概述

这是一个利用不同K线形态作为交易信号的策略。它可以检测9种常见的蜡烛形态,并根据这些形态产生买入和卖出信号。

策略原理

该策略的核心逻辑是识别不同的K线形态,包括十字星、锤头、启明星等。当识别到bullish的形态时,会产生买入信号;当识别到bearish的形态时,会产生卖出信号。

比如,当检测到三只上涨的白色实体K线时,就是“三只白兵”的信号,表示市场目前为bull趋势,这个时候会产生买入信号。

又比如,当一根长阴线的K线完全吞噬前一根阳线的实体时,形成了熊ISHengulfing的形态,预示着趋势反转,这个时候会产生卖出信号。

优势分析

这种基于形态识别的策略,可以抓住短期的反转点,特别适合短线交易。识别准确的形态信号,可以及时捕捉到价格的反转,进入利润方向。

相比于单纯的移动平均线等技术指标策略,K线形态策略结合了对价格行情和市场情绪的判断,交易信号更加准确可靠。

风险分析

该策略主要依赖于对K线形态的准确判断。如果判断失误,很容易形成错误的交易信号,从而导致亏损。

此外,任何技术分析策略都无法完全规避系统性风险,例如政策影响、黑天鹅事件等都可能对交易造成影响。

可以通过止损来控制风险。当价格向相反方向突破某个范围时,可以及时止损退出。

优化方向

可以扩充识别的K线形态种类,再多加入一些高效的形态信号,例如锤子线、倒锤子线、分离线等,用以确认交易信号。

可以结合其他指标进行过滤,避免在不确定的市场环境中产生交易信号。例如MACD、RSI等指标发出的讯号,可以避开低质量的K线形态信号。

可以优化止损逻辑,当价格向相反方向突破一定幅度时止损。同时结合波动率指标,来动态调整止损范围。

总结

这是一个非常实用的短线交易策略。它识别常见的K线形态来产生交易信号,可以抓住价格短期的反转机会。同时也需要注意一些潜在的风险,适当进行优化以控制风险和提高效率。

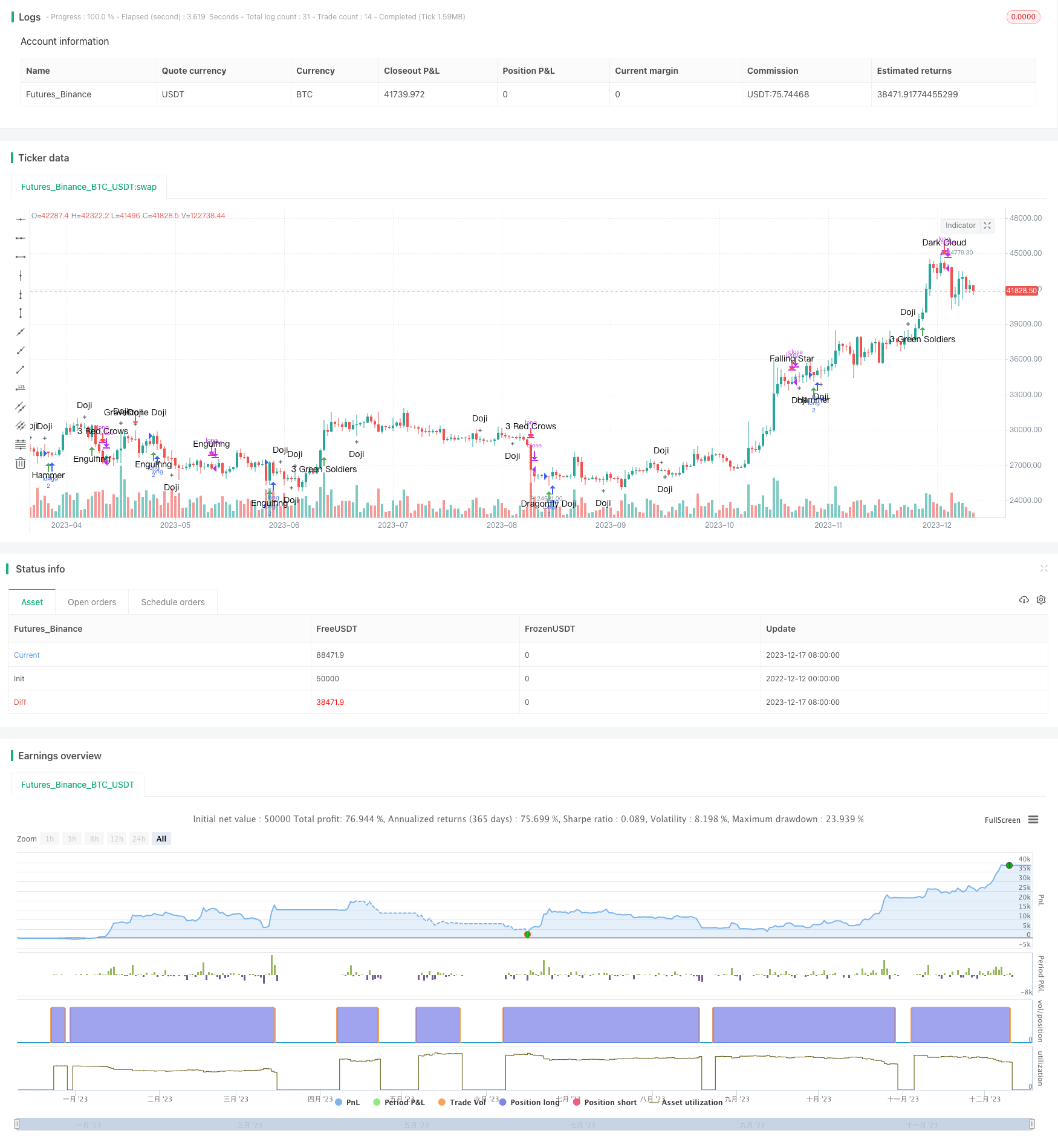

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Dan Pasco

strategy("Candlestick Signals Strategy" , shorttitle="Candlestick Signal Strategy $1000", overlay = true , initial_capital = 1000)

//Settings input menu

dojicon = input(title = "Show Doji's", type=bool, defval = true)

gravedojicon = input(title = "Gravestone Doji/Dragonfly Doji", type=bool, defval = true)

tbctwscon = input(title = "3 Red Crows/3 Green Soldiers", type=bool, defval = true)

tlscon = input(title = "Three Line Strike", type=bool, defval = true)

pcon = input(title = "Piercing/Dark Cloud", type=bool, defval = true)

mscon = input(title = "Morning Star", type=bool, defval = true)

escon = input(title = "Evening Star", type=bool, defval = true)

econ = input(title = "Engulfing", type=bool, defval = true)

hcon = input(title = "Hammer", type=bool, defval = true)

fscon = input(title = "Falling Star", type=bool, defval = true)

//Doji Up

dojiup = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (close-low)>(high-open) and (open-close)<((high-open)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (open-low)>(high-close) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojiup, style=shape.cross,location=location.belowbar, text="Doji", color=black)

//Doji Down

dojidown = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (high-open)>(close-low) and (open-close)<((close-low)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (high-close)>(open-low) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojidown, style=shape.cross,location=location.abovebar, text="Doji", color=black)

//Gravestone Doji Bull

gravedojibull = (close-open)>0 and ((high-close)/8)>(close-open) and ((high-close)/5)>(open-low) and gravedojicon == true

plotshape(gravedojibull, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Gravestone Doji Bear

gravedojibear = (open-close)>0 and ((high-open)/8)>(open-close) and ((high-open)/5)>(close-low) and gravedojicon == true

plotshape(gravedojibear, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Dragonfly Doji Bull

dragondojibull = (close-open)>0 and ((open-low)/8)>(close-open) and ((open-low)/5)>(high-close) and gravedojicon == true

plotshape(dragondojibull, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Dragonfly Doji Bear

dragondojibear = (open-close)>0 and ((close-low)/8)>(open-close) and ((close-low)/5)>(high-open) and gravedojicon == true

plotshape(dragondojibear, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Three Black Crows

tbc = (low[2]<low[3] and low[1]<low[2] and low<low[1] and high[2]<high[3] and high[1]<high[2] and high<high[1] and (close[3]-open[3])>0 and (open[2]-close[2])>0 and (open[1]-close[1])>0 and (open-close)>0 and (open-close)>(close-low) and (open-close)>(high-open) and (open[1]-close[1])>(close[1]-low[1]) and (open[1]-close[1])>(high[1]-open[1]) and (open[2]-close[2])>(close[2]-low[2]) and (open[2]-close[2])>(high[2]-open[2]) and tbctwscon == true)

plotshape(tbc, style=shape.arrowdown,location=location.abovebar, text="3 Red Crows", color=red)

//Three White Soldiers

tws = (high[2]>high[3] and high[1]>high[2] and high>high[1] and low[2]>low[3] and low[1]>low[2] and low>low[1] and (open[3]-close[3])>0 and (close[2]-open[2])>0 and (close[1]-open[1])>0 and (close-open)>0 and (close-open)>(open-low) and (close-open)>(high-close) and (close[1]-open[1])>(open[1]-low[1]) and (close[1]-open[1])>(high[1]-close[1]) and (close[2]-open[2])>(open[2]-low[2]) and (close[2]-open[2])>(high[2]-close[2]) and tbctwscon == true)

plotshape(tws, style=shape.arrowup,location=location.belowbar, text="3 Green Soldiers", color=green)

//Three Line Strike Up

tlsu = ((close-open)>0 and (open[1]-close[1])>0 and (open[2]-close[2])>0 and (open[3]-close[3])>0 and open<close[1] and low[1]<low[2] and low[2]<low[3] and high>high[3] and low<low[1] and tlscon == true)

plotshape(tlsu, style=shape.arrowup,location=location.belowbar, text="3 Line Strike", color=green)

//Three Line Strike Down

tlsd = ((open-close)>0 and (close[1]-open[1])>0 and (close[2]-open[2])>0 and (close[3]-open[3])>0 and open>close[1] and high[1]>high[2] and high[2]>high[3] and low<low[3] and high>high[1] and tlscon == true)

plotshape(tlsd, style=shape.arrowdown,location=location.abovebar, text="3 Line Strike", color=red)

//Piercing Up

pu = ((open[1]-close[1])>0 and (close-open)>0 and (open[1]-close[1])>(high[1]-open[1]) and (open[1]-close[1])>(close[1]-low[1]) and (close-open)>(high-close) and (close-open)>(open-low) and open<close[1] and ((open[1]+close[1])/2)<close and ((close-open)/2)>(high-close) and close<open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(pu, style=shape.arrowup,location=location.belowbar, text="Piercing Up", color=green)

//Dark Cloud

dc = ((close[1]-open[1])>0 and (open-close)>0 and (close[1]-open[1])>(high[1]-close[1]) and (close[1]-open[1])>(open[1]-low[1]) and (open-close)>(high-open) and (open-close)>(close-low) and open>close[1] and ((open[1]+close[1])/2)>close and ((open-close)/2)>(close-low) and close>open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(dc, style=shape.arrowdown,location=location.abovebar, text="Dark Cloud", color=red)

//Morning Star 1 Up

ms1u = ((open[2]-close[2])>0 and (close-open)>0 and (open[1]-close[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(open[1]-close[1]) and (open[2]-close[2])>(open[1]-close[1]) and open[1]<close[2] and open[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms1u, style=shape.arrowup,location=location.belowbar, text="Morning Star", color=green)

//Morning Star 2 Up

ms2u = ((open[2]-close[2])>0 and (close-open)>0 and (close[1]-open[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(close[1]-open[1]) and (open[2]-close[2])>(close[1]-open[1]) and close[1]<close[2] and close[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms2u, style=shape.arrowup,location=location.belowbar, text="Morning Star X2", color=green)

//Evening Star 1 Down

es1d = ((close[2]-open[2])>0 and (open-close)>0 and (close[1]-open[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(close[1]-open[1]) and (close[2]-open[2])>(close[1]-open[1]) and open[1]>close[2] and open[1]>open and escon == true)

plotshape(es1d, style=shape.arrowdown,location=location.abovebar, text="Evening Star", color=red)

//Evening Star 2 Down

es2d = ((close[2]-open[2])>0 and (open-close)>0 and (open[1]-close[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(open[1]-close[1]) and (close[2]-open[2])>(open[1]-close[1]) and close[1]>close[2] and close[1]>open and close[1]!=open[1] and escon == true)

plotshape(es2d, style=shape.arrowdown,location=location.abovebar, text="Evening X2", color=red)

//Bullish Engulfing

beu = (open[1]-close[1])>0 and (close-open)>0 and high>high[1] and low<low[1] and (close-open)>(open[1]-close[1]) and (close-open)>(high-close) and (close-open)>(open-low) and econ == true

plotshape(beu, style=shape.arrowup,location=location.belowbar, text="Engulfing", color=green)

//Bearish Engulfing

bed = (close[1]-open[1])>0 and (open-close)>0 and high>high[1] and low<low[1] and (open-close)>(close[1]-open[1]) and (open-close)>(high-open) and (open-close)>(close-low) and econ == true

plotshape(bed, style=shape.arrowdown,location=location.abovebar, text="Engulfing", color=red)

//Bullish Hammer Up

bhu1 = (close-open)>0 and ((close-open)/3)>(high-close) and ((open-low)/2)>(close-open) and (close-open)>((open-low)/8) and hcon == true

plotshape(bhu1, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bearish Hammer Up

bhu2 = (open-close)>0 and ((open-close)/3)>(high-open) and ((close-low)/2)>(open-close) and (open-close)>((close-low)/8) and hcon == true

plotshape(bhu2, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bullish Falling Star

bfs1 = (close-open)>0 and ((close-open)/3)>(open-low) and ((high-close)/2)>(close-open) and (close-open)>((high-close)/8) and fscon == true

plotshape(bfs1, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Bearish Falling Star

bfs2 = (open-close)>0 and ((open-close)/3)>(close-low) and ((high-open)/2)>(open-close) and (open-close)>((high-open)/8) and fscon == true

plotshape(bfs2, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Declaring the buy signals

buy = (dragondojibear == true and gravedojicon == true) or (dragondojibull == true and gravedojicon == true) or (tws == true and tbctwscon == true) or (tlsu == true and tlscon == true) or (pu == true and pcon == true) or (ms1u == true and mscon == true) or (ms2u == true and mscon == true) or (beu == true and econ == true) or (bhu1 == true and hcon == true) or (bhu2 == true and hcon == true)

//Declaring the sell signals

sell = (gravedojibear == true and gravedojicon == true) or (gravedojibull == true and gravedojicon == true) or (tbc == true and tbctwscon == true) or (tlsd == true and tlscon == true) or (dc == true and pcon == true) or (es1d == true and escon == true) or (es2d == true and escon == true) or (bed == true and econ == true) or (bfs1 == true and fscon == true) or (bfs2 == true and fscon == true)

//Execute historic backtesting

ordersize = floor(strategy.equity/close) // To dynamically calculate the order size as the account equity increases or decreases.

strategy.entry("long",strategy.long,ordersize,when=buy) // Buy

strategy.close("long", when=sell) //Sell