概述

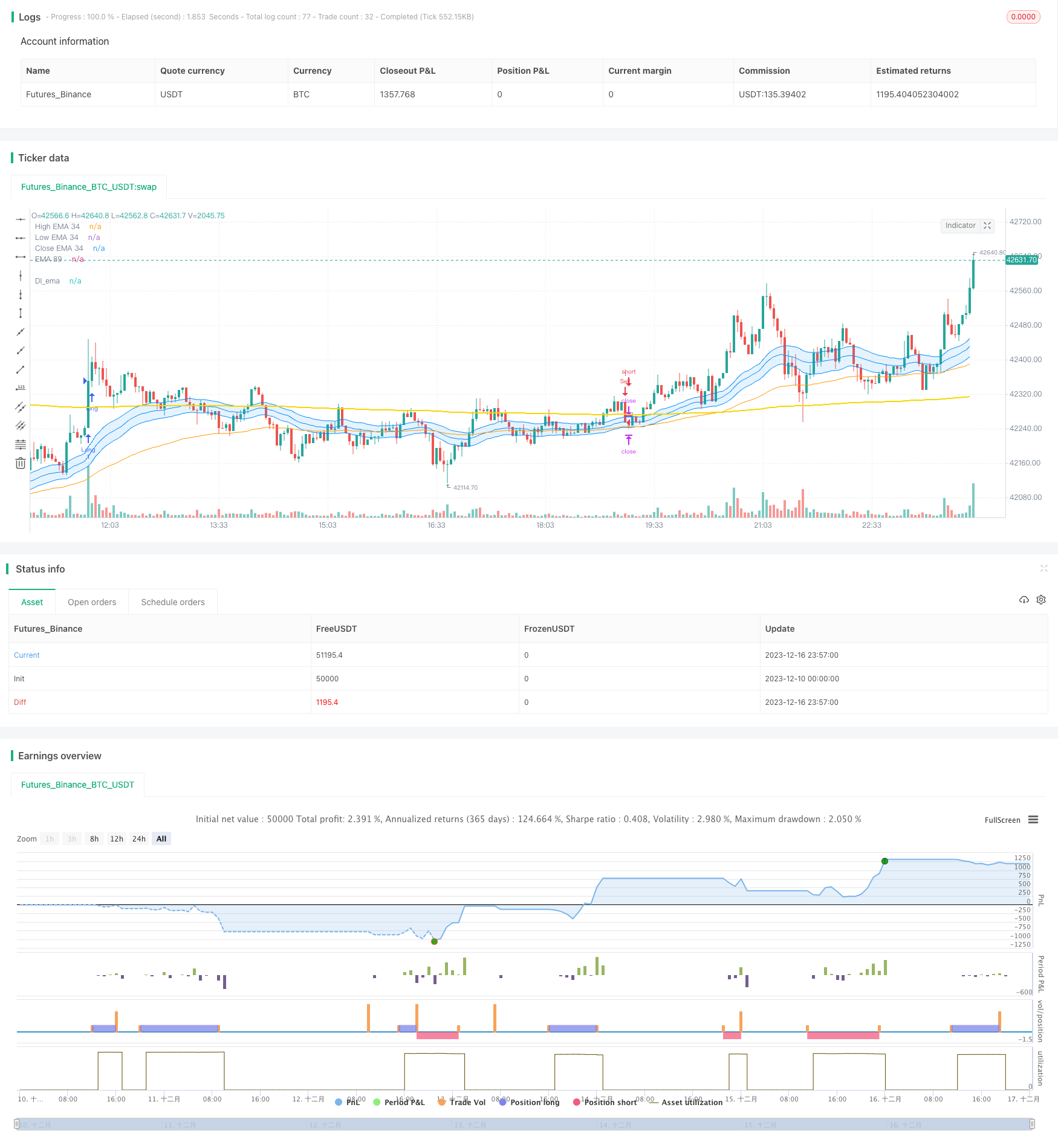

本策略是一个结合动量指标和均线指标的趋势追踪策略。它使用指数移动平均线作为主要的趋势判断工具,并结合高额成交量来发出买入和卖出信号。该策略适用于中长线持仓,追踪市场主要趋势。

策略原理

使用34周期的EMA作为主要的趋势判断工具。当价格上穿EMA时为看涨信号,下穿EMA时为看跌信号。

将成交量的21日移动平均线与最近1.5倍的平均量比较。如果当前成交量大于1.5倍平均量,则认为是高量。

3.只有在价格与EMA形成金叉且为高量时,才发出买入信号;只有在价格与EMA形成死叉且为高量时,才发出卖出信号。

4.开仓后设置止损和止盈比例,可自定义设置。

这样综合考虑了趋势、动量和风险控制等多种因素,比较全面和稳定。

优势分析

使用EMA判断市场主要趋势方向,可以有效跟踪中长线趋势。

结合高额成交量进行FILTER,可以避免被假突破误导。

设置止损止盈比例,可以有效控制单笔交易的风险。

采用中长线持仓策略,不受高频市场噪音的影响,稳定持盈。

风险与解决方案

被高频假突破误导的概率较大。解决方法是加入交易量验证。

中长线持仓增加资金占用。解决方法是适当控制仓位规模。

均线交易策略可能滞后,无法抓住短线机会。解决方法是结合其他短线信号。

大幅震荡行情中可能出现较大亏损。解决方法是设定合适的止损位置。

优化方向

测试不同EMA周期参数的优劣,找到最优参数。

测试不同止损止盈比例的参数对策略收益率和抗风险能力的影响。

尝试结合其他指标如MACD、KDJ等判断短线机会。

优化资金管理策略,如仓位控制、动态止损等方法。

总结

本策略总体来说是一个价值稳定的中长线持仓策略。它能有效跟踪市场主要趋势,并利用量能指标来过滤误导信号。同时,采取适当的止损和止盈手段控制单笔交易的风险。可谓是趋势交易的“定盘清淡”之作。如果进行适当优化,相信可以获得更加理想的策略收益率。

策略源码

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingSignalHub

//@version=5

strategy("Di strategy ", overlay=true)

//date setting

fromDay = input(defval = 1, title = "Ngày bắt đầu", group = "Cài đặt thời gian")

fromMonth = input(defval = 1, title = "Tháng bắt đầu", group = "Cài đặt thời gian")

fromYear = input(defval = 2023, title = "Năm bắt đầu", group = "Cài đặt thời gian")

toDay = input(defval = 31, title = "Đến ngày", group = "Cài đặt thời gian")

toMonth = input(defval = 12, title = "Đến tháng", group = "Cài đặt thời gian")

toYear = input(defval = 2033, title = "Đến năm", group = "Cài đặt thời gian")

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond() =>

time >= startDate and time <= finishDate ? true : false

//snr setting

price = close

ema34 = input.int(34, minval=2, title="EMA 34", group = "Cài đặt EMA")

pacC = ta.ema(close,ema34)

pacL = ta.ema(low,ema34)

pacH = ta.ema(high,ema34)

L =plot(pacL, color=color.rgb(3, 139, 251), linewidth=1, title="High EMA 34")

H =plot(pacH, color=color.rgb(3, 137, 247), linewidth=1, title="Low EMA 34")

C =plot(pacC, color=color.rgb(4, 138, 248), linewidth=1, title="Close EMA 34")

fill(L,H, color=color.rgb(33, 149, 243, 85),title="Fill dãi EMA 34")

//EMA full setting

ema89 =ta.ema(close,89)

DIema= ta.ema(close,458)

plot(DIema,title="DI_ema",color=color.rgb(247, 214, 3),linewidth=2)

plot(ema89,title="EMA 89",color=color.orange,linewidth=1)

//ema200= ta.ema(close,200)

//ema610= ta.ema(close,610)

//ema144= ta.ema(close,144)

//ema258= ta.ema(close,258)

//plot(ema200,title="EMA 200",color=color.purple,linewidth=2)

//plot(ema610,title="EMA 610",color=color.white,linewidth=2)

//plot(ema144,title="144Banker",color=color.green,linewidth=1)

//plot(ema258,title="258Banker",color=color.yellow,linewidth=1)

EMAbuy = ta.crossover(price, DIema)

EMAsell = ta.crossunder(price, DIema)

//volume setting

vol = (volume)

length = input(21, "Đường Trung Bình Vol", group = "Cài đặt Volume" )

div = input(1.5, "Mức trung bình", group = "Cài đặt Volume" )

up = close > open

down = open>close

Volhigh = volume> (ta.ema(volume, length)*div)

//Cài đặt lệnh

longCondition = EMAbuy and Volhigh

if time_cond()

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = EMAsell and Volhigh

if time_cond()

if (shortCondition)

strategy.entry("Sell", strategy.short)

stopPer = input.float(1.0, title="Stop Loss %", group = "Cài đặt TP & SL %" ) / 100

takePer = input.float(2.0, title="Take Profit %", group = "Cài đặt TP & SL %" ) / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

if strategy.position_size > 0

strategy.exit(id="Đóng Long", stop=longStop, limit=longTake)

if strategy.position_size < 0

strategy.exit(id="Đóng Sell", stop=shortStop, limit=shortTake)

alertcondition(longCondition, title = "Tín hiệu BUY", message = "Tín hiệu BUY")

alertcondition(shortCondition, title = "Tín hiệu SELL", message = "Tín hiệu SELL")

//PLOT FIXED SLTP LINE

//plotshape(strategy.position_size > 0 ? longStop : na, shape.labelup, color=color.rgb(34, 249, 6, 50), linewidth=1, title="Long SL")

//plot(strategy.position_size < 0 ? shortStop : na, style=plot.style_circles, color=color.rgb(250, 8, 8, 50), linewidth=1, title="Short SL")

//plot(strategy.position_size > 0 ? longTake : na, style=plot.style_linebr, color=color.rgb(59, 248, 7), linewidth=1, title="Long TP")

//plot(strategy.position_size < 0 ? shortTake : na, style=plot.style_linebr, color=color.rgb(247, 7, 7), linewidth=1, title="Short TP")