Стратегия следования за трендом двойного разворота

Обзор

Это стратегия для отслеживания трендов, объединенная с двойным сигналом обратного отсчета. Она объединяет 123 стратегии обратного отсчета и стратегию индекса производительности, чтобы отслеживать точки обратного отсчета цены и обеспечивать более надежное определение тренда.

Стратегический принцип

Эта стратегия состоит из двух подстратегий:

- 123 Стратегия переворота

Используйте 14-дневную K-линию, чтобы определить обратный сигнал. Конкретные правила:

- Многоголовый сигнал: закрытие цены снизилось за два дня, текущая цена закрытия K-линии выше, чем закрытие цены за предыдущий день, Stochastic Slow на 9 день ниже 50

- Поверхностный сигнал: цена на закрытие на первые два дня выросла, текущая цена на закрытие линии K ниже, чем цена на закрытие на предыдущий день, Stochastic Fast на 9 день выше 50

- Стратегия индекса производительности

В качестве индикатора используются взлеты и падения за последние 14 дней.

- Показатель производительности> ((0)), создает многоголовый сигнал

- Показатель производительности <(0), создает пустой сигнал

Окончательный сигнал - это комбинация двух сигналов. То есть, для создания фактической операции купли-продажи необходим однонаправленный многополосный сигнал.

Это позволяет отфильтровывать часть шума, что делает сигнал более надежным.

Стратегические преимущества

Эта двойная система имеет следующие преимущества:

- Сигналы более надежны, когда используются двойные факторы

- Это позволяет эффективно отфильтровывать рыночный шум и избегать ложных сигналов.

- 123 формы классические и практические, легко оценить и воспроизвести

- Индекс производительности позволяет определить будущие тенденции

- Гибкий и оптимизируемый набор параметров

Стратегический риск

Однако эта стратегия также несет в себе некоторые риски:

- Возможно, мы пропустили внезапный поворот и не смогли полностью уловить тенденцию.

- Комбинация двойных условий приводит к уменьшению сигнала, что может повлиять на прибыльность

- Необходимость принятия решений на равных, подверженность особым колебаниям в акциях

- Проблемы с параметрами могут привести к отклонению сигнала

Можно рассмотреть следующие варианты оптимизации:

- Настройка параметров, таких как длина K-линии, Стохастический цикл и т. д.

- Оптимизация логики суждения двойных сигналов

- Вместе с другими факторами, такими как объем перевода.

- Увеличение убыточности

Подвести итог

Эта стратегия включает в себя двойное обратное суждение, что позволяет эффективно обнаруживать точки переворота цены. Хотя вероятность возникновения сигнала снижена, она имеет высокую надежность и подходит для захвата средне-длинных тенденций. Эффективность стратегии может быть дополнительно усилена с помощью параметрической корректировки и многофакторной оптимизации.

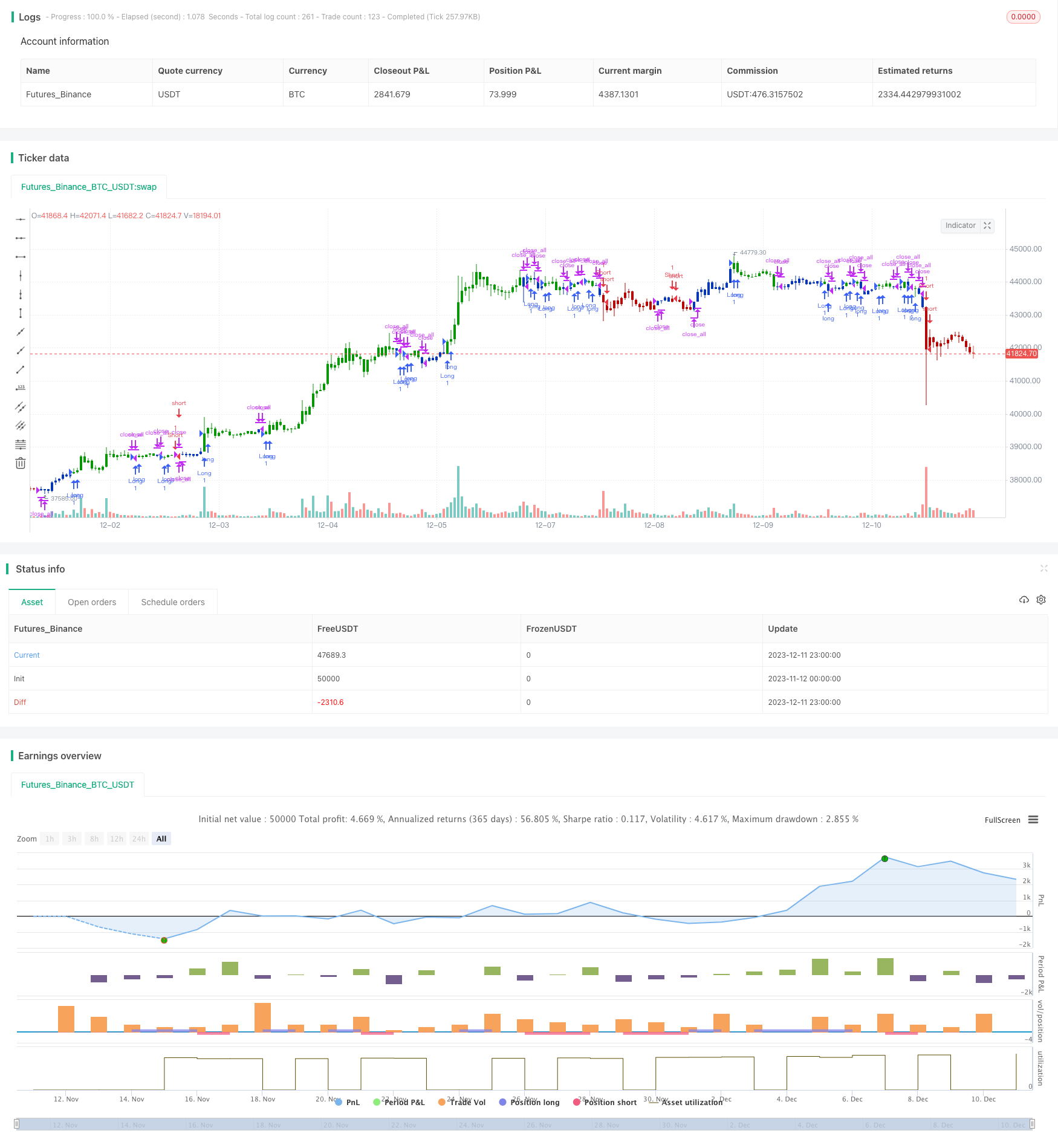

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 15/04/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Performance indicator or a more familiar term, KPI (key performance indicator),

// is an industry term that measures the performance. Generally used by organizations,

// they determine whether the company is successful or not, and the degree of success.

// It is used on a business’ different levels, to quantify the progress or regress of a

// department, of an employee or even of a certain program or activity. For a manager

// it’s extremely important to determine which KPIs are relevant for his activity, and

// what is important almost always depends on which department he wants to measure the

// performance for. So the indicators set for the financial team will be different than

// the ones for the marketing department and so on.

//

// Similar to the KPIs companies use to measure their performance on a monthly, quarterly

// and yearly basis, the stock market makes use of a performance indicator as well, although

// on the market, the performance index is calculated on a daily basis. The stock market

// performance indicates the direction of the stock market as a whole, or of a specific stock

// and gives traders an overall impression over the future security prices, helping them decide

// the best move. A change in the indicator gives information about future trends a stock could

// adopt, information about a sector or even on the whole economy. The financial sector is the

// most relevant department of the economy and the indicators provide information on its overall

// health, so when a stock price moves upwards, the indicators are a signal of good news. On the

// other hand, if the price of a particular stock decreases, that is because bad news about its

// performance are out and they generate negative signals to the market, causing the price to go

// downwards. One could state that the movement of the security prices and consequently, the movement

// of the indicators are an overall evaluation of a country’s economic trend.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

PI(Period) =>

pos = 0.0

xKPI = (close - close[Period]) * 100 / close[Period]

pos := iff(xKPI > 0, 1,

iff(xKPI < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Perfomance index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Perfomance index ----")

Period = input(14, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posPI = PI(Period)

pos = iff(posReversal123 == 1 and posPI == 1 , 1,

iff(posReversal123 == -1 and posPI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )