Strategi kuantitatif berdasarkan pivot Kamachira dan jalur Bollinger

Tarikh penciptaan:

2024-02-05 14:23:59

Akhirnya diubah suai:

2024-02-05 14:23:59

Salin:

0

Bilangan klik:

1065

1

fokus pada

1664

Pengikut

Gambaran keseluruhan

Strategi ini mula-mula mengira titik pusat Kamachila berdasarkan harga tertinggi, terendah, dan harga penutupan pada hari perdagangan sebelumnya. Kemudian, ia menapis harga dengan penunjuk Bollinger Bands dan menghasilkan isyarat perdagangan apabila harga menembusi titik pusat.

Prinsip Strategi

- Hitung harga tertinggi, terendah, dan penutupan pada hari perdagangan sebelumnya

- Kaedah untuk mengira sumbu Kamakura yang terdiri daripada H4, H3, H2, H1 dan L1, L2, L3 dan L4

- Berhitung 20 hari Brin naik dan turun

- Buat lebih apabila harga naik dan turun, buat kosong apabila turun

- Titik hentian terletak berhampiran jalur atas atau bawah Brin

Analisis kelebihan

- Axis Kamachila mengandungi beberapa titik rintangan sokongan utama untuk meningkatkan kebolehpercayaan isyarat perdagangan

- Gabungan dengan penunjuk Brin, penapis penembusan palsu yang berkesan

- Pelbagai set parameter, fleksibiliti perdagangan

Analisis risiko

- Seting parameter penunjuk tali pinggang Brin yang tidak betul boleh menyebabkan kesilapan isyarat perdagangan

- Bilangan titik kritikal pada aksen Kamachila bergantung kepada harga pada hari perdagangan sebelumnya, yang mungkin dipengaruhi oleh lompatan malam

- Operasi Berbilang Kepala Bebas Berhadapan Risiko Kerugian

Arah pengoptimuman

- Mengoptimumkan parameter Brin untuk mencari kombinasi parameter yang terbaik

- Penapisan penembusan palsu yang digabungkan dengan petunjuk lain

- Meningkatkan strategi penangguhan kerugian dan mengurangkan kerugian tunggal

ringkaskan

Strategi ini menggunakan integrasi Kacamatera Axis dan Bollinger Bands untuk menghasilkan isyarat perdagangan apabila harga menembusi tahap rintangan sokongan utama. Keuntungan dan kestabilan strategi dapat ditingkatkan melalui pengoptimuman parameter dan penapisan isyarat. Secara keseluruhan, strategi ini jelas, dapat dikendalikan, dan layak untuk diuji secara langsung.

Kod sumber strategi

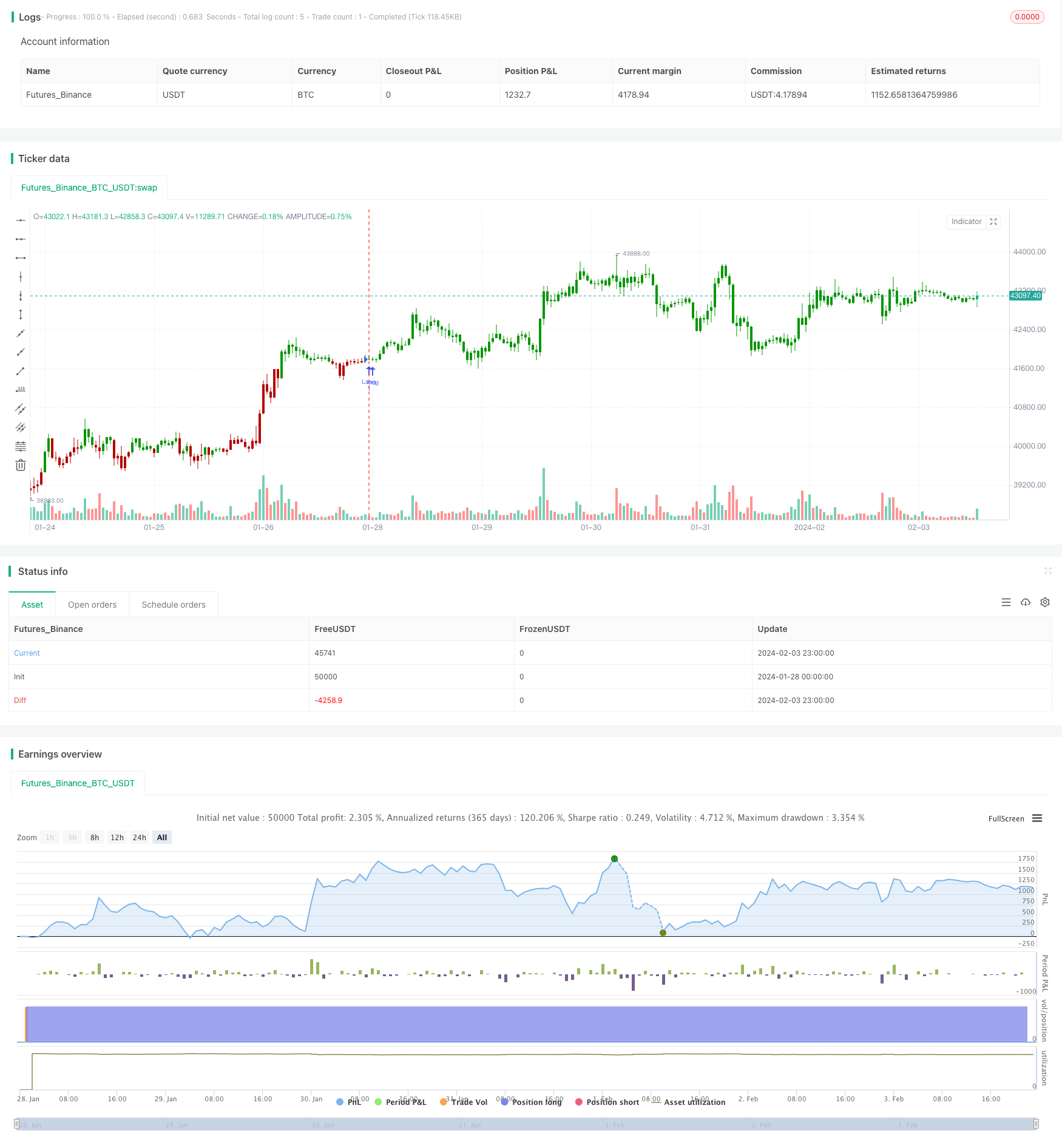

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/05/2020

// Camarilla pivot point formula is the refined form of existing classic pivot point formula.

// The Camarilla method was developed by Nick Stott who was a very successful bond trader.

// What makes it better is the use of Fibonacci numbers in calculation of levels.

//

// Camarilla equations are used to calculate intraday support and resistance levels using

// the previous days volatility spread. Camarilla equations take previous day’s high, low and

// close as input and generates 8 levels of intraday support and resistance based on pivot points.

// There are 4 levels above pivot point and 4 levels below pivot points. The most important levels

// are L3 L4 and H3 H4. H3 and L3 are the levels to go against the trend with stop loss around H4 or L4 .

// While L4 and H4 are considered as breakout levels when these levels are breached its time to

// trade with the trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Camarilla Pivot Points V2 Backtest", shorttitle="CPP V2", overlay = true)

res = input(title="Resolution", type=input.resolution, defval="D")

width = input(1, minval=1)

SellFrom = input(title="Sell from ", defval="R1", options=["R1", "R2", "R3", "R4"])

BuyFrom = input(title="Buu from ", defval="S1", options=["S1", "S2", "S3", "S4"])

reverse = input(false, title="Trade reverse")

xHigh = security(syminfo.tickerid,res, high)

xLow = security(syminfo.tickerid,res, low)

xClose = security(syminfo.tickerid,res, close)

H4 = (0.55*(xHigh-xLow)) + xClose

H3 = (0.275*(xHigh-xLow)) + xClose

H2 = (0.183*(xHigh-xLow)) + xClose

H1 = (0.0916*(xHigh-xLow)) + xClose

L1 = xClose - (0.0916*(xHigh-xLow))

L2 = xClose - (0.183*(xHigh-xLow))

L3 = xClose - (0.275*(xHigh-xLow))

L4 = xClose - (0.55*(xHigh-xLow))

pos = 0

S = iff(BuyFrom == "S1", H1,

iff(BuyFrom == "S2", H2,

iff(BuyFrom == "S3", H3,

iff(BuyFrom == "S4", H4,0))))

B = iff(SellFrom == "R1", L1,

iff(SellFrom == "R2", L2,

iff(SellFrom == "R3", L3,

iff(SellFrom == "R4", L4,0))))

pos := iff(close > B, 1,

iff(close < S, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )