Muster-K-Linien-Handelsstrategie

Überblick

Es ist eine Strategie, die verschiedene K-Linie-Formen als Handelssignale verwendet. Es kann 9 häufig vorkommenden Kurven-Formen erkennen und basierend auf diesen Formen Kauf- und Verkaufssignale erzeugen.

Strategieprinzip

Die Kernlogik der Strategie besteht darin, verschiedene K-Linie-Formen zu identifizieren, darunter Kreuz-, Kopf- und Sternschnuppen. Wenn eine bullische Form identifiziert wird, wird ein Kaufsignal erzeugt; wenn eine bärische Form identifiziert wird, wird ein Verkaufsignal erzeugt.

Zum Beispiel, wenn drei aufsteigende weiße K-Linien entdeckt werden, ist das Signal von drei weißen Soldaten, dass der Markt derzeit in einem bullischen Trend ist, und es wird ein Kaufsignal erzeugt.

Wenn beispielsweise ein langes K-Signal die Entität eines vorherigen Y-Signals vollständig verschlingt, entsteht eine Form des Bären-ISHengulfing, die eine Trendwende voraussagt, bei der ein Verkaufssignal erzeugt wird.

Analyse der Stärken

Diese Strategie basiert auf der Formerkennung und kann kurzfristige Wendepunkte erfassen. Sie eignet sich besonders für Short-Line-Handel. Durch die Identifizierung der genauen Formsignale kann die Preisumkehr rechtzeitig erfasst und in die Gewinnrichtung gebracht werden.

Die K-Line-Strategie kombiniert die Beurteilung der Preisentwicklung und der Marktstimmung und ist somit ein sehr präziseres und zuverlässigeres Handelssignal im Vergleich zu einer einfachen Technischen Indikator-Strategie wie beispielsweise einem Moving Average.

Risikoanalyse

Die Strategie beruht hauptsächlich auf der richtigen Einschätzung der K-Linie-Form. Wenn die Einschätzung fehlerhaft ist, kann leicht ein falsches Handelssignal erzeugt werden, was zu Verlusten führt.

Darüber hinaus kann keine technische Analyse-Strategie vollständig Systemrisiken vermeiden, die sich auf den Handel auswirken können, wie z. B. politische Einflüsse, Black Swan-Vorfälle usw.

Risiken können durch Stop Loss kontrolliert werden. Wenn der Preis eine bestimmte Grenze in die entgegengesetzte Richtung durchbricht, kann der Stop Loss zeitnah ausgeschaltet werden.

Optimierungsrichtung

Die K-Linien-Formen können erweitert werden, um weitere effiziente Formsignale, wie z. B. die Antennenleine, die Inverse-Antennenleine, die Trennleine usw., hinzuzufügen, um die Transaktionssignale zu bestätigen.

In Kombination mit anderen Indikatoren kann eine Filterung vorgenommen werden, um Handelssignale in unsicheren Marktumgebungen zu vermeiden. Die Signale von Indikatoren wie MACD, RSI und anderen können ein geringwertiges K-Linie-Signal vermeiden.

Die Stop-Logik kann optimiert werden, indem bei einem Preisbruch in die entgegengesetzte Richtung gestoppt wird. Die Stop-Range kann in Kombination mit den Volatilitätsindikatoren dynamisch angepasst werden.

Zusammenfassen

Dies ist eine sehr praktische Short-Line-Handelsstrategie. Sie erkennt die üblichen K-Line-Formen, um Handelssignale zu erzeugen, die kurzfristige Wendechancen für die Preise ergreifen können. Gleichzeitig ist auf einige potenzielle Risiken zu achten, die angemessen optimiert werden müssen, um Risiken zu kontrollieren und Effizienz zu steigern.

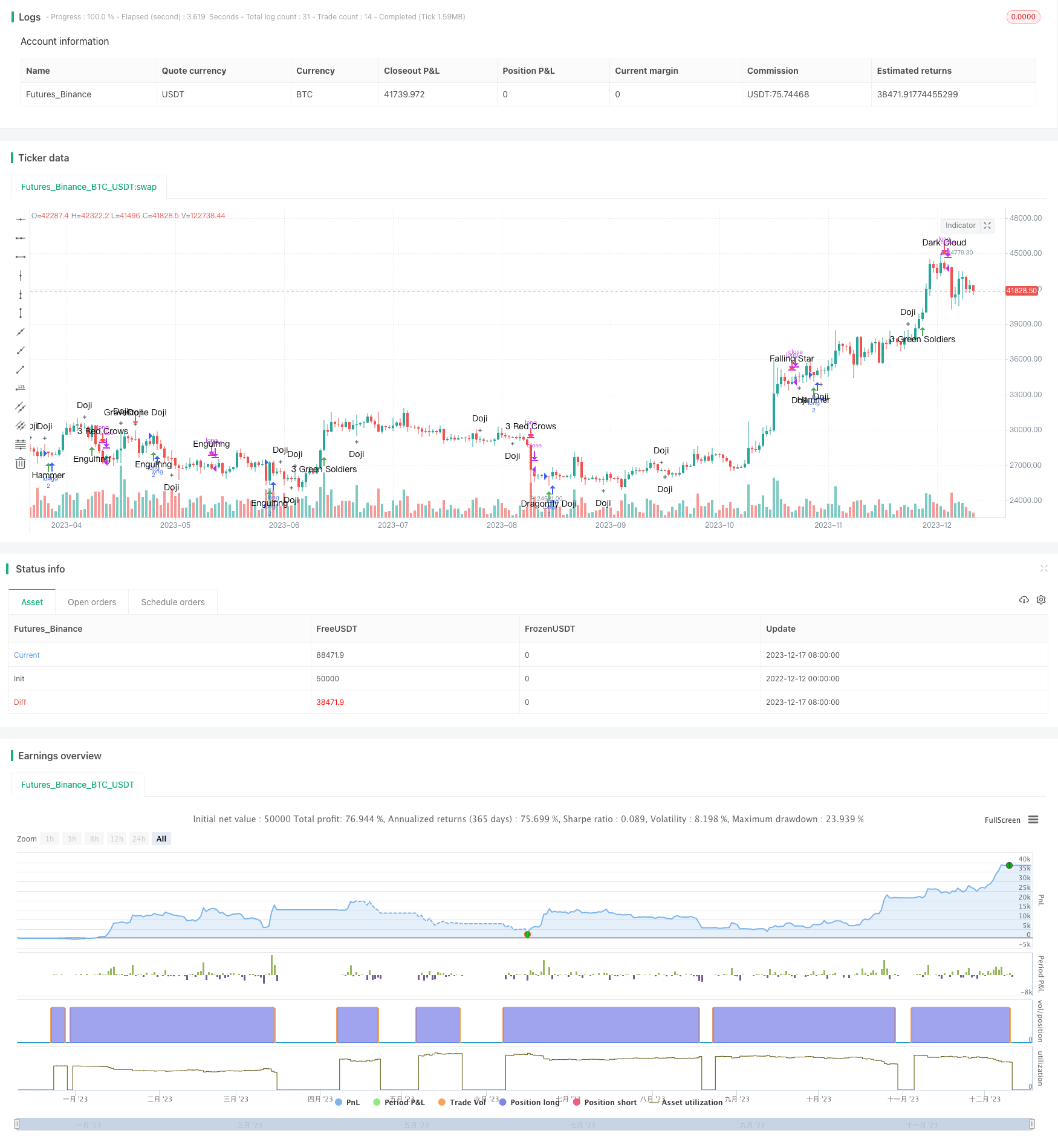

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Dan Pasco

strategy("Candlestick Signals Strategy" , shorttitle="Candlestick Signal Strategy $1000", overlay = true , initial_capital = 1000)

//Settings input menu

dojicon = input(title = "Show Doji's", type=bool, defval = true)

gravedojicon = input(title = "Gravestone Doji/Dragonfly Doji", type=bool, defval = true)

tbctwscon = input(title = "3 Red Crows/3 Green Soldiers", type=bool, defval = true)

tlscon = input(title = "Three Line Strike", type=bool, defval = true)

pcon = input(title = "Piercing/Dark Cloud", type=bool, defval = true)

mscon = input(title = "Morning Star", type=bool, defval = true)

escon = input(title = "Evening Star", type=bool, defval = true)

econ = input(title = "Engulfing", type=bool, defval = true)

hcon = input(title = "Hammer", type=bool, defval = true)

fscon = input(title = "Falling Star", type=bool, defval = true)

//Doji Up

dojiup = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (close-low)>(high-open) and (open-close)<((high-open)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (open-low)>(high-close) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojiup, style=shape.cross,location=location.belowbar, text="Doji", color=black)

//Doji Down

dojidown = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (high-open)>(close-low) and (open-close)<((close-low)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (high-close)>(open-low) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojidown, style=shape.cross,location=location.abovebar, text="Doji", color=black)

//Gravestone Doji Bull

gravedojibull = (close-open)>0 and ((high-close)/8)>(close-open) and ((high-close)/5)>(open-low) and gravedojicon == true

plotshape(gravedojibull, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Gravestone Doji Bear

gravedojibear = (open-close)>0 and ((high-open)/8)>(open-close) and ((high-open)/5)>(close-low) and gravedojicon == true

plotshape(gravedojibear, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Dragonfly Doji Bull

dragondojibull = (close-open)>0 and ((open-low)/8)>(close-open) and ((open-low)/5)>(high-close) and gravedojicon == true

plotshape(dragondojibull, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Dragonfly Doji Bear

dragondojibear = (open-close)>0 and ((close-low)/8)>(open-close) and ((close-low)/5)>(high-open) and gravedojicon == true

plotshape(dragondojibear, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Three Black Crows

tbc = (low[2]<low[3] and low[1]<low[2] and low<low[1] and high[2]<high[3] and high[1]<high[2] and high<high[1] and (close[3]-open[3])>0 and (open[2]-close[2])>0 and (open[1]-close[1])>0 and (open-close)>0 and (open-close)>(close-low) and (open-close)>(high-open) and (open[1]-close[1])>(close[1]-low[1]) and (open[1]-close[1])>(high[1]-open[1]) and (open[2]-close[2])>(close[2]-low[2]) and (open[2]-close[2])>(high[2]-open[2]) and tbctwscon == true)

plotshape(tbc, style=shape.arrowdown,location=location.abovebar, text="3 Red Crows", color=red)

//Three White Soldiers

tws = (high[2]>high[3] and high[1]>high[2] and high>high[1] and low[2]>low[3] and low[1]>low[2] and low>low[1] and (open[3]-close[3])>0 and (close[2]-open[2])>0 and (close[1]-open[1])>0 and (close-open)>0 and (close-open)>(open-low) and (close-open)>(high-close) and (close[1]-open[1])>(open[1]-low[1]) and (close[1]-open[1])>(high[1]-close[1]) and (close[2]-open[2])>(open[2]-low[2]) and (close[2]-open[2])>(high[2]-close[2]) and tbctwscon == true)

plotshape(tws, style=shape.arrowup,location=location.belowbar, text="3 Green Soldiers", color=green)

//Three Line Strike Up

tlsu = ((close-open)>0 and (open[1]-close[1])>0 and (open[2]-close[2])>0 and (open[3]-close[3])>0 and open<close[1] and low[1]<low[2] and low[2]<low[3] and high>high[3] and low<low[1] and tlscon == true)

plotshape(tlsu, style=shape.arrowup,location=location.belowbar, text="3 Line Strike", color=green)

//Three Line Strike Down

tlsd = ((open-close)>0 and (close[1]-open[1])>0 and (close[2]-open[2])>0 and (close[3]-open[3])>0 and open>close[1] and high[1]>high[2] and high[2]>high[3] and low<low[3] and high>high[1] and tlscon == true)

plotshape(tlsd, style=shape.arrowdown,location=location.abovebar, text="3 Line Strike", color=red)

//Piercing Up

pu = ((open[1]-close[1])>0 and (close-open)>0 and (open[1]-close[1])>(high[1]-open[1]) and (open[1]-close[1])>(close[1]-low[1]) and (close-open)>(high-close) and (close-open)>(open-low) and open<close[1] and ((open[1]+close[1])/2)<close and ((close-open)/2)>(high-close) and close<open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(pu, style=shape.arrowup,location=location.belowbar, text="Piercing Up", color=green)

//Dark Cloud

dc = ((close[1]-open[1])>0 and (open-close)>0 and (close[1]-open[1])>(high[1]-close[1]) and (close[1]-open[1])>(open[1]-low[1]) and (open-close)>(high-open) and (open-close)>(close-low) and open>close[1] and ((open[1]+close[1])/2)>close and ((open-close)/2)>(close-low) and close>open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(dc, style=shape.arrowdown,location=location.abovebar, text="Dark Cloud", color=red)

//Morning Star 1 Up

ms1u = ((open[2]-close[2])>0 and (close-open)>0 and (open[1]-close[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(open[1]-close[1]) and (open[2]-close[2])>(open[1]-close[1]) and open[1]<close[2] and open[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms1u, style=shape.arrowup,location=location.belowbar, text="Morning Star", color=green)

//Morning Star 2 Up

ms2u = ((open[2]-close[2])>0 and (close-open)>0 and (close[1]-open[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(close[1]-open[1]) and (open[2]-close[2])>(close[1]-open[1]) and close[1]<close[2] and close[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms2u, style=shape.arrowup,location=location.belowbar, text="Morning Star X2", color=green)

//Evening Star 1 Down

es1d = ((close[2]-open[2])>0 and (open-close)>0 and (close[1]-open[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(close[1]-open[1]) and (close[2]-open[2])>(close[1]-open[1]) and open[1]>close[2] and open[1]>open and escon == true)

plotshape(es1d, style=shape.arrowdown,location=location.abovebar, text="Evening Star", color=red)

//Evening Star 2 Down

es2d = ((close[2]-open[2])>0 and (open-close)>0 and (open[1]-close[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(open[1]-close[1]) and (close[2]-open[2])>(open[1]-close[1]) and close[1]>close[2] and close[1]>open and close[1]!=open[1] and escon == true)

plotshape(es2d, style=shape.arrowdown,location=location.abovebar, text="Evening X2", color=red)

//Bullish Engulfing

beu = (open[1]-close[1])>0 and (close-open)>0 and high>high[1] and low<low[1] and (close-open)>(open[1]-close[1]) and (close-open)>(high-close) and (close-open)>(open-low) and econ == true

plotshape(beu, style=shape.arrowup,location=location.belowbar, text="Engulfing", color=green)

//Bearish Engulfing

bed = (close[1]-open[1])>0 and (open-close)>0 and high>high[1] and low<low[1] and (open-close)>(close[1]-open[1]) and (open-close)>(high-open) and (open-close)>(close-low) and econ == true

plotshape(bed, style=shape.arrowdown,location=location.abovebar, text="Engulfing", color=red)

//Bullish Hammer Up

bhu1 = (close-open)>0 and ((close-open)/3)>(high-close) and ((open-low)/2)>(close-open) and (close-open)>((open-low)/8) and hcon == true

plotshape(bhu1, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bearish Hammer Up

bhu2 = (open-close)>0 and ((open-close)/3)>(high-open) and ((close-low)/2)>(open-close) and (open-close)>((close-low)/8) and hcon == true

plotshape(bhu2, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bullish Falling Star

bfs1 = (close-open)>0 and ((close-open)/3)>(open-low) and ((high-close)/2)>(close-open) and (close-open)>((high-close)/8) and fscon == true

plotshape(bfs1, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Bearish Falling Star

bfs2 = (open-close)>0 and ((open-close)/3)>(close-low) and ((high-open)/2)>(open-close) and (open-close)>((high-open)/8) and fscon == true

plotshape(bfs2, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Declaring the buy signals

buy = (dragondojibear == true and gravedojicon == true) or (dragondojibull == true and gravedojicon == true) or (tws == true and tbctwscon == true) or (tlsu == true and tlscon == true) or (pu == true and pcon == true) or (ms1u == true and mscon == true) or (ms2u == true and mscon == true) or (beu == true and econ == true) or (bhu1 == true and hcon == true) or (bhu2 == true and hcon == true)

//Declaring the sell signals

sell = (gravedojibear == true and gravedojicon == true) or (gravedojibull == true and gravedojicon == true) or (tbc == true and tbctwscon == true) or (tlsd == true and tlscon == true) or (dc == true and pcon == true) or (es1d == true and escon == true) or (es2d == true and escon == true) or (bed == true and econ == true) or (bfs1 == true and fscon == true) or (bfs2 == true and fscon == true)

//Execute historic backtesting

ordersize = floor(strategy.equity/close) // To dynamically calculate the order size as the account equity increases or decreases.

strategy.entry("long",strategy.long,ordersize,when=buy) // Buy

strategy.close("long", when=sell) //Sell