Strategi Kuantitatif Berdasarkan Indeks Stochastic Momentum dan RSI

Gambaran keseluruhan

Strategi ini adalah berdasarkan Stochastic Momentum Index (SMI) dan Relative Strength Index (RSI). Selain itu, penapis warna dan penapis entiti K-Line telah dimasukkan sebagai kriteria penilaian tambahan.

Prinsip Strategi

Strategi ini bergantung pada SMI dan RSI untuk membuat keputusan. SMI menentukan sama ada saham itu terlalu banyak dijual, dan RSI menentukan kekuatan saham yang relatif lemah.

- SMI oversell ((di bawah had bawah), dianggap sebagai isyarat beli

- RSI di bawah paras terendah sebagai isyarat untuk membeli

- Isyarat beli dikeluarkan apabila SMI oversold dan RSI pada masa yang sama berada di bawah paras paras paras yang sesuai

- Logik penghakiman isyarat kosong serupa

Di samping itu, strategi ini juga menetapkan mod isyarat ganda. Mod ini memerlukan SMI dan RSI untuk memberi isyarat pada masa yang sama untuk berdagang. Ini dapat mengurangkan isyarat palsu dengan berkesan.

Selain itu, strategi ini juga menambah penapis warna dan penapis entiti K-line. Kedua-dua penapis ini memerlukan entiti K-line yang lebih besar, dan harga penutupan K-line terakhir lebih tinggi daripada harga pembukaan. Ini dapat mengelakkan lagi perdagangan palsu.

Kelebihan Strategik

- Pertimbangan RSI agak kuat, dan pengesahan dua kali dapat mengurangkan isyarat palsu

- Menetapkan mod dua isyarat dapat mengurangkan perdagangan yang tidak sah

- Penapis warna dan penapis entiti K-line dapat menyaring penembusan palsu dengan berkesan

- Strategi menjalankan logik yang jelas dan mudah

- Kebanyakan parameter boleh disesuaikan

Risiko dan pengoptimuman strategi

- SMI dan RSI boleh menghasilkan lebih banyak isyarat palsu apabila digunakan sebagai penunjuk berasingan.

- Dalam mod isyarat ganda, peluang perdagangan yang lebih baik mungkin terlepas jika parameter ditetapkan dengan tidak betul

- Boleh menguji keuntungan strategi di bawah parameter kitaran yang berbeza untuk mencari kombinasi parameter terbaik

- Tetapan parameter terhad tertentu yang boleh dinilai melalui simulasi atau pengesanan semula

- Kaedah penapis yang boleh dipertimbangkan

ringkaskan

Strategi ini mengintegrasikan isyarat kedua-dua indikator SMI dan RSI, dan mengeluarkan arahan perdagangan melalui pengesahan berganda. Filter warna dan penapis entiti K-line dapat disaring untuk penembusan palsu. Logik operasi strategi ini sederhana dan jelas, dan kebanyakan parameter dapat disesuaikan.

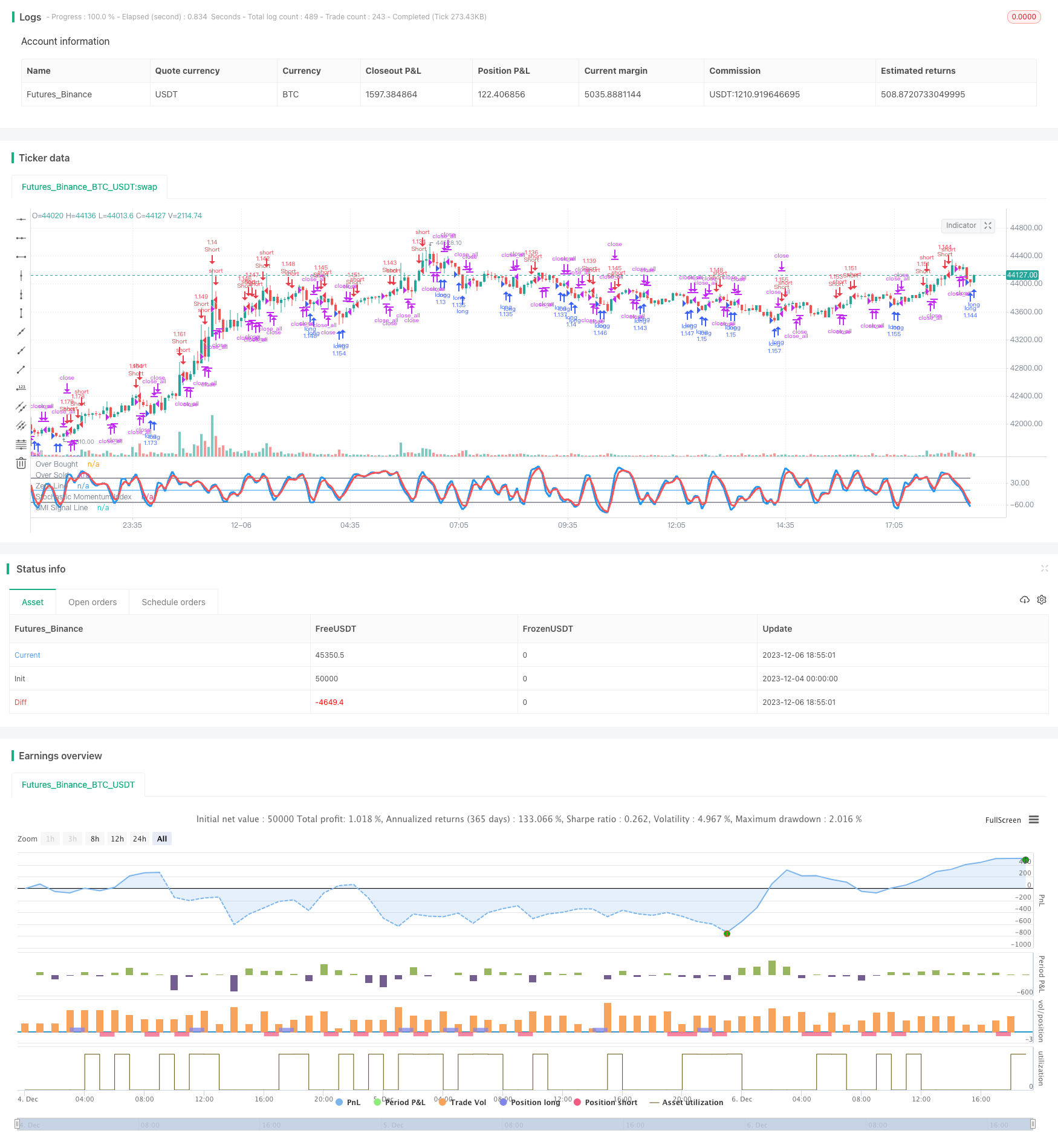

/*backtest

start: 2023-12-04 00:00:00

end: 2023-12-06 19:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Stochastic Strategy v1.3", shorttitle = "Stochastic str 1.3", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

usesmi = input(true, defval = true, title = "Use SMI Strategy")

usersi = input(true, defval = true, title = "Use RSI Strategy")

usecol = input(true, defval = true, title = "Use Color-Filter")

usebod = input(true, defval = true, title = "Use Body-Filter")

a = input(2, defval = 2, minval = 2, maxval = 50, title = "SMI Percent K Length")

b = input(2, defval = 2, minval = 2, maxval = 50, title = "SMI Percent D Length")

limitsmi = input(50, defval = 50, minval = 1, maxval = 100, title = "SMI Limit")

periodrsi = input(2, defval = 2, minval = 2, maxval = 50, title = "RSI Period")

limitrsi = input(10, defval = 10, minval = 1, maxval = 50, title = "RSI Limit")

double = input(false, defval = false, title = "SMI+RSI Mode")

showbg = input(false, defval = false, title = "Show background")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(close), 0), periodrsi)

fastdown = rma(-min(change(close), 0), periodrsi)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Stochastic Momentum Index

ll = lowest (low, a)

hh = highest (high, a)

diff = hh - ll

rdiff = close - (hh+ll)/2

//avgrel = ema(ema(rdiff,b),b)

//avgdiff = ema(ema(diff,b),b)

avgrel = sma(sma(rdiff,b),b)

avgdiff = sma(sma(diff,b),b)

SMI = avgdiff != 0 ? (avgrel/(avgdiff/2)*100) : 0

SMIsignal = ema(SMI,b)

//Lines

plot(SMI, color = blue, linewidth = 3, title = "Stochastic Momentum Index")

plot(SMIsignal, color = red, linewidth = 3, title = "SMI Signal Line")

plot(limitsmi, color = black, title = "Over Bought")

plot(-1 * limitsmi, color = black, title = "Over Sold")

plot(0, color = blue, title = "Zero Line")

//Color-Filter

gb = close > open or usecol == false

rb = close < open or usecol == false

//Body Filter

nbody = abs(close - open)

abody = sma(nbody, 10)

body = nbody > abody / 3 or usebod == false

//Signals

up1 = SMI < -1 * limitsmi and rb and body and usesmi

dn1 = SMI > limitsmi and gb and body and usesmi

up2 = fastrsi < limitrsi and rb and body and usersi

dn2 = fastrsi > 100 - limitrsi and gb and body and usersi

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)) and body

//Background

redb = (SMI > limitsmi and usesmi) or (fastrsi > 100 - limitrsi and usersi)

limeb = (SMI < -1 * limitsmi and usesmi) or (fastrsi < limitrsi and usersi)

col = showbg == false ? na : redb ? red : limeb ? lime : na

bgcolor(col, transp = 50)

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

signalup = ((up1 or up2) and double == false) or (up1 and up2 and double)

if signalup

if strategy.position_size < 0

strategy.close_all()

strategy.entry("long", strategy.long, needlong == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

signaldn = ((dn1 or dn2) and double == false) or (dn1 and dn2 and double)

if signaldn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()