Strategi perdagangan swing adaptif berdasarkan penembusan harga

Tarikh penciptaan:

2023-12-04 14:34:13

Akhirnya diubah suai:

2023-12-04 14:34:13

Salin:

0

Bilangan klik:

672

1

fokus pada

1619

Pengikut

Gambaran keseluruhan

Strategi ini mengenal pasti trend pasaran berdasarkan titik penembusan harga, dan digabungkan dengan indikator penyesuaian diri untuk menilai trend besar, untuk menangkap peluang pembalikan harga jangka pendek. Strategi ini sesuai untuk perdagangan mata wang digital dengan kadar turun naik yang tinggi.

Prinsip Strategi

- Kenali titik harga yang paling tinggi sebagai sempadan saluran. Apabila harga mencipta tinggi baru atau rendah baru, ambil titik itu sebagai sempadan saluran.

- Hitung MA penunjuk turun naik yang beradaptasi untuk menentukan arah trend keseluruhan. Makna MA yang lebih besar menunjukkan bahawa masa ini berada dalam tahap gegaran.

- Apabila harga menembusi saluran ke atas, ia menghasilkan isyarat beli; apabila harga menembusi saluran ke bawah, ia menghasilkan isyarat jual.

- Tetapkan titik hentian. Titik hentian untuk kedudukan panjang ditetapkan sebagai 1% daripada harga masuk.

Analisis kelebihan

- Saluran harga mempunyai kemampuan beradaptasi untuk menentukan titik perubahan trend.

- Indeks turun naik menilai trend besar, mengelakkan kehilangan arah dalam trend goyah.

- Strategi berbalik, sesuai untuk menangkap kenaikan harga jangka pendek.

Analisis risiko

- Dalam keadaan penurunan yang berterusan, ia mudah untuk mencetuskan beberapa titik berhenti, menyebabkan kerugian yang lebih besar.

- Dalam keadaan yang tidak menentu, pembelian dan penjualan yang kerap berlaku menyebabkan kos dagangan meningkat.

- Perdagangan automatik mempunyai risiko kecocokan.

Arah pengoptimuman

- Mengoptimumkan parameter MA untuk menilai pergerakan keseluruhan.

- Meningkatkan penunjuk tenaga dan mengelakkan isyarat pembalikan tenaga yang lemah.

- Menambah model pembelajaran mesin untuk mengoptimumkan dinamik parameter.

ringkaskan

Strategi ini mempunyai idea keseluruhan yang jelas dan mempunyai nilai praktikal tertentu. Tetapi anda masih perlu berhati-hati untuk mengawal risiko perdagangan untuk mengelakkan kerugian yang lebih besar dalam keadaan tertentu. Langkah seterusnya boleh dioptimumkan dari pelbagai dimensi seperti rangka keseluruhan, parameter indikator, dan kawalan risiko, untuk menjadikan parameter strategi dan isyarat perdagangan lebih dipercayai.

Kod sumber strategi

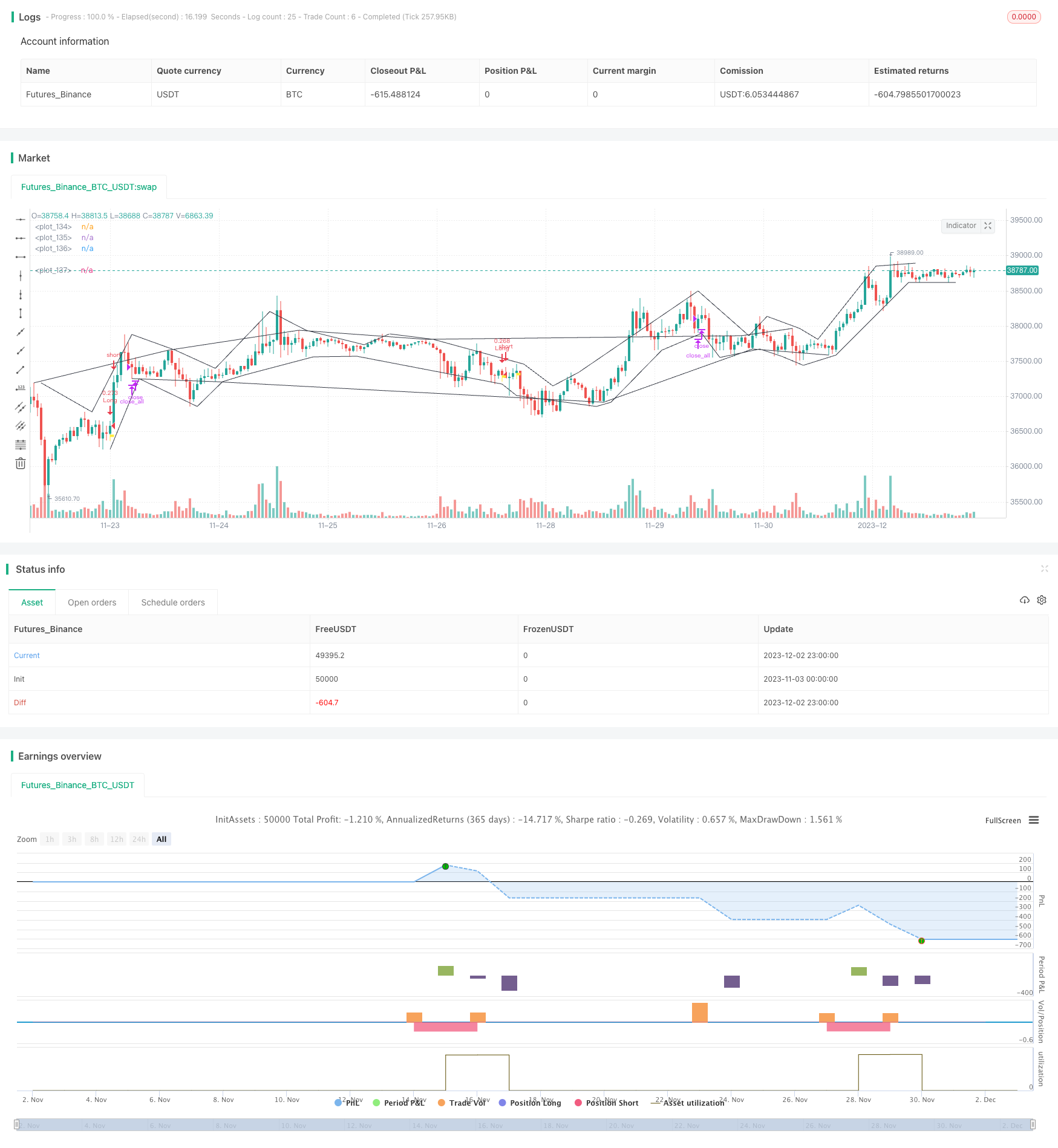

/*backtest

start: 2023-11-03 00:00:00

end: 2023-12-03 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version = 4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingGroundhog

// ||--- Cash & Date:

cash_amout = 10000

pyramid_val = 1

cash_given_per_lot = cash_amout/pyramid_val

startDate = input(title="Start Date",defval=13)

startMonth = input(title="Start Month",defval=9)

startYear = input(title="Start Year",defval=2021)

afterStartDate = (time >= timestamp(syminfo.timezone,startYear, startMonth, startDate, 0, 0))

// ||------------------------------------------------------------------------------------------------------

// ||--- Strategy:

strategy(title="TradingGroundhog - Strategy & Fractal V1 - Short term", overlay=true, max_bars_back = 4000, max_labels_count=500, commission_type=strategy.commission.percent, commission_value=0.00,default_qty_type=strategy.cash, default_qty_value= cash_given_per_lot, pyramiding=pyramid_val)

// ||------------------------------------------------------------------------------------------------------

// ||--- Fractal Recognition:

filterBW = input(true, title="filter Bill Williams Fractals:")

filterFractals = input(true, title="Filter fractals using extreme method:")

length = input(2, title="Extreme Window:")

regulartopfractal = high[4] < high[3] and high[3] < high[2] and high[2] > high[1] and high[1] > high[0]

regularbotfractal = low[4] > low[3] and low[3] > low[2] and low[2] < low[1] and low[1] < low[0]

billwtopfractal = filterBW ? false : (high[4] < high[2] and high[3] < high[2] and high[2] > high[1] and high[2] > high[0] ? true : false)

billwbotfractal = filterBW ? false : (low[4] > low[2] and low[3] > low[2] and low[2] < low[1] and low[2] < low[0] ? true : false)

ftop = filterBW ? regulartopfractal : regulartopfractal or billwtopfractal

fbot = filterBW ? regularbotfractal : regularbotfractal or billwbotfractal

topf = ftop ? high[2] >= highest(high, length) ? true : false : false

botf = fbot ? low[2] <= lowest(low, length) ? true : false : false

filteredtopf = filterFractals ? topf : ftop

filteredbotf = filterFractals ? botf : fbot

// ||------------------------------------------------------------------------------------------------------

// ||--- V1 : Added Swing High/Low Option

ShowSwingsHL = input(true)

highswings = filteredtopf == false ? na : valuewhen(filteredtopf == true, high[2], 2) < valuewhen(filteredtopf == true, high[2], 1) and valuewhen(filteredtopf == true, high[2], 1) > valuewhen(filteredtopf == true, high[2], 0)

lowswings = filteredbotf == false ? na : valuewhen(filteredbotf == true, low[2], 2) > valuewhen(filteredbotf == true, low[2], 1) and valuewhen(filteredbotf == true, low[2], 1) < valuewhen(filteredbotf == true, low[2], 0)

//---------------------------------------------------------------------------------------------------------

// ||--- V2 : Plot Lines based on the fractals.

showchannel = input(true)

//---------------------------------------------------------------------------------------------------------

// ||--- ZigZag:

showZigZag = input(true)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal computation:

istop = filteredtopf ? true : false

isbot = filteredbotf ? true : false

topcount = barssince(istop)

botcount = barssince(isbot)

vamp = input(title="VolumeMA", defval=2)

vam = sma(volume, vamp)

fractalup = 0.0

fractaldown = 0.0

up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

fractalup := up ? high[3] : fractalup[1]

fractaldown := down ? low[3] : fractaldown[1]

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal save:

fractaldown_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractaldown_save) < 3

if array.size(fractaldown_save) == 0

array.push(fractaldown_save, fractaldown[i])

else

if fractaldown[i] != array.get(fractaldown_save, array.size(fractaldown_save)-1)

array.push(fractaldown_save, fractaldown[i])

if array.size(fractaldown_save) < 3

array.push(fractaldown_save, fractaldown)

array.push(fractaldown_save, fractaldown)

fractalup_save = array.new_float(0)

for i = 0 to 4000

if array.size(fractalup_save) < 3

if array.size(fractalup_save) == 0

array.push(fractalup_save, fractalup[i])

else

if fractalup[i] != array.get(fractalup_save, array.size(fractalup_save)-1)

array.push(fractalup_save, fractalup[i])

if array.size(fractalup_save) < 3

array.push(fractalup_save, fractalup)

array.push(fractalup_save, fractalup)

Bottom_1 = array.get(fractaldown_save, 0)

Bottom_2 = array.get(fractaldown_save, 1)

Bottom_3 = array.get(fractaldown_save, 2)

Top_1 = array.get(fractalup_save, 0)

Top_2 = array.get(fractalup_save, 1)

Top_3 = array.get(fractalup_save, 2)

//----------------------------------------------------------------------------------------------------------

// ||--- Fractal Buy Sell Signal:

bool Signal_Test = false

bool Signal_Test_OUT_TEMP = false

var Signal_Test_TEMP = false

longLossPerc = input(title="Long Stop Loss (%)", minval=0.0, step=0.1, defval=0.01) * 0.01

if filteredbotf and open < Bottom_1 and (Bottom_1 - open) / Bottom_1 >= longLossPerc

Signal_Test := true

if filteredtopf and open > Top_1

Signal_Test_TEMP := true

if filteredtopf and Signal_Test_TEMP

Signal_Test_TEMP := false

Signal_Test_OUT_TEMP := true

//----------------------------------------------------------------------------------------------------------

// ||--- Plotting:

//plotshape(filteredtopf, style=shape.triangledown, location=location.abovebar, color=color.red, text="•", offset=0)

//plotshape(filteredbotf, style=shape.triangleup, location=location.belowbar, color=color.lime, text="•", offset=0)

//plotshape(ShowSwingsHL ? highswings : na, style=shape.triangledown, location=location.abovebar, color=color.maroon, text="H", offset=0)

//plotshape(ShowSwingsHL ? lowswings : na, style=shape.triangleup, location=location.belowbar, color=color.green, text="L", offset=0)

plot(showchannel ? (filteredtopf ? high[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (filteredbotf ? low[2] : na) : na, color=color.black, offset=0)

plot(showchannel ? (highswings ? high[2] : na) : na, color=color.black, offset=-2)

plot(showchannel ? (lowswings ? low[2] : na) : na, color=color.black, offset=-2)

plotshape(Signal_Test, style=shape.flag, location=location.belowbar, color=color.yellow, offset=0)

plotshape(Signal_Test_OUT_TEMP, style=shape.flag, location=location.abovebar, color=color.white, offset=0)

//----------------------------------------------------------------------------------------------------------

// ||--- Buy And Sell:

strategy.entry(id="Long", long=true, when = Signal_Test and afterStartDate)

strategy.close_all(when = Signal_Test_OUT_TEMP and afterStartDate)

//----------------------------------------------------------------------------------------------------------