Strategi Perdagangan Arah Dua Bawah Momentum Sensitif Harga PPO

Gambaran keseluruhan

Strategi perdagangan berorientasikan binari PPO Price Sensitivity Dynamics adalah strategi perdagangan yang mengesan trend pembentukan binari harga dengan menggunakan indikator harga sensitiviti dinamika harga. Ia menggabungkan penilaian pembentukan binari PPO dan penilaian ciri pergerakan harga, untuk menentukan lokasi tepat untuk titik perubahan binari harga, dan menghasilkan isyarat perdagangan.

Prinsip Strategi

Strategi ini menggunakan indikator PPO untuk menentukan ciri harga double bottom, dan pada masa yang sama menentukan titik terendah harga, dan memantau secara langsung sama ada indikator PPO menunjukkan ciri-ciri bawah. Apabila indikator PPO muncul dalam bentuk double bottom yang berbalik dari bawah ke atas, menunjukkan bahawa ia kini berada di titik peluang membeli.

Di sisi lain, strategi ini bekerjasama dengan penilaian nilai minimum harga untuk menentukan sama ada harga berada pada tahap yang lebih rendah. Apabila harga berada pada tahap yang rendah, jika indikator PPO menunjukkan ciri-ciri bawah, ia akan menghasilkan isyarat beli.

Penghakiman dua kali ganda melalui penghakiman ciri-ciri pembalikan indikator PPO dan pengesahan kedudukan harga, dapat mengenal pasti peluang pembalikan harga dengan berkesan, menyaring beberapa isyarat palsu, dan meningkatkan kualiti isyarat.

Analisis kelebihan

Menggunakan bentuk dua-bottom PPO indikator, anda boleh menentukan tepat masa untuk membeli.

Dengan penentuan kedudukan harga, ia dapat menyaring isyarat palsu yang dihasilkan pada titik yang lebih tinggi dan meningkatkan kualiti isyarat.

Indeks PPO sensitif, dapat menangkap trend perubahan harga dengan cepat, sesuai untuk mengesan trend.

Menggunakan mekanisme pengesahan dua kali dapat mengurangkan risiko transaksi secara berkesan.

Risiko dan penyelesaian

Indikator PPO mudah menghasilkan isyarat palsu, perlu ditambah dengan petunjuk lain untuk pengesahan. Indikator garis rata atau indikator turun naik boleh ditambah sebagai bantuan.

Pembaikan dua dasar tidak semestinya berterusan, terdapat risiko penurunan lagi. Anda boleh menetapkan titik berhenti kehilangan, mengoptimumkan pengurusan kedudukan.

Tetapan parameter yang tidak betul boleh menyebabkan risiko kebocoran atau pembelian yang salah. Kombinasi parameter perlu dioptimumkan dengan ujian berulang.

Jumlah kod yang lebih besar, boleh terus bermodulasi, mengurangkan kod yang berulang.

Arah pengoptimuman

Tambah modul stop loss, optimumkan strategi pengurusan kedudukan.

Menambah penyokong pengesahan rata-rata atau penyokong pengesahan lonjakan.

Kod modular, mengurangkan logik penghakiman berulang.

Teruskan mengoptimumkan parameter untuk meningkatkan kestabilan.

Uji lebih banyak aplikasi arbitraj.

ringkaskan

PPO harga sensitiviti dinamik strategi perdagangan orientasi dua dasar dengan menangkap ciri-ciri dua dasar PPO, digabungkan dengan pengesahan dua hala yang ditentukan oleh kedudukan harga, mencapai penempatan yang berkesan pada titik perubahan harga. Berbanding dengan penilaian satu indikator, ia mempunyai keunggulan yang lebih tepat dalam penghakiman dan penyaringan kebisingan. Tetapi strategi ini juga mempunyai beberapa isyarat risiko palsu, yang memerlukan terus mengoptimumkan portofolio indikator, dan dibantu dengan strategi pengurusan kedudukan yang ketat, anda boleh memperoleh keuntungan yang stabil dalam kehidupan nyata.

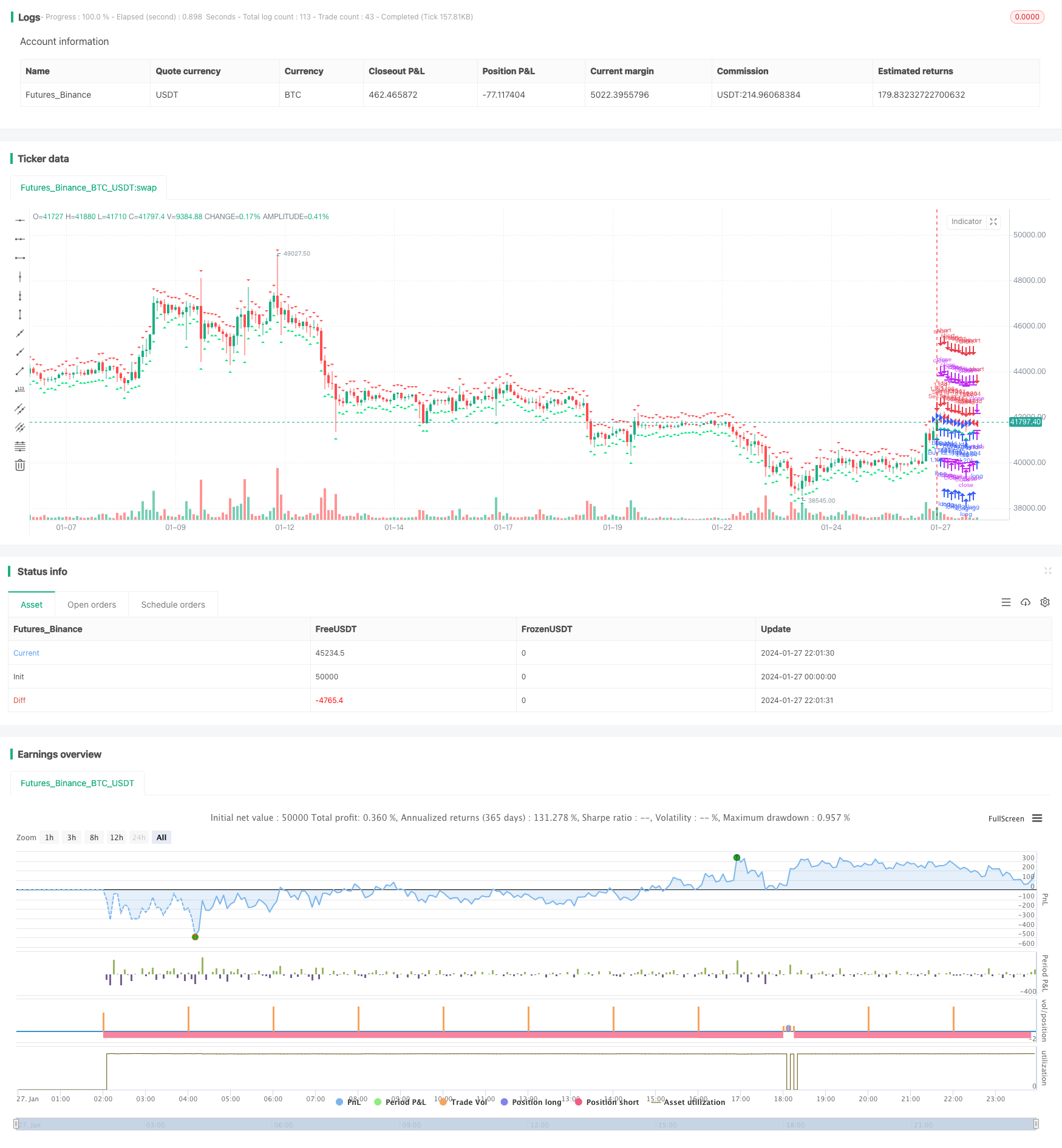

/*backtest

start: 2024-01-27 00:00:00

end: 2024-01-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © luciancapdefier

//@version=4

strategy("PPO Divergence ST", overlay=true, initial_capital=30000, calc_on_order_fills=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// time

FromYear = input(2019, "Backtest Start Year")

FromMonth = input(1, "Backtest Start Month")

FromDay = input(1, "Backtest Start Day")

ToYear = input(2999, "Backtest End Year")

ToMonth = input(1, "Backtest End Month")

ToDay = input(1, "Backtest End Day")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false

source = close

topbots = input(true, title="Show PPO high/low triangles?")

long_term_div = input(true, title="Use long term divergences?")

div_lookback_period = input(55, minval=1, title="Lookback Period")

fastLength = input(12, minval=1, title="PPO Fast")

slowLength=input(26, minval=1, title="PPO Slow")

signalLength=input(9,minval=1, title="PPO Signal")

smoother = input(2,minval=1, title="PPO Smooth")

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

macd2=(macd/slowMA)*100

d = sma(macd2, smoother) // smoothing PPO

bullishPrice = low

priceMins = bullishPrice > bullishPrice[1] and bullishPrice[1] < bullishPrice[2] or low[1] == low[2] and low[1] < low and low[1] < low[3] or low[1] == low[2] and low[1] == low[3] and low[1] < low and low[1] < low[4] or low[1] == low[2] and low[1] == low[3] and low[1] and low[1] == low[4] and low[1] < low and low[1] < low[5] // this line identifies bottoms and plateaus in the price

oscMins= d > d[1] and d[1] < d[2] // this line identifies bottoms in the PPO

BottomPointsInPPO = oscMins

bearishPrice = high

priceMax = bearishPrice < bearishPrice[1] and bearishPrice[1] > bearishPrice[2] or high[1] == high[2] and high[1] > high and high[1] > high[3] or high[1] == high[2] and high[1] == high[3] and high[1] > high and high[1] > high[4] or high[1] == high[2] and high[1] == high[3] and high[1] and high[1] == high[4] and high[1] > high and high[1] > high[5] // this line identifies tops in the price

oscMax = d < d[1] and d[1] > d[2] // this line identifies tops in the PPO

TopPointsInPPO = oscMax

currenttrough4=valuewhen (oscMins, d[1], 0) // identifies the value of PPO at the most recent BOTTOM in the PPO

lasttrough4=valuewhen (oscMins, d[1], 1) // NOT USED identifies the value of PPO at the second most recent BOTTOM in the PPO

currenttrough5=valuewhen (oscMax, d[1], 0) // identifies the value of PPO at the most recent TOP in the PPO

lasttrough5=valuewhen (oscMax, d[1], 1) // NOT USED identifies the value of PPO at the second most recent TOP in the PPO

currenttrough6=valuewhen (priceMins, low[1], 0) // this line identifies the low (price) at the most recent bottom in the Price

lasttrough6=valuewhen (priceMins, low[1], 1) // NOT USED this line identifies the low (price) at the second most recent bottom in the Price

currenttrough7=valuewhen (priceMax, high[1], 0) // this line identifies the high (price) at the most recent top in the Price

lasttrough7=valuewhen (priceMax, high[1], 1) // NOT USED this line identifies the high (price) at the second most recent top in the Price

delayedlow = priceMins and barssince(oscMins) < 3 ? low[1] : na

delayedhigh = priceMax and barssince(oscMax) < 3 ? high[1] : na

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away

filter = barssince(priceMins) < 5 ? lowest(currenttrough6, 4) : na

filter2 = barssince(priceMax) < 5 ? highest(currenttrough7, 4) : na

//delayedbottom/top when oscillator bottom/top is earlier than price bottom/top

y11 = valuewhen(oscMins, delayedlow, 0)

y12 = valuewhen(oscMax, delayedhigh, 0)

// only take tops/bottoms in price when tops/bottoms are less than 5 bars away, since 2nd most recent top/bottom in osc

y2=valuewhen(oscMax, filter2, 1) // identifies the highest high in the tops of price with 5 bar lookback period SINCE the SECOND most recent top in PPO

y6=valuewhen(oscMins, filter, 1) // identifies the lowest low in the bottoms of price with 5 bar lookback period SINCE the SECOND most recent bottom in PPO

long_term_bull_filt = valuewhen(priceMins, lowest(div_lookback_period), 1)

long_term_bear_filt = valuewhen(priceMax, highest(div_lookback_period), 1)

y3=valuewhen(oscMax, currenttrough5, 0) // identifies the value of PPO in the most recent top of PPO

y4=valuewhen(oscMax, currenttrough5, 1) // identifies the value of PPO in the second most recent top of PPO

y7=valuewhen(oscMins, currenttrough4, 0) // identifies the value of PPO in the most recent bottom of PPO

y8=valuewhen(oscMins, currenttrough4, 1) // identifies the value of PPO in the SECOND most recent bottom of PPO

y9=valuewhen(oscMins, currenttrough6, 0)

y10=valuewhen(oscMax, currenttrough7, 0)

bulldiv= BottomPointsInPPO ? d[1] : na // plots dots at bottoms in the PPO

beardiv= TopPointsInPPO ? d[1]: na // plots dots at tops in the PPO

i = currenttrough5 < highest(d, div_lookback_period) // long term bearish oscilator divergence

i2 = y10 > long_term_bear_filt // long term bearish top divergence

i3 = delayedhigh > long_term_bear_filt // long term bearish delayedhigh divergence

i4 = currenttrough4 > lowest(d, div_lookback_period) // long term bullish osc divergence

i5 = y9 < long_term_bull_filt // long term bullish bottom div

i6 = delayedlow < long_term_bull_filt // long term bullish delayedbottom div

//plot(0, color=gray)

//plot(d, color=black)

//plot(bulldiv, title = "Bottoms", color=maroon, style=circles, linewidth=3, offset= -1)

//plot(beardiv, title = "Tops", color=green, style=circles, linewidth=3, offset= -1)

bearishdiv1 = (y10 > y2 and oscMax and y3 < y4) ? true : false

bearishdiv2 = (delayedhigh > y2 and y3 < y4) ? true : false

bearishdiv3 = (long_term_div and oscMax and i and i2) ? true : false

bearishdiv4 = (long_term_div and i and i3) ? true : false

bullishdiv1 = (y9 < y6 and oscMins and y7 > y8) ? true : false

bullishdiv2 = (delayedlow < y6 and y7 > y8) ? true : false

bullishdiv3 = (long_term_div and oscMins and i4 and i5) ? true : false

bullishdiv4 = (long_term_div and i4 and i6) ? true : false

bearish = bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4

bullish = bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4

greendot = beardiv != 0 ? true : false

reddot = bulldiv != 0 ? true : false

if (reddot and window())

strategy.entry("Buy Id", strategy.long, comment="BUY")

if (greendot and window())

strategy.entry("Sell Id", strategy.short, comment="SELL")

alertcondition( bearish, title="Bearish Signal (Orange)", message="Orange & Bearish: Short " )

alertcondition( bullish, title="Bullish Signal (Purple)", message="Purple & Bullish: Long " )

alertcondition( greendot, title="PPO High (Green)", message="Green High Point: Short " )

alertcondition( reddot, title="PPO Low (Red)", message="Red Low Point: Long " )

// plotshape(bearish ? d : na, text='▼\nP', style=shape.labeldown, location=location.abovebar, color=color(orange,0), textcolor=color(white,0), offset=0)

// plotshape(bullish ? d : na, text='P\n▲', style=shape.labelup, location=location.belowbar, color=color(#C752FF,0), textcolor=color(white,0), offset=0)

plotshape(topbots and greendot ? d : na, text='', style=shape.triangledown, location=location.abovebar, color=color.red, offset=0, size=size.tiny)

plotshape(topbots and reddot ? d : na, text='', style=shape.triangleup, location=location.belowbar, color=color.lime, offset=0, size=size.tiny)

//barcolor(bearishdiv1 or bearishdiv2 or bearishdiv3 or bearishdiv4 ? orange : na)

//barcolor(bullishdiv1 or bullishdiv2 or bullishdiv3 or bullishdiv4 ? fuchsia : na)

//barcolor(#dedcdc)