概述

RSI通道价差跟踪策略通过跟踪RSI指标在阈值通道内的波动,结合价格的突破来产生交易信号。该策略致力于捕捉加密货币市场中的快速买卖爆发。

策略原理

使用Hull移动平均线平滑RSI,生成平滑后的RSI指标。包括收盘价RSI、最高价RSI、最低价RSI和中位数价RSI。

设置RSI通道范围为55-45。当RSI指标进入55-45通道,表示进入震荡区间。

当收盘价RSI指标从通道上线回落时,并且收盘价低于中位数价,表明价格承压;而此时中位数价RSI指标仍高于通道上限,表明中位数价仍有买入动力,符合追踪中位数价突破的逻辑,因此产生买入信号。

当收盘价RSI从通道下限反弹时,并且收盘价高于中位数价,表明价格有支撑;而此时中位数价RSI指标低于通道下限,表明中位数价承压较大,符合追踪中位数价突破的逻辑,因此产生卖出信号。

最高价RSI和最低价RSI指标用于及时识别交易信号失效,快速止损。

策略优势

使用中位数价突破追踪中位数价的强势方向,符合趋势跟踪的理念。

RSI震荡在阈值通道内,提示进入盘整,这时使用中位数价追踪中位数价的强势方向,避免被困在区间震荡中。

最高价RSI和最低价RSI指标用于快速识别交易信号失效,进行快速止损,可有效控制亏损。

策略风险

RSI指标设定不当可能导致过于灵敏或迟钝。

中位数价突破的意义并不总是可靠的,中位数价自身也可能处于震荡。

加密货币市场波动较大,止损位置设定过于宽松可能导致亏损扩大。

解决方法:

- 优化RSI参数,使其对价格变化响应适度

- 结合更多指标判断中位数价突破的可靠性

- 适当缩紧止损位置,防止亏损过大

策略优化方向

- 结合更多指标判断中位数价的突破方向

可以引入像布林带等指标,判断中位数价是否接近上下轨,从而提高对中位数价突破方向的判断的准确性。

- 引入机器学习模型辅助判断

使用LSTM等深度学习模型对中位数价的未来走势进行预测,辅助确定中位数价能否成功突破某一方向。

- 使用适应性止损

根据市场波动程度,实时调整止损位置。例如波动加大时,适当收紧止损位置;波动减小时,可以适当放宽止损位置。

总结

RSI通道价差跟踪策略通过跟踪RSI指标在通道内的波动并结合价格的突破来产生交易信号,致力于捕捉加密货币市场的快速买卖爆发。该策略有效结合了趋势追踪和区间识别的方法,在价差缩小时仍可获得较好的交易信号。同时设置的快速止损机制也使得策略风险可控。下一步,可以通过结合更多指标判断和机器学习预测的方法进一步提升策略的可靠性和收益率。

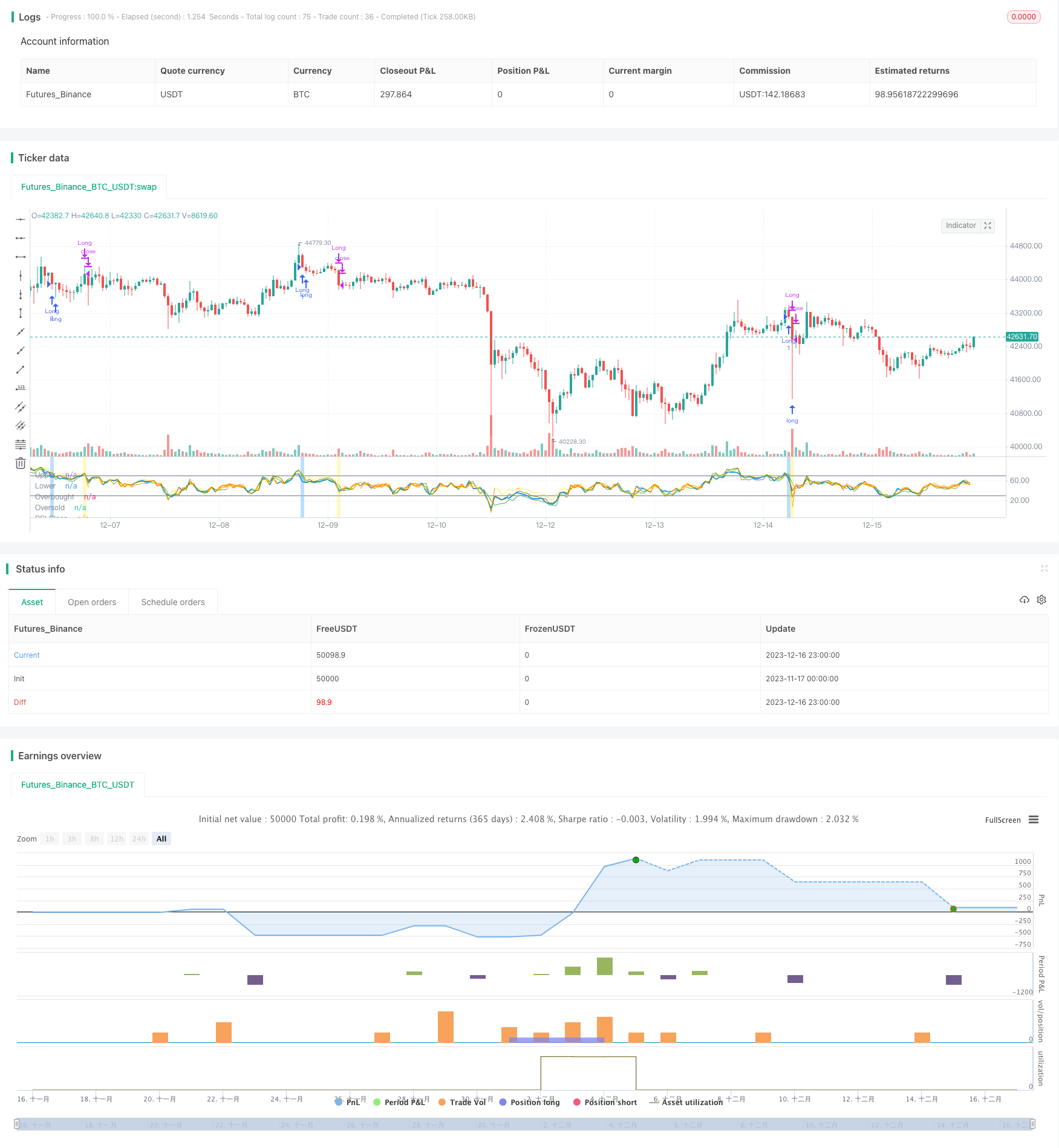

/*backtest

start: 2023-11-17 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hull MA of RSI Strategy",overlay=false)

//+++++++++++++++++++++++++++++++

//++++++++++++ Setup ++++++++++++

//+++++++++++++++++++++++++++++++

// RSI

rsi1_tt="=== RSI ==="

rsi1_len=input(13,title="Period",inline="set",group=rsi1_tt)

//Mid

mid_tt="=== Mid Channel ==="

upper=input(55.0,title="Upper",inline="set",group=mid_tt)

lower=input(45.0,title="Lower",inline="set",group=mid_tt)

//Over

over_tt="=== Over ==="

ovb=input(70.0,title="Overbought",inline="set",group=over_tt)

ovs=input(30.0,title="Oversold",inline="set",group=over_tt)

//++++++++++++++++++++++++++++++++++++++++

//++++++++++++ Hull MA of RSI ++++++++++++

//++++++++++++++++++++++++++++++++++++++++

hma_tt="=== Hull MA ==="

hma_len=input(3,title="Period",inline="set",group=hma_tt)

rsi_c=hma(rsi(close,rsi1_len),hma_len)

rsi_h=hma(rsi(high,rsi1_len),hma_len)

rsi_l=hma(rsi(low,rsi1_len),hma_len)

rsi_hl2=hma(rsi(hl2,rsi1_len),hma_len)

//++++++++++++++++++++++++++++++++

//++++++++++++ Signal ++++++++++++

//++++++++++++++++++++++++++++++++

var order_status="None"

BuySignal=

crossunder(rsi_c,ovb)

and

close<hl2

and

rsi_hl2>ovb

and

order_status=="None"

CloseBuy=

order_status[1]=="Long"

and

(crossover(rsi_c,ovb)

or

crossunder(rsi_l,upper))

SellSignal=

crossover(rsi_c,ovs)

and

close>hl2

and

rsi_hl2<ovs

and

order_status=="None"

CloseSell=

order_status[1]=="Short"

and

(crossunder(rsi_c,ovs)

or

crossover(rsi_h,lower))

ExitSignal=

CloseBuy

or

CloseSell

if BuySignal

order_status:="Long"

if SellSignal

order_status:="Short"

if ExitSignal

order_status:="None"

//+++++++++++++++++++++++++++++++++++

//++++++++++++ Plot Line ++++++++++++

//+++++++++++++++++++++++++++++++++++

rsi_c_col=

rsi_c>upper?color.new(color.blue,0):

rsi_c<lower?color.new(color.blue,0):

color.new(color.orange,0)

rsi_h_col=

rsi_h>upper?color.new(color.green,0):

rsi_h<lower?color.new(color.green,0):

color.new(color.orange,0)

rsi_l_col=

rsi_l>upper?color.new(color.yellow,0):

rsi_l<lower?color.new(color.yellow,0):

color.new(color.orange,0)

rsi_hl2_col=

rsi_hl2>upper?color.new(color.olive,0):

rsi_hl2<lower?color.new(color.olive,0):

color.new(color.orange,0)

plot(rsi_c,title="RSI Close",color=rsi_c_col,linewidth=2)

plot(rsi_h,title="RSI High",color=rsi_h_col,linewidth=1)

plot(rsi_l,title="RSI Low",color=rsi_l_col,linewidth=1)

plot(rsi_hl2,title="RSI HL2",color=rsi_hl2_col,linewidth=1)

upper_line=hline(upper,title="Upper",color=color.new(color.black,100))

lower_line=hline(lower,title="Lower",color=color.new(color.black,100))

fill(upper_line,lower_line,title="Mid Channel",color=color.silver)

ovb_line=hline(ovb,title="Overbought",color=color.new(color.silver,0),linestyle=hline.style_solid,linewidth=2)

ovs_line=hline(ovs,title="Oversold",color=color.new(color.silver,0),linestyle=hline.style_solid,linewidth=2)

//++++++++++++++++++++++++++++++++++++++++++++++++

//++++++++++++ Plot Analyzing Signals ++++++++++++

//++++++++++++++++++++++++++++++++++++++++++++++++

//Color

buy_col=

BuySignal?color.new(color.blue,70):na

sell_col=

SellSignal?color.new(color.red,70):na

close_buy_col=

CloseBuy and order_status[1]=="Long"?color.new(color.yellow,70):na

close_sell_col=

CloseSell and order_status[1]=="Short"?color.new(color.yellow,70):na

//Background

bgcolor(close_buy_col, title='Close Buy', offset=0)

bgcolor(close_sell_col, title='Close Sell', offset=0)

bgcolor(sell_col, title='Sell', offset=0)

bgcolor(buy_col, title='Buy', offset=0)

//++++++++++++++++++++++++++++++++++

//++++++++++++ Backtest ++++++++++++

//++++++++++++++++++++++++++++++++++

strategy.entry("Long",strategy.long,when=BuySignal)

strategy.close("Long",when=CloseBuy)

strategy.entry("Short",strategy.short,when=SellSignal)

strategy.close("Short",when=CloseSell)

//EOF