상승과 하락을 기준으로 계산합니다. 규칙은 다음과 같습니다.

- 성능 지수>(0), 멀티 헤드 신호를 생성

- 성능 지수 <(0), 공허 신호를 생성

최종 신호는 두 가지의 신호의 합성이다. 즉 동방향의 다공영 신호가 필요하여 실질적인 거래가 이루어진다.

그래서 소음을 필터링하여 신호를 더 안정적으로 전송할 수 있습니다.

전략적 이점

이 쌍방향 시스템은 다음과 같은 장점이 있습니다.

- 두 가지 요소가 결합되어 신호가 더 신뢰할 수 있습니다.

- 시장 소음을 효과적으로 필터링하여 잘못된 신호를 방지합니다.

- 123 형식은 고전적이고 실용적이며, 판단과 재생이 쉽다.

- 성능 지수는 미래의 추세를 판단할 수 있습니다.

- 변수 모음이 유연하고 추가적으로 최적화 할 수 있습니다.

전략적 위험

이 전략에는 몇 가지 위험도 있습니다.

- 급격한 반전을 놓칠 수도 있고, 전체적인 추세를 파악할 수 없습니다.

- 이중 조건의 조합으로 인해 신호가 감소하여 수익성에 영향을 미칠 수 있습니다.

- 동향 판단이 필요하며, 주식 특유의 변동에 민감하다

- 매개 변수 설정 문제로 인해 신호의 오차가 발생할 수 있습니다.

다음의 몇 가지 측면에서 최적화를 고려할 수 있습니다.

- K선 길이, 스토카스틱 주기 등과 같은 변수를 조정합니다.

- 이중 신호 판단 논리를 최적화

- 그 결과, 이 두가지 요소는

- 손해 방지 장치

요약하다

이 전략은 이중 반전 판단을 통합하여 가격 전환점을 효과적으로 발견할 수 있다. 신호 발생 확률이 낮아졌지만 신뢰성이 높기 때문에 중장기 트렌드를 포착하는 데 적합하다. 매개 변수 조정과 다중 요소 최적화를 통해 전략 효과를 더욱 강화할 수 있다.

전략 소스 코드

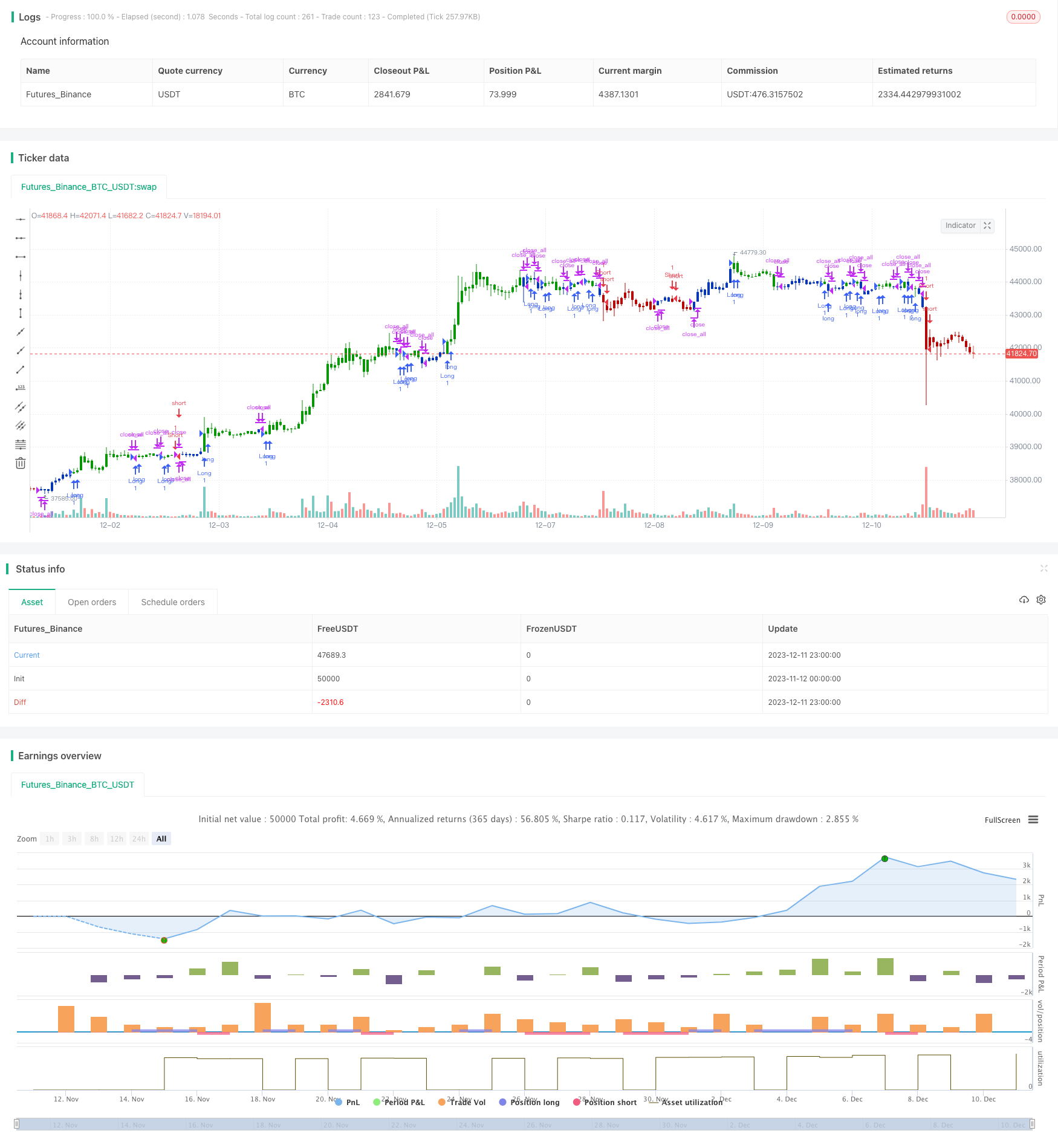

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 15/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Performance indicator or a more familiar term, KPI (key performance indicator),

// is an industry term that measures the performance. Generally used by organizations,

// they determine whether the company is successful or not, and the degree of success.

// It is used on a business’ different levels, to quantify the progress or regress of a

// department, of an employee or even of a certain program or activity. For a manager

// it’s extremely important to determine which KPIs are relevant for his activity, and

// what is important almost always depends on which department he wants to measure the

// performance for. So the indicators set for the financial team will be different than

// the ones for the marketing department and so on.

//

// Similar to the KPIs companies use to measure their performance on a monthly, quarterly

// and yearly basis, the stock market makes use of a performance indicator as well, although

// on the market, the performance index is calculated on a daily basis. The stock market

// performance indicates the direction of the stock market as a whole, or of a specific stock

// and gives traders an overall impression over the future security prices, helping them decide

// the best move. A change in the indicator gives information about future trends a stock could

// adopt, information about a sector or even on the whole economy. The financial sector is the

// most relevant department of the economy and the indicators provide information on its overall

// health, so when a stock price moves upwards, the indicators are a signal of good news. On the

// other hand, if the price of a particular stock decreases, that is because bad news about its

// performance are out and they generate negative signals to the market, causing the price to go

// downwards. One could state that the movement of the security prices and consequently, the movement

// of the indicators are an overall evaluation of a country’s economic trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PI(Period) =>

pos = 0.0

xKPI = (close - close[Period]) * 100 / close[Period]

pos := iff(xKPI > 0, 1,

iff(xKPI < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Perfomance index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Perfomance index ----")

Period = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPI = PI(Period)

pos = iff(posReversal123 == 1 and posPI == 1 , 1,

iff(posReversal123 == -1 and posPI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )