Strategi penjejakan arah aliran dinamik

Gambaran keseluruhan

Idea utama strategi ini adalah untuk mengesan trend pasaran secara dinamik, membeli apabila trend meningkat, dan menjual apabila trend menurun. Ia menilai arah trend dengan mengira kombinasi beberapa petunjuk, seperti regresi linear, Hull Moving Average yang diubah suai, dan sebagainya.

Prinsip Strategi

Strategi ini menggunakan pelbagai petunjuk teknikal untuk menentukan arah trend. Pertama, ia mengira saluran julat, yang batas atas dan bawahnya dihitung berdasarkan purata bergerak mudah dan parameter input. Kemudian, ia mengira purata bergerak Hull yang diubahsuai, yang dianggap sebagai gambaran yang lebih tepat mengenai trend.

Untuk mengurangkan isyarat yang salah, strategi ini juga merancang beberapa penapis. Contohnya menggunakan EMA untuk menentukan sama ada ia berada dalam trend menurun, dan menggunakan penunjuk tingkap untuk menentukan perubahan RSI. Penapis ini dapat mengelakkan menghasilkan isyarat perdagangan dalam keadaan goyah.

Bagi entry dan stop loss, strategi ini mencatat harga pembukaan terakhir dan menetapkan peratusan stop loss. Sebagai contoh, jika harga pembukaan terakhir adalah \( 100, menetapkan sasaran stop loss \) 102 dan harga stop loss $ 95.

Analisis kelebihan

Strategi ini mempunyai beberapa kelebihan:

- Ia juga boleh digunakan untuk menjejaki perubahan trend secara dinamik dan menangkap arah garis yang lebih panjang.

- Penggunaan pelbagai penapis untuk mengurangkan kebisingan dan mengelakkan perdagangan yang kerap dalam keadaan gegaran;

- Mengubah kedudukan stop loss secara automatik untuk mengesan trend;

- Anda boleh mencari kombinasi parameter yang optimum secara automatik dengan mengoptimumkan parameter.

Analisis risiko

Strategi ini mempunyai beberapa risiko:

- Walau bagaimanapun, ia masih tidak dapat mengelakkan sepenuhnya risiko untuk terjejas. Jika trend berubah, ia mungkin akan menyebabkan kerugian yang lebih besar.

- Tetapan parameter yang tidak betul boleh menyebabkan prestasi strategi yang tidak baik. Anda perlu mencari kombinasi parameter terbaik dengan mengoptimumkan.

- Tempoh pemprosesan data yang terlalu lama boleh menyebabkan kelewatan isyarat. Pengiraan penunjuk perlu dioptimumkan agar secepat mungkin.

Untuk mengawal risiko, anda boleh menetapkan stop loss, trail stop atau menggunakan pilihan untuk mengunci keuntungan. Di samping itu, anda mesti menguji kombinasi parameter berulang kali untuk mencari julat parameter yang boleh dipercayai.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dalam beberapa aspek:

- Ujian lebih banyak kombinasi penunjuk untuk mencari cara yang lebih dipercayai untuk menilai trend;

- Menyesuaikan julat parameter untuk mencari parameter yang optimum;

- Pengoptimuman penapis isyarat, mencari keseimbangan antara kebisingan dan kelewatan;

- Cuba belajar mesin dan lain-lain untuk menghasilkan peraturan perdagangan secara automatik.

Dalam proses pengoptimuman, pengukuran dan perdagangan simulasi mesti digunakan sepenuhnya untuk menilai kualiti isyarat dan kestabilan strategi. Hanya penyelesaian pengoptimuman yang telah disahkan sepenuhnya yang boleh digunakan di lapangan.

ringkaskan

Strategi ini overall adalah strategi pengesanan trend yang lebih baik. Ia menggunakan beberapa indikator untuk menilai trend, menetapkan penapis untuk mengurangkan isyarat yang salah, dan dapat menyesuaikan trend pengesanan stop loss secara automatik. Jika parameter ditetapkan dengan betul, ia dapat menangkap trend garis tengah dengan lancar.

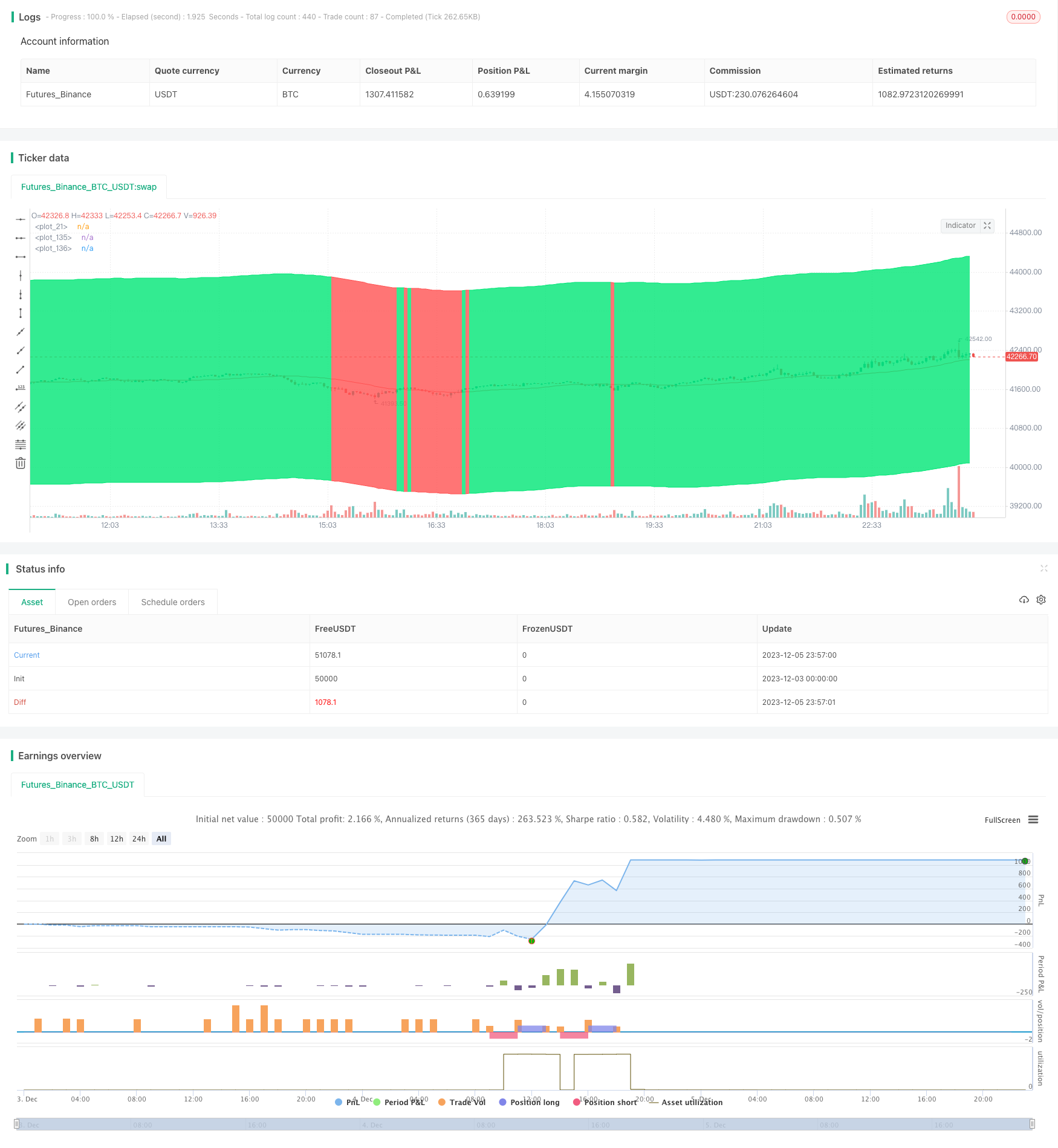

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-06 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © RafaelZioni

//@version=4

strategy(title = " BTC 15 min", overlay = true, pyramiding=1,initial_capital = 10000, default_qty_type= strategy.percent_of_equity, default_qty_value = 20, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.075)

strat_dir_input = input(title="Strategy Direction", defval="all", options=["long", "short", "all"])

strat_dir_value = strat_dir_input == "long" ? strategy.direction.long : strat_dir_input == "short" ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

price = close

length8 = input(30,title = 'length of channel')

upmult = input(title = 'upper percent',type=input.float, step=0.1, defval=5)

lowmult = input(title = 'lower percent',type=input.float, step=0.1, defval=5)

basis = sma(close, length8)

vup = upmult * price / 100

vlow = lowmult * price / 100

upper = basis + vup

lower = basis - vlow

plot(basis, color=color.red)

//

fastLength = input(3, title="Fast filter length ", minval=1)

slowLength = input(21,title="Slow filter length", minval=1)

source=close

v1=ema(source,fastLength)

v2=ema(source,slowLength)

//

leng=1

p1=close[1]

len55 = 10

//taken from https://www.tradingview.com/script/Ql1FjjfX-security-free-MTF-example-JD/

HTF = input("1D", type=input.resolution)

ti = change( time(HTF) ) != 0

T_c = fixnan( ti ? close : na )

vrsi = rsi(cum(change(T_c) * volume), leng)

pp=wma(vrsi,len55)

d=(vrsi[1]-pp[1])

len100 = 10

x=ema(d,len100)

//

zx=x/-1

col=zx > 0? color.lime : color.orange

//

tf10 = input("1", title = "Timeframe", type = input.resolution, options = ["1", "5", "15", "30", "60","120", "240","360","720", "D", "W"])

length = input(50, title = "Period", type = input.integer)

shift = input(1, title = "Shift", type = input.integer)

hma(_src, _length)=>

wma((2 * wma(_src, _length / 2)) - wma(_src, _length), round(sqrt(_length)))

hma3(_src, _length)=>

p = length/2

wma(wma(close,p/3)*3 - wma(close,p/2) - wma(close,p),p)

b =security(syminfo.tickerid, tf10, hma3(close[1], length)[shift])

//plot(a,color=color.gray)

//plot(b,color=color.yellow)

close_price = close[0]

len = input(25)

linear_reg = linreg(close_price, len, 0)

buy=crossover(linear_reg, b)

sell=crossunder(linear_reg, b) or crossunder(close[1],upper)

//

src2=low

src3=high

Min =input(15)

leni = timeframe.isintraday and timeframe.multiplier >= 1 ?

Min / timeframe.multiplier * 7 :

timeframe.isintraday and timeframe.multiplier < 60 ?

60 / timeframe.multiplier * 24 * 7 : 7

l1 = wma(src2,leni)

h1 = wma(src3,leni)

//

m=(h1+l1)/2

//

len5 = 100

src5=m

//

multi = 2

mean = ema(src5, len5)

stddev = multi * stdev(src5, len5)

b5 = mean + stddev

s5 = mean - stddev

var bool long = na

var bool short = na

long :=crossover(src5, s5)

short := crossunder(src5, b5)

var float last_open_long = na

var float last_open_short = na

last_open_long := long ? close : nz(last_open_long[1])

last_open_short := short ? close : nz(last_open_short[1])

entry_value =last_open_long

entry_value1=last_open_short

r=100

//

highb = highest(entry_value1, r)

lowb = lowest(entry_value, r)

d5 = highb - lowb

me = (highb + lowb) / 2

h4 = highb - d5 * 0.236

c3 = highb - d5 * 0.382

c4 = highb - d5 * 0.618

l4 = highb - d5 * 0.764

//

col2 = close >= me ? color.lime : color.red

p5 = plot(upper, color=col2)

p2 = plot(lower, color=col2)

fill(p5, p2,color=col2)

// Conditions

longCond = bool(na)

shortCond = bool(na)

longCond := crossover(zx,0) or buy

shortCond := sell

// Count your long short conditions for more control with Pyramiding

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if longCond

sectionLongs := sectionLongs + 1

sectionShorts := 0

sectionShorts

if shortCond

sectionLongs := 0

sectionShorts := sectionShorts + 1

sectionShorts

// Pyramiding

pyrl = 1

// These check to see your signal and cross references it against the pyramiding settings above

longCondition = longCond and sectionLongs <= pyrl

shortCondition = shortCond and sectionShorts <= pyrl

// Get the price of the last opened long or short

last_open_longCondition = float(na)

last_open_shortCondition = float(na)

last_open_longCondition := longCondition ? open : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? open : nz(last_open_shortCondition[1])

// Check if your last postion was a long or a short

last_longCondition = float(na)

last_shortCondition = float(na)

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

// Take profit

isTPl = true

//isTPs = input(false, "Take Profit Short")

tp = input(2, "Exit Profit %", type=input.float)

long_tp = isTPl and crossover(high, (1 + tp / 100) * last_open_longCondition) and longCondition == 0 and in_longCondition == 1

//short_tp = isTPs and crossunder(low, (1 - tp / 100) * last_open_shortCondition) and

//shortCondition == 0 and in_shortCondition == 1

// Stop Loss

isSLl = input(true,"buy Loss Long")

//isSLs = input(false, "buy Loss Short")

sl = 0.0

sl := input(5, " rebuy %", type=input.float)

long_sl = isSLl and crossunder(low, (1 - sl / 100) * last_open_longCondition) and

longCondition == 0 and in_longCondition == 1

//short_sl = isSLs and crossover(high, (1 + sl / 100) * last_open_shortCondition) and

//shortCondition == 0 and in_shortCondition == 1

//

// Conditions

longCond5 = bool(na)

shortCond5 = bool(na)

longCond5 := longCondition

shortCond5 := long_tp

//

sectionLongs5 = 0

sectionLongs5 := nz(sectionLongs5[1])

sectionShorts5 = 0

sectionShorts5 := nz(sectionShorts5[1])

if longCond5

sectionLongs5 := sectionLongs5 + 1

sectionShorts5 := 0

sectionShorts5

if shortCond5

sectionLongs5 := 0

sectionShorts5 := sectionShorts5 + 1

sectionShorts5

//

pyr5 = 1

longCondition5 = longCond5 and sectionLongs5 <= pyr5

shortCondition5 = shortCond5 and sectionShorts5 <= pyr5

// Get the price of the last opened long or short

last_open_longCondition5 = float(na)

last_open_shortCondition5 = float(na)

last_open_longCondition5 := longCondition5 ? open : nz(last_open_longCondition5[1])

last_open_shortCondition5 := shortCondition5 ? open : nz(last_open_shortCondition5[1])

last_longCondition5 = float(na)

last_shortCondition5 = float(na)

last_longCondition5 := longCondition5 ? time : nz(last_longCondition5[1])

last_shortCondition5 := shortCondition5 ? time : nz(last_shortCondition5[1])

in_longCondition5 = last_longCondition5 > last_shortCondition5

in_shortCondition5 = last_shortCondition5 > last_longCondition5

//

filter=input(true)

g(v, p) => round(v * (pow(10, p))) / pow(10, p)

risk = input(100)

leverage = input(1)

c = g((strategy.equity * leverage / open) * (risk / 100), 4)

//

l =(v1 > v2 or filter == false ) and longCondition or long_sl

//

//l = longCondition or long_sl

s=shortCondition5

if l

strategy.entry("buy", strategy.long,c)

if s

strategy.entry("sell", strategy.short,c)

per(pcnt) =>

strategy.position_size != 0 ? round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss=input(title=" stop loss", defval=5, minval=0.01)

los = per(stoploss)

q1=input(title=" qty_percent1", defval=50, minval=1)

q2=input(title=" qty_percent2", defval=50, minval=1)

tp10=input(title=" Take profit1", defval=1, minval=0.01)

tp20=input(title=" Take profit2", defval=2, minval=0.01)

strategy.exit("x1", qty_percent = q1, profit = per(tp10), loss = los)

strategy.exit("x2", qty_percent = q2, profit = per(tp20), loss = los)