Strategi Manajemen Perdagangan Grid Dinamis

Ringkasan

Strategi Manajemen Perdagangan Grid Dinamis (Dynamic Grid Trading Management Strategy) adalah strategi perdagangan yang didasarkan pada perubahan harga. Strategi ini memanfaatkan volatilitas pasar untuk mencapai tujuan mengoptimalkan portofolio investasi dengan mengatur titik beli dan jual di berbagai tingkat harga. Strategi ini cocok untuk berbagai kondisi pasar, terutama untuk kepemilikan jangka panjang, perdagangan langsung, dan perdagangan swing tanpa leverage.

Prinsip Strategi

Inti dari strategi manajemen perdagangan grid dinamis adalah menggunakan pivot point berdasarkan siklus waktu untuk menentukan tingkat grid. Dengan menyiapkan beberapa titik beli dan jual, strategi ini memungkinkan untuk membeli ketika harga turun dan menjual ketika harga naik. Strategi ini akan terus membeli ketika harga pasar turun, untuk mengurangi biaya pembelian rata-rata.

Keunggulan Strategis

- Beradaptasi dengan perubahan pasarStrategi ini efektif untuk beradaptasi dengan fluktuasi pasar, baik di pasar bullish maupun pasar bearish.

- Dispersi risikoDengan melakukan perdagangan pada tingkat harga yang berbeda, risiko pembelian atau penjualan pada satu titik harga terdispersi.

- Keuntungan jangka panjangStrategi kepemilikan jangka panjang yang sesuai, dengan biaya rata-rata, mungkin mendapatkan keuntungan stabil dalam jangka panjang.

Risiko Strategis

- Perlakuan ekstrim pasarStrategi ini mungkin menghadapi risiko yang lebih besar dalam kondisi pasar yang ekstrim, seperti fluktuasi besar atau runtuhnya pasar.

- Strategi untuk mengoptimalkan kebutuhanStrategi perlu terus disesuaikan dan dioptimalkan sesuai dengan kondisi pasar, untuk menyesuaikan dengan lingkungan pasar yang berbeda.

Arah optimasi strategi

- Pengaturan parameterAda beberapa hal yang perlu diperhatikan dalam trading Forex: Mengatur ukuran grid dan frekuensi trading sesuai dengan perubahan pasar, untuk menyesuaikan diri dengan berbagai pergerakan pasar.

- Pengendalian RisikoMenggunakan mekanisme manajemen risiko yang lebih halus, seperti pengaturan stop loss, untuk menghindari kerugian besar dalam kondisi pasar yang ekstrim.

Meringkaskan

Strategi manajemen perdagangan grid dinamis adalah strategi perdagangan yang fleksibel dan cocok untuk berbagai lingkungan pasar. Ini bertujuan untuk mengurangi risiko dan mencapai keuntungan jangka panjang dengan membeli dan menjual di berbagai tingkat harga. Namun, karena ketidakpastian pasar, strategi ini perlu terus disesuaikan dan dioptimalkan untuk menyesuaikan diri dengan perubahan pasar.

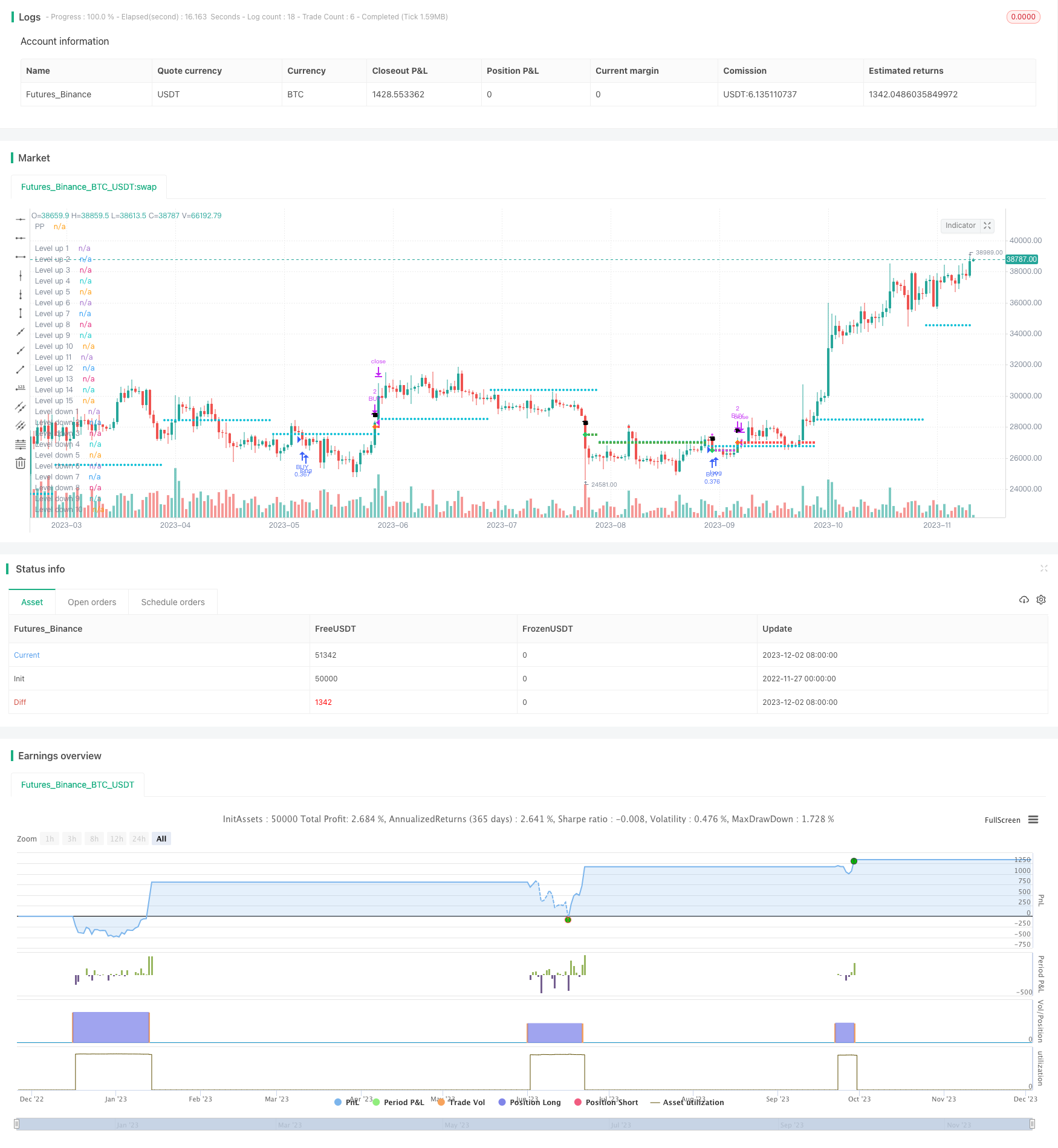

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © XaviZ

//@version=4

strategy(title = "CoGrid Management", shorttitle = "CoGrid💹", overlay = true, pyramiding = 1000, default_qty_value = 0)

// ———————————————————— Inputs

WOption = input('PRICE', " 》 WIDTH TYPE", options = ['PRICE','% PP'])

Width = input(500, " 》 WIDTH", type = input.float, minval = 0)

ppPeriod = input('Month', " 》 PP PERIOD", options = ['Day','Week','15D','Month'])

BuyType = input("CASH", " 》 BUY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

BuyQ = input(10000, " 》 QUANTITY TO BUY", type = input.float, minval = 0)

SellType = input('CONTRACTS', " 》 SELL TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

SellQ = input(2, " 》 QUANTITY TO SELL", type = input.float, minval = 0)

// ———————————————————— Vars

// ————— Buy Price & Sell Price

var float OpenPrice = na

OpenPrice := nz(OpenPrice[1])

// ————— Final Buy Price & Final Sell Price

var float FinalBuyPrice = na

FinalBuyPrice := nz(FinalBuyPrice[1])

var float FinalSellPrice = na

FinalSellPrice := nz(FinalSellPrice[1])

var float FinalOpenPrice = na

FinalOpenPrice := nz(FinalOpenPrice[1])

// ————— Average Price

var int nBuys = na

nBuys := nz(nBuys[1])

var int nSells = na

nSells := nz(nSells[1])

var float sumBuy = na

sumBuy := nz(sumBuy[1])

var float sumSell = na

sumSell := nz(sumSell[1])

var float sumQtyBuy = na

sumQtyBuy := nz(sumQtyBuy[1])

var float sumQtySell = na

sumQtySell := nz(sumQtySell[1])

var float AveragePrice = na

AveragePrice := nz(AveragePrice[1])

// ————— Fibonacci Pivots Level Calculation

var float PP = na

// ————— Origin from Rounded Pivot Points or last Sell

var float PPdownOrigin = na

// ————— Origin from Rounded Position Price

var float PPupOrigin = na

// ————— Final Buy & Sell Conditions

var bool BuyCondition = na

BuyCondition := nz(BuyCondition[1])

var bool SellCondition = na

SellCondition := nz(SellCondition[1])

// ————— Backtest

BuyFactor = BuyType == "CONTRACTS" ? 1 : BuyType == "% EQUITY" ? (100 / (strategy.equity / close)) : close

SellFactor = SellType == "CASH" ? close : 1

BuyQuanTity = BuyQ / BuyFactor

SellQuanTity = SellQ / SellFactor

// ———————————————————— Pivot Points

// ————— Pivot Points Period

res = ppPeriod == '15D' ? '15D' : ppPeriod == 'Week' ? 'W' : ppPeriod == 'Day' ? 'D' : 'M'

// ————— High, Low, Close Calc.

// "Function to securely and simply call `security()` so that it never repaints and never looks ahead" (@PineCoders)

f_secureSecurity(_symbol, _res, _src) => security(_symbol, _res, _src[1], lookahead = barmerge.lookahead_on)

phigh = f_secureSecurity(syminfo.tickerid, res, high)

plow = f_secureSecurity(syminfo.tickerid, res, low)

pclose = f_secureSecurity(syminfo.tickerid, res, close)

// ————— Fibonacci Pivots Level Calculation

PP := (phigh + plow + pclose) / 3

// ———————————————————— Grid Strategy

// ————— Width between levels

float GridWidth = WOption == 'PRICE' ? Width : PP * (Width/100)

// ————— Origin from Rounded Pivot Points

PPdownOrigin := floor(PP / GridWidth) * GridWidth

// ————— Origin from Rounded Average Position Price

PPupOrigin := nz(PPupOrigin[1])

// ————— Grid Calculation

fGrid(_1, _2, _n) =>

_a = _1, _b = _2, _c = 0.0

for _i = 1 to _n

if _i == 1

_c := _a

else

_c := _a + _b

_a := _c

// ————— Initial Open Price

fOpenPrice() =>

var float _ldown = na

var bool _pb = na

var float _lup = na

var bool _ps = na

var float _OpenPrice = na

_OpenPrice := nz(_OpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_ps := crossover(high, _lup) and low <= _lup

if _pb

_OpenPrice := _ldown

if _ps

_OpenPrice := _lup

_OpenPrice

OpenPrice := fOpenPrice()

// ————— Buy at better Price

fBuyCondition(_n) =>

var float _ldown = na

_ldown := nz(_ldown[1])

var bool _pb = na

_pb := nz(_pb[1])

var bool _BuyCondition = na

_BuyCondition := nz(_BuyCondition[1])

for _i = 1 to _n

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_BuyCondition := nz(nBuys) == 0 ? _pb and _ldown < (fixnan(OpenPrice[1]) - GridWidth / 4) : _pb and _ldown < (fixnan(FinalOpenPrice[1]) - GridWidth / 4)

_BuyCondition

// ————— Sell at better Price

fSellCondition(_n) =>

var float _lup = na

_lup := nz(_lup[1])

var bool _ps = na

_ps := nz(_ps[1])

var bool _SellCondition = na

_SellCondition := nz(_SellCondition[1])

for _i = 1 to _n

_lup := fGrid(PPupOrigin, GridWidth, _i)

_ps := crossover(high, _lup) and low <= _lup

_SellCondition := nz(nSells) == 0 ? _ps and _lup > (fixnan(OpenPrice[1]) + GridWidth / 4) : _ps and _lup > (fixnan(FinalOpenPrice[1]) + GridWidth / 4)

_SellCondition

// ————— Final Open Price

fFinalOpenPrice() =>

var float _ldown = na

_ldown := nz(_ldown[1])

var float _lup = na

_lup := nz(_lup[1])

var float _FinalBuyPrice = na

_FinalBuyPrice := nz(_FinalBuyPrice[1])

var float _FinalSellPrice = na

_FinalSellPrice := nz(_FinalSellPrice[1])

var float _FinalOpenPrice = na

_FinalOpenPrice := nz(_FinalOpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

if fBuyCondition(_i)

_FinalBuyPrice := _ldown

_FinalOpenPrice := _ldown

if fSellCondition(_i)

_FinalSellPrice := _lup

_FinalOpenPrice := _lup

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice]

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice] = fFinalOpenPrice()

FinalBuyPrice := _FinalBuyPrice, FinalSellPrice := _FinalSellPrice, FinalOpenPrice := _FinalOpenPrice

// ————— Average Price & Backtest

for _i = 1 to 15

if fBuyCondition(_i)

nBuys := nBuys + 1

nSells := na

sumBuy := FinalOpenPrice * BuyQuanTity + nz(sumBuy[1])

sumQtyBuy := BuyQuanTity + nz(sumQtyBuy[1])

AveragePrice := sumBuy / sumQtyBuy

strategy.entry("BUY", strategy.long, qty = BuyQuanTity)

if fSellCondition(_i)

nBuys := na

nSells := nSells + 1

sumBuy := na

sumQtyBuy := na

strategy.close("BUY", qty = SellType != "% EQUITY" ? SellQuanTity : na, qty_percent = (SellType == "% EQUITY" ? SellQuanTity : na), comment = "SELL")

// ————— Origin from Rounded Pivot Points or last Sell

PPdownOrigin := (WOption == 'PRICE') ?

(fixnan(FinalSellPrice[1]) <= PP ? (floor(fixnan(FinalSellPrice[1]) / GridWidth) * GridWidth) - GridWidth : floor(PP / GridWidth) * GridWidth) :

(fixnan(FinalSellPrice[1]) <= PP ? fixnan(FinalSellPrice[1]) - GridWidth : PP)

// ————— Origin from Rounded Average Buy Price

PPupOrigin := WOption == 'PRICE' ?

((ceil(fixnan(AveragePrice[1]) / GridWidth) * GridWidth) + GridWidth) :

(fixnan(AveragePrice[1]) + GridWidth)

// ———————————————————— Plotting

// ————— Plotting Pivot Points

plot(PP, title = "PP", style = plot.style_circles, color = color.aqua, linewidth = 2)

// ————— Plotting the average price

plot(nBuys > 1 ? AveragePrice[1] : na, title = "Average Price", style = plot.style_circles, color = color.fuchsia, linewidth = 2)

// ————— Buy Conditions ————— Sell Conditions

pb1 = fBuyCondition(1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na, ps1 = fSellCondition(1) ? fGrid(PPupOrigin, GridWidth, 1) : na

pb2 = fBuyCondition(2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na, ps2 = fSellCondition(2) ? fGrid(PPupOrigin, GridWidth, 2) : na

pb3 = fBuyCondition(3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na, ps3 = fSellCondition(3) ? fGrid(PPupOrigin, GridWidth, 3) : na

pb4 = fBuyCondition(4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na, ps4 = fSellCondition(4) ? fGrid(PPupOrigin, GridWidth, 4) : na

pb5 = fBuyCondition(5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na, ps5 = fSellCondition(5) ? fGrid(PPupOrigin, GridWidth, 5) : na

pb6 = fBuyCondition(6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na, ps6 = fSellCondition(6) ? fGrid(PPupOrigin, GridWidth, 6) : na

pb7 = fBuyCondition(7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na, ps7 = fSellCondition(7) ? fGrid(PPupOrigin, GridWidth, 7) : na

pb8 = fBuyCondition(8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na, ps8 = fSellCondition(8) ? fGrid(PPupOrigin, GridWidth, 8) : na

pb9 = fBuyCondition(9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na, ps9 = fSellCondition(9) ? fGrid(PPupOrigin, GridWidth, 9) : na

pb10 = fBuyCondition(10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na, ps10 = fSellCondition(10) ? fGrid(PPupOrigin, GridWidth, 10) : na

pb11 = fBuyCondition(11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na, ps11 = fSellCondition(11) ? fGrid(PPupOrigin, GridWidth, 11) : na

pb12 = fBuyCondition(12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na, ps12 = fSellCondition(12) ? fGrid(PPupOrigin, GridWidth, 12) : na

pb13 = fBuyCondition(13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na, ps13 = fSellCondition(13) ? fGrid(PPupOrigin, GridWidth, 13) : na

pb14 = fBuyCondition(14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na, ps14 = fSellCondition(14) ? fGrid(PPupOrigin, GridWidth, 14) : na

pb15 = fBuyCondition(15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na, ps15 = fSellCondition(15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Level Conditions

lb1 = low < fGrid(PPdownOrigin, -GridWidth, 1) and PP > fGrid(PPdownOrigin, -GridWidth, 1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na

lb2 = low < fGrid(PPdownOrigin, -GridWidth, 2) and PP > fGrid(PPdownOrigin, -GridWidth, 2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na

lb3 = low < fGrid(PPdownOrigin, -GridWidth, 3) and PP > fGrid(PPdownOrigin, -GridWidth, 3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na

lb4 = low < fGrid(PPdownOrigin, -GridWidth, 4) and PP > fGrid(PPdownOrigin, -GridWidth, 4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na

lb5 = low < fGrid(PPdownOrigin, -GridWidth, 5) and PP > fGrid(PPdownOrigin, -GridWidth, 5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na

lb6 = low < fGrid(PPdownOrigin, -GridWidth, 6) and PP > fGrid(PPdownOrigin, -GridWidth, 6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na

lb7 = low < fGrid(PPdownOrigin, -GridWidth, 7) and PP > fGrid(PPdownOrigin, -GridWidth, 7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na

lb8 = low < fGrid(PPdownOrigin, -GridWidth, 8) and PP > fGrid(PPdownOrigin, -GridWidth, 8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na

lb9 = low < fGrid(PPdownOrigin, -GridWidth, 9) and PP > fGrid(PPdownOrigin, -GridWidth, 9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na

lb10 = low < fGrid(PPdownOrigin, -GridWidth, 10) and PP > fGrid(PPdownOrigin, -GridWidth, 10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na

lb11 = low < fGrid(PPdownOrigin, -GridWidth, 11) and PP > fGrid(PPdownOrigin, -GridWidth, 11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na

lb12 = low < fGrid(PPdownOrigin, -GridWidth, 12) and PP > fGrid(PPdownOrigin, -GridWidth, 12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na

lb13 = low < fGrid(PPdownOrigin, -GridWidth, 13) and PP > fGrid(PPdownOrigin, -GridWidth, 13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na

lb14 = low < fGrid(PPdownOrigin, -GridWidth, 14) and PP > fGrid(PPdownOrigin, -GridWidth, 14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na

lb15 = low < fGrid(PPdownOrigin, -GridWidth, 15) and PP > fGrid(PPdownOrigin, -GridWidth, 15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na

// ————— Sell Level Conditions

ls1 = high > fGrid(PPupOrigin, GridWidth, 1) and PP < fGrid(PPupOrigin, GridWidth, 1) ? fGrid(PPupOrigin, GridWidth, 1) : na

ls2 = high > fGrid(PPupOrigin, GridWidth, 2) and PP < fGrid(PPupOrigin, GridWidth, 2) ? fGrid(PPupOrigin, GridWidth, 2) : na

ls3 = high > fGrid(PPupOrigin, GridWidth, 3) and PP < fGrid(PPupOrigin, GridWidth, 3) ? fGrid(PPupOrigin, GridWidth, 3) : na

ls4 = high > fGrid(PPupOrigin, GridWidth, 4) and PP < fGrid(PPupOrigin, GridWidth, 4) ? fGrid(PPupOrigin, GridWidth, 4) : na

ls5 = high > fGrid(PPupOrigin, GridWidth, 5) and PP < fGrid(PPupOrigin, GridWidth, 5) ? fGrid(PPupOrigin, GridWidth, 5) : na

ls6 = high > fGrid(PPupOrigin, GridWidth, 6) and PP < fGrid(PPupOrigin, GridWidth, 6) ? fGrid(PPupOrigin, GridWidth, 6) : na

ls7 = high > fGrid(PPupOrigin, GridWidth, 7) and PP < fGrid(PPupOrigin, GridWidth, 7) ? fGrid(PPupOrigin, GridWidth, 7) : na

ls8 = high > fGrid(PPupOrigin, GridWidth, 8) and PP < fGrid(PPupOrigin, GridWidth, 8) ? fGrid(PPupOrigin, GridWidth, 8) : na

ls9 = high > fGrid(PPupOrigin, GridWidth, 9) and PP < fGrid(PPupOrigin, GridWidth, 9) ? fGrid(PPupOrigin, GridWidth, 9) : na

ls10 = high > fGrid(PPupOrigin, GridWidth, 10) and PP < fGrid(PPupOrigin, GridWidth, 10) ? fGrid(PPupOrigin, GridWidth, 10) : na

ls11 = high > fGrid(PPupOrigin, GridWidth, 11) and PP < fGrid(PPupOrigin, GridWidth, 11) ? fGrid(PPupOrigin, GridWidth, 11) : na

ls12 = high > fGrid(PPupOrigin, GridWidth, 12) and PP < fGrid(PPupOrigin, GridWidth, 12) ? fGrid(PPupOrigin, GridWidth, 12) : na

ls13 = high > fGrid(PPupOrigin, GridWidth, 13) and PP < fGrid(PPupOrigin, GridWidth, 13) ? fGrid(PPupOrigin, GridWidth, 13) : na

ls14 = high > fGrid(PPupOrigin, GridWidth, 14) and PP < fGrid(PPupOrigin, GridWidth, 14) ? fGrid(PPupOrigin, GridWidth, 14) : na

ls15 = high > fGrid(PPupOrigin, GridWidth, 15) and PP < fGrid(PPupOrigin, GridWidth, 15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Shapes

plotshape(pb1, title = "Buy 1", style = shape.diamond, location = location.absolute, color = color.lime, text = "1", size = size.tiny)

plotshape(pb2, title = "Buy 2", style = shape.diamond, location = location.absolute, color = color.lime, text = "2", size = size.tiny)

plotshape(pb3, title = "Buy 3", style = shape.diamond, location = location.absolute, color = color.lime, text = "3", size = size.tiny)

plotshape(pb4, title = "Buy 4", style = shape.diamond, location = location.absolute, color = color.lime, text = "4", size = size.tiny)

plotshape(pb5, title = "Buy 5", style = shape.diamond, location = location.absolute, color = color.lime, text = "5", size = size.tiny)

plotshape(pb6, title = "Buy 6", style = shape.diamond, location = location.absolute, color = color.lime, text = "6", size = size.tiny)

plotshape(pb7, title = "Buy 7", style = shape.diamond, location = location.absolute, color = color.lime, text = "7", size = size.tiny)

plotshape(pb8, title = "Buy 8", style = shape.diamond, location = location.absolute, color = color.lime, text = "8", size = size.tiny)

plotshape(pb9, title = "Buy 9", style = shape.diamond, location = location.absolute, color = color.lime, text = "9", size = size.tiny)

plotshape(pb10, title = "Buy 10", style = shape.diamond, location = location.absolute, color = color.lime, text = "10", size = size.tiny)

plotshape(pb11, title = "Buy 11", style = shape.diamond, location = location.absolute, color = color.lime, text = "11", size = size.tiny)

plotshape(pb12, title = "Buy 12", style = shape.diamond, location = location.absolute, color = color.lime, text = "12", size = size.tiny)

plotshape(pb13, title = "Buy 13", style = shape.diamond, location = location.absolute, color = color.lime, text = "13", size = size.tiny)

plotshape(pb14, title = "Buy 14", style = shape.diamond, location = location.absolute, color = color.lime, text = "14", size = size.tiny)

plotshape(pb15, title = "Buy 15", style = shape.diamond, location = location.absolute, color = color.lime, text = "15", size = size.tiny)

// ————— Sell Shapes

plotshape(ps1, title = "Sell 1", style = shape.diamond, location = location.absolute, color = color.orange, text = "1", size = size.tiny)

plotshape(ps2, title = "Sell 2", style = shape.diamond, location = location.absolute, color = color.orange, text = "2", size = size.tiny)

plotshape(ps3, title = "Sell 3", style = shape.diamond, location = location.absolute, color = color.orange, text = "3", size = size.tiny)

plotshape(ps4, title = "Sell 4", style = shape.diamond, location = location.absolute, color = color.orange, text = "4", size = size.tiny)

plotshape(ps5, title = "Sell 5", style = shape.diamond, location = location.absolute, color = color.orange, text = "5", size = size.tiny)

plotshape(ps6, title = "Sell 6", style = shape.diamond, location = location.absolute, color = color.orange, text = "6", size = size.tiny)

plotshape(ps7, title = "Sell 7", style = shape.diamond, location = location.absolute, color = color.orange, text = "7", size = size.tiny)

plotshape(ps8, title = "Sell 8", style = shape.diamond, location = location.absolute, color = color.orange, text = "8", size = size.tiny)

plotshape(ps9, title = "Sell 9", style = shape.diamond, location = location.absolute, color = color.orange, text = "9", size = size.tiny)

plotshape(ps10, title = "Sell 10", style = shape.diamond, location = location.absolute, color = color.orange, text = "10", size = size.tiny)

plotshape(ps11, title = "Sell 11", style = shape.diamond, location = location.absolute, color = color.orange, text = "11", size = size.tiny)

plotshape(ps12, title = "Sell 12", style = shape.diamond, location = location.absolute, color = color.orange, text = "12", size = size.tiny)

plotshape(ps13, title = "Sell 13", style = shape.diamond, location = location.absolute, color = color.orange, text = "13", size = size.tiny)

plotshape(ps14, title = "Sell 14", style = shape.diamond, location = location.absolute, color = color.orange, text = "14", size = size.tiny)

plotshape(ps15, title = "Sell 15", style = shape.diamond, location = location.absolute, color = color.orange, text = "15", size = size.tiny)

// ————— Plotting Lines under PP // ————— Plotting Lines above PP

plot(lb1, title = "Level down 1", style = plot.style_circles, color = color.green), plot(ls1, title = "Level up 1", style = plot.style_circles, color = color.red)

plot(lb2, title = "Level down 2", style = plot.style_circles, color = color.green), plot(ls2, title = "Level up 2", style = plot.style_circles, color = color.red)

plot(lb3, title = "Level down 3", style = plot.style_circles, color = color.green), plot(ls3, title = "Level up 3", style = plot.style_circles, color = color.red)

plot(lb4, title = "Level down 4", style = plot.style_circles, color = color.green), plot(ls4, title = "Level up 4", style = plot.style_circles, color = color.red)

plot(lb5, title = "Level down 5", style = plot.style_circles, color = color.green), plot(ls5, title = "Level up 5", style = plot.style_circles, color = color.red)

plot(lb6, title = "Level down 6", style = plot.style_circles, color = color.green), plot(ls6, title = "Level up 6", style = plot.style_circles, color = color.red)

plot(lb7, title = "Level down 7", style = plot.style_circles, color = color.green), plot(ls7, title = "Level up 7", style = plot.style_circles, color = color.red)

plot(lb8, title = "Level down 8", style = plot.style_circles, color = color.green), plot(ls8, title = "Level up 8", style = plot.style_circles, color = color.red)

plot(lb9, title = "Level down 9", style = plot.style_circles, color = color.green), plot(ls9, title = "Level up 9", style = plot.style_circles, color = color.red)

plot(lb10, title = "Level down 10", style = plot.style_circles, color = color.green), plot(ls10, title = "Level up 10", style = plot.style_circles, color = color.red)

plot(lb11, title = "Level down 11", style = plot.style_circles, color = color.green), plot(ls11, title = "Level up 11", style = plot.style_circles, color = color.red)

plot(lb12, title = "Level down 12", style = plot.style_circles, color = color.green), plot(ls12, title = "Level up 12", style = plot.style_circles, color = color.red)

plot(lb13, title = "Level down 13", style = plot.style_circles, color = color.green), plot(ls13, title = "Level up 13", style = plot.style_circles, color = color.red)

plot(lb14, title = "Level down 14", style = plot.style_circles, color = color.green), plot(ls14, title = "Level up 14", style = plot.style_circles, color = color.red)

plot(lb15, title = "Level down 15", style = plot.style_circles, color = color.green), plot(ls15, title = "Level up 15", style = plot.style_circles, color = color.red)

// by XaviZ💤