Stratégie de trading de modèle K-line

Aperçu

Il s’agit d’une stratégie qui utilise différentes formes de ligne K comme signaux de négociation. Il peut détecter 9 formes de courbes courantes et générer des signaux d’achat et de vente en fonction de ces formes.

Principe de stratégie

La logique centrale de la stratégie est d’identifier les différentes formes de la ligne K, y compris les croix, les têtes et les étoiles lumineuses. Lorsqu’une forme est identifiée comme étant haussière, elle génère un signal d’achat; lorsqu’une forme est identifiée comme étant baissière, elle génère un signal de vente.

Par exemple, lorsque l’on détecte trois lignes K de l’entité blanche en hausse, c’est le signal de la chute de trois troupes blanches, indiquant que le marché est actuellement en hausse, ce qui génère un signal d’achat.

Par exemple, lorsque le K d’une longue ligne négative engloutit complètement l’entité de la ligne négative précédente, la forme d’ISHengulfing de l’ours est créée, ce qui annonce un renversement de tendance et génère un signal de vente.

Analyse des avantages

Cette stratégie basée sur l’identification de la forme permet de saisir des points de retournement à court terme, particulièrement adaptés aux transactions en ligne courte. L’identification de signaux de forme précis permet de saisir en temps opportun le retournement des prix et d’entrer dans la direction des bénéfices.

Les stratégies d’indicateurs techniques comme les simples moyennes mobiles, combinant des jugements sur les mouvements de prix et l’humeur du marché, sont plus précises et plus fiables que les stratégies d’indicateurs techniques.

Analyse des risques

La stratégie repose principalement sur un jugement précis de la forme de la ligne K. Si le jugement est erroné, il est facile de former de faux signaux de négociation, ce qui entraîne des pertes.

De plus, aucune stratégie d’analyse technique ne peut éviter complètement les risques systémiques, tels que les effets politiques, les événements de Black Swan, etc., qui peuvent avoir un impact sur les transactions.

Il est possible de contrôler le risque en faisant un stop loss. Lorsque le prix franchit une certaine limite, il est possible de faire un stop loss en temps opportun.

Direction d’optimisation

Les types de formes de K-lignes identifiées peuvent être étendus avec des signaux de formes plus efficaces, tels que les lignes de souris, les lignes de souris inversées, les lignes de séparation, etc., pour confirmer les signaux de transaction.

Il est possible de filtrer en combinaison avec d’autres indicateurs pour éviter de générer des signaux de négociation dans un environnement de marché incertain. Les signaux émis par des indicateurs tels que le MACD, le RSI, etc., peuvent éviter les signaux de forme de ligne K de faible qualité.

Il est possible d’optimiser la logique d’arrêt de la perte lorsque le prix dépasse une certaine amplitude dans la direction opposée. En combinaison avec l’indicateur de volatilité, il est possible d’ajuster dynamiquement la portée de la perte.

Résumer

Il s’agit d’une stratégie de négociation de courte ligne très pratique. Elle identifie les formes courantes de la ligne K pour générer des signaux de négociation qui permettent de saisir les opportunités de retournement de prix à court terme.

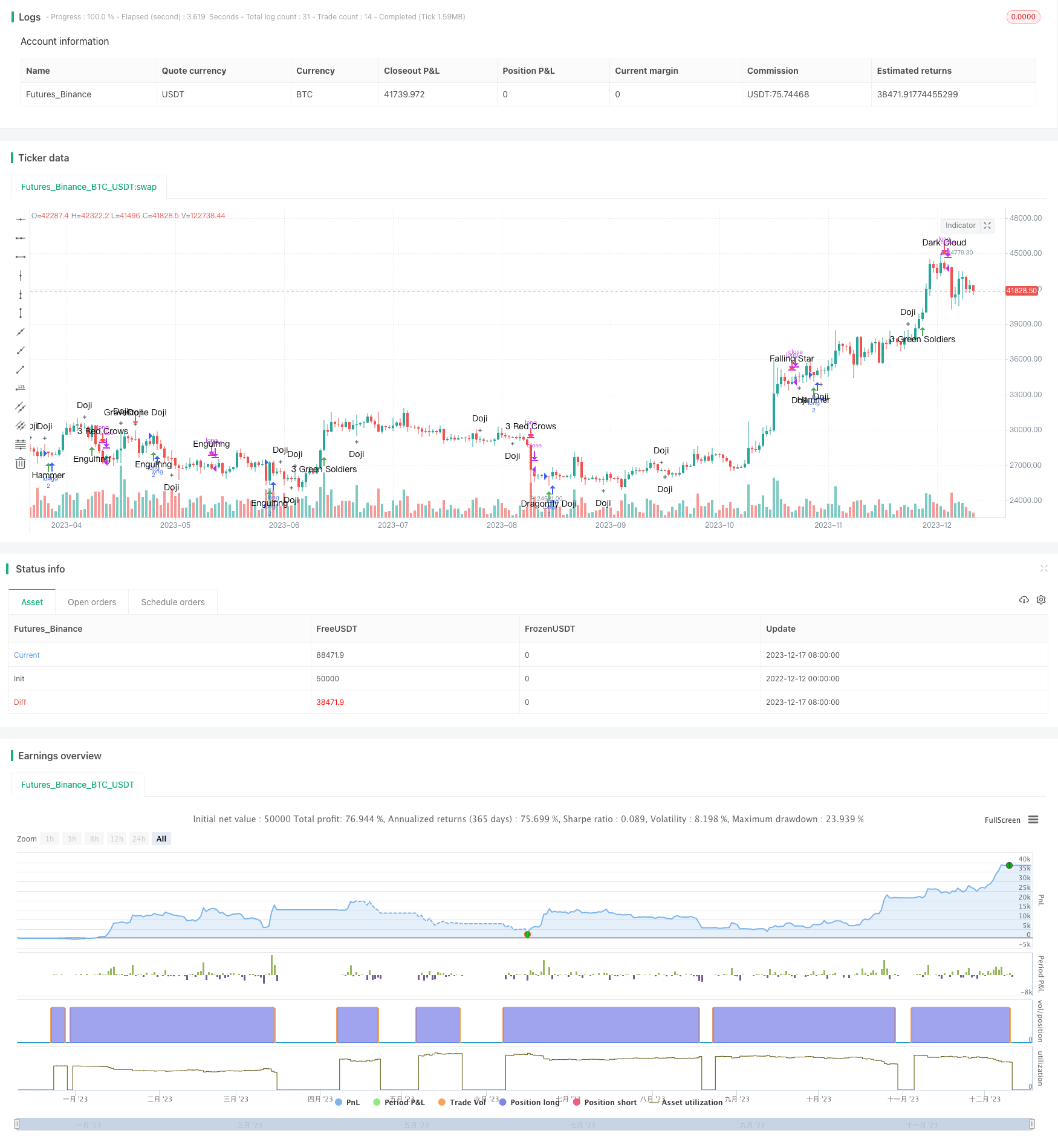

/*backtest

start: 2022-12-12 00:00:00

end: 2023-12-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Dan Pasco

strategy("Candlestick Signals Strategy" , shorttitle="Candlestick Signal Strategy $1000", overlay = true , initial_capital = 1000)

//Settings input menu

dojicon = input(title = "Show Doji's", type=bool, defval = true)

gravedojicon = input(title = "Gravestone Doji/Dragonfly Doji", type=bool, defval = true)

tbctwscon = input(title = "3 Red Crows/3 Green Soldiers", type=bool, defval = true)

tlscon = input(title = "Three Line Strike", type=bool, defval = true)

pcon = input(title = "Piercing/Dark Cloud", type=bool, defval = true)

mscon = input(title = "Morning Star", type=bool, defval = true)

escon = input(title = "Evening Star", type=bool, defval = true)

econ = input(title = "Engulfing", type=bool, defval = true)

hcon = input(title = "Hammer", type=bool, defval = true)

fscon = input(title = "Falling Star", type=bool, defval = true)

//Doji Up

dojiup = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (close-low)>(high-open) and (open-close)<((high-open)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (open-low)>(high-close) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojiup, style=shape.cross,location=location.belowbar, text="Doji", color=black)

//Doji Down

dojidown = (open-close)>0 ? (high-open)>(open-close) and (close-low)>(open-close) and (high-open)>(close-low) and (open-close)<((close-low)/8) : (open-low)>(close-open) and (high-close)>(close-open) and (high-close)>(open-low) and (close-open)<((high-close)/8) and dojicon == true

plotshape(dojidown, style=shape.cross,location=location.abovebar, text="Doji", color=black)

//Gravestone Doji Bull

gravedojibull = (close-open)>0 and ((high-close)/8)>(close-open) and ((high-close)/5)>(open-low) and gravedojicon == true

plotshape(gravedojibull, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Gravestone Doji Bear

gravedojibear = (open-close)>0 and ((high-open)/8)>(open-close) and ((high-open)/5)>(close-low) and gravedojicon == true

plotshape(gravedojibear, style=shape.arrowdown,location=location.abovebar, text="Gravestone Doji", color=red)

//Dragonfly Doji Bull

dragondojibull = (close-open)>0 and ((open-low)/8)>(close-open) and ((open-low)/5)>(high-close) and gravedojicon == true

plotshape(dragondojibull, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Dragonfly Doji Bear

dragondojibear = (open-close)>0 and ((close-low)/8)>(open-close) and ((close-low)/5)>(high-open) and gravedojicon == true

plotshape(dragondojibear, style=shape.arrowup,location=location.belowbar, text="Dragonfly Doji", color=green)

//Three Black Crows

tbc = (low[2]<low[3] and low[1]<low[2] and low<low[1] and high[2]<high[3] and high[1]<high[2] and high<high[1] and (close[3]-open[3])>0 and (open[2]-close[2])>0 and (open[1]-close[1])>0 and (open-close)>0 and (open-close)>(close-low) and (open-close)>(high-open) and (open[1]-close[1])>(close[1]-low[1]) and (open[1]-close[1])>(high[1]-open[1]) and (open[2]-close[2])>(close[2]-low[2]) and (open[2]-close[2])>(high[2]-open[2]) and tbctwscon == true)

plotshape(tbc, style=shape.arrowdown,location=location.abovebar, text="3 Red Crows", color=red)

//Three White Soldiers

tws = (high[2]>high[3] and high[1]>high[2] and high>high[1] and low[2]>low[3] and low[1]>low[2] and low>low[1] and (open[3]-close[3])>0 and (close[2]-open[2])>0 and (close[1]-open[1])>0 and (close-open)>0 and (close-open)>(open-low) and (close-open)>(high-close) and (close[1]-open[1])>(open[1]-low[1]) and (close[1]-open[1])>(high[1]-close[1]) and (close[2]-open[2])>(open[2]-low[2]) and (close[2]-open[2])>(high[2]-close[2]) and tbctwscon == true)

plotshape(tws, style=shape.arrowup,location=location.belowbar, text="3 Green Soldiers", color=green)

//Three Line Strike Up

tlsu = ((close-open)>0 and (open[1]-close[1])>0 and (open[2]-close[2])>0 and (open[3]-close[3])>0 and open<close[1] and low[1]<low[2] and low[2]<low[3] and high>high[3] and low<low[1] and tlscon == true)

plotshape(tlsu, style=shape.arrowup,location=location.belowbar, text="3 Line Strike", color=green)

//Three Line Strike Down

tlsd = ((open-close)>0 and (close[1]-open[1])>0 and (close[2]-open[2])>0 and (close[3]-open[3])>0 and open>close[1] and high[1]>high[2] and high[2]>high[3] and low<low[3] and high>high[1] and tlscon == true)

plotshape(tlsd, style=shape.arrowdown,location=location.abovebar, text="3 Line Strike", color=red)

//Piercing Up

pu = ((open[1]-close[1])>0 and (close-open)>0 and (open[1]-close[1])>(high[1]-open[1]) and (open[1]-close[1])>(close[1]-low[1]) and (close-open)>(high-close) and (close-open)>(open-low) and open<close[1] and ((open[1]+close[1])/2)<close and ((close-open)/2)>(high-close) and close<open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(pu, style=shape.arrowup,location=location.belowbar, text="Piercing Up", color=green)

//Dark Cloud

dc = ((close[1]-open[1])>0 and (open-close)>0 and (close[1]-open[1])>(high[1]-close[1]) and (close[1]-open[1])>(open[1]-low[1]) and (open-close)>(high-open) and (open-close)>(close-low) and open>close[1] and ((open[1]+close[1])/2)>close and ((open-close)/2)>(close-low) and close>open[1] and (high<high[1] or low>low[1]) and pcon == true)

plotshape(dc, style=shape.arrowdown,location=location.abovebar, text="Dark Cloud", color=red)

//Morning Star 1 Up

ms1u = ((open[2]-close[2])>0 and (close-open)>0 and (open[1]-close[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(open[1]-close[1]) and (open[2]-close[2])>(open[1]-close[1]) and open[1]<close[2] and open[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms1u, style=shape.arrowup,location=location.belowbar, text="Morning Star", color=green)

//Morning Star 2 Up

ms2u = ((open[2]-close[2])>0 and (close-open)>0 and (close[1]-open[1])>=0 and (open[2]-close[2])>(high[2]-open[2]) and (open[2]-close[2])>(close[2]-low[2]) and (close-open)>(high-close) and (close-open)>(open-low) and (close-open)>(close[1]-open[1]) and (open[2]-close[2])>(close[1]-open[1]) and close[1]<close[2] and close[1]<open and open[1]!=close[1] and mscon == true)

plotshape(ms2u, style=shape.arrowup,location=location.belowbar, text="Morning Star X2", color=green)

//Evening Star 1 Down

es1d = ((close[2]-open[2])>0 and (open-close)>0 and (close[1]-open[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(close[1]-open[1]) and (close[2]-open[2])>(close[1]-open[1]) and open[1]>close[2] and open[1]>open and escon == true)

plotshape(es1d, style=shape.arrowdown,location=location.abovebar, text="Evening Star", color=red)

//Evening Star 2 Down

es2d = ((close[2]-open[2])>0 and (open-close)>0 and (open[1]-close[1])>=0 and (close[2]-open[2])>(high[2]-close[2]) and (close[2]-open[2])>(open[2]-low[2]) and (open-close)>(high-open) and (open-close)>(close-low) and (open-close)>(open[1]-close[1]) and (close[2]-open[2])>(open[1]-close[1]) and close[1]>close[2] and close[1]>open and close[1]!=open[1] and escon == true)

plotshape(es2d, style=shape.arrowdown,location=location.abovebar, text="Evening X2", color=red)

//Bullish Engulfing

beu = (open[1]-close[1])>0 and (close-open)>0 and high>high[1] and low<low[1] and (close-open)>(open[1]-close[1]) and (close-open)>(high-close) and (close-open)>(open-low) and econ == true

plotshape(beu, style=shape.arrowup,location=location.belowbar, text="Engulfing", color=green)

//Bearish Engulfing

bed = (close[1]-open[1])>0 and (open-close)>0 and high>high[1] and low<low[1] and (open-close)>(close[1]-open[1]) and (open-close)>(high-open) and (open-close)>(close-low) and econ == true

plotshape(bed, style=shape.arrowdown,location=location.abovebar, text="Engulfing", color=red)

//Bullish Hammer Up

bhu1 = (close-open)>0 and ((close-open)/3)>(high-close) and ((open-low)/2)>(close-open) and (close-open)>((open-low)/8) and hcon == true

plotshape(bhu1, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bearish Hammer Up

bhu2 = (open-close)>0 and ((open-close)/3)>(high-open) and ((close-low)/2)>(open-close) and (open-close)>((close-low)/8) and hcon == true

plotshape(bhu2, style=shape.arrowup,location=location.belowbar, text="Hammer", color=green)

//Bullish Falling Star

bfs1 = (close-open)>0 and ((close-open)/3)>(open-low) and ((high-close)/2)>(close-open) and (close-open)>((high-close)/8) and fscon == true

plotshape(bfs1, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Bearish Falling Star

bfs2 = (open-close)>0 and ((open-close)/3)>(close-low) and ((high-open)/2)>(open-close) and (open-close)>((high-open)/8) and fscon == true

plotshape(bfs2, style=shape.arrowdown,location=location.abovebar, text="Falling Star", color=red)

//Declaring the buy signals

buy = (dragondojibear == true and gravedojicon == true) or (dragondojibull == true and gravedojicon == true) or (tws == true and tbctwscon == true) or (tlsu == true and tlscon == true) or (pu == true and pcon == true) or (ms1u == true and mscon == true) or (ms2u == true and mscon == true) or (beu == true and econ == true) or (bhu1 == true and hcon == true) or (bhu2 == true and hcon == true)

//Declaring the sell signals

sell = (gravedojibear == true and gravedojicon == true) or (gravedojibull == true and gravedojicon == true) or (tbc == true and tbctwscon == true) or (tlsd == true and tlscon == true) or (dc == true and pcon == true) or (es1d == true and escon == true) or (es2d == true and escon == true) or (bed == true and econ == true) or (bfs1 == true and fscon == true) or (bfs2 == true and fscon == true)

//Execute historic backtesting

ordersize = floor(strategy.equity/close) // To dynamically calculate the order size as the account equity increases or decreases.

strategy.entry("long",strategy.long,ordersize,when=buy) // Buy

strategy.close("long", when=sell) //Sell