Strategi trailing stop pembalikan arah aliran

Gambaran keseluruhan

Strategi ini adalah berdasarkan indikator trend reversal, yang digabungkan dengan mekanisme berhenti kehilangan trend, untuk mencapai kesan trend di pasaran trend, mengurangkan kerugian di pasaran yang menyeluruh.

Prinsip Strategi

Strategi ini menggunakan Hull Moving Average sebagai penanda trend utama. Apabila harga naik melalui Hull Average, lakukan over; apabila harga turun melalui Hull Average, lakukan short.

Selepas membuka kedudukan, jika harga berbalik, iaitu mengesahkan Hull Average berlaku, logik perubahan trend akan dijalankan dan kedudukan semasa akan ditutup.

Strategi ini juga memperkenalkan mekanisme tracking trend stop loss. Setelah membuka kedudukan, harga stop loss dinamik akan dikira berdasarkan ATR. Dengan pergerakan harga, garis stop loss juga akan menyesuaikan secara dinamik, untuk mencapai tracking stop loss yang menguntungkan.

Kelebihan Strategik

- Menggunakan purata Hull untuk menentukan titik pembalikan trend, purata Hull sangat sensitif terhadap isyarat penembusan

- Pengesahan trend yang digabungkan dengan purata McGinley untuk menyaring beberapa pecah palsu

- Menggunakan mekanisme hentian kecederaan yang dinamik, boleh menyesuaikan ketinggian hentian kecederaan mengikut turun naik pasaran, untuk mengawal kerugian dengan berkesan

- Memeriksa Hull Average untuk bertindak balas tepat pada masanya untuk membalikkan trend dan mengelakkan kerugian yang lebih besar

- Mudah untuk menukar kombinasi parameter yang berbeza untuk ujian, mencari parameter yang optimum

Risiko dan Penyelesaian

Keadaan di mana kemusnahan mungkin dicetuskan dalam keadaan gegaran

- boleh meluaskan stop loss yang sesuai untuk meningkatkan zon penangguhan

Dalam keadaan yang teruk, penangguhan mungkin tidak mengikuti pergerakan harga.

- Ia boleh memendekkan kitaran pelepasan dan membolehkan stop loss untuk mengikuti harga lebih cepat.

Penembusan palsu boleh menyebabkan kerugian yang tidak perlu

- Menambah petunjuk lain untuk pengesahan dan mengelakkan penembusan palsu

Parameter yang tidak betul boleh menyebabkan persembahan yang tidak baik

- Anda boleh mengkaji semula kitaran pasaran yang berbeza untuk mencari parameter yang optimum

Optimum idea

Menambah petunjuk lain dengan pengesahan, seperti bentuk K, Brinks, RSI dan sebagainya, untuk meningkatkan kualiti isyarat

Mengoptimumkan parameter mengikut pelbagai jenis dan tempoh untuk mencari kombinasi parameter yang terbaik

Kaedah pembelajaran mesin dan lain-lain boleh dicuba untuk mengoptimumkan parameter penyesuaian diri

Mengoptimumkan algoritma hentikan kerugian, meminimumkan kerugian yang tidak perlu, dengan syarat untuk memastikan hentikan kerugian

Strategi pengurusan kedudukan yang dioptimumkan dengan pengurusan dana

Pertimbangan untuk memasukkan mekanisme penangguhan automatik

ringkaskan

Strategi ini secara keseluruhan merupakan strategi pengesanan trend yang lebih mantap. Berbanding dengan berhenti tetap, strategi ini menggunakan mekanisme berhenti yang dinamik, yang dapat menyesuaikan amplitudo stop loss mengikut turun naik pasaran, secara berkesan mengurangkan kebarangkalian penutupan stop loss. Pada masa yang sama, Hull averages dan pengenalan logik perubahan trend, dapat memberikan tindak balas yang lebih cepat terhadap pembalikan trend. Tetapi strategi ini juga mempunyai risiko tertentu, seperti risiko stop loss dalam keadaan gegaran, risiko false breakout, dan sebagainya.

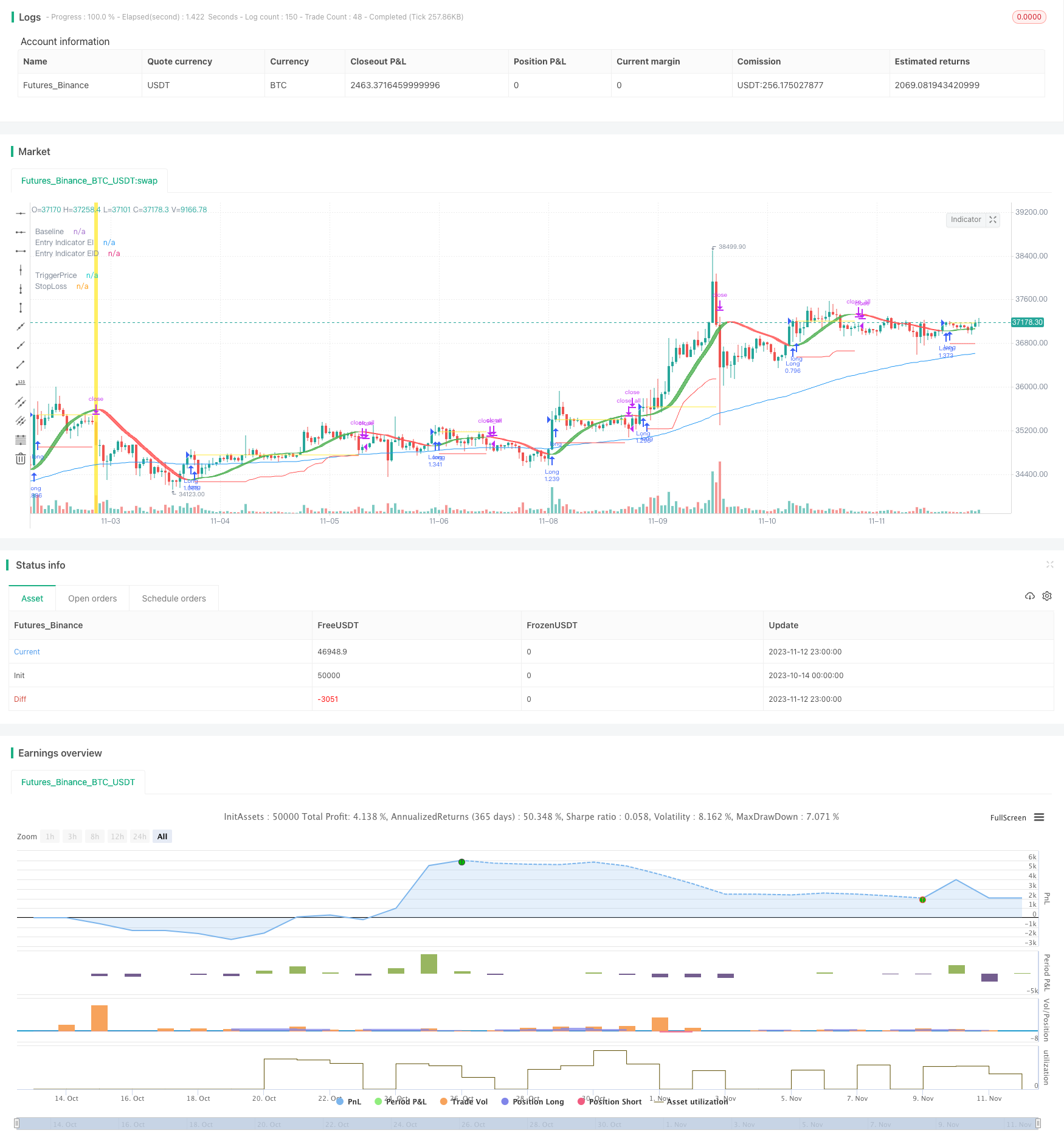

/*backtest

start: 2023-10-14 00:00:00

end: 2023-11-13 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Milleman

//@version=4

strategy("MilleMachine", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.06)

// Additional settings

Mode = input(title="Mode", defval="LongShort", options=["LongShort", "OnlyLong", "OnlyShort","Indicator Mode"])

UseTP = false //input(false, title="Use Take Profit?")

QuickSwitch = true //input(true, title="Quickswitch")

UseTC = true //input(true, title="Use Trendchange?")

// Risk management settings

//Spacer2 = input(false, title="======= Risk management settings =======")

Risk = input(1.0, title="% Risk",minval=0)/100

RRR = 2 //input(2,title="Risk Reward Ratio",step=0.1,minval=0,maxval=20)

SL_Mode = false // input(true, title="ON = Fixed SL / OFF = Dynamic SL (ATR)")

SL_Fix = 3 //input(3,title="StopLoss %",step=0.25, minval=0)/100

ATR = atr(14) //input(14,title="Periode ATR"))

Mul = input(2,title="ATR Multiplier",step=0.1)

xATR = ATR * Mul

SL = SL_Mode ? SL_Fix : (1 - close/(close+xATR))

// INDICATORS //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Ind(type, src, len) =>

float result = 0

if type=="McGinley"

result := na(result[1]) ? ema(src, len) : result[1] + (src - result[1]) / (len * pow(src/result[1], 4))

if type=="HMA"

result := wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

if type=="EHMA"

result := ema(2*ema(src, len/2)-ema(src, len), round(sqrt(len)))

if type=="THMA"

lend = len/2

result := wma(wma(src, lend/3)*3-wma(src, lend/2)-wma(src,lend), lend)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VWMA" // Volume Weighted

result := vwma(src, len)

if type=="SMMA" // Smoothed

w = wma(src, len)

result := (w[1] * (len - 1) + src) / len

if type == "RMA"

result := rma(src, len)

if type=="LSMA" // Least Squares

result := linreg(src, len, 0)

if type=="ALMA" // Arnaud Legoux

result := alma(src, len, 0.85, 6)

if type=="Kijun" //Kijun-sen

kijun = avg(lowest(len), highest(len))

result :=kijun

if type=="WWSA" // Welles Wilder Smoothed Moving Average

result := nz(result[1]) + (close -nz(result[1]))/len

result

// Baseline : Switch from Long to Short and vice versa

BL_Act = input(true, title="====== Activate Baseline - Switch L/S ======")

BL_type = input(title="Baseline Type", defval="McGinley", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

BL_src = input(close, title="BL source")

BL_len = input(50, title="BL length", minval=1)

BL = Ind(BL_type,BL_src, BL_len)

// Confirmation indicator

C1_Act = input(false, title="===== Activate Confirmation indicator =====")

C1_type = input(title="C1 Entry indicator", defval="SMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

C1_src = input(close, title="Source")

C1_len = input(5,title="Length", minval=1)

C1 = Ind(C1_type,C1_src,C1_len)

// Entry indicator : Hull Moving Average

Spacer5 = input(true, title="====== ENTRY indicator =======")

EI_type = input(title="EI Entry indicator", defval="HMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

EI_src = input(close, title="Source")

EI_Len = input(46,title="Length", minval=1)

EI = Ind(EI_type,EI_src,EI_Len)

// Trail stop settings

TrailActivation = input(true, title="===== Activate Trailing Stop =====")

TS_type = input(title="TS Traling Stop Type", defval="EMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

TrailSLScaling = 1 //input(100, title="SL Scaling", minval=0, step=5)/100

TrailingSourceLong = Ind(TS_type,low,input(5,"Smoothing Trail Long EMA", minval=1))

TrailingSourceShort = Ind(TS_type,high,input(2,"Smoothing Trail Short EMA", minval=1))

//VARIABLES MANAGEMENT

TriggerPrice = 0.0, TriggerPrice := TriggerPrice[1]

TriggerSL = 0.0, TriggerSL := TriggerSL[1]

SLPrice = 0.0, SLPrice := SLPrice[1], TPPrice = 0.0, TPPrice := TPPrice[1]

isLong = false, isLong := isLong[1], isShort = false, isShort := isShort[1]

//LOGIC

GoLong = crossover(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] > 1) and (not C1_Act or C1>C1[1]) and (Mode == "LongShort" or Mode == "OnlyLong")

GoShort = crossunder(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] < 1) and (not C1_Act or C1<C1[1]) and (Mode == "LongShort" or Mode == "OnlyShort")

ExitLong = isLong and crossunder(EI,EI[1]) and UseTC

ExitShort = isShort and crossover(EI,EI[1]) and UseTC

//FRAMEWORK

//Reset Long-Short memory

if isLong and strategy.position_size == 0.0

isLong := false

if isShort and strategy.position_size == 0.0

isShort := false

//Long

if GoLong

isLong := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 + (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1-TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((TriggerPrice-SLPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Long", strategy.long, comment=tostring(round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if isLong

NewValSL = TrailingSourceLong * (1 - (SL*TrailSLScaling))

if TrailActivation and NewValSL > SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if ExitLong

strategy.close_all(comment="TrendChange")

isLong := false

//Short

if GoShort

isShort := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 - (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1 + TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((SLPrice-TriggerPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Short", strategy.short, comment=tostring(round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if isShort

NewValSL = TrailingSourceShort * (1 + (SL*TrailSLScaling))

if TrailActivation and NewValSL < SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if ExitShort

strategy.close_all(comment="TrendChange")

isShort := false

//VISUALISATION

plot(BL_Act?BL:na, color=color.blue,title="Baseline")

plot(C1_Act?C1:na, color=color.yellow,title="confirmation Indicator")

EIColor = EI>EI[1] ? color.green : color.red

Fill_EI = plot(EI, color=EIColor, linewidth=1, transp=40, title="Entry Indicator EI")

Fill_EID = plot(EI[1], color=EIColor, linewidth=1, transp=40, title="Entry Indicator EID")

fill(Fill_EI,Fill_EID, title="EI_Fill", color=EIColor,transp=50)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TriggerPrice : na, title="TriggerPrice", color=color.yellow, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TPPrice : na, title="TakeProfit", color=color.green, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? SLPrice : na, title="StopLoss", color=color.red, style=plot.style_linebr)

bgcolor(isLong[1] and cross(low,SLPrice) and low[1] > SLPrice and TriggerPrice>SLPrice ? color.yellow : na, transp=75, title="SL Long")

bgcolor(isShort[1] and cross(high,SLPrice) and high[1] < SLPrice and TriggerPrice<SLPrice ? color.yellow : na, transp=75, title="SL Short")