Strategi Pengurusan Perdagangan Grid Dinamik

Gambaran keseluruhan

Strategi Pengurusan Perdagangan Grid Dinamik adalah strategi perdagangan berdasarkan perubahan harga. Ia memanfaatkan turun naik pasaran untuk mencapai tujuan mengoptimumkan portfolio dengan menetapkan titik beli dan jual pada tahap harga yang berbeza.

Prinsip Strategi

Strategi pengurusan perdagangan grid dinamik berpusat pada penggunaan titik-titik pusat berdasarkan kitaran masa untuk menentukan tahap grid. Ia mewujudkan strategi membeli apabila harga turun dan menjual apabila harga naik dengan menetapkan beberapa titik beli dan jual.

Kelebihan Strategik

- Beradaptasi dengan turun naik pasaranStrategi ini boleh digunakan untuk beradaptasi dengan pasaran yang bergolak, baik di pasaran lembu mahupun di pasaran beruang.

- Penyebaran risiko: Mengedarkan risiko pembelian atau penjualan pada satu titik harga dengan berdagang pada pelbagai tahap harga.

- Pendapatan jangka panjang: sesuai untuk strategi pemegang jangka panjang, mungkin mendapat keuntungan yang stabil dalam jangka panjang melalui kos purata.

Risiko Strategik

- Pelanggaran pasaranStrategi ini mungkin menghadapi risiko yang lebih besar dalam keadaan pasaran yang melampau, seperti turun naik yang teruk atau kejatuhan pasaran.

- Strategi untuk mengoptimumkan keperluanStrategi perlu sentiasa disesuaikan dan dioptimumkan mengikut keadaan pasaran untuk menyesuaikan diri dengan keadaan pasaran yang berbeza.

Arah pengoptimuman strategi

- Penyesuaian parameter: Mengubah saiz grid dan kekerapan dagangan mengikut perubahan pasaran untuk menyesuaikan diri dengan perubahan pasaran yang berbeza.

- Kawalan RisikoMemperkenalkan mekanisme pengurusan risiko yang lebih halus, seperti menetapkan titik berhenti untuk mengelakkan kerugian besar dalam keadaan pasaran yang melampau.

ringkaskan

Strategi pengurusan perdagangan grid dinamik adalah strategi perdagangan yang fleksibel yang sesuai untuk pelbagai keadaan pasaran. Ia bertujuan untuk mengurangkan risiko dan mencapai keuntungan jangka panjang dengan membeli dan menjual di pelbagai peringkat harga.

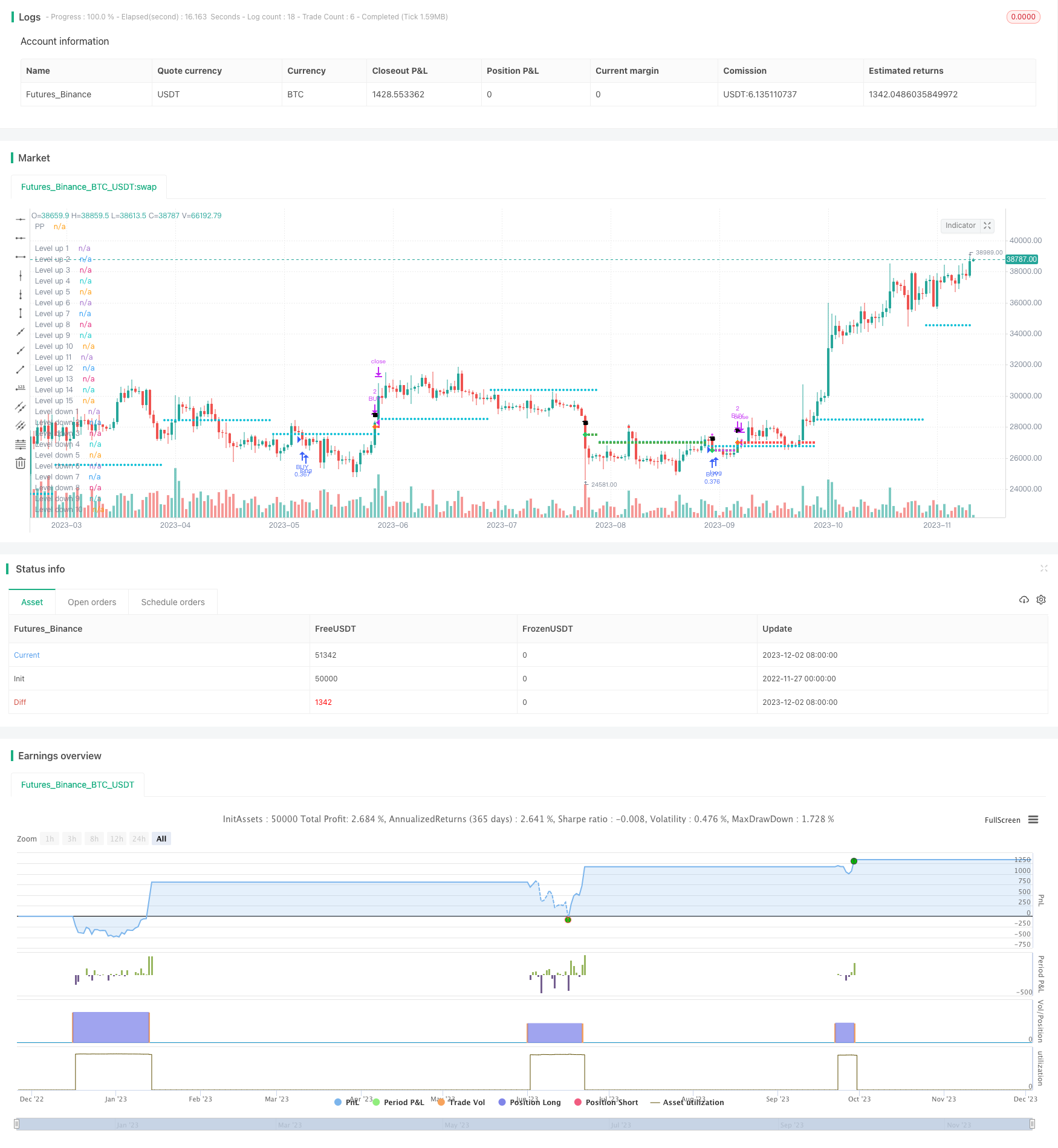

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © XaviZ

//@version=4

strategy(title = "CoGrid Management", shorttitle = "CoGrid💹", overlay = true, pyramiding = 1000, default_qty_value = 0)

// ———————————————————— Inputs

WOption = input('PRICE', " 》 WIDTH TYPE", options = ['PRICE','% PP'])

Width = input(500, " 》 WIDTH", type = input.float, minval = 0)

ppPeriod = input('Month', " 》 PP PERIOD", options = ['Day','Week','15D','Month'])

BuyType = input("CASH", " 》 BUY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

BuyQ = input(10000, " 》 QUANTITY TO BUY", type = input.float, minval = 0)

SellType = input('CONTRACTS', " 》 SELL TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

SellQ = input(2, " 》 QUANTITY TO SELL", type = input.float, minval = 0)

// ———————————————————— Vars

// ————— Buy Price & Sell Price

var float OpenPrice = na

OpenPrice := nz(OpenPrice[1])

// ————— Final Buy Price & Final Sell Price

var float FinalBuyPrice = na

FinalBuyPrice := nz(FinalBuyPrice[1])

var float FinalSellPrice = na

FinalSellPrice := nz(FinalSellPrice[1])

var float FinalOpenPrice = na

FinalOpenPrice := nz(FinalOpenPrice[1])

// ————— Average Price

var int nBuys = na

nBuys := nz(nBuys[1])

var int nSells = na

nSells := nz(nSells[1])

var float sumBuy = na

sumBuy := nz(sumBuy[1])

var float sumSell = na

sumSell := nz(sumSell[1])

var float sumQtyBuy = na

sumQtyBuy := nz(sumQtyBuy[1])

var float sumQtySell = na

sumQtySell := nz(sumQtySell[1])

var float AveragePrice = na

AveragePrice := nz(AveragePrice[1])

// ————— Fibonacci Pivots Level Calculation

var float PP = na

// ————— Origin from Rounded Pivot Points or last Sell

var float PPdownOrigin = na

// ————— Origin from Rounded Position Price

var float PPupOrigin = na

// ————— Final Buy & Sell Conditions

var bool BuyCondition = na

BuyCondition := nz(BuyCondition[1])

var bool SellCondition = na

SellCondition := nz(SellCondition[1])

// ————— Backtest

BuyFactor = BuyType == "CONTRACTS" ? 1 : BuyType == "% EQUITY" ? (100 / (strategy.equity / close)) : close

SellFactor = SellType == "CASH" ? close : 1

BuyQuanTity = BuyQ / BuyFactor

SellQuanTity = SellQ / SellFactor

// ———————————————————— Pivot Points

// ————— Pivot Points Period

res = ppPeriod == '15D' ? '15D' : ppPeriod == 'Week' ? 'W' : ppPeriod == 'Day' ? 'D' : 'M'

// ————— High, Low, Close Calc.

// "Function to securely and simply call `security()` so that it never repaints and never looks ahead" (@PineCoders)

f_secureSecurity(_symbol, _res, _src) => security(_symbol, _res, _src[1], lookahead = barmerge.lookahead_on)

phigh = f_secureSecurity(syminfo.tickerid, res, high)

plow = f_secureSecurity(syminfo.tickerid, res, low)

pclose = f_secureSecurity(syminfo.tickerid, res, close)

// ————— Fibonacci Pivots Level Calculation

PP := (phigh + plow + pclose) / 3

// ———————————————————— Grid Strategy

// ————— Width between levels

float GridWidth = WOption == 'PRICE' ? Width : PP * (Width/100)

// ————— Origin from Rounded Pivot Points

PPdownOrigin := floor(PP / GridWidth) * GridWidth

// ————— Origin from Rounded Average Position Price

PPupOrigin := nz(PPupOrigin[1])

// ————— Grid Calculation

fGrid(_1, _2, _n) =>

_a = _1, _b = _2, _c = 0.0

for _i = 1 to _n

if _i == 1

_c := _a

else

_c := _a + _b

_a := _c

// ————— Initial Open Price

fOpenPrice() =>

var float _ldown = na

var bool _pb = na

var float _lup = na

var bool _ps = na

var float _OpenPrice = na

_OpenPrice := nz(_OpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_ps := crossover(high, _lup) and low <= _lup

if _pb

_OpenPrice := _ldown

if _ps

_OpenPrice := _lup

_OpenPrice

OpenPrice := fOpenPrice()

// ————— Buy at better Price

fBuyCondition(_n) =>

var float _ldown = na

_ldown := nz(_ldown[1])

var bool _pb = na

_pb := nz(_pb[1])

var bool _BuyCondition = na

_BuyCondition := nz(_BuyCondition[1])

for _i = 1 to _n

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_BuyCondition := nz(nBuys) == 0 ? _pb and _ldown < (fixnan(OpenPrice[1]) - GridWidth / 4) : _pb and _ldown < (fixnan(FinalOpenPrice[1]) - GridWidth / 4)

_BuyCondition

// ————— Sell at better Price

fSellCondition(_n) =>

var float _lup = na

_lup := nz(_lup[1])

var bool _ps = na

_ps := nz(_ps[1])

var bool _SellCondition = na

_SellCondition := nz(_SellCondition[1])

for _i = 1 to _n

_lup := fGrid(PPupOrigin, GridWidth, _i)

_ps := crossover(high, _lup) and low <= _lup

_SellCondition := nz(nSells) == 0 ? _ps and _lup > (fixnan(OpenPrice[1]) + GridWidth / 4) : _ps and _lup > (fixnan(FinalOpenPrice[1]) + GridWidth / 4)

_SellCondition

// ————— Final Open Price

fFinalOpenPrice() =>

var float _ldown = na

_ldown := nz(_ldown[1])

var float _lup = na

_lup := nz(_lup[1])

var float _FinalBuyPrice = na

_FinalBuyPrice := nz(_FinalBuyPrice[1])

var float _FinalSellPrice = na

_FinalSellPrice := nz(_FinalSellPrice[1])

var float _FinalOpenPrice = na

_FinalOpenPrice := nz(_FinalOpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

if fBuyCondition(_i)

_FinalBuyPrice := _ldown

_FinalOpenPrice := _ldown

if fSellCondition(_i)

_FinalSellPrice := _lup

_FinalOpenPrice := _lup

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice]

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice] = fFinalOpenPrice()

FinalBuyPrice := _FinalBuyPrice, FinalSellPrice := _FinalSellPrice, FinalOpenPrice := _FinalOpenPrice

// ————— Average Price & Backtest

for _i = 1 to 15

if fBuyCondition(_i)

nBuys := nBuys + 1

nSells := na

sumBuy := FinalOpenPrice * BuyQuanTity + nz(sumBuy[1])

sumQtyBuy := BuyQuanTity + nz(sumQtyBuy[1])

AveragePrice := sumBuy / sumQtyBuy

strategy.entry("BUY", strategy.long, qty = BuyQuanTity)

if fSellCondition(_i)

nBuys := na

nSells := nSells + 1

sumBuy := na

sumQtyBuy := na

strategy.close("BUY", qty = SellType != "% EQUITY" ? SellQuanTity : na, qty_percent = (SellType == "% EQUITY" ? SellQuanTity : na), comment = "SELL")

// ————— Origin from Rounded Pivot Points or last Sell

PPdownOrigin := (WOption == 'PRICE') ?

(fixnan(FinalSellPrice[1]) <= PP ? (floor(fixnan(FinalSellPrice[1]) / GridWidth) * GridWidth) - GridWidth : floor(PP / GridWidth) * GridWidth) :

(fixnan(FinalSellPrice[1]) <= PP ? fixnan(FinalSellPrice[1]) - GridWidth : PP)

// ————— Origin from Rounded Average Buy Price

PPupOrigin := WOption == 'PRICE' ?

((ceil(fixnan(AveragePrice[1]) / GridWidth) * GridWidth) + GridWidth) :

(fixnan(AveragePrice[1]) + GridWidth)

// ———————————————————— Plotting

// ————— Plotting Pivot Points

plot(PP, title = "PP", style = plot.style_circles, color = color.aqua, linewidth = 2)

// ————— Plotting the average price

plot(nBuys > 1 ? AveragePrice[1] : na, title = "Average Price", style = plot.style_circles, color = color.fuchsia, linewidth = 2)

// ————— Buy Conditions ————— Sell Conditions

pb1 = fBuyCondition(1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na, ps1 = fSellCondition(1) ? fGrid(PPupOrigin, GridWidth, 1) : na

pb2 = fBuyCondition(2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na, ps2 = fSellCondition(2) ? fGrid(PPupOrigin, GridWidth, 2) : na

pb3 = fBuyCondition(3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na, ps3 = fSellCondition(3) ? fGrid(PPupOrigin, GridWidth, 3) : na

pb4 = fBuyCondition(4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na, ps4 = fSellCondition(4) ? fGrid(PPupOrigin, GridWidth, 4) : na

pb5 = fBuyCondition(5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na, ps5 = fSellCondition(5) ? fGrid(PPupOrigin, GridWidth, 5) : na

pb6 = fBuyCondition(6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na, ps6 = fSellCondition(6) ? fGrid(PPupOrigin, GridWidth, 6) : na

pb7 = fBuyCondition(7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na, ps7 = fSellCondition(7) ? fGrid(PPupOrigin, GridWidth, 7) : na

pb8 = fBuyCondition(8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na, ps8 = fSellCondition(8) ? fGrid(PPupOrigin, GridWidth, 8) : na

pb9 = fBuyCondition(9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na, ps9 = fSellCondition(9) ? fGrid(PPupOrigin, GridWidth, 9) : na

pb10 = fBuyCondition(10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na, ps10 = fSellCondition(10) ? fGrid(PPupOrigin, GridWidth, 10) : na

pb11 = fBuyCondition(11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na, ps11 = fSellCondition(11) ? fGrid(PPupOrigin, GridWidth, 11) : na

pb12 = fBuyCondition(12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na, ps12 = fSellCondition(12) ? fGrid(PPupOrigin, GridWidth, 12) : na

pb13 = fBuyCondition(13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na, ps13 = fSellCondition(13) ? fGrid(PPupOrigin, GridWidth, 13) : na

pb14 = fBuyCondition(14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na, ps14 = fSellCondition(14) ? fGrid(PPupOrigin, GridWidth, 14) : na

pb15 = fBuyCondition(15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na, ps15 = fSellCondition(15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Level Conditions

lb1 = low < fGrid(PPdownOrigin, -GridWidth, 1) and PP > fGrid(PPdownOrigin, -GridWidth, 1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na

lb2 = low < fGrid(PPdownOrigin, -GridWidth, 2) and PP > fGrid(PPdownOrigin, -GridWidth, 2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na

lb3 = low < fGrid(PPdownOrigin, -GridWidth, 3) and PP > fGrid(PPdownOrigin, -GridWidth, 3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na

lb4 = low < fGrid(PPdownOrigin, -GridWidth, 4) and PP > fGrid(PPdownOrigin, -GridWidth, 4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na

lb5 = low < fGrid(PPdownOrigin, -GridWidth, 5) and PP > fGrid(PPdownOrigin, -GridWidth, 5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na

lb6 = low < fGrid(PPdownOrigin, -GridWidth, 6) and PP > fGrid(PPdownOrigin, -GridWidth, 6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na

lb7 = low < fGrid(PPdownOrigin, -GridWidth, 7) and PP > fGrid(PPdownOrigin, -GridWidth, 7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na

lb8 = low < fGrid(PPdownOrigin, -GridWidth, 8) and PP > fGrid(PPdownOrigin, -GridWidth, 8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na

lb9 = low < fGrid(PPdownOrigin, -GridWidth, 9) and PP > fGrid(PPdownOrigin, -GridWidth, 9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na

lb10 = low < fGrid(PPdownOrigin, -GridWidth, 10) and PP > fGrid(PPdownOrigin, -GridWidth, 10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na

lb11 = low < fGrid(PPdownOrigin, -GridWidth, 11) and PP > fGrid(PPdownOrigin, -GridWidth, 11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na

lb12 = low < fGrid(PPdownOrigin, -GridWidth, 12) and PP > fGrid(PPdownOrigin, -GridWidth, 12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na

lb13 = low < fGrid(PPdownOrigin, -GridWidth, 13) and PP > fGrid(PPdownOrigin, -GridWidth, 13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na

lb14 = low < fGrid(PPdownOrigin, -GridWidth, 14) and PP > fGrid(PPdownOrigin, -GridWidth, 14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na

lb15 = low < fGrid(PPdownOrigin, -GridWidth, 15) and PP > fGrid(PPdownOrigin, -GridWidth, 15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na

// ————— Sell Level Conditions

ls1 = high > fGrid(PPupOrigin, GridWidth, 1) and PP < fGrid(PPupOrigin, GridWidth, 1) ? fGrid(PPupOrigin, GridWidth, 1) : na

ls2 = high > fGrid(PPupOrigin, GridWidth, 2) and PP < fGrid(PPupOrigin, GridWidth, 2) ? fGrid(PPupOrigin, GridWidth, 2) : na

ls3 = high > fGrid(PPupOrigin, GridWidth, 3) and PP < fGrid(PPupOrigin, GridWidth, 3) ? fGrid(PPupOrigin, GridWidth, 3) : na

ls4 = high > fGrid(PPupOrigin, GridWidth, 4) and PP < fGrid(PPupOrigin, GridWidth, 4) ? fGrid(PPupOrigin, GridWidth, 4) : na

ls5 = high > fGrid(PPupOrigin, GridWidth, 5) and PP < fGrid(PPupOrigin, GridWidth, 5) ? fGrid(PPupOrigin, GridWidth, 5) : na

ls6 = high > fGrid(PPupOrigin, GridWidth, 6) and PP < fGrid(PPupOrigin, GridWidth, 6) ? fGrid(PPupOrigin, GridWidth, 6) : na

ls7 = high > fGrid(PPupOrigin, GridWidth, 7) and PP < fGrid(PPupOrigin, GridWidth, 7) ? fGrid(PPupOrigin, GridWidth, 7) : na

ls8 = high > fGrid(PPupOrigin, GridWidth, 8) and PP < fGrid(PPupOrigin, GridWidth, 8) ? fGrid(PPupOrigin, GridWidth, 8) : na

ls9 = high > fGrid(PPupOrigin, GridWidth, 9) and PP < fGrid(PPupOrigin, GridWidth, 9) ? fGrid(PPupOrigin, GridWidth, 9) : na

ls10 = high > fGrid(PPupOrigin, GridWidth, 10) and PP < fGrid(PPupOrigin, GridWidth, 10) ? fGrid(PPupOrigin, GridWidth, 10) : na

ls11 = high > fGrid(PPupOrigin, GridWidth, 11) and PP < fGrid(PPupOrigin, GridWidth, 11) ? fGrid(PPupOrigin, GridWidth, 11) : na

ls12 = high > fGrid(PPupOrigin, GridWidth, 12) and PP < fGrid(PPupOrigin, GridWidth, 12) ? fGrid(PPupOrigin, GridWidth, 12) : na

ls13 = high > fGrid(PPupOrigin, GridWidth, 13) and PP < fGrid(PPupOrigin, GridWidth, 13) ? fGrid(PPupOrigin, GridWidth, 13) : na

ls14 = high > fGrid(PPupOrigin, GridWidth, 14) and PP < fGrid(PPupOrigin, GridWidth, 14) ? fGrid(PPupOrigin, GridWidth, 14) : na

ls15 = high > fGrid(PPupOrigin, GridWidth, 15) and PP < fGrid(PPupOrigin, GridWidth, 15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Shapes

plotshape(pb1, title = "Buy 1", style = shape.diamond, location = location.absolute, color = color.lime, text = "1", size = size.tiny)

plotshape(pb2, title = "Buy 2", style = shape.diamond, location = location.absolute, color = color.lime, text = "2", size = size.tiny)

plotshape(pb3, title = "Buy 3", style = shape.diamond, location = location.absolute, color = color.lime, text = "3", size = size.tiny)

plotshape(pb4, title = "Buy 4", style = shape.diamond, location = location.absolute, color = color.lime, text = "4", size = size.tiny)

plotshape(pb5, title = "Buy 5", style = shape.diamond, location = location.absolute, color = color.lime, text = "5", size = size.tiny)

plotshape(pb6, title = "Buy 6", style = shape.diamond, location = location.absolute, color = color.lime, text = "6", size = size.tiny)

plotshape(pb7, title = "Buy 7", style = shape.diamond, location = location.absolute, color = color.lime, text = "7", size = size.tiny)

plotshape(pb8, title = "Buy 8", style = shape.diamond, location = location.absolute, color = color.lime, text = "8", size = size.tiny)

plotshape(pb9, title = "Buy 9", style = shape.diamond, location = location.absolute, color = color.lime, text = "9", size = size.tiny)

plotshape(pb10, title = "Buy 10", style = shape.diamond, location = location.absolute, color = color.lime, text = "10", size = size.tiny)

plotshape(pb11, title = "Buy 11", style = shape.diamond, location = location.absolute, color = color.lime, text = "11", size = size.tiny)

plotshape(pb12, title = "Buy 12", style = shape.diamond, location = location.absolute, color = color.lime, text = "12", size = size.tiny)

plotshape(pb13, title = "Buy 13", style = shape.diamond, location = location.absolute, color = color.lime, text = "13", size = size.tiny)

plotshape(pb14, title = "Buy 14", style = shape.diamond, location = location.absolute, color = color.lime, text = "14", size = size.tiny)

plotshape(pb15, title = "Buy 15", style = shape.diamond, location = location.absolute, color = color.lime, text = "15", size = size.tiny)

// ————— Sell Shapes

plotshape(ps1, title = "Sell 1", style = shape.diamond, location = location.absolute, color = color.orange, text = "1", size = size.tiny)

plotshape(ps2, title = "Sell 2", style = shape.diamond, location = location.absolute, color = color.orange, text = "2", size = size.tiny)

plotshape(ps3, title = "Sell 3", style = shape.diamond, location = location.absolute, color = color.orange, text = "3", size = size.tiny)

plotshape(ps4, title = "Sell 4", style = shape.diamond, location = location.absolute, color = color.orange, text = "4", size = size.tiny)

plotshape(ps5, title = "Sell 5", style = shape.diamond, location = location.absolute, color = color.orange, text = "5", size = size.tiny)

plotshape(ps6, title = "Sell 6", style = shape.diamond, location = location.absolute, color = color.orange, text = "6", size = size.tiny)

plotshape(ps7, title = "Sell 7", style = shape.diamond, location = location.absolute, color = color.orange, text = "7", size = size.tiny)

plotshape(ps8, title = "Sell 8", style = shape.diamond, location = location.absolute, color = color.orange, text = "8", size = size.tiny)

plotshape(ps9, title = "Sell 9", style = shape.diamond, location = location.absolute, color = color.orange, text = "9", size = size.tiny)

plotshape(ps10, title = "Sell 10", style = shape.diamond, location = location.absolute, color = color.orange, text = "10", size = size.tiny)

plotshape(ps11, title = "Sell 11", style = shape.diamond, location = location.absolute, color = color.orange, text = "11", size = size.tiny)

plotshape(ps12, title = "Sell 12", style = shape.diamond, location = location.absolute, color = color.orange, text = "12", size = size.tiny)

plotshape(ps13, title = "Sell 13", style = shape.diamond, location = location.absolute, color = color.orange, text = "13", size = size.tiny)

plotshape(ps14, title = "Sell 14", style = shape.diamond, location = location.absolute, color = color.orange, text = "14", size = size.tiny)

plotshape(ps15, title = "Sell 15", style = shape.diamond, location = location.absolute, color = color.orange, text = "15", size = size.tiny)

// ————— Plotting Lines under PP // ————— Plotting Lines above PP

plot(lb1, title = "Level down 1", style = plot.style_circles, color = color.green), plot(ls1, title = "Level up 1", style = plot.style_circles, color = color.red)

plot(lb2, title = "Level down 2", style = plot.style_circles, color = color.green), plot(ls2, title = "Level up 2", style = plot.style_circles, color = color.red)

plot(lb3, title = "Level down 3", style = plot.style_circles, color = color.green), plot(ls3, title = "Level up 3", style = plot.style_circles, color = color.red)

plot(lb4, title = "Level down 4", style = plot.style_circles, color = color.green), plot(ls4, title = "Level up 4", style = plot.style_circles, color = color.red)

plot(lb5, title = "Level down 5", style = plot.style_circles, color = color.green), plot(ls5, title = "Level up 5", style = plot.style_circles, color = color.red)

plot(lb6, title = "Level down 6", style = plot.style_circles, color = color.green), plot(ls6, title = "Level up 6", style = plot.style_circles, color = color.red)

plot(lb7, title = "Level down 7", style = plot.style_circles, color = color.green), plot(ls7, title = "Level up 7", style = plot.style_circles, color = color.red)

plot(lb8, title = "Level down 8", style = plot.style_circles, color = color.green), plot(ls8, title = "Level up 8", style = plot.style_circles, color = color.red)

plot(lb9, title = "Level down 9", style = plot.style_circles, color = color.green), plot(ls9, title = "Level up 9", style = plot.style_circles, color = color.red)

plot(lb10, title = "Level down 10", style = plot.style_circles, color = color.green), plot(ls10, title = "Level up 10", style = plot.style_circles, color = color.red)

plot(lb11, title = "Level down 11", style = plot.style_circles, color = color.green), plot(ls11, title = "Level up 11", style = plot.style_circles, color = color.red)

plot(lb12, title = "Level down 12", style = plot.style_circles, color = color.green), plot(ls12, title = "Level up 12", style = plot.style_circles, color = color.red)

plot(lb13, title = "Level down 13", style = plot.style_circles, color = color.green), plot(ls13, title = "Level up 13", style = plot.style_circles, color = color.red)

plot(lb14, title = "Level down 14", style = plot.style_circles, color = color.green), plot(ls14, title = "Level up 14", style = plot.style_circles, color = color.red)

plot(lb15, title = "Level down 15", style = plot.style_circles, color = color.green), plot(ls15, title = "Level up 15", style = plot.style_circles, color = color.red)

// by XaviZ💤