Strategi kuantitatif berdasarkan kadar perubahan harga dan purata bergerak

Gambaran keseluruhan

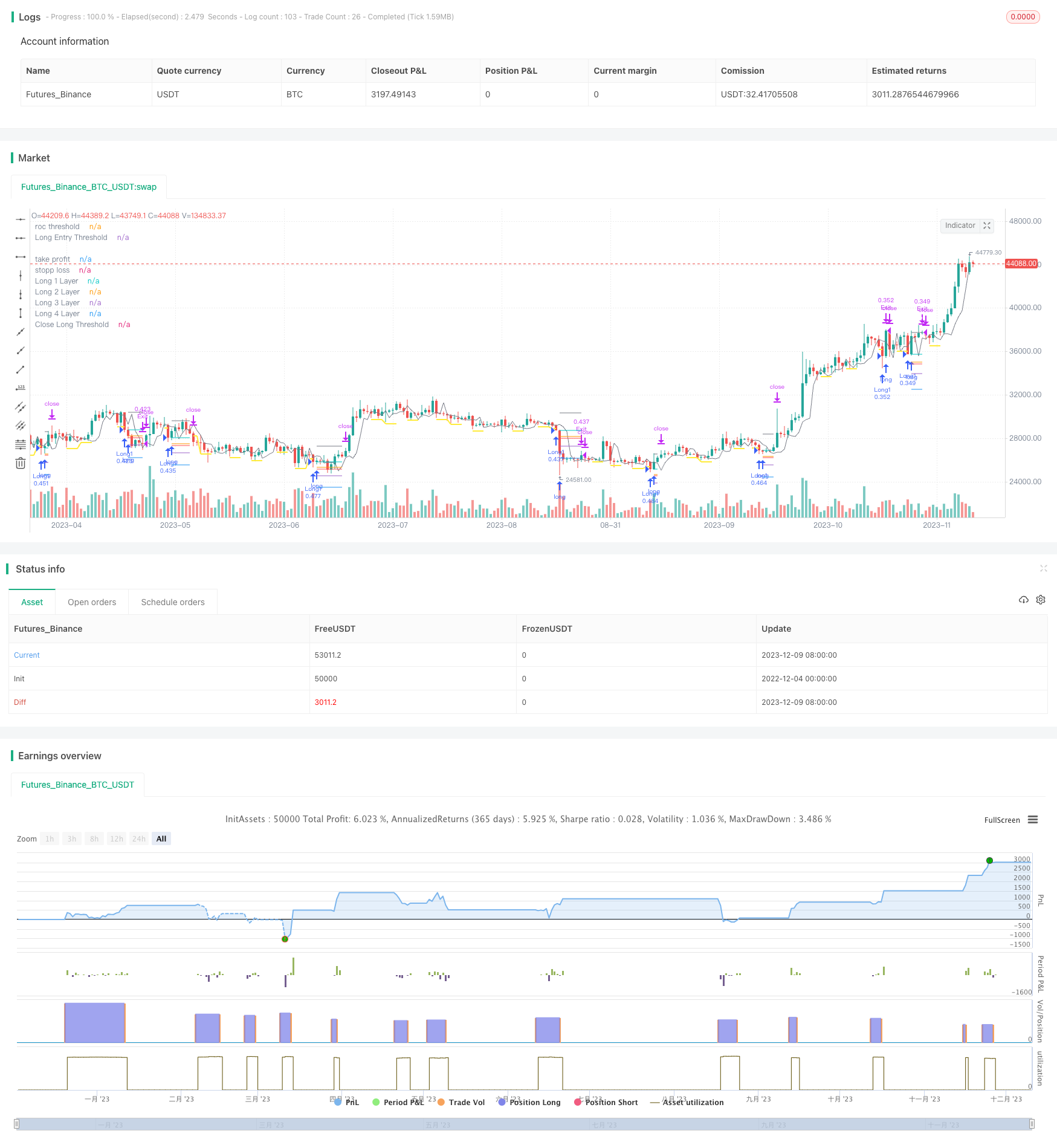

Strategi ini menggabungkan kadar perubahan harga dan garis rata dengan petunjuk teknikal untuk menentukan lokasi tepat untuk membeli dan menjual. Apabila harga turun dengan jelas, anda boleh membuat kedudukan beli dan membuka posisi berganda jika harga turun lebih lanjut. Apabila harga naik, anda boleh membuat kedudukan jual dan melonggarkan apabila harga terus naik.

Prinsip Strategi

Membeli Logik

- Mengira kadar perubahan harga ROC, dan menetapkan garis nilai rendah beli.

- Apabila harga jatuh di bawah garis harga rendah, catatkan titik tersebut dan mulakan garis harga terhad.

- Beli talian terhad yang ditetapkan untuk jangka masa berdasarkan parameter input, dan ditutup selepas tamat tempoh.

- Apabila harga terus menurun dan melanggar garis batas beli, bukalah kedudukan multihead pertama.

Menjual Logik

- Mengira ROC perubahan harga dan menetapkan garis nilai rugi untuk dijual.

- Apabila harga melepasi garis harga terendah, catatkan titik tersebut dan mulakan garis harga terendah.

- Jual talian terhad yang ditetapkan untuk jangka masa berdasarkan parameter input, ditutup selepas tamat tempoh.

- Apabila harga terus meningkat dan melanggar batas batas, semua kedudukan overhead akan dihapuskan.

Kawalan Risiko

Strategi terbina dalam berhenti dan berhenti fungsi, parameter yang boleh disesuaikan, mengawal risiko kedudukan yang ada dalam masa nyata.

Kaedah penimbunan

Setiap membuka satu kedudukan perdagangan, mengikut parameter input, harga pembelian seterusnya ditetapkan dalam perkadaran tertentu, untuk mencapai kesan pembelian dan penambahan stok secara berturut-turut.

Analisis kelebihan

- ROC sangat sensitif terhadap perubahan harga dan lokasi tempat jual beli tepat.

- Menggunakan talian terhad untuk lebih mengesahkan masa pembelian dan penjualan, untuk mengelakkan penembusan palsu.

- Kaedah pembiayaan boleh mengesan nilai pasaran dengan memastikan risiko dapat dikawal.

- Fungsi stop loss terbina dalam mengawal risiko kedudukan tunggal.

Risiko dan Penyelesaian

- Apabila pasaran mengalami turun naik yang teruk, strategi mungkin membuka terlalu banyak kedudukan. Penyelesaian adalah menetapkan parameter untuk menambah kedudukan dengan munasabah, mengawal jumlah kedudukan.

- Apabila trend turun naik harga tidak jelas, harga stop loss atau stop loss mungkin sering dicetuskan. Anda boleh melonggarkan stop loss atau mematikan fungsi ini dengan sewajarnya.

Cadangan Optimasi

- Gabungan dengan penapis waktu masuk indikator lain. Sebagai contoh, dengan garis rata-rata, penunjuk ROC hanya diambil apabila harga jatuh di bawah garis rata-rata.

- Mengoptimumkan logik kenaikan harga, hanya memulakan kenaikan harga jika syarat tertentu dipenuhi. Sebagai contoh, teruskan kenaikan hanya jika harga jatuh lagi melebihi tahap tertentu.

- Tetapan parameter yang berbeza-beza antara varieti yang berbeza memerlukan pengesanan dan simulasi yang mencukupi untuk mendapatkan kombinasi parameter yang terbaik.

- Anda boleh menetapkan stop loss yang sesuai dengan anda dan menetapkan stop loss yang berbeza mengikut turun naik pasaran.

ringkaskan

Strategi ini menggunakan pengukur ROC untuk menentukan titik jual beli, memfilterkan isyarat dengan cara yang terhad, melindungi risiko terhad, dan memperluaskan keuntungan dengan menaikkan saham. Dengan parameter yang ditetapkan dengan wajar, anda boleh mendapatkan keuntungan tambahan sambil memastikan risiko berada dalam lingkungan yang boleh dikawal.

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @version=4

// © A3Sh

// Rate of price change / Price averaging strategy //

// When the price drops to a specified percentage, a Long Entry Threshold is setup.

// The Long Entry Threshold is only active for a specified number of bars and will de-activate when not crossed.

// When the price drops further and crosses the Entry Threshold with a minimum of a specified percentage, a Long Position is entered.

// The same reverse logic used to close the Long Position.

// Stop loss and take profit are active by default. With proper tweaking of the settings it is possible to de-activate SL and TP.

// The strategy is inspired by the following strategies:

// Price Change Scalping Strategy developed by Prosum Solutions, https://www.tradingview.com/script/ue7Uc3sN-Price-Change-Scalping-Strategy-v1-0-0/

// Scalping Dips On Trend Strategy developed by Coinrule, https://www.tradingview.com/script/iHHO0PJA-Scalping-Dips-On-Trend-by-Coinrule/

strategy(title = "ROC_PA_Strategy_@A3Sh", overlay = true )

// Portfolio & Leverage Example

// credit: @RafaelZioni, https://www.tradingview.com/script/xGk5K4DE-BTC-15-min/

ge(value, precision) => round(value * (pow(10, precision))) / pow(10, precision)

port = input(25, group = "Risk", title = "Portfolio Percentage", type = input.float, step = 0.1, minval = 0.1, maxval = 200)

leverage = input(1, group = "Risk", title = "Leverage", minval = 1, maxval = 100)

mm = input(5, group = "Risk", title = "Broker Maintenance Margin Percentage", type = input.float, step = 0.1, minval = 0.1, maxval = 200)

c = ge((strategy.equity * leverage / open) * (port / 100), 4)

// Take Profit

tpa = input(true, type = input.bool, title = "Take Profit", group = "Risk", inline = "Take Profit")

tpp = input(5.6, type = input.float, title = "Percentage" , group = "Risk", step = 0.1, minval = 0.1, inline = "Take Profit")

tp = strategy.position_avg_price + (strategy.position_avg_price / 100 * tpp)

plot (tpa and strategy.position_size > 0 ? tp : na, color = color.gray, title = "take profit", style= plot.style_linebr, linewidth = 1)

// Stop Loss

sla = input(true, type = input.bool, title = "Stop Lossss ", group = "Risk", inline = "Stop Loss")

slp = input(2.5, type = input.float, title = "Percentage", group = "Risk", step = 0.1, minval = 0.1, inline = "Stop Loss")

sl = strategy.position_avg_price - (strategy.position_avg_price / 100 *slp)

plot (sla and strategy.position_size > 0 ? sl : na, color = color.red, title = "stopp loss", style= plot.style_linebr, linewidth = 1)

stopLoss = sla ? sl : na

// Long position entry layers. Percentage from the entry price of the the first long

ps2 = input(2, group = "Price Averaging Layers", title = "2nd Layer Long Entry %", step = 0.1)

ps3 = input(5, group = "Price Averaging Layers", title = "3rd Layer Long Entry %", step = 0.1)

ps4 = input(9, group = "Price Averaging Layers", title = "4th Layer Long Entry %", step = 0.1)

// ROC_Trigger Logic to open Long Position

rocLookBack = input(3, group = "ROC Logic to OPEN Long Entry", title="Rate of Change bar lookback")

rocThreshold = input(0.5, group = "ROC Logic to OPEN Long Entry", title="ROC Threshold % to Setup Long Entry", step = 0.1)

entryLimit = input(0.5, group = "ROC Logic to OPEN Long Entry", title="Price Drop Threshold % to OPEN Long Entry", step = 0.1)

entryTime = input(3, group = "ROC Logic to OPEN Long Entry", title="Duration of Long Entry Threshold Line in bars")

minLimit = input(0.8, group = "ROC Logic to OPEN Long Entry", title="Min % of Price Drop to OPEN Long Entry", step = 0.1)

//ROC calculation based to the price level of previous X bars

roc = close[rocLookBack] - (close / 100 * rocThreshold)

plot (roc, color = color.gray, title = "roc threshold", linewidth = 1 , transp = 20)

rocT1 = open > roc and close < roc ? 1 : 0 // When the price CROSSES the Entry Limit

rocT2 = (open < roc) and (close < roc) ? 1 : 0 // When the price is BELOW the Entry Limit

rocTrigger = rocT1 or rocT2

// Condition for Setting Up a Long Entry Thershold Line

rocCrossed = false

var SetUpLong = false

if rocTrigger and not SetUpLong

rocCrossed := true

SetUpLong := true

// Defining the Value of the Long Entry Thershold

condforValue = rocCrossed and (open - low) / (open / 100) > 0 or (open < roc and close < roc) ? low - (close / 100 * entryLimit) : roc - (close / 100 * entryLimit)

openValue = valuewhen (rocCrossed, condforValue, 0)

// Defining the length of the Long Entry Thershold in bars, specified with an input parameter

sincerocCrossed = barssince (rocCrossed)

plotLineOpen = (sincerocCrossed <= entryTime) ? openValue : na

endLineOpen = sincerocCrossed == entryTime ? 1 : 0

// Set the conditions back to false when the Entry Limit Threshold Line ends after specied number of bars

if endLineOpen and SetUpLong

rocCrossed := false

SetUpLong := false

// Set minimum percentage of price drop to open a Long Position.

minThres = (open - close) / (open / 100) > minLimit ? 1 : 0

// Open Long Trigger

openLong = crossunder (close, plotLineOpen) and strategy.position_size == 0 and minThres

plot (strategy.position_size == 0 ? plotLineOpen : na, title = "Long Entry Threshold", color= color.yellow, style= plot.style_linebr, linewidth = 2)

// Show vertical dashed line when long condition is triggered

// credit: @midtownsk8rguy, https://www.tradingview.com/script/EmTkvfCM-vline-Function-for-Pine-Script-v4-0/

vline(BarIndex, Color, LineStyle, LineWidth) =>

return = line.new(BarIndex, low - tr, BarIndex, high + tr, xloc.bar_index, extend.both, Color, LineStyle, LineWidth)

// if (openLong)

// vline(bar_index, color.blue, line.style_dashed, 1)

// ROC_Trigger Logic to close Long Position

rocLookBackL = input(3, group = "ROC Logic to CLOSE Long Entry", title = "Rate of Change bar lookback")

entryThresholdL = input(0.8, group = "ROC Logic to CLOSE Long Entry", title = "ROC Threshold % to Setup Close Threshold", step = 0.1) // Percentage from close price

entryLimit_CL = input(1.7, group = "ROC Logic to CLOSE Long Entry", title = "Price Rise Threshold % to CLOSE Long Entry", step = 0.1) // Percentage from roc threshold

entryTime_CL = input(3, group = "ROC Logic to CLOSE Long Entry", title = "Duration of Entry Limit in bars")

roc_CL = close[rocLookBackL] + (close/100 *entryThresholdL)

//plot(rocL, color=color.gray, linewidth=1, transp=20)

rocT1_CL = open < roc_CL and close > roc_CL ? 1 : 0

rocT2_CL = (open > roc_CL) and (close > roc_CL) ? 1 : 0

rocTrigger_CL = rocT1_CL or rocT2_CL

// Condition for Setting Up a Long CLOSE Thershold Line

rocCrossed_CL = false

var SetUpClose = false

if rocTrigger_CL and not SetUpClose

// The trigger for condA occurs and the last condition set was condB.

rocCrossed_CL := true

SetUpClose := true

// Defining the Value of the Long CLOSE Thershold

condforValue_CL= rocCrossed_CL and (high - open) / (open / 100) > 0 or (open > roc_CL and close > roc_CL) ? high + (close / 100 * entryLimit_CL) : roc_CL + (close / 100 * entryLimit_CL)

closeValue = valuewhen (rocCrossed_CL, condforValue_CL, 0)

// Defining the length of the Long CLOSE Thershold in bars, specified with an input parameter

sincerocCrossed_CL = barssince(rocCrossed_CL)

plotLineClose = (sincerocCrossed_CL <= entryTime_CL) ? closeValue : na

endLineClose = (sincerocCrossed_CL == entryTime_CL) ? 1 : 0

// Set the conditions back to false when the CLOSE Limit Threshold Line ends after specied number of bars

if endLineClose and SetUpClose

rocCrossed_CL := false

SetUpClose := false

plot(strategy.position_size > 0 ? plotLineClose : na, color = color.white, title = "Close Long Threshold", style = plot.style_linebr, linewidth = 2)

// ROC Close + Take Profit combined

closeCondition = close < tp ? plotLineClose : tpa ? tp : plotLineClose

// Store values to create and plot the different PA layers

long1 = valuewhen(openLong, close, 0)

long2 = valuewhen(openLong, close - (close / 100 * ps2), 0)

long3 = valuewhen(openLong, close - (close / 100 * ps3), 0)

long4 = valuewhen(openLong, close - (close / 100 * ps4), 0)

eps1 = 0.00

eps1 := na(eps1[1]) ? na : eps1[1]

eps2 = 0.00

eps2 := na(eps2[1]) ? na : eps2[1]

eps3 = 0.00

eps3 := na(eps3[1]) ? na : eps3[1]

eps4 = 0.00

eps4 := na(eps4[1]) ? na : eps4[1]

plot (strategy.position_size > 0 ? eps1 : na, title = "Long 1 Layer", style = plot.style_linebr)

plot (strategy.position_size > 0 ? eps2 : na, title = "Long 2 Layer", style = plot.style_linebr)

plot (strategy.position_size > 0 ? eps3 : na, title = "Long 3 Layer", style = plot.style_linebr)

plot (strategy.position_size > 0 ? eps4 : na, title = "Long 4 Layer", style = plot.style_linebr)

// Ener Long Positions

if (openLong and strategy.opentrades == 0)

eps1 := long1

eps2 := long2

eps3 := long3

eps4 := long4

strategy.entry("Long1", strategy.long, c, comment = "a=binance2 e=binance s=bnbusdt b=buy q=20% t=market")

if (strategy.opentrades == 1)

strategy.entry("Long2", strategy.long, c, limit = eps2, comment = "a=binance2 e=binance s=bnbusdt b=buy q=25% t=market")

if (strategy.opentrades == 2)

strategy.entry("Long3", strategy.long, c, limit = eps3, comment = "a=binance2 e=binance s=bnbusdt b=buy q=33.3% t=market")

if (strategy.opentrades == 3)

strategy.entry("Long4", strategy.long, c, limit = eps4, comment = "a=binance2 e=binance s=bnbusdt b=buy q=50% t=market")

// Setup Limit Close / Take Profit / Stop Loss order

strategy.exit("Exit", stop = stopLoss, limit = closeCondition, when =(rocTrigger_CL and strategy.position_size > 0), comment= "a=binance2 e=binance s=bnbusdt b=sell q=100% t=market")

// Make sure that all open limit orders are canceled after exiting all the positions

longClose = strategy.position_size[1] > 0 and strategy.position_size == 0 ? 1 : 0

if longClose

strategy.cancel_all()