गतिशील ग्रिड ट्रेडिंग प्रबंधन रणनीति

अवलोकन

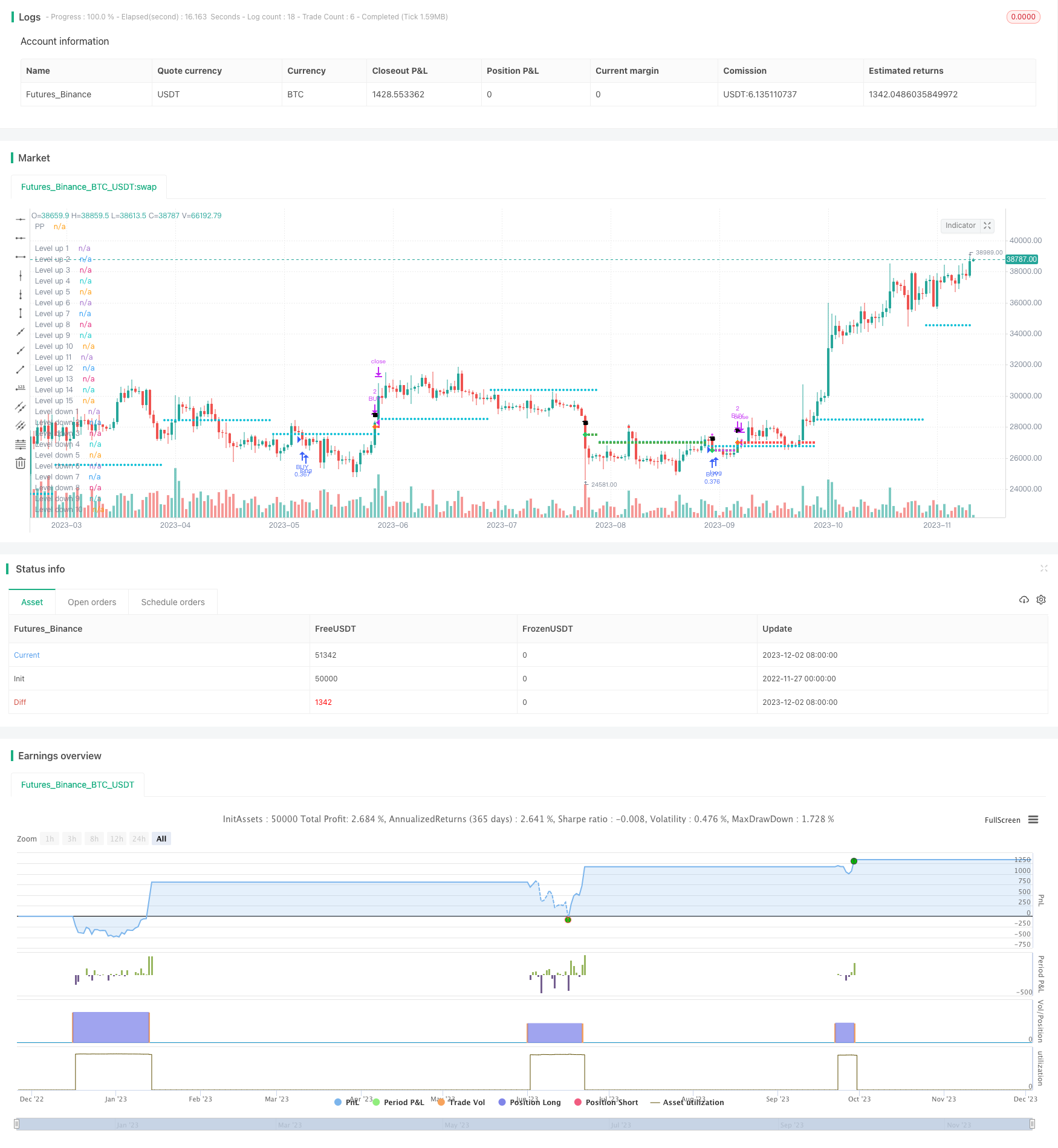

डायनामिक ग्रिड ट्रेडिंग मैनेजमेंट रणनीति (Dynamic Grid Trading Management Strategy) एक ट्रेडिंग रणनीति है जो मूल्य परिवर्तन पर आधारित है। यह पोर्टफोलियो को अनुकूलित करने के उद्देश्य से विभिन्न मूल्य स्तरों पर खरीदने और बेचने के बिंदुओं को स्थापित करके बाजार की अस्थिरता का उपयोग करता है। यह रणनीति विभिन्न बाजार स्थितियों के लिए उपयुक्त है, विशेष रूप से लंबी अवधि के लिए उपयुक्त है।

रणनीति सिद्धांत

डायनामिक ग्रिड ट्रेडिंग प्रबंधन रणनीति का मूल समय चक्र पर आधारित धुरी बिंदुओं का उपयोग करके ग्रिड स्तरों को निर्धारित करने में है। यह कई खरीदने और बेचने के बिंदुओं को स्थापित करके, कीमतों में गिरावट के दौरान खरीदने और कीमतों में वृद्धि के दौरान बेचने की रणनीति को पूरा करता है। जब बाजार की कीमतें गिरती हैं, तो रणनीति खरीदती रहती है, जिससे औसत खरीद लागत कम हो जाती है। जब बाजार की कीमतें औसत खरीद मूल्य से अधिक होती हैं, तो रणनीति बेचने लगती है, और यदि कीमतें बढ़ती रहती हैं, तो बिक्री जारी रहती है, जिससे लाभ होता है।

रणनीतिक लाभ

- बाजार में उतार-चढ़ाव के लिए अनुकूलयह रणनीति बाजार में उतार-चढ़ाव के लिए प्रभावी है और इसे बैल या भालू बाजार में लागू किया जा सकता है।

- जोखिम का फैलाव: विभिन्न मूल्य स्तरों पर व्यापार करके, एक एकल मूल्य बिंदु पर खरीदने या बेचने के जोखिम को फैलाता है।

- दीर्घकालिक लाभ: दीर्घकालिक होल्डिंग रणनीति के लिए उपयुक्त, औसत लागत प्रभावशीलता के माध्यम से, लंबे समय में स्थिर रिटर्न की संभावना।

रणनीतिक जोखिम

- बाजार चरमपंथी व्यवहारइस रणनीति को चरम बाजार व्यवहार जैसे कि भारी उतार-चढ़ाव या बाजार में गिरावट के कारण जोखिम भरा हो सकता है।

- रणनीतिक अनुकूलन की आवश्यकता: रणनीति को बाजार की स्थितियों के अनुसार लगातार समायोजित और अनुकूलित करने की आवश्यकता है ताकि यह विभिन्न बाजार स्थितियों के अनुकूल हो सके।

रणनीति अनुकूलन दिशा

- पैरामीटर समायोजनबाजार के परिवर्तनों के अनुसार, विभिन्न बाजार उतार-चढ़ावों को समायोजित करने के लिए ग्रिड आकार और ट्रेडिंग आवृत्ति को समायोजित करें।

- जोखिम नियंत्रण: अत्यधिक बाजार स्थितियों में भारी नुकसान से बचने के लिए स्टॉप लॉस की स्थापना जैसे अधिक परिष्कृत जोखिम प्रबंधन तंत्र की शुरूआत।

संक्षेप

डायनामिक ग्रिड ट्रेडिंग मैनेजमेंट रणनीति एक लचीली ट्रेडिंग रणनीति है, जो कई प्रकार के बाजार परिदृश्यों के लिए उपयुक्त है। इसका उद्देश्य जोखिम को कम करना और विभिन्न मूल्य स्तरों पर खरीदारी और बिक्री करके दीर्घकालिक रिटर्न प्राप्त करना है। हालांकि, बाजार की अप्रत्याशितता के कारण, रणनीति को बाजार में बदलाव के अनुकूल होने के लिए लगातार समायोजन और अनुकूलन की आवश्यकता होती है। कुल मिलाकर, यह रणनीति निवेशकों के लिए एक आकर्षक विकल्प प्रदान करती है जो दीर्घकालिक स्थिर रिटर्न की तलाश में हैं।

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © XaviZ

//@version=4

strategy(title = "CoGrid Management", shorttitle = "CoGrid💹", overlay = true, pyramiding = 1000, default_qty_value = 0)

// ———————————————————— Inputs

WOption = input('PRICE', " 》 WIDTH TYPE", options = ['PRICE','% PP'])

Width = input(500, " 》 WIDTH", type = input.float, minval = 0)

ppPeriod = input('Month', " 》 PP PERIOD", options = ['Day','Week','15D','Month'])

BuyType = input("CASH", " 》 BUY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

BuyQ = input(10000, " 》 QUANTITY TO BUY", type = input.float, minval = 0)

SellType = input('CONTRACTS', " 》 SELL TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

SellQ = input(2, " 》 QUANTITY TO SELL", type = input.float, minval = 0)

// ———————————————————— Vars

// ————— Buy Price & Sell Price

var float OpenPrice = na

OpenPrice := nz(OpenPrice[1])

// ————— Final Buy Price & Final Sell Price

var float FinalBuyPrice = na

FinalBuyPrice := nz(FinalBuyPrice[1])

var float FinalSellPrice = na

FinalSellPrice := nz(FinalSellPrice[1])

var float FinalOpenPrice = na

FinalOpenPrice := nz(FinalOpenPrice[1])

// ————— Average Price

var int nBuys = na

nBuys := nz(nBuys[1])

var int nSells = na

nSells := nz(nSells[1])

var float sumBuy = na

sumBuy := nz(sumBuy[1])

var float sumSell = na

sumSell := nz(sumSell[1])

var float sumQtyBuy = na

sumQtyBuy := nz(sumQtyBuy[1])

var float sumQtySell = na

sumQtySell := nz(sumQtySell[1])

var float AveragePrice = na

AveragePrice := nz(AveragePrice[1])

// ————— Fibonacci Pivots Level Calculation

var float PP = na

// ————— Origin from Rounded Pivot Points or last Sell

var float PPdownOrigin = na

// ————— Origin from Rounded Position Price

var float PPupOrigin = na

// ————— Final Buy & Sell Conditions

var bool BuyCondition = na

BuyCondition := nz(BuyCondition[1])

var bool SellCondition = na

SellCondition := nz(SellCondition[1])

// ————— Backtest

BuyFactor = BuyType == "CONTRACTS" ? 1 : BuyType == "% EQUITY" ? (100 / (strategy.equity / close)) : close

SellFactor = SellType == "CASH" ? close : 1

BuyQuanTity = BuyQ / BuyFactor

SellQuanTity = SellQ / SellFactor

// ———————————————————— Pivot Points

// ————— Pivot Points Period

res = ppPeriod == '15D' ? '15D' : ppPeriod == 'Week' ? 'W' : ppPeriod == 'Day' ? 'D' : 'M'

// ————— High, Low, Close Calc.

// "Function to securely and simply call `security()` so that it never repaints and never looks ahead" (@PineCoders)

f_secureSecurity(_symbol, _res, _src) => security(_symbol, _res, _src[1], lookahead = barmerge.lookahead_on)

phigh = f_secureSecurity(syminfo.tickerid, res, high)

plow = f_secureSecurity(syminfo.tickerid, res, low)

pclose = f_secureSecurity(syminfo.tickerid, res, close)

// ————— Fibonacci Pivots Level Calculation

PP := (phigh + plow + pclose) / 3

// ———————————————————— Grid Strategy

// ————— Width between levels

float GridWidth = WOption == 'PRICE' ? Width : PP * (Width/100)

// ————— Origin from Rounded Pivot Points

PPdownOrigin := floor(PP / GridWidth) * GridWidth

// ————— Origin from Rounded Average Position Price

PPupOrigin := nz(PPupOrigin[1])

// ————— Grid Calculation

fGrid(_1, _2, _n) =>

_a = _1, _b = _2, _c = 0.0

for _i = 1 to _n

if _i == 1

_c := _a

else

_c := _a + _b

_a := _c

// ————— Initial Open Price

fOpenPrice() =>

var float _ldown = na

var bool _pb = na

var float _lup = na

var bool _ps = na

var float _OpenPrice = na

_OpenPrice := nz(_OpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_ps := crossover(high, _lup) and low <= _lup

if _pb

_OpenPrice := _ldown

if _ps

_OpenPrice := _lup

_OpenPrice

OpenPrice := fOpenPrice()

// ————— Buy at better Price

fBuyCondition(_n) =>

var float _ldown = na

_ldown := nz(_ldown[1])

var bool _pb = na

_pb := nz(_pb[1])

var bool _BuyCondition = na

_BuyCondition := nz(_BuyCondition[1])

for _i = 1 to _n

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_BuyCondition := nz(nBuys) == 0 ? _pb and _ldown < (fixnan(OpenPrice[1]) - GridWidth / 4) : _pb and _ldown < (fixnan(FinalOpenPrice[1]) - GridWidth / 4)

_BuyCondition

// ————— Sell at better Price

fSellCondition(_n) =>

var float _lup = na

_lup := nz(_lup[1])

var bool _ps = na

_ps := nz(_ps[1])

var bool _SellCondition = na

_SellCondition := nz(_SellCondition[1])

for _i = 1 to _n

_lup := fGrid(PPupOrigin, GridWidth, _i)

_ps := crossover(high, _lup) and low <= _lup

_SellCondition := nz(nSells) == 0 ? _ps and _lup > (fixnan(OpenPrice[1]) + GridWidth / 4) : _ps and _lup > (fixnan(FinalOpenPrice[1]) + GridWidth / 4)

_SellCondition

// ————— Final Open Price

fFinalOpenPrice() =>

var float _ldown = na

_ldown := nz(_ldown[1])

var float _lup = na

_lup := nz(_lup[1])

var float _FinalBuyPrice = na

_FinalBuyPrice := nz(_FinalBuyPrice[1])

var float _FinalSellPrice = na

_FinalSellPrice := nz(_FinalSellPrice[1])

var float _FinalOpenPrice = na

_FinalOpenPrice := nz(_FinalOpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

if fBuyCondition(_i)

_FinalBuyPrice := _ldown

_FinalOpenPrice := _ldown

if fSellCondition(_i)

_FinalSellPrice := _lup

_FinalOpenPrice := _lup

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice]

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice] = fFinalOpenPrice()

FinalBuyPrice := _FinalBuyPrice, FinalSellPrice := _FinalSellPrice, FinalOpenPrice := _FinalOpenPrice

// ————— Average Price & Backtest

for _i = 1 to 15

if fBuyCondition(_i)

nBuys := nBuys + 1

nSells := na

sumBuy := FinalOpenPrice * BuyQuanTity + nz(sumBuy[1])

sumQtyBuy := BuyQuanTity + nz(sumQtyBuy[1])

AveragePrice := sumBuy / sumQtyBuy

strategy.entry("BUY", strategy.long, qty = BuyQuanTity)

if fSellCondition(_i)

nBuys := na

nSells := nSells + 1

sumBuy := na

sumQtyBuy := na

strategy.close("BUY", qty = SellType != "% EQUITY" ? SellQuanTity : na, qty_percent = (SellType == "% EQUITY" ? SellQuanTity : na), comment = "SELL")

// ————— Origin from Rounded Pivot Points or last Sell

PPdownOrigin := (WOption == 'PRICE') ?

(fixnan(FinalSellPrice[1]) <= PP ? (floor(fixnan(FinalSellPrice[1]) / GridWidth) * GridWidth) - GridWidth : floor(PP / GridWidth) * GridWidth) :

(fixnan(FinalSellPrice[1]) <= PP ? fixnan(FinalSellPrice[1]) - GridWidth : PP)

// ————— Origin from Rounded Average Buy Price

PPupOrigin := WOption == 'PRICE' ?

((ceil(fixnan(AveragePrice[1]) / GridWidth) * GridWidth) + GridWidth) :

(fixnan(AveragePrice[1]) + GridWidth)

// ———————————————————— Plotting

// ————— Plotting Pivot Points

plot(PP, title = "PP", style = plot.style_circles, color = color.aqua, linewidth = 2)

// ————— Plotting the average price

plot(nBuys > 1 ? AveragePrice[1] : na, title = "Average Price", style = plot.style_circles, color = color.fuchsia, linewidth = 2)

// ————— Buy Conditions ————— Sell Conditions

pb1 = fBuyCondition(1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na, ps1 = fSellCondition(1) ? fGrid(PPupOrigin, GridWidth, 1) : na

pb2 = fBuyCondition(2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na, ps2 = fSellCondition(2) ? fGrid(PPupOrigin, GridWidth, 2) : na

pb3 = fBuyCondition(3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na, ps3 = fSellCondition(3) ? fGrid(PPupOrigin, GridWidth, 3) : na

pb4 = fBuyCondition(4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na, ps4 = fSellCondition(4) ? fGrid(PPupOrigin, GridWidth, 4) : na

pb5 = fBuyCondition(5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na, ps5 = fSellCondition(5) ? fGrid(PPupOrigin, GridWidth, 5) : na

pb6 = fBuyCondition(6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na, ps6 = fSellCondition(6) ? fGrid(PPupOrigin, GridWidth, 6) : na

pb7 = fBuyCondition(7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na, ps7 = fSellCondition(7) ? fGrid(PPupOrigin, GridWidth, 7) : na

pb8 = fBuyCondition(8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na, ps8 = fSellCondition(8) ? fGrid(PPupOrigin, GridWidth, 8) : na

pb9 = fBuyCondition(9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na, ps9 = fSellCondition(9) ? fGrid(PPupOrigin, GridWidth, 9) : na

pb10 = fBuyCondition(10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na, ps10 = fSellCondition(10) ? fGrid(PPupOrigin, GridWidth, 10) : na

pb11 = fBuyCondition(11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na, ps11 = fSellCondition(11) ? fGrid(PPupOrigin, GridWidth, 11) : na

pb12 = fBuyCondition(12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na, ps12 = fSellCondition(12) ? fGrid(PPupOrigin, GridWidth, 12) : na

pb13 = fBuyCondition(13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na, ps13 = fSellCondition(13) ? fGrid(PPupOrigin, GridWidth, 13) : na

pb14 = fBuyCondition(14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na, ps14 = fSellCondition(14) ? fGrid(PPupOrigin, GridWidth, 14) : na

pb15 = fBuyCondition(15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na, ps15 = fSellCondition(15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Level Conditions

lb1 = low < fGrid(PPdownOrigin, -GridWidth, 1) and PP > fGrid(PPdownOrigin, -GridWidth, 1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na

lb2 = low < fGrid(PPdownOrigin, -GridWidth, 2) and PP > fGrid(PPdownOrigin, -GridWidth, 2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na

lb3 = low < fGrid(PPdownOrigin, -GridWidth, 3) and PP > fGrid(PPdownOrigin, -GridWidth, 3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na

lb4 = low < fGrid(PPdownOrigin, -GridWidth, 4) and PP > fGrid(PPdownOrigin, -GridWidth, 4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na

lb5 = low < fGrid(PPdownOrigin, -GridWidth, 5) and PP > fGrid(PPdownOrigin, -GridWidth, 5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na

lb6 = low < fGrid(PPdownOrigin, -GridWidth, 6) and PP > fGrid(PPdownOrigin, -GridWidth, 6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na

lb7 = low < fGrid(PPdownOrigin, -GridWidth, 7) and PP > fGrid(PPdownOrigin, -GridWidth, 7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na

lb8 = low < fGrid(PPdownOrigin, -GridWidth, 8) and PP > fGrid(PPdownOrigin, -GridWidth, 8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na

lb9 = low < fGrid(PPdownOrigin, -GridWidth, 9) and PP > fGrid(PPdownOrigin, -GridWidth, 9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na

lb10 = low < fGrid(PPdownOrigin, -GridWidth, 10) and PP > fGrid(PPdownOrigin, -GridWidth, 10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na

lb11 = low < fGrid(PPdownOrigin, -GridWidth, 11) and PP > fGrid(PPdownOrigin, -GridWidth, 11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na

lb12 = low < fGrid(PPdownOrigin, -GridWidth, 12) and PP > fGrid(PPdownOrigin, -GridWidth, 12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na

lb13 = low < fGrid(PPdownOrigin, -GridWidth, 13) and PP > fGrid(PPdownOrigin, -GridWidth, 13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na

lb14 = low < fGrid(PPdownOrigin, -GridWidth, 14) and PP > fGrid(PPdownOrigin, -GridWidth, 14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na

lb15 = low < fGrid(PPdownOrigin, -GridWidth, 15) and PP > fGrid(PPdownOrigin, -GridWidth, 15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na

// ————— Sell Level Conditions

ls1 = high > fGrid(PPupOrigin, GridWidth, 1) and PP < fGrid(PPupOrigin, GridWidth, 1) ? fGrid(PPupOrigin, GridWidth, 1) : na

ls2 = high > fGrid(PPupOrigin, GridWidth, 2) and PP < fGrid(PPupOrigin, GridWidth, 2) ? fGrid(PPupOrigin, GridWidth, 2) : na

ls3 = high > fGrid(PPupOrigin, GridWidth, 3) and PP < fGrid(PPupOrigin, GridWidth, 3) ? fGrid(PPupOrigin, GridWidth, 3) : na

ls4 = high > fGrid(PPupOrigin, GridWidth, 4) and PP < fGrid(PPupOrigin, GridWidth, 4) ? fGrid(PPupOrigin, GridWidth, 4) : na

ls5 = high > fGrid(PPupOrigin, GridWidth, 5) and PP < fGrid(PPupOrigin, GridWidth, 5) ? fGrid(PPupOrigin, GridWidth, 5) : na

ls6 = high > fGrid(PPupOrigin, GridWidth, 6) and PP < fGrid(PPupOrigin, GridWidth, 6) ? fGrid(PPupOrigin, GridWidth, 6) : na

ls7 = high > fGrid(PPupOrigin, GridWidth, 7) and PP < fGrid(PPupOrigin, GridWidth, 7) ? fGrid(PPupOrigin, GridWidth, 7) : na

ls8 = high > fGrid(PPupOrigin, GridWidth, 8) and PP < fGrid(PPupOrigin, GridWidth, 8) ? fGrid(PPupOrigin, GridWidth, 8) : na

ls9 = high > fGrid(PPupOrigin, GridWidth, 9) and PP < fGrid(PPupOrigin, GridWidth, 9) ? fGrid(PPupOrigin, GridWidth, 9) : na

ls10 = high > fGrid(PPupOrigin, GridWidth, 10) and PP < fGrid(PPupOrigin, GridWidth, 10) ? fGrid(PPupOrigin, GridWidth, 10) : na

ls11 = high > fGrid(PPupOrigin, GridWidth, 11) and PP < fGrid(PPupOrigin, GridWidth, 11) ? fGrid(PPupOrigin, GridWidth, 11) : na

ls12 = high > fGrid(PPupOrigin, GridWidth, 12) and PP < fGrid(PPupOrigin, GridWidth, 12) ? fGrid(PPupOrigin, GridWidth, 12) : na

ls13 = high > fGrid(PPupOrigin, GridWidth, 13) and PP < fGrid(PPupOrigin, GridWidth, 13) ? fGrid(PPupOrigin, GridWidth, 13) : na

ls14 = high > fGrid(PPupOrigin, GridWidth, 14) and PP < fGrid(PPupOrigin, GridWidth, 14) ? fGrid(PPupOrigin, GridWidth, 14) : na

ls15 = high > fGrid(PPupOrigin, GridWidth, 15) and PP < fGrid(PPupOrigin, GridWidth, 15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Shapes

plotshape(pb1, title = "Buy 1", style = shape.diamond, location = location.absolute, color = color.lime, text = "1", size = size.tiny)

plotshape(pb2, title = "Buy 2", style = shape.diamond, location = location.absolute, color = color.lime, text = "2", size = size.tiny)

plotshape(pb3, title = "Buy 3", style = shape.diamond, location = location.absolute, color = color.lime, text = "3", size = size.tiny)

plotshape(pb4, title = "Buy 4", style = shape.diamond, location = location.absolute, color = color.lime, text = "4", size = size.tiny)

plotshape(pb5, title = "Buy 5", style = shape.diamond, location = location.absolute, color = color.lime, text = "5", size = size.tiny)

plotshape(pb6, title = "Buy 6", style = shape.diamond, location = location.absolute, color = color.lime, text = "6", size = size.tiny)

plotshape(pb7, title = "Buy 7", style = shape.diamond, location = location.absolute, color = color.lime, text = "7", size = size.tiny)

plotshape(pb8, title = "Buy 8", style = shape.diamond, location = location.absolute, color = color.lime, text = "8", size = size.tiny)

plotshape(pb9, title = "Buy 9", style = shape.diamond, location = location.absolute, color = color.lime, text = "9", size = size.tiny)

plotshape(pb10, title = "Buy 10", style = shape.diamond, location = location.absolute, color = color.lime, text = "10", size = size.tiny)

plotshape(pb11, title = "Buy 11", style = shape.diamond, location = location.absolute, color = color.lime, text = "11", size = size.tiny)

plotshape(pb12, title = "Buy 12", style = shape.diamond, location = location.absolute, color = color.lime, text = "12", size = size.tiny)

plotshape(pb13, title = "Buy 13", style = shape.diamond, location = location.absolute, color = color.lime, text = "13", size = size.tiny)

plotshape(pb14, title = "Buy 14", style = shape.diamond, location = location.absolute, color = color.lime, text = "14", size = size.tiny)

plotshape(pb15, title = "Buy 15", style = shape.diamond, location = location.absolute, color = color.lime, text = "15", size = size.tiny)

// ————— Sell Shapes

plotshape(ps1, title = "Sell 1", style = shape.diamond, location = location.absolute, color = color.orange, text = "1", size = size.tiny)

plotshape(ps2, title = "Sell 2", style = shape.diamond, location = location.absolute, color = color.orange, text = "2", size = size.tiny)

plotshape(ps3, title = "Sell 3", style = shape.diamond, location = location.absolute, color = color.orange, text = "3", size = size.tiny)

plotshape(ps4, title = "Sell 4", style = shape.diamond, location = location.absolute, color = color.orange, text = "4", size = size.tiny)

plotshape(ps5, title = "Sell 5", style = shape.diamond, location = location.absolute, color = color.orange, text = "5", size = size.tiny)

plotshape(ps6, title = "Sell 6", style = shape.diamond, location = location.absolute, color = color.orange, text = "6", size = size.tiny)

plotshape(ps7, title = "Sell 7", style = shape.diamond, location = location.absolute, color = color.orange, text = "7", size = size.tiny)

plotshape(ps8, title = "Sell 8", style = shape.diamond, location = location.absolute, color = color.orange, text = "8", size = size.tiny)

plotshape(ps9, title = "Sell 9", style = shape.diamond, location = location.absolute, color = color.orange, text = "9", size = size.tiny)

plotshape(ps10, title = "Sell 10", style = shape.diamond, location = location.absolute, color = color.orange, text = "10", size = size.tiny)

plotshape(ps11, title = "Sell 11", style = shape.diamond, location = location.absolute, color = color.orange, text = "11", size = size.tiny)

plotshape(ps12, title = "Sell 12", style = shape.diamond, location = location.absolute, color = color.orange, text = "12", size = size.tiny)

plotshape(ps13, title = "Sell 13", style = shape.diamond, location = location.absolute, color = color.orange, text = "13", size = size.tiny)

plotshape(ps14, title = "Sell 14", style = shape.diamond, location = location.absolute, color = color.orange, text = "14", size = size.tiny)

plotshape(ps15, title = "Sell 15", style = shape.diamond, location = location.absolute, color = color.orange, text = "15", size = size.tiny)

// ————— Plotting Lines under PP // ————— Plotting Lines above PP

plot(lb1, title = "Level down 1", style = plot.style_circles, color = color.green), plot(ls1, title = "Level up 1", style = plot.style_circles, color = color.red)

plot(lb2, title = "Level down 2", style = plot.style_circles, color = color.green), plot(ls2, title = "Level up 2", style = plot.style_circles, color = color.red)

plot(lb3, title = "Level down 3", style = plot.style_circles, color = color.green), plot(ls3, title = "Level up 3", style = plot.style_circles, color = color.red)

plot(lb4, title = "Level down 4", style = plot.style_circles, color = color.green), plot(ls4, title = "Level up 4", style = plot.style_circles, color = color.red)

plot(lb5, title = "Level down 5", style = plot.style_circles, color = color.green), plot(ls5, title = "Level up 5", style = plot.style_circles, color = color.red)

plot(lb6, title = "Level down 6", style = plot.style_circles, color = color.green), plot(ls6, title = "Level up 6", style = plot.style_circles, color = color.red)

plot(lb7, title = "Level down 7", style = plot.style_circles, color = color.green), plot(ls7, title = "Level up 7", style = plot.style_circles, color = color.red)

plot(lb8, title = "Level down 8", style = plot.style_circles, color = color.green), plot(ls8, title = "Level up 8", style = plot.style_circles, color = color.red)

plot(lb9, title = "Level down 9", style = plot.style_circles, color = color.green), plot(ls9, title = "Level up 9", style = plot.style_circles, color = color.red)

plot(lb10, title = "Level down 10", style = plot.style_circles, color = color.green), plot(ls10, title = "Level up 10", style = plot.style_circles, color = color.red)

plot(lb11, title = "Level down 11", style = plot.style_circles, color = color.green), plot(ls11, title = "Level up 11", style = plot.style_circles, color = color.red)

plot(lb12, title = "Level down 12", style = plot.style_circles, color = color.green), plot(ls12, title = "Level up 12", style = plot.style_circles, color = color.red)

plot(lb13, title = "Level down 13", style = plot.style_circles, color = color.green), plot(ls13, title = "Level up 13", style = plot.style_circles, color = color.red)

plot(lb14, title = "Level down 14", style = plot.style_circles, color = color.green), plot(ls14, title = "Level up 14", style = plot.style_circles, color = color.red)

plot(lb15, title = "Level down 15", style = plot.style_circles, color = color.green), plot(ls15, title = "Level up 15", style = plot.style_circles, color = color.red)

// by XaviZ💤