Model pembalikan pecahan berdasarkan strategi Pedagang Penyu

Gambaran keseluruhan

Strategi ini adalah berdasarkan kepada strategi yang terkenal oleh peniaga-peniaga pelaut, yang telah terbukti selama bertahun-tahun. Ia menghantar isyarat kedudukan panjang dan kosong, dan boleh membuat sehingga 5 pesanan piramid, yang bermaksud bahawa strategi ini boleh mencetuskan sehingga 5 pesanan dalam arah yang sama.

Perlu diperhatikan bahawa strategi ini menggabungkan dua sistem yang bekerja bersama-sama (S1 dan S2).

Prinsip Strategi

Saiz kedudukan sangat penting bagi peniaga pelaut untuk menguruskan risiko dengan betul. Strategi penyesuaian kedudukan ini disesuaikan dengan turun naik pasaran dan akaun (Pendapatan dan Kerugian). Ia berdasarkan ATR (Rangkuman Sebenar Rata-rata), yang juga boleh dikenali sebagai N.

Jumlah unit yang dibeli ialah:

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

Anda boleh menambah peratusan akaun anda mengikut keutamaan risiko anda, tetapi peniaga-peniaga Pantai Merah secara lalai adalah 1%. Jika anda berdagang dengan kontrak, unit mesti secara lalai turun ke bawah.

Terdapat juga peraturan tambahan untuk mengurangkan risiko apabila nilai akaun kurang daripada modal awal: dalam kes ini, dalam formula satuan mesti digantikan dengan formula berikut:

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

Terdapat dua sistem yang berfungsi bersama: Penembusan adalah kedudukan tinggi atau rendah yang baru. Jika ia adalah kedudukan tinggi baru, kita membuka kedudukan terbalik, sebaliknya, jika ia adalah kedudukan rendah baru, kita memasuki kedudukan kosong.

Kami menambah satu peraturan tambahan: Peraturan tambahan ini membolehkan peniaga untuk mengambil bahagian dalam trend utama, jika isyarat Sistem 1 telah dilangkau. Jika isyarat Sistem 1 telah dilangkau, dan garis K seterusnya juga merupakan penembusan baru pada hari ke-20, maka S1 tidak akan menghantar isyarat. Kita mesti menunggu isyarat S2 atau menunggu tidak menghasilkan garis K baru untuk mengaktifkan semula S1.

Analisis kelebihan

Strategi Pantai membolehkan kita menambah unit tambahan kepada kedudukan apabila pergerakan harga menguntungkan kita. Saya telah mengkonfigurasi strategi untuk membenarkan sehingga 5 pesanan ditambahkan ke arah yang sama. Oleh itu, jika harga berubah dari Beli, kita akan menambah unit.

Kami akan menetapkan pesanan pertama sebagai pesanan maksimum. Perintah piramid seterusnya akan menjadi lebih sedikit unit daripada pesanan pertama.

Kami telah menetapkan maksimum 10% stop loss untuk pesanan pertama anda, yang bermaksud anda tidak akan kehilangan lebih daripada 10% dari nilai pesanan pertama anda.*ATR ((20), pesanan piramid anda mungkin akan kehilangan lebih banyak, dan tidak ada jaminan kerugian tidak melebihi 10%. Risiko masih dikendalikan dengan baik kerana nilai pesanan ini lebih rendah daripada nilai pesanan pertama.

Analisis risiko

Risiko terbesar dalam strategi ini adalah memegang kedudukan yang terlalu besar. Oleh kerana pesanan yang ditugaskan menggunakan harga pasaran, jika beberapa harga pasaran yang besar diturunkan pada masa yang sama, akan memberi kesan besar kepada tawaran dan menyebabkan penurunan besar. Ini akan menyebabkan kerugian besar.

Risiko lain ialah peruntukan pengurusan wang yang tidak sesuai. Peruntukan yang salah atau peruntukan yang terlalu besar boleh menyebabkan kerugian besar. Ini memerlukan peruntukan yang berhati-hati mengikut keutamaan risiko anda.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dalam beberapa aspek:

Anda boleh menguji kesan parameter yang berbeza terhadap kadar pulangan dan kadar Sharpe, seperti kitaran ATR, pengganda ATR yang terhenti, dan sebagainya. Cari kombinasi parameter yang optimum.

Peraturan masuk dan keluar yang berbeza boleh diuji. Sebagai contoh, bentuk garis K digunakan sebagai syarat penapisan tambahan.

Anda boleh mencuba jenis penutupan lain, seperti penutupan bergerak, penutupan dinamik. Ini mungkin dapat mengurangkan kemungkinan penutupan yang ditembusi.

Anda boleh menguji pelbagai jumlah pesanan piramid. Semakin banyak pesanan, semakin besar leverage dan risiko. Cari titik keseimbangan terbaik.

Anda boleh cuba untuk menghentikan perdagangan dalam jangka masa tertentu (seperti sebelum data pekerjaan bukan pertanian AS dikeluarkan) untuk mengelakkan kejatuhan peristiwa besar.

ringkaskan

Secara keseluruhan, strategi ini mempunyai keseimbangan risiko dan keuntungan yang baik, sesuai untuk perdagangan trend panjang dan sederhana. Ia mempunyai kelebihan seperti sistem perdagangan, risiko yang terkawal. Dengan pengoptimuman, kestabilan dan kadar keuntungan strategi dapat ditingkatkan lagi.

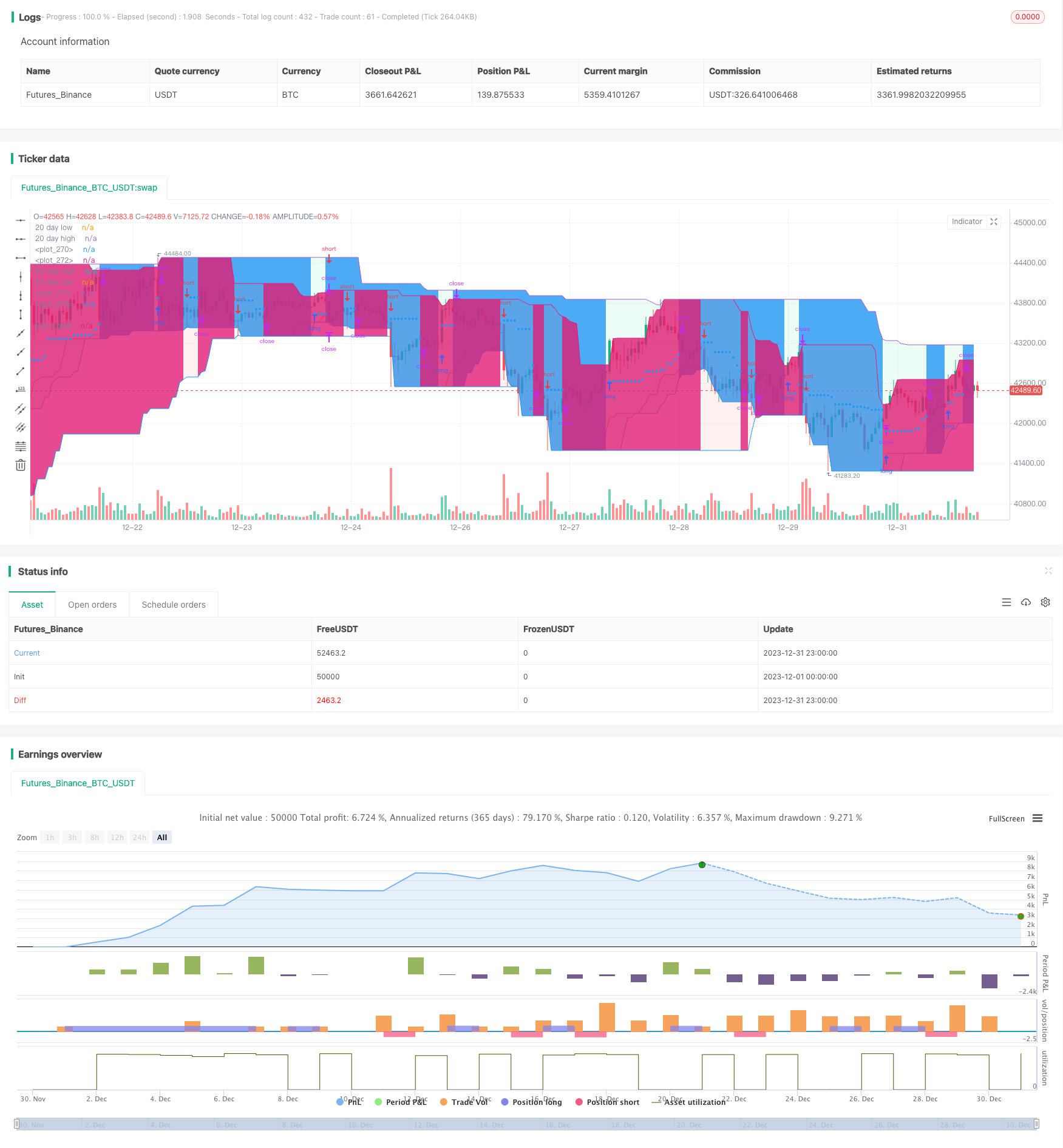

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gsanson66

//This strategy is based on the famous "Turtle Strategy"

//A well-known strategy which proved its performance during past years

//@version=5

strategy("TURTLE STRATEGY", overlay=true)

//------------------------------TOOL TIPS--------------------------------//

t1 = "Percentage of the account the trader is willing to lose. This percentage is used to define the position size based on previous gains or losses. Turtle traders default to 1%."

t2 = "ATR Length"

t3 = "ATR Multiplier to fix the Stop Loss"

t4 = "Pyramiding : ATR Multiplier to set a profit target to increase position size"

t5 = "System 1 enter long if there is a new high after this selected period of time"

t6 = "System 2 enter long if there is a new high after this selected period of time"

t7 = "Exit Long from system 1 if there is a new low after this selected period of time"

t8 = "Exit Long from system 2 if there is a new low after this selected period of time"

t9 = "System 1 enter short if there is a new low after this selected period of time"

t10 = "System 2 enter short if there is a new low after this selected period of time"

t11 = "Exit short from system 1 if there is a new high after this selected period of time"

t12 = "Exit short from system 2 if there is a new high after this selected period of time"

//----------------------------------------FUNCTIONS---------------------------------------//

//@function Displays text passed to `txt` when called.

debugLabel(txt, color) =>

label.new(bar_index, high, text=txt, color=color, style=label.style_label_lower_right, textcolor=color.black, size=size.small)

//@function which looks if the close date of the current bar falls inside the date range

inBacktestPeriod(start, end) => true

//---------------------------------------USER INPUTS--------------------------------------//

//Risk Management and turtle system input

percentage_to_risk = input.float(1, "Risk % of capital", maxval=100, minval=0, group="Turtle Parameters", tooltip=t1)

atr_period = input.int(20, "ATR period", minval=1, group="Turtle Parameters", tooltip=t2)

stop_N_multiplier = input.float(1.5, "Stop ATR", minval=0.1, group="Turtle Parameters", tooltip=t3)

pyramid_profit = input.float(0.5, "Pyramid Profit", minval=0.01, group="Turtle Parameters", tooltip=t4)

S1_long = input.int(20, "S1 Long", minval=1, group="Turtle Parameters", tooltip=t5)

S2_long = input.int(55, "S2 Long", minval=1, group="Turtle Parameters", tooltip=t6)

S1_long_exit = input.int(10, "S1 Long Exit", minval=1, group="Turtle Parameters", tooltip=t7)

S2_long_exit = input.int(20, "S2 Long Exit", minval=1, group="Turtle Parameters", tooltip=t8)

S1_short = input.int(15, "S1 Short", minval=1, group="Turtle Parameters", tooltip=t9)

S2_short = input.int(55, "S2 Short", minval=1, group="Turtle Parameters", tooltip=t10)

S1_short_exit = input.int(7, "S1 Short Exit", minval=1, group="Turtle Parameters", tooltip=t11)

S2_short_exit = input.int(20, "S2 Short Exit", minval=1, group="Turtle Parameters", tooltip=t12)

//Backtesting period

startDate = input(title="Start Date", defval=timestamp("1 Jan 2020 00:00:00"), group="Backtesting Period")

endDate = input(title="End Date", defval=timestamp("1 July 2034 00:00:00"), group="Backtesting Period")

//----------------------------------VARIABLES INITIALISATION-----------------------------//

//Turtle variables

atr = ta.atr(atr_period)

var float buy_price_long = na

var float buy_price_short = na

var float stop_loss_long = na

var float stop_loss_short = na

float account = na

//Entry variables

day_high_syst1 = ta.highest(high, S1_long)

day_low_syst1 = ta.lowest(low, S1_short)

day_high_syst2 = ta.highest(high, S2_long)

day_low_syst2 = ta.lowest(low, S2_short)

var bool skip = false

var bool unskip_buffer_long = false

var bool unskip_buffer_short = false

//Exit variables

exit_long_syst1 = ta.lowest(low, S1_long_exit)

exit_short_syst1 = ta.highest(high, S1_short_exit)

exit_long_syst2 = ta.lowest(low, S2_long_exit)

exit_short_syst2 = ta.highest(high, S2_short_exit)

float exit_signal = na

//Backtesting period

bool inRange = na

//------------------------------CHECKING SOME CONDITIONS ON EACH SCRIPT EXECUTION-------------------------------//

strategy.initial_capital = 50000

//Checking if the date belong to the range

inRange := inBacktestPeriod(startDate, endDate)

//Checking if the current equity is higher or lower than the initial capital to adjusted position size

if strategy.equity - strategy.openprofit < strategy.initial_capital

account := (strategy.equity-strategy.openprofit)*(strategy.equity-strategy.openprofit)/strategy.initial_capital

else

account := strategy.equity - strategy.openprofit

//Checking if we close all trades in case where we exit the backtesting period

if strategy.position_size!=0 and not inRange

strategy.close_all()

debugLabel("END OF BACKTESTING PERIOD : we close the trade", color=color.rgb(116, 116, 116))

//--------------------------------------SKIP MANAGEMENT------------------------------------//

//Checking if a long signal has been skiped and system2 is not triggered

if skip and high>day_high_syst1[1] and high<day_high_syst2[1]

unskip_buffer_long := true

//Checking if a short signal has been skiped and system2 is not triggered

if skip and low<day_low_syst1[1] and low>day_low_syst2[1]

unskip_buffer_short := true

//Checking if current high is lower than previous 20_day_high after a skiped long signal to set skip to false

if unskip_buffer_long

if high<day_high_syst1[1]

skip := false

unskip_buffer_long := false

//Checking if current low is higher than previous 20_day_low after a skiped short signal to set skip to false

if unskip_buffer_short

if low>day_low_syst1[1]

skip := false

unskip_buffer_short := false

//Checking if we have an open position to reset skip and unskip buffers

if strategy.position_size!=0 and skip

skip := false

unskip_buffer_long := false

unskip_buffer_short := false

//--------------------------------------------ENTRY CONDITIONS--------------------------------------------------//

//We calculate the position size based on turtle calculation

unit = (percentage_to_risk/100)*account/atr*syminfo.pointvalue

//Long order for system 1

if not skip and not (strategy.position_size>0) and inRange

strategy.cancel("Long Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_high_syst1>account

unit := account/day_high_syst1

stop_loss_long := day_high_syst1 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst1*0.9

stop_loss_long := day_high_syst1*0.9

strategy.order("Long Syst 1", strategy.long, unit, stop=day_high_syst1)

buy_price_long := day_high_syst1

//Long order for system 2

if skip and not (strategy.position_size>0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_high_syst2>account

unit := account/day_high_syst2

stop_loss_long := day_high_syst2 - stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_long < day_high_syst2*0.9

stop_loss_long := day_high_syst2*0.9

strategy.order("Long Syst 2", strategy.long, unit, stop=day_high_syst2)

buy_price_long := day_high_syst2

//Short order for system 1

if not skip and not (strategy.position_size<0) and inRange

strategy.cancel("Short Syst 2")

//We check that position size doesn't exceed available equity

if unit*day_low_syst1>account

unit := account/day_low_syst1

stop_loss_short := day_low_syst1 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst1*1.1

stop_loss_short := day_low_syst1*1.1

strategy.order("Short Syst 1", strategy.short, unit, stop=day_low_syst1)

buy_price_short := day_low_syst1

//Short order for system 2

if skip and not (strategy.position_size<0) and inRange

//We check that position size doesn't exceed available equity

if unit*day_low_syst2>account

unit := account/day_low_syst2

stop_loss_short := day_low_syst2 + stop_N_multiplier*atr

//We adjust SL if it's greater than 10% of trade value and fix it to 10%

if stop_loss_short > day_low_syst2*1.1

stop_loss_short := day_low_syst2*1.1

strategy.order("Short Syst 2", strategy.short, unit, stop=day_low_syst2)

buy_price_short := day_low_syst2

//-------------------------------PYRAMIDAL------------------------------------//

//Pyramid for long orders

if close > buy_price_long + (pyramid_profit*atr) and strategy.position_size>0

//We calculate the remaining capital

remaining_capital = account - strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the long position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_long := stop_loss_long + pyramid_profit*atr

strategy.entry("Pyramid Long", strategy.long, units_to_add)

buy_price_long := close

//Pyramid for short orders

if close < buy_price_short - (pyramid_profit*atr) and strategy.position_size<0

//We calculate the remaining capital

remaining_capital = account + strategy.position_size*strategy.position_avg_price*(1-0.0018)

//We calculate units to add to the short position

units_to_add = (percentage_to_risk/100)*remaining_capital/atr*syminfo.pointvalue

if remaining_capital > units_to_add

//We set the new Stop loss

stop_loss_short := stop_loss_short - pyramid_profit*atr

strategy.entry("Pyramid Short", strategy.short, units_to_add)

buy_price_short := close

//----------------------------EXIT ORDERS-------------------------------//

//Checking if exit_long_syst1 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 1"

if exit_long_syst1[1] > stop_loss_long

exit_signal := exit_long_syst1[1]

else

exit_signal := stop_loss_long

//Checking if exit_long_syst2 is higher than stop_loss_long

if strategy.opentrades.entry_id(0)=="Long Syst 2"

if exit_long_syst2[1] > stop_loss_long

exit_signal := exit_long_syst2[1]

else

exit_signal := stop_loss_long

//Checking if exit_short_syst1 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 1"

if exit_short_syst1[1] < stop_loss_short

exit_signal := exit_short_syst1[1]

else

exit_signal := stop_loss_short

//Checking if exit_short_syst2 is lower than stop_loss_short

if strategy.opentrades.entry_id(0)=="Short Syst 2"

if exit_short_syst2[1] < stop_loss_short

exit_signal := exit_short_syst2[1]

else

exit_signal := stop_loss_short

//If the exit order is configured to close the position at a profit, we set 'skip' to true (we substract commission)

if strategy.position_size*exit_signal>strategy.position_size*strategy.position_avg_price*(1-0.0018)

strategy.cancel("Long Syst 1")

strategy.cancel("Short Syst 1")

skip := true

if strategy.position_size*exit_signal<=strategy.position_size*strategy.position_avg_price*(1-0.0018)

skip := false

//We place stop exit orders

if strategy.position_size > 0

strategy.exit("Exit Long", stop=exit_signal)

if strategy.position_size < 0

strategy.exit("Exit Short", stop=exit_signal)

//------------------------------PLOTTING ELEMENTS-------------------------------//

plotchar(atr, "ATR", "", location.top, color.rgb(131, 5, 83))

//Plotting enter threshold

plot(day_high_syst1[1], "20 day high", color.rgb(118, 217, 159))

plot(day_high_syst2[1], "55 day high", color.rgb(4, 92, 53))

plot(day_low_syst1[1], "20 day low", color.rgb(234, 108, 108))

plot(day_low_syst2[1], "55 day low", color.rgb(149, 17, 17))

//Plotting Exit Signal

plot(exit_signal, "Exit Signal", color.blue, style=plot.style_circles)

//Plotting our position

exit_long_syst2_plot = plot(exit_long_syst2[1], color=na)

day_high_syst2_plot = plot(day_high_syst2[1], color=na)

exit_short_syst2_plot = plot(exit_short_syst2[1], color=na)

day_low_syst2_plot = plot(day_low_syst2[1], color=na)

fill(exit_long_syst2_plot, day_high_syst2_plot, color=strategy.position_size>0 ? color.new(color.lime, 90) : na)

fill(exit_short_syst2_plot, day_low_syst2_plot, color=strategy.position_size<0 ? color.new(color.red, 90) : na)