Стратегия управления динамической сетевой торговлей

Обзор

Стратегия управления торговлей динамической сеткой (Dynamic Grid Trading Management Strategy) - это стратегия торговли, основанная на изменениях цен. Она использует волатильность рынка для достижения цели оптимизации портфеля путем установки точек покупки и продажи на разных уровнях цен.

Стратегический принцип

В основе стратегии управления торговлей в динамической сетке лежит использование основанных на временных циклах точек опоры для определения уровня сетки. Она реализуется путем установки нескольких точек покупки и продажи, чтобы покупать, когда цена падает, и продавать, когда цена растет.

Стратегические преимущества

- Приспосабливаться к рыночным колебаниямЭта стратегия эффективно адаптируется к рыночным колебаниям и может использоваться как в бычьих, так и в медвежьих рынках.

- Распределение риска: распределяет риск покупки или продажи в одной ценовой точке путем торгов на разных ценовых уровнях

- Долгосрочные выгоды: подходит для долгосрочной стратегии хранения, с возможностью получения стабильной прибыли в долгосрочной перспективе за счет средней эффективности затрат.

Стратегический риск

- Рыночные экстремистыВ случае экстремальных рыночных явлений, таких как резкая волатильность или обвал рынка, стратегия может быть подвержена риску.

- Стратегия оптимизации потребностейСтратегия должна постоянно корректироваться и оптимизироваться в зависимости от рыночных условий, чтобы адаптироваться к различным рыночным условиям.

Направление оптимизации стратегии

- Настройка параметровВ соответствии с изменениями рынка, корректировать размер сетки и частоту торгов, чтобы адаптироваться к различным рыночным колебаниям.

- Контроль рискаВведение более тонких механизмов управления рисками, таких как установка стоп-лосс, чтобы избежать значительных потерь в экстремальных рыночных условиях.

Подвести итог

Стратегия управления торговлей динамической сеткой - это гибкая стратегия торговли, применимая к различным рыночным условиям. Она направлена на снижение риска и достижение долгосрочной прибыли путем купли-продажи на разных уровнях цен. Однако, из-за непредсказуемости рынка стратегия нуждается в постоянной корректировке и оптимизации, чтобы адаптироваться к изменениям рынка. В целом, эта стратегия представляет собой привлекательный вариант для инвесторов, которые стремятся к долгосрочной стабильной прибыли.

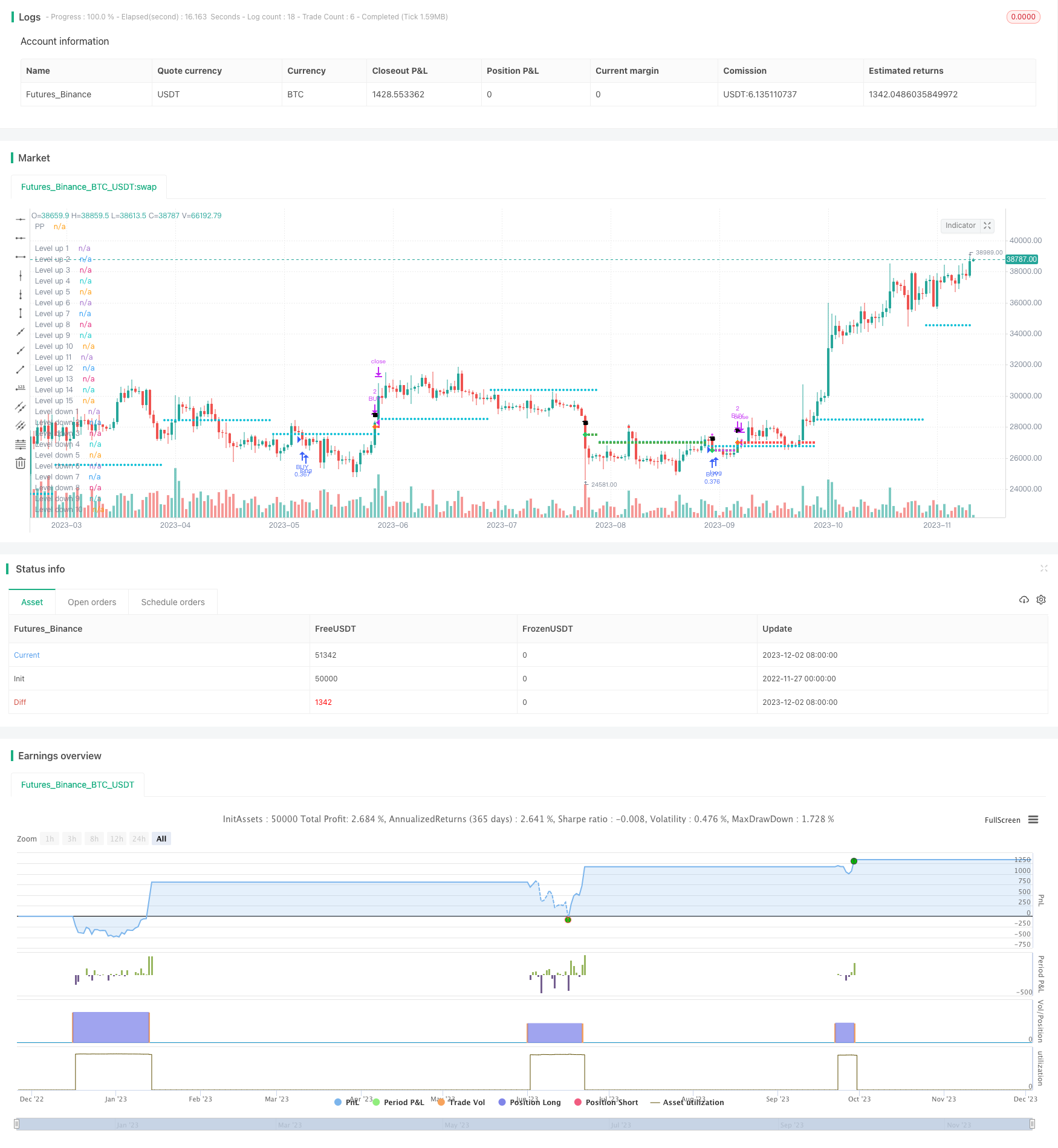

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © XaviZ

//@version=4

strategy(title = "CoGrid Management", shorttitle = "CoGrid💹", overlay = true, pyramiding = 1000, default_qty_value = 0)

// ———————————————————— Inputs

WOption = input('PRICE', " 》 WIDTH TYPE", options = ['PRICE','% PP'])

Width = input(500, " 》 WIDTH", type = input.float, minval = 0)

ppPeriod = input('Month', " 》 PP PERIOD", options = ['Day','Week','15D','Month'])

BuyType = input("CASH", " 》 BUY TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

BuyQ = input(10000, " 》 QUANTITY TO BUY", type = input.float, minval = 0)

SellType = input('CONTRACTS', " 》 SELL TYPE", options = ["CONTRACTS","CASH","% EQUITY"])

SellQ = input(2, " 》 QUANTITY TO SELL", type = input.float, minval = 0)

// ———————————————————— Vars

// ————— Buy Price & Sell Price

var float OpenPrice = na

OpenPrice := nz(OpenPrice[1])

// ————— Final Buy Price & Final Sell Price

var float FinalBuyPrice = na

FinalBuyPrice := nz(FinalBuyPrice[1])

var float FinalSellPrice = na

FinalSellPrice := nz(FinalSellPrice[1])

var float FinalOpenPrice = na

FinalOpenPrice := nz(FinalOpenPrice[1])

// ————— Average Price

var int nBuys = na

nBuys := nz(nBuys[1])

var int nSells = na

nSells := nz(nSells[1])

var float sumBuy = na

sumBuy := nz(sumBuy[1])

var float sumSell = na

sumSell := nz(sumSell[1])

var float sumQtyBuy = na

sumQtyBuy := nz(sumQtyBuy[1])

var float sumQtySell = na

sumQtySell := nz(sumQtySell[1])

var float AveragePrice = na

AveragePrice := nz(AveragePrice[1])

// ————— Fibonacci Pivots Level Calculation

var float PP = na

// ————— Origin from Rounded Pivot Points or last Sell

var float PPdownOrigin = na

// ————— Origin from Rounded Position Price

var float PPupOrigin = na

// ————— Final Buy & Sell Conditions

var bool BuyCondition = na

BuyCondition := nz(BuyCondition[1])

var bool SellCondition = na

SellCondition := nz(SellCondition[1])

// ————— Backtest

BuyFactor = BuyType == "CONTRACTS" ? 1 : BuyType == "% EQUITY" ? (100 / (strategy.equity / close)) : close

SellFactor = SellType == "CASH" ? close : 1

BuyQuanTity = BuyQ / BuyFactor

SellQuanTity = SellQ / SellFactor

// ———————————————————— Pivot Points

// ————— Pivot Points Period

res = ppPeriod == '15D' ? '15D' : ppPeriod == 'Week' ? 'W' : ppPeriod == 'Day' ? 'D' : 'M'

// ————— High, Low, Close Calc.

// "Function to securely and simply call `security()` so that it never repaints and never looks ahead" (@PineCoders)

f_secureSecurity(_symbol, _res, _src) => security(_symbol, _res, _src[1], lookahead = barmerge.lookahead_on)

phigh = f_secureSecurity(syminfo.tickerid, res, high)

plow = f_secureSecurity(syminfo.tickerid, res, low)

pclose = f_secureSecurity(syminfo.tickerid, res, close)

// ————— Fibonacci Pivots Level Calculation

PP := (phigh + plow + pclose) / 3

// ———————————————————— Grid Strategy

// ————— Width between levels

float GridWidth = WOption == 'PRICE' ? Width : PP * (Width/100)

// ————— Origin from Rounded Pivot Points

PPdownOrigin := floor(PP / GridWidth) * GridWidth

// ————— Origin from Rounded Average Position Price

PPupOrigin := nz(PPupOrigin[1])

// ————— Grid Calculation

fGrid(_1, _2, _n) =>

_a = _1, _b = _2, _c = 0.0

for _i = 1 to _n

if _i == 1

_c := _a

else

_c := _a + _b

_a := _c

// ————— Initial Open Price

fOpenPrice() =>

var float _ldown = na

var bool _pb = na

var float _lup = na

var bool _ps = na

var float _OpenPrice = na

_OpenPrice := nz(_OpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_ps := crossover(high, _lup) and low <= _lup

if _pb

_OpenPrice := _ldown

if _ps

_OpenPrice := _lup

_OpenPrice

OpenPrice := fOpenPrice()

// ————— Buy at better Price

fBuyCondition(_n) =>

var float _ldown = na

_ldown := nz(_ldown[1])

var bool _pb = na

_pb := nz(_pb[1])

var bool _BuyCondition = na

_BuyCondition := nz(_BuyCondition[1])

for _i = 1 to _n

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_pb := crossunder(low, _ldown) and high >= _ldown

_BuyCondition := nz(nBuys) == 0 ? _pb and _ldown < (fixnan(OpenPrice[1]) - GridWidth / 4) : _pb and _ldown < (fixnan(FinalOpenPrice[1]) - GridWidth / 4)

_BuyCondition

// ————— Sell at better Price

fSellCondition(_n) =>

var float _lup = na

_lup := nz(_lup[1])

var bool _ps = na

_ps := nz(_ps[1])

var bool _SellCondition = na

_SellCondition := nz(_SellCondition[1])

for _i = 1 to _n

_lup := fGrid(PPupOrigin, GridWidth, _i)

_ps := crossover(high, _lup) and low <= _lup

_SellCondition := nz(nSells) == 0 ? _ps and _lup > (fixnan(OpenPrice[1]) + GridWidth / 4) : _ps and _lup > (fixnan(FinalOpenPrice[1]) + GridWidth / 4)

_SellCondition

// ————— Final Open Price

fFinalOpenPrice() =>

var float _ldown = na

_ldown := nz(_ldown[1])

var float _lup = na

_lup := nz(_lup[1])

var float _FinalBuyPrice = na

_FinalBuyPrice := nz(_FinalBuyPrice[1])

var float _FinalSellPrice = na

_FinalSellPrice := nz(_FinalSellPrice[1])

var float _FinalOpenPrice = na

_FinalOpenPrice := nz(_FinalOpenPrice[1])

for _i = 1 to 15

_ldown := fGrid(PPdownOrigin, -GridWidth, _i)

_lup := fGrid(PPupOrigin, GridWidth, _i)

if fBuyCondition(_i)

_FinalBuyPrice := _ldown

_FinalOpenPrice := _ldown

if fSellCondition(_i)

_FinalSellPrice := _lup

_FinalOpenPrice := _lup

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice]

[_FinalBuyPrice,_FinalSellPrice,_FinalOpenPrice] = fFinalOpenPrice()

FinalBuyPrice := _FinalBuyPrice, FinalSellPrice := _FinalSellPrice, FinalOpenPrice := _FinalOpenPrice

// ————— Average Price & Backtest

for _i = 1 to 15

if fBuyCondition(_i)

nBuys := nBuys + 1

nSells := na

sumBuy := FinalOpenPrice * BuyQuanTity + nz(sumBuy[1])

sumQtyBuy := BuyQuanTity + nz(sumQtyBuy[1])

AveragePrice := sumBuy / sumQtyBuy

strategy.entry("BUY", strategy.long, qty = BuyQuanTity)

if fSellCondition(_i)

nBuys := na

nSells := nSells + 1

sumBuy := na

sumQtyBuy := na

strategy.close("BUY", qty = SellType != "% EQUITY" ? SellQuanTity : na, qty_percent = (SellType == "% EQUITY" ? SellQuanTity : na), comment = "SELL")

// ————— Origin from Rounded Pivot Points or last Sell

PPdownOrigin := (WOption == 'PRICE') ?

(fixnan(FinalSellPrice[1]) <= PP ? (floor(fixnan(FinalSellPrice[1]) / GridWidth) * GridWidth) - GridWidth : floor(PP / GridWidth) * GridWidth) :

(fixnan(FinalSellPrice[1]) <= PP ? fixnan(FinalSellPrice[1]) - GridWidth : PP)

// ————— Origin from Rounded Average Buy Price

PPupOrigin := WOption == 'PRICE' ?

((ceil(fixnan(AveragePrice[1]) / GridWidth) * GridWidth) + GridWidth) :

(fixnan(AveragePrice[1]) + GridWidth)

// ———————————————————— Plotting

// ————— Plotting Pivot Points

plot(PP, title = "PP", style = plot.style_circles, color = color.aqua, linewidth = 2)

// ————— Plotting the average price

plot(nBuys > 1 ? AveragePrice[1] : na, title = "Average Price", style = plot.style_circles, color = color.fuchsia, linewidth = 2)

// ————— Buy Conditions ————— Sell Conditions

pb1 = fBuyCondition(1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na, ps1 = fSellCondition(1) ? fGrid(PPupOrigin, GridWidth, 1) : na

pb2 = fBuyCondition(2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na, ps2 = fSellCondition(2) ? fGrid(PPupOrigin, GridWidth, 2) : na

pb3 = fBuyCondition(3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na, ps3 = fSellCondition(3) ? fGrid(PPupOrigin, GridWidth, 3) : na

pb4 = fBuyCondition(4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na, ps4 = fSellCondition(4) ? fGrid(PPupOrigin, GridWidth, 4) : na

pb5 = fBuyCondition(5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na, ps5 = fSellCondition(5) ? fGrid(PPupOrigin, GridWidth, 5) : na

pb6 = fBuyCondition(6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na, ps6 = fSellCondition(6) ? fGrid(PPupOrigin, GridWidth, 6) : na

pb7 = fBuyCondition(7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na, ps7 = fSellCondition(7) ? fGrid(PPupOrigin, GridWidth, 7) : na

pb8 = fBuyCondition(8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na, ps8 = fSellCondition(8) ? fGrid(PPupOrigin, GridWidth, 8) : na

pb9 = fBuyCondition(9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na, ps9 = fSellCondition(9) ? fGrid(PPupOrigin, GridWidth, 9) : na

pb10 = fBuyCondition(10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na, ps10 = fSellCondition(10) ? fGrid(PPupOrigin, GridWidth, 10) : na

pb11 = fBuyCondition(11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na, ps11 = fSellCondition(11) ? fGrid(PPupOrigin, GridWidth, 11) : na

pb12 = fBuyCondition(12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na, ps12 = fSellCondition(12) ? fGrid(PPupOrigin, GridWidth, 12) : na

pb13 = fBuyCondition(13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na, ps13 = fSellCondition(13) ? fGrid(PPupOrigin, GridWidth, 13) : na

pb14 = fBuyCondition(14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na, ps14 = fSellCondition(14) ? fGrid(PPupOrigin, GridWidth, 14) : na

pb15 = fBuyCondition(15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na, ps15 = fSellCondition(15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Level Conditions

lb1 = low < fGrid(PPdownOrigin, -GridWidth, 1) and PP > fGrid(PPdownOrigin, -GridWidth, 1) ? fGrid(PPdownOrigin, -GridWidth, 1) : na

lb2 = low < fGrid(PPdownOrigin, -GridWidth, 2) and PP > fGrid(PPdownOrigin, -GridWidth, 2) ? fGrid(PPdownOrigin, -GridWidth, 2) : na

lb3 = low < fGrid(PPdownOrigin, -GridWidth, 3) and PP > fGrid(PPdownOrigin, -GridWidth, 3) ? fGrid(PPdownOrigin, -GridWidth, 3) : na

lb4 = low < fGrid(PPdownOrigin, -GridWidth, 4) and PP > fGrid(PPdownOrigin, -GridWidth, 4) ? fGrid(PPdownOrigin, -GridWidth, 4) : na

lb5 = low < fGrid(PPdownOrigin, -GridWidth, 5) and PP > fGrid(PPdownOrigin, -GridWidth, 5) ? fGrid(PPdownOrigin, -GridWidth, 5) : na

lb6 = low < fGrid(PPdownOrigin, -GridWidth, 6) and PP > fGrid(PPdownOrigin, -GridWidth, 6) ? fGrid(PPdownOrigin, -GridWidth, 6) : na

lb7 = low < fGrid(PPdownOrigin, -GridWidth, 7) and PP > fGrid(PPdownOrigin, -GridWidth, 7) ? fGrid(PPdownOrigin, -GridWidth, 7) : na

lb8 = low < fGrid(PPdownOrigin, -GridWidth, 8) and PP > fGrid(PPdownOrigin, -GridWidth, 8) ? fGrid(PPdownOrigin, -GridWidth, 8) : na

lb9 = low < fGrid(PPdownOrigin, -GridWidth, 9) and PP > fGrid(PPdownOrigin, -GridWidth, 9) ? fGrid(PPdownOrigin, -GridWidth, 9) : na

lb10 = low < fGrid(PPdownOrigin, -GridWidth, 10) and PP > fGrid(PPdownOrigin, -GridWidth, 10) ? fGrid(PPdownOrigin, -GridWidth, 10) : na

lb11 = low < fGrid(PPdownOrigin, -GridWidth, 11) and PP > fGrid(PPdownOrigin, -GridWidth, 11) ? fGrid(PPdownOrigin, -GridWidth, 11) : na

lb12 = low < fGrid(PPdownOrigin, -GridWidth, 12) and PP > fGrid(PPdownOrigin, -GridWidth, 12) ? fGrid(PPdownOrigin, -GridWidth, 12) : na

lb13 = low < fGrid(PPdownOrigin, -GridWidth, 13) and PP > fGrid(PPdownOrigin, -GridWidth, 13) ? fGrid(PPdownOrigin, -GridWidth, 13) : na

lb14 = low < fGrid(PPdownOrigin, -GridWidth, 14) and PP > fGrid(PPdownOrigin, -GridWidth, 14) ? fGrid(PPdownOrigin, -GridWidth, 14) : na

lb15 = low < fGrid(PPdownOrigin, -GridWidth, 15) and PP > fGrid(PPdownOrigin, -GridWidth, 15) ? fGrid(PPdownOrigin, -GridWidth, 15) : na

// ————— Sell Level Conditions

ls1 = high > fGrid(PPupOrigin, GridWidth, 1) and PP < fGrid(PPupOrigin, GridWidth, 1) ? fGrid(PPupOrigin, GridWidth, 1) : na

ls2 = high > fGrid(PPupOrigin, GridWidth, 2) and PP < fGrid(PPupOrigin, GridWidth, 2) ? fGrid(PPupOrigin, GridWidth, 2) : na

ls3 = high > fGrid(PPupOrigin, GridWidth, 3) and PP < fGrid(PPupOrigin, GridWidth, 3) ? fGrid(PPupOrigin, GridWidth, 3) : na

ls4 = high > fGrid(PPupOrigin, GridWidth, 4) and PP < fGrid(PPupOrigin, GridWidth, 4) ? fGrid(PPupOrigin, GridWidth, 4) : na

ls5 = high > fGrid(PPupOrigin, GridWidth, 5) and PP < fGrid(PPupOrigin, GridWidth, 5) ? fGrid(PPupOrigin, GridWidth, 5) : na

ls6 = high > fGrid(PPupOrigin, GridWidth, 6) and PP < fGrid(PPupOrigin, GridWidth, 6) ? fGrid(PPupOrigin, GridWidth, 6) : na

ls7 = high > fGrid(PPupOrigin, GridWidth, 7) and PP < fGrid(PPupOrigin, GridWidth, 7) ? fGrid(PPupOrigin, GridWidth, 7) : na

ls8 = high > fGrid(PPupOrigin, GridWidth, 8) and PP < fGrid(PPupOrigin, GridWidth, 8) ? fGrid(PPupOrigin, GridWidth, 8) : na

ls9 = high > fGrid(PPupOrigin, GridWidth, 9) and PP < fGrid(PPupOrigin, GridWidth, 9) ? fGrid(PPupOrigin, GridWidth, 9) : na

ls10 = high > fGrid(PPupOrigin, GridWidth, 10) and PP < fGrid(PPupOrigin, GridWidth, 10) ? fGrid(PPupOrigin, GridWidth, 10) : na

ls11 = high > fGrid(PPupOrigin, GridWidth, 11) and PP < fGrid(PPupOrigin, GridWidth, 11) ? fGrid(PPupOrigin, GridWidth, 11) : na

ls12 = high > fGrid(PPupOrigin, GridWidth, 12) and PP < fGrid(PPupOrigin, GridWidth, 12) ? fGrid(PPupOrigin, GridWidth, 12) : na

ls13 = high > fGrid(PPupOrigin, GridWidth, 13) and PP < fGrid(PPupOrigin, GridWidth, 13) ? fGrid(PPupOrigin, GridWidth, 13) : na

ls14 = high > fGrid(PPupOrigin, GridWidth, 14) and PP < fGrid(PPupOrigin, GridWidth, 14) ? fGrid(PPupOrigin, GridWidth, 14) : na

ls15 = high > fGrid(PPupOrigin, GridWidth, 15) and PP < fGrid(PPupOrigin, GridWidth, 15) ? fGrid(PPupOrigin, GridWidth, 15) : na

// ————— Buy Shapes

plotshape(pb1, title = "Buy 1", style = shape.diamond, location = location.absolute, color = color.lime, text = "1", size = size.tiny)

plotshape(pb2, title = "Buy 2", style = shape.diamond, location = location.absolute, color = color.lime, text = "2", size = size.tiny)

plotshape(pb3, title = "Buy 3", style = shape.diamond, location = location.absolute, color = color.lime, text = "3", size = size.tiny)

plotshape(pb4, title = "Buy 4", style = shape.diamond, location = location.absolute, color = color.lime, text = "4", size = size.tiny)

plotshape(pb5, title = "Buy 5", style = shape.diamond, location = location.absolute, color = color.lime, text = "5", size = size.tiny)

plotshape(pb6, title = "Buy 6", style = shape.diamond, location = location.absolute, color = color.lime, text = "6", size = size.tiny)

plotshape(pb7, title = "Buy 7", style = shape.diamond, location = location.absolute, color = color.lime, text = "7", size = size.tiny)

plotshape(pb8, title = "Buy 8", style = shape.diamond, location = location.absolute, color = color.lime, text = "8", size = size.tiny)

plotshape(pb9, title = "Buy 9", style = shape.diamond, location = location.absolute, color = color.lime, text = "9", size = size.tiny)

plotshape(pb10, title = "Buy 10", style = shape.diamond, location = location.absolute, color = color.lime, text = "10", size = size.tiny)

plotshape(pb11, title = "Buy 11", style = shape.diamond, location = location.absolute, color = color.lime, text = "11", size = size.tiny)

plotshape(pb12, title = "Buy 12", style = shape.diamond, location = location.absolute, color = color.lime, text = "12", size = size.tiny)

plotshape(pb13, title = "Buy 13", style = shape.diamond, location = location.absolute, color = color.lime, text = "13", size = size.tiny)

plotshape(pb14, title = "Buy 14", style = shape.diamond, location = location.absolute, color = color.lime, text = "14", size = size.tiny)

plotshape(pb15, title = "Buy 15", style = shape.diamond, location = location.absolute, color = color.lime, text = "15", size = size.tiny)

// ————— Sell Shapes

plotshape(ps1, title = "Sell 1", style = shape.diamond, location = location.absolute, color = color.orange, text = "1", size = size.tiny)

plotshape(ps2, title = "Sell 2", style = shape.diamond, location = location.absolute, color = color.orange, text = "2", size = size.tiny)

plotshape(ps3, title = "Sell 3", style = shape.diamond, location = location.absolute, color = color.orange, text = "3", size = size.tiny)

plotshape(ps4, title = "Sell 4", style = shape.diamond, location = location.absolute, color = color.orange, text = "4", size = size.tiny)

plotshape(ps5, title = "Sell 5", style = shape.diamond, location = location.absolute, color = color.orange, text = "5", size = size.tiny)

plotshape(ps6, title = "Sell 6", style = shape.diamond, location = location.absolute, color = color.orange, text = "6", size = size.tiny)

plotshape(ps7, title = "Sell 7", style = shape.diamond, location = location.absolute, color = color.orange, text = "7", size = size.tiny)

plotshape(ps8, title = "Sell 8", style = shape.diamond, location = location.absolute, color = color.orange, text = "8", size = size.tiny)

plotshape(ps9, title = "Sell 9", style = shape.diamond, location = location.absolute, color = color.orange, text = "9", size = size.tiny)

plotshape(ps10, title = "Sell 10", style = shape.diamond, location = location.absolute, color = color.orange, text = "10", size = size.tiny)

plotshape(ps11, title = "Sell 11", style = shape.diamond, location = location.absolute, color = color.orange, text = "11", size = size.tiny)

plotshape(ps12, title = "Sell 12", style = shape.diamond, location = location.absolute, color = color.orange, text = "12", size = size.tiny)

plotshape(ps13, title = "Sell 13", style = shape.diamond, location = location.absolute, color = color.orange, text = "13", size = size.tiny)

plotshape(ps14, title = "Sell 14", style = shape.diamond, location = location.absolute, color = color.orange, text = "14", size = size.tiny)

plotshape(ps15, title = "Sell 15", style = shape.diamond, location = location.absolute, color = color.orange, text = "15", size = size.tiny)

// ————— Plotting Lines under PP // ————— Plotting Lines above PP

plot(lb1, title = "Level down 1", style = plot.style_circles, color = color.green), plot(ls1, title = "Level up 1", style = plot.style_circles, color = color.red)

plot(lb2, title = "Level down 2", style = plot.style_circles, color = color.green), plot(ls2, title = "Level up 2", style = plot.style_circles, color = color.red)

plot(lb3, title = "Level down 3", style = plot.style_circles, color = color.green), plot(ls3, title = "Level up 3", style = plot.style_circles, color = color.red)

plot(lb4, title = "Level down 4", style = plot.style_circles, color = color.green), plot(ls4, title = "Level up 4", style = plot.style_circles, color = color.red)

plot(lb5, title = "Level down 5", style = plot.style_circles, color = color.green), plot(ls5, title = "Level up 5", style = plot.style_circles, color = color.red)

plot(lb6, title = "Level down 6", style = plot.style_circles, color = color.green), plot(ls6, title = "Level up 6", style = plot.style_circles, color = color.red)

plot(lb7, title = "Level down 7", style = plot.style_circles, color = color.green), plot(ls7, title = "Level up 7", style = plot.style_circles, color = color.red)

plot(lb8, title = "Level down 8", style = plot.style_circles, color = color.green), plot(ls8, title = "Level up 8", style = plot.style_circles, color = color.red)

plot(lb9, title = "Level down 9", style = plot.style_circles, color = color.green), plot(ls9, title = "Level up 9", style = plot.style_circles, color = color.red)

plot(lb10, title = "Level down 10", style = plot.style_circles, color = color.green), plot(ls10, title = "Level up 10", style = plot.style_circles, color = color.red)

plot(lb11, title = "Level down 11", style = plot.style_circles, color = color.green), plot(ls11, title = "Level up 11", style = plot.style_circles, color = color.red)

plot(lb12, title = "Level down 12", style = plot.style_circles, color = color.green), plot(ls12, title = "Level up 12", style = plot.style_circles, color = color.red)

plot(lb13, title = "Level down 13", style = plot.style_circles, color = color.green), plot(ls13, title = "Level up 13", style = plot.style_circles, color = color.red)

plot(lb14, title = "Level down 14", style = plot.style_circles, color = color.green), plot(ls14, title = "Level up 14", style = plot.style_circles, color = color.red)

plot(lb15, title = "Level down 15", style = plot.style_circles, color = color.green), plot(ls15, title = "Level up 15", style = plot.style_circles, color = color.red)

// by XaviZ💤