Stratégie de trading de tendance basée sur la divergence des prix

Aperçu

Cette stratégie est une stratégie de trading de tendance basée sur des signaux de dispersion de prix. Elle utilise plusieurs indicateurs pour détecter les signaux de dispersion de prix, tels que le RSI, le MACD, les stochastiques, etc., et est confirmée par l’oscillateur Murray Math.

Principe de stratégie

La théorie de la diffusion des prix est au cœur de la stratégie. Quand les prix sont innovants et élevés, mais que l’indicateur n’est pas innovant, on parle de diffusion des prix en période de baisse; quand les prix sont innovants et que l’indicateur n’est pas innovant, on parle de diffusion des prix en période de hausse.

Les conditions d’admission à la stratégie sont les suivantes:

- Détection de signaux de dispersion des prix, y compris les dispersions régulières et cachées

- L’oscillateur de Murray Math est situé dans la zone de tendance correspondante

La condition de sortie est que l’oscillateur soit à zéro en traversant la ligne médiane.

Analyse des avantages

Cette stratégie, combinant la théorie de la dispersion des prix et la confirmation de la tendance, présente les avantages suivants:

- Utiliser les signaux de dispersion des prix pour détecter les points de retournement de tendance potentiels

- Les oscillateurs d’application confirment la tendance actuelle et évitent les fausses percées

- Plusieurs combinaisons d’indicateurs et de paramètres, qui peuvent être ajustées de manière flexible

- Le suivi des tendances et la prévention des pertes

- Les règles logiques sont claires, le code est optimisé

Analyse des risques

Les principaux risques sont les suivants:

- Les signaux de dispersion des prix peuvent être faux et ne permettent pas de confirmer une reprise de tendance.

- Une mauvaise configuration des paramètres de l’oscillateur peut entraîner des fuites et des opportunités manquées

- La tendance excessive des positions libres entraîne un risque de perte plus élevé

- Le nombre de transactions et le coût des points de glissement pourraient augmenter pendant les périodes de forte volatilité

Il est recommandé de mettre en place des arrêts de perte, d’ajuster les positions et d’optimiser les combinaisons de paramètres pour réduire le risque.

Direction d’optimisation

Il y a encore de la place pour optimiser cette stratégie:

- Ajout d’algorithmes d’apprentissage automatique et optimisation en temps réel des combinaisons de paramètres

- Augmentation des techniques d’arrêt adaptatives, telles que le suivi des arrêts, l’arrêt moyen, etc.

- Un meilleur rapport sonore avec plus d’indicateurs et de conditions de filtrage

- Ajustez dynamiquement les paramètres de l’oscillateur pour optimiser les jugements de tendance

- Optimiser la gestion des risques, définir des limites de retrait maximal, etc.

Résumer

La stratégie intègre la théorie de la dispersion des prix et des indicateurs d’analyse des tendances, permettant de détecter efficacement les points de conversion de tendance potentiels. En combinaison avec des mesures de gestion des risques optimisées, une meilleure rentabilité de la stratégie peut être obtenue.

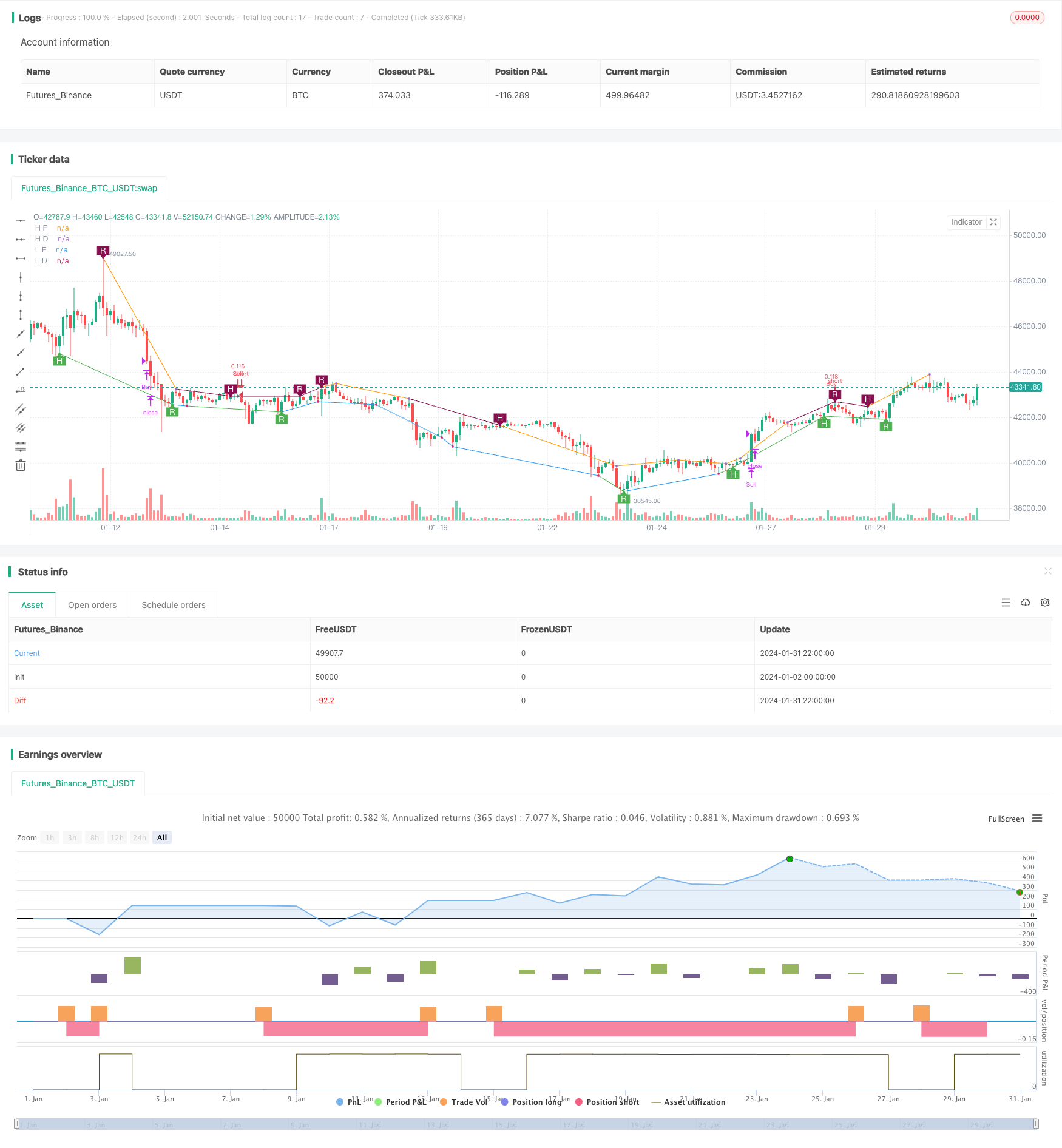

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//

// Title: [STRATEGY][UL]Price Divergence Strategy V1

// Author: JustUncleL

// Date: 23-Oct-2016

// Version: v1.0

//

// Description:

// A trend trading strategy the uses Price Divergence detection signals, that

// are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based).

//

// *** USE AT YOUR OWN RISK ***

//

// Mofidifications:

// 1.0 - original

//

// References:

// Strategy Based on:

// - [RS]Price Divergence Detector V2 by RicardoSantos

// - UCS_Murrey's Math Oscillator by Ucsgears

// Some Code borrowed from:

// - "Strategy Code Example by JayRogers"

// Information on Divergence Trading:

// - http://www.babypips.com/school/high-school/trading-divergences

//

strategy(title='[STRATEGY][UL]Price Divergence Strategy v1.0', pyramiding=0, overlay=true, initial_capital=10000, calc_on_every_tick=false,

currency=currency.USD,default_qty_type=strategy.percent_of_equity,default_qty_value=10)

// || General Input:

method = input(title='Method (0=rsi, 1=macd, 2=stoch, 3=volume, 4=acc/dist, 5=fisher, 6=cci):', defval=1, minval=0, maxval=6)

SHOW_LABEL = input(title='Show Labels', type=bool, defval=true)

SHOW_CHANNEL = input(title='Show Channel', type=bool, defval=false)

uHid = input(true,title="Use Hidden Divergence in Strategy")

uReg = input(true,title="Use Regular Divergence in Strategy")

// || RSI / STOCH / VOLUME / ACC/DIST Input:

rsi_smooth = input(title='RSI/STOCH/Volume/ACC-DIST/Fisher/cci Smooth:', defval=5)

// || MACD Input:

macd_src = input(title='MACD Source:', defval=close)

macd_fast = input(title='MACD Fast:', defval=12)

macd_slow = input(title='MACD Slow:', defval=26)

macd_smooth = input(title='MACD Smooth Signal:', defval=9)

// || Functions:

f_top_fractal(_src)=>_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and _src[2] > _src[0]

f_bot_fractal(_src)=>_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and _src[2] < _src[0]

f_fractalize(_src)=>f_top_fractal(_src) ? 1 : f_bot_fractal(_src) ? -1 : 0

// ||••> START MACD FUNCTION

f_macd(_src, _fast, _slow, _smooth)=>

_fast_ma = sma(_src, _fast)

_slow_ma = sma(_src, _slow)

_macd = _fast_ma-_slow_ma

_signal = ema(_macd, _smooth)

_hist = _macd - _signal

// ||<•• END MACD FUNCTION

// ||••> START ACC/DIST FUNCTION

f_accdist(_smooth)=>_return=sma(cum(close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume), _smooth)

// ||<•• END ACC/DIST FUNCTION

// ||••> START FISHER FUNCTION

f_fisher(_src, _window)=>

_h = highest(_src, _window)

_l = lowest(_src, _window)

_value0 = .66 * ((_src - _l) / max(_h - _l, .001) - .5) + .67 * nz(_value0[1])

_value1 = _value0 > .99 ? .999 : _value0 < -.99 ? -.999 : _value0

_fisher = .5 * log((1 + _value1) / max(1 - _value1, .001)) + .5 * nz(_fisher[1])

// ||<•• END FISHER FUNCTION

method_high = method == 0 ? rsi(high, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(high, rsi_smooth) :

method == 6 ? cci(high, rsi_smooth) :

na

method_low = method == 0 ? rsi(low, rsi_smooth) :

method == 1 ? f_macd(macd_src, macd_fast, macd_slow, macd_smooth) :

method == 2 ? stoch(close, high, low, rsi_smooth) :

method == 3 ? sma(volume, rsi_smooth) :

method == 4 ? f_accdist(rsi_smooth) :

method == 5 ? f_fisher(low, rsi_smooth) :

method == 6 ? cci(low, rsi_smooth) :

na

fractal_top = f_fractalize(method_high) > 0 ? method_high[2] : na

fractal_bot = f_fractalize(method_low) < 0 ? method_low[2] : na

high_prev = valuewhen(fractal_top, method_high[2], 1)

high_price = valuewhen(fractal_top, high[2], 1)

low_prev = valuewhen(fractal_bot, method_low[2], 1)

low_price = valuewhen(fractal_bot, low[2], 1)

regular_bearish_div = fractal_top and high[2] > high_price and method_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and method_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and method_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and method_low[2] < low_prev

plot(title='H F', series=fractal_top ? high[2] : na, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='L F', series=fractal_bot ? low[2] : na, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, offset=-2)

plot(title='H D', series=fractal_top ? high[2] : na, style=circles, color=regular_bearish_div or hidden_bearish_div ? maroon : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plot(title='L D', series=fractal_bot ? low[2] : na, style=circles, color=regular_bullish_div or hidden_bullish_div ? green : not SHOW_CHANNEL ? na : silver, linewidth=3, offset=-2)

plotshape(title='+RBD', series=not SHOW_LABEL ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='+HBD', series=not SHOW_LABEL ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=maroon, textcolor=white, offset=-2)

plotshape(title='-RBD', series=not SHOW_LABEL ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

plotshape(title='-HBD', series=not SHOW_LABEL ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=green, textcolor=white, offset=-2)

// Code borrowed from UCS_Murrey's Math Oscillator by Ucsgears

// - UCS_MMLO

// Inputs

length = input(100, minval = 10, title = "MMLO Look back Length")

quad = input(2, minval = 1, maxval = 4, step = 1, title = "Mininum Quadrant for MMLO Support")

mult = 0.125

// Donchanin Channel

hi = highest(high, length)

lo = lowest(low, length)

range = hi - lo

multiplier = (range) * mult

midline = lo + multiplier * 4

oscillator = (close - midline)/(range/2)

a = oscillator > 0

b = oscillator > 0 and oscillator > mult*2

c = oscillator > 0 and oscillator > mult*4

d = oscillator > 0 and oscillator > mult*6

z = oscillator < 0

y = oscillator < 0 and oscillator < -mult*2

x = oscillator < 0 and oscillator < -mult*4

w = oscillator < 0 and oscillator < -mult*6

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 100, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => ((uReg and regular_bullish_div) or (uHid and hidden_bullish_div)) and (quad==1? a[1]: quad==2?b[1]: quad==3?c[1]: quad==4?d[1]: false)// functions can be used to wrap up and work out complex conditions

exitLong() => oscillator <= 0

strategy.entry(id = "Buy", long = true, when = enterLong() )// use function or simple condition to decide when to get in

strategy.close(id = "Buy", when = exitLong() )// ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => ((uReg and regular_bearish_div) or (uHid and hidden_bearish_div)) and (quad==1? z[1]: quad==2?y[1]: quad==3?x[1]: quad==4?w[1]: false)

exitShort() => oscillator >= 0

strategy.entry(id = "Sell", long = false, when = enterShort())

strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

//EOF