Estrategia de trading con patrón K-line

Descripción general

Se trata de una estrategia que utiliza diferentes formas de la línea K como señales de negociación. Se puede detectar 9 formas de la línea K comunes y generar señales de compra y venta en función de estas formas.

Principio de estrategia

La lógica central de esta estrategia es identificar diferentes formas de la línea K, incluyendo las estrellas cruzadas, cubo, estrella de sol, etc. Cuando se identifica una forma de aumento, se genera una señal de compra; cuando se identifica una forma de descenso, se genera una señal de venta.

Por ejemplo, cuando se detecta la línea K de tres entidades blancas que suben, es una señal de que hay tres cuerpos blancos que suben, lo que indica que el mercado está en una tendencia alcista, en este momento se generará una señal de compra.

Por ejemplo, cuando una línea K de un hilo negro se traga por completo a la entidad de un hilo amarillo anterior, se forma el ISHengulfing de los osos, lo que indica un cambio de tendencia y genera una señal de venta.

Análisis de las ventajas

Esta estrategia basada en la identificación de la forma, que puede capturar los puntos de inflexión a corto plazo, es especialmente adecuada para el comercio de líneas cortas. La identificación de la señal de forma precisa puede capturar la reversión de los precios en el momento oportuno y entrar en la dirección de las ganancias.

En comparación con las estrategias de indicadores técnicos como las simples medias móviles, la estrategia de la forma de la línea K combina el juicio de los movimientos de precios y la emoción del mercado, y las señales de negociación son más precisas y confiables.

Análisis de riesgos

La estrategia depende principalmente de un juicio preciso de la forma de la línea K. Si el juicio es erróneo, es fácil que se formen señales de negociación erróneas, lo que lleva a pérdidas.

Además, ninguna estrategia de análisis técnico puede evitar por completo los riesgos sistemáticos, como los efectos de las políticas, los eventos de cisne negro y otros que pueden afectar a las operaciones.

Se puede controlar el riesgo con un stop loss. Cuando el precio rompe un rango en la dirección opuesta, se puede detener el riesgo y salir a tiempo.

Dirección de optimización

Se puede ampliar la variedad de formas de K-lineas identificadas con la adición de algunas señales de formas más eficientes, como líneas de cubo, líneas de cubo inversa, líneas de separación, etc., para confirmar la señal de transacción.

Se puede filtrar en combinación con otros indicadores para evitar la generación de señales de negociación en un entorno de mercado incierto. Se puede evitar la señal de baja calidad de la forma de la línea K, como la señal emitida por indicadores como MACD, RSI, etc.

Se puede optimizar la lógica de parada de pérdidas, cuando el precio se rompe en la dirección opuesta a una cierta amplitud. Al mismo tiempo, en combinación con los indicadores de fluctuación, para ajustar dinámicamente el rango de parada.

Resumir

Esta es una estrategia de negociación de línea corta muy práctica. Identifica las formas comunes de la línea K para generar señales de negociación que pueden aprovechar las oportunidades de reversión de precios a corto plazo. Al mismo tiempo, se debe tener en cuenta algunos riesgos potenciales y optimizar adecuadamente para controlar los riesgos y mejorar la eficiencia.

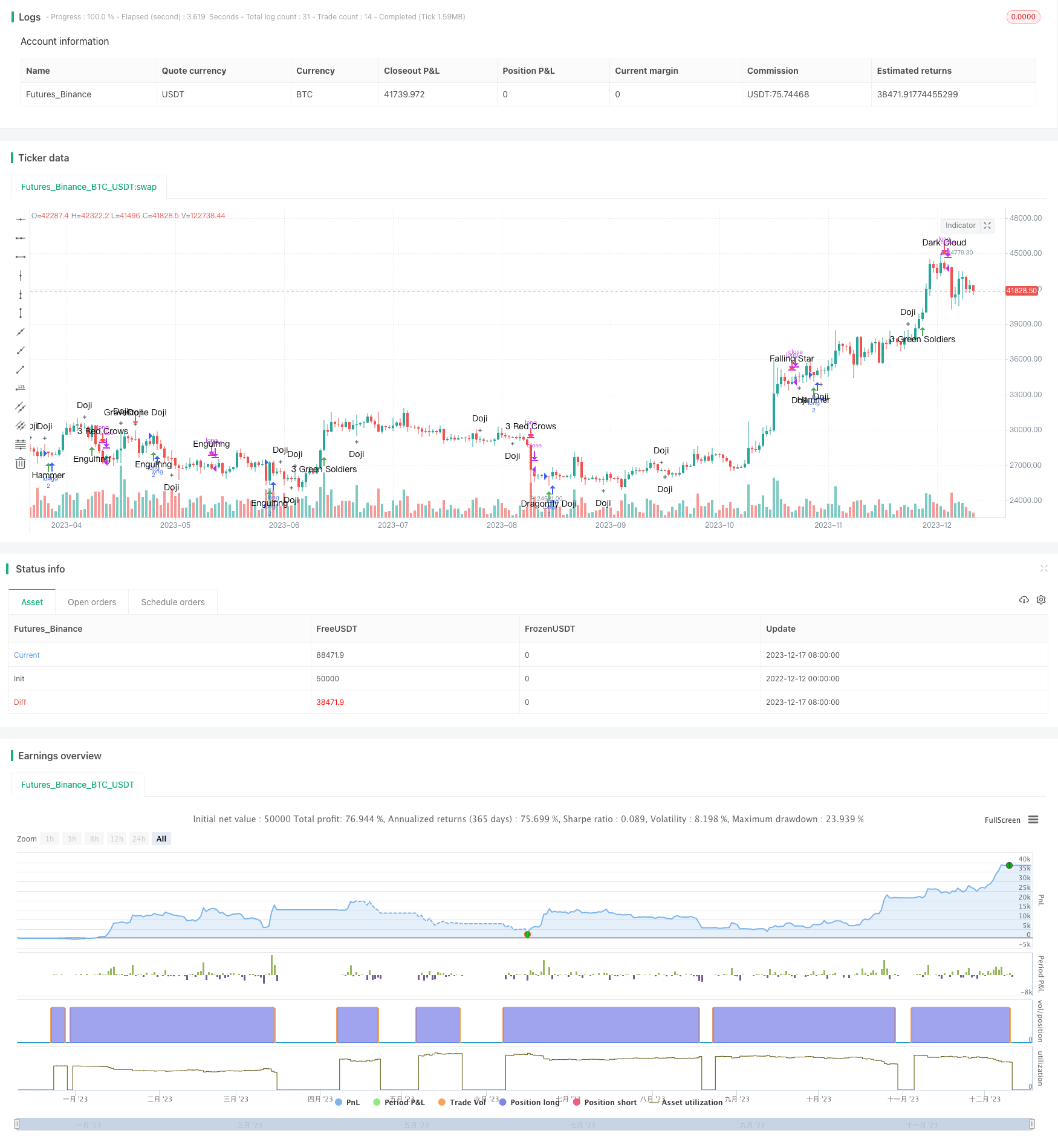

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Dan Pasco

strategy("Candlestick Signals Strategy" , shorttitle="Candlestick Signal Strategy $1000", overlay = true , initial_capital = 1000)

//Settings input menu

dojicon = input(title = "Show Doji's", type=bool, defval = true)

gravedojicon = input(title = "Gravestone Doji/Dragonfly Doji", type=bool, defval = true)

tbctwscon = input(title = "3 Red Crows/3 Green Soldiers", type=bool, defval = true)

tlscon = input(title = "Three Line Strike", type=bool, defval = true)

pcon = input(title = "Piercing/Dark Cloud", type=bool, defval = true)

mscon = input(title = "Morning Star", type=bool, defval = true)

escon = input(title = "Evening Star", type=bool, defval = true)

econ = input(title = "Engulfing", type=bool, defval = true)

hcon = input(title = "Hammer", type=bool, defval = true)

fscon = input(title = "Falling Star", type=bool, defval = true)

//Doji Up

dojiup = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (close-low)>(high-open) and (open-close)<((high-open)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (open-low)>(high-close) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojiup, style=shape.cross,location=location.belowbar, text="Doji", color=black)

//Doji Down

dojidown = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (high-open)>(close-low) and (open-close)<((close-low)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (high-close)>(open-low) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojidown, style=shape.cross,location=location.abovebar, text="Doji", color=black)

//Gravestone Doji Bull

gravedojibull = (close-open)>0 and ((high-close)/8)>(close-open) and ((high-close)/5)>(open-low) and gravedojicon == true

plotshape(gravedojibull, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Gravestone Doji Bear

gravedojibear = (open-close)>0 and ((high-open)/8)>(open-close) and ((high-open)/5)>(close-low) and gravedojicon == true

plotshape(gravedojibear, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Dragonfly Doji Bull

dragondojibull = (close-open)>0 and ((open-low)/8)>(close-open) and ((open-low)/5)>(high-close) and gravedojicon == true

plotshape(dragondojibull, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Dragonfly Doji Bear

dragondojibear = (open-close)>0 and ((close-low)/8)>(open-close) and ((close-low)/5)>(high-open) and gravedojicon == true

plotshape(dragondojibear, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Three Black Crows

tbc = (low[2]<low[3] and low[1]<low[2] and low<low[1] and high[2]<high[3] and high[1]<high[2] and high<high[1] and (close[3]-open[3])>0 and (open[2]-close[2])>0 and (open[1]-close[1])>0 and (open-close)>0 and (open-close)>(close-low) and (open-close)>(high-open) and (open[1]-close[1])>(close[1]-low[1]) and (open[1]-close[1])>(high[1]-open[1]) and (open[2]-close[2])>(close[2]-low[2]) and (open[2]-close[2])>(high[2]-open[2]) and tbctwscon == true)

plotshape(tbc, style=shape.arrowdown,location=location.abovebar, text="3 Red Crows", color=red)

//Three White Soldiers

tws = (high[2]>high[3] and high[1]>high[2] and high>high[1] and low[2]>low[3] and low[1]>low[2] and low>low[1] and (open[3]-close[3])>0 and (close[2]-open[2])>0 and (close[1]-open[1])>0 and (close-open)>0 and (close-open)>(open-low) and (close-open)>(high-close) and (close[1]-open[1])>(open[1]-low[1]) and (close[1]-open[1])>(high[1]-close[1]) and (close[2]-open[2])>(open[2]-low[2]) and (close[2]-open[2])>(high[2]-close[2]) and tbctwscon == true)

plotshape(tws, style=shape.arrowup,location=location.belowbar, text="3 Green Soldiers", color=green)

//Three Line Strike Up

tlsu = ((close-open)>0 and (open[1]-close[1])>0 and (open[2]-close[2])>0 and (open[3]-close[3])>0 and open<close[1] and low[1]<low[2] and low[2]<low[3] and high>high[3] and low<low[1] and tlscon == true)

plotshape(tlsu, style=shape.arrowup,location=location.belowbar, text="3 Line Strike", color=green)

//Three Line Strike Down

tlsd = ((open-close)>0 and (close[1]-open[1])>0 and (close[2]-open[2])>0 and (close[3]-open[3])>0 and open>close[1] and high[1]>high[2] and high[2]>high[3] and low<low[3] and high>high[1] and tlscon == true)

plotshape(tlsd, style=shape.arrowdown,location=location.abovebar, text="3 Line Strike", color=red)

//Piercing Up

pu = ((open[1]-close[1])>0 and (close-open)>0 and (open[1]-close[1])>(high[1]-open[1]) and (open[1]-close[1])>(close[1]-low[1]) and (close-open)>(high-close) and (close-open)>(open-low) and open<close[1] and ((open[1]+close[1])/2)<close and ((close-open)/2)>(high-close) and close<open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(pu, style=shape.arrowup,location=location.belowbar, text="Piercing Up", color=green)

//Dark Cloud

dc = ((close[1]-open[1])>0 and (open-close)>0 and (close[1]-open[1])>(high[1]-close[1]) and (close[1]-open[1])>(open[1]-low[1]) and (open-close)>(high-open) and (open-close)>(close-low) and open>close[1] and ((open[1]+close[1])/2)>close and ((open-close)/2)>(close-low) and close>open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(dc, style=shape.arrowdown,location=location.abovebar, text="Dark Cloud", color=red)

//Morning Star 1 Up

ms1u = ((open[2]-close[2])>0 and (close-open)>0 and (open[1]-close[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(open[1]-close[1]) and (open[2]-close[2])>(open[1]-close[1]) and open[1]<close[2] and open[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms1u, style=shape.arrowup,location=location.belowbar, text="Morning Star", color=green)

//Morning Star 2 Up

ms2u = ((open[2]-close[2])>0 and (close-open)>0 and (close[1]-open[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(close[1]-open[1]) and (open[2]-close[2])>(close[1]-open[1]) and close[1]<close[2] and close[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms2u, style=shape.arrowup,location=location.belowbar, text="Morning Star X2", color=green)

//Evening Star 1 Down

es1d = ((close[2]-open[2])>0 and (open-close)>0 and (close[1]-open[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(close[1]-open[1]) and (close[2]-open[2])>(close[1]-open[1]) and open[1]>close[2] and open[1]>open and escon == true)

plotshape(es1d, style=shape.arrowdown,location=location.abovebar, text="Evening Star", color=red)

//Evening Star 2 Down

es2d = ((close[2]-open[2])>0 and (open-close)>0 and (open[1]-close[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(open[1]-close[1]) and (close[2]-open[2])>(open[1]-close[1]) and close[1]>close[2] and close[1]>open and close[1]!=open[1] and escon == true)

plotshape(es2d, style=shape.arrowdown,location=location.abovebar, text="Evening X2", color=red)

//Bullish Engulfing

beu = (open[1]-close[1])>0 and (close-open)>0 and high>high[1] and low<low[1] and (close-open)>(open[1]-close[1]) and (close-open)>(high-close) and (close-open)>(open-low) and econ == true

plotshape(beu, style=shape.arrowup,location=location.belowbar, text="Engulfing", color=green)

//Bearish Engulfing

bed = (close[1]-open[1])>0 and (open-close)>0 and high>high[1] and low<low[1] and (open-close)>(close[1]-open[1]) and (open-close)>(high-open) and (open-close)>(close-low) and econ == true

plotshape(bed, style=shape.arrowdown,location=location.abovebar, text="Engulfing", color=red)

//Bullish Hammer Up

bhu1 = (close-open)>0 and ((close-open)/3)>(high-close) and ((open-low)/2)>(close-open) and (close-open)>((open-low)/8) and hcon == true

plotshape(bhu1, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bearish Hammer Up

bhu2 = (open-close)>0 and ((open-close)/3)>(high-open) and ((close-low)/2)>(open-close) and (open-close)>((close-low)/8) and hcon == true

plotshape(bhu2, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bullish Falling Star

bfs1 = (close-open)>0 and ((close-open)/3)>(open-low) and ((high-close)/2)>(close-open) and (close-open)>((high-close)/8) and fscon == true

plotshape(bfs1, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Bearish Falling Star

bfs2 = (open-close)>0 and ((open-close)/3)>(close-low) and ((high-open)/2)>(open-close) and (open-close)>((high-open)/8) and fscon == true

plotshape(bfs2, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Declaring the buy signals

buy = (dragondojibear == true and gravedojicon == true) or (dragondojibull == true and gravedojicon == true) or (tws == true and tbctwscon == true) or (tlsu == true and tlscon == true) or (pu == true and pcon == true) or (ms1u == true and mscon == true) or (ms2u == true and mscon == true) or (beu == true and econ == true) or (bhu1 == true and hcon == true) or (bhu2 == true and hcon == true)

//Declaring the sell signals

sell = (gravedojibear == true and gravedojicon == true) or (gravedojibull == true and gravedojicon == true) or (tbc == true and tbctwscon == true) or (tlsd == true and tlscon == true) or (dc == true and pcon == true) or (es1d == true and escon == true) or (es2d == true and escon == true) or (bed == true and econ == true) or (bfs1 == true and fscon == true) or (bfs2 == true and fscon == true)

//Execute historic backtesting

ordersize = floor(strategy.equity/close) // To dynamically calculate the order size as the account equity increases or decreases.

strategy.entry("long",strategy.long,ordersize,when=buy) // Buy

strategy.close("long", when=sell) //Sell