Stratégie de trading multi-indicateurs à moyenne mobile croisée

Aperçu

Cette stratégie combine plusieurs indicateurs techniques, y compris le SAR parabolique, la moyenne mobile à triple indice (TEMA), la moyenne mobile à indice ordinaire (EMA), l’indicateur de force relative (RSI), l’indicateur d’équilibre (OBV), etc., pour identifier les signaux de retournement des prix des actions et, combinés à des filtres de tendance et à des paramètres de stop-loss, pour générer des signaux d’achat et de vente.

Principe de stratégie

La stratégie utilise le SAR parabolique comme principal indicateur de signal de revers des prix. Le SAR présente un état de plusieurs têtes au-dessus du prix et un état vide en dessous du prix.

Afin de filtrer les faux signaux, la stratégie utilise les indicateurs techniques TEMA ou EMA comme signaux de confirmation. Un signal d’achat est généré uniquement si le signal SAR et TEMA (traversé lentement sur la ligne rapide) ou EMA (traversé lentement sur la ligne rapide) se produisent simultanément. Un signal de vente est généré uniquement si le signal SAR et TEMA (traversé lentement sur la ligne rapide) ou EMA (traversé lentement sur la ligne rapide) se produisent simultanément.

La stratégie fournit également un indicateur RSI et un indicateur OBV comme signaux de confirmation de choix.

En outre, la stratégie fournit un affichage graphique de trois indicateurs techniques EMA, permettant une meilleure observation de la tendance des prix; fournit un affichage de l’indicateur de mode eMAMA, qui aide à déterminer les points de basculement de la tendance.

La stratégie fournit également un tableau d’indicateurs sous le graphique, permettant de voir rapidement les mises à jour de plusieurs indicateurs.

Analyse des avantages

Cette stratégie, combinant plusieurs indicateurs tels que le SAR, l’EMA/TEMA, le RSI et l’OBV, permet de détecter efficacement les signaux de retournement de prix et d’éviter les fausses ruptures. L’ajout d’une triple EMA et d’une moyenne mobile eMAMA peut améliorer la précision des jugements de tendance.

Les graphiques présentent une richesse d’indicateurs permettant de voir l’ensemble de la situation du marché. Les tableaux de synthèse des indicateurs ajoutés permettent d’obtenir rapidement le dernier état de plusieurs indicateurs.

Les règles de la logique des transactions sont claires et les paramètres sont ajustables pour s’adapter à différentes variétés de transactions.

Analyse des risques

La stratégie repose sur la conversion des indicateurs pour émettre des signaux, et si les indicateurs ne sont pas correctement configurés, cela génère un grand nombre de signaux de négociation bruyants. Les paramètres de l’indicateur doivent être optimisés en fonction des différentes variétés de transactions.

Dans les marchés où le tableau de bord est aligné, les indicateurs SAR peuvent produire de fréquents faux signaux. Il est alors nécessaire de prêter attention à la confirmation des indicateurs de jugement de tendance.

Une mauvaise sélection des variétés commerciales peut aussi conduire à l’échec de la stratégie. Il faut choisir des variétés avec une tendance évidente pour appliquer la stratégie.

Direction d’optimisation

Cette stratégie peut être optimisée dans les directions suivantes:

- Optimiser les paramètres SAR et réduire le bruit

- Optimisation des paramètres des moyennes mobiles pour améliorer la précision des jugements de tendances

- Remplacement des indicateurs de confirmation, test de l’efficacité des indicateurs tels que RSI, OBV

- Ajout d’indicateurs additionnels et analyse de plusieurs périodes

- Optimiser les stratégies de stop loss et limiter les pertes individuelles

Résumer

Cette stratégie de négociation multi-indicateurs transversale, intégrant de nombreux indicateurs d’analyse technique couramment utilisés, forme un signal de décision d’achat et de vente. Elle permet d’identifier efficacement les points de retournement des prix, présente des paramètres ajustables et faciles à optimiser.

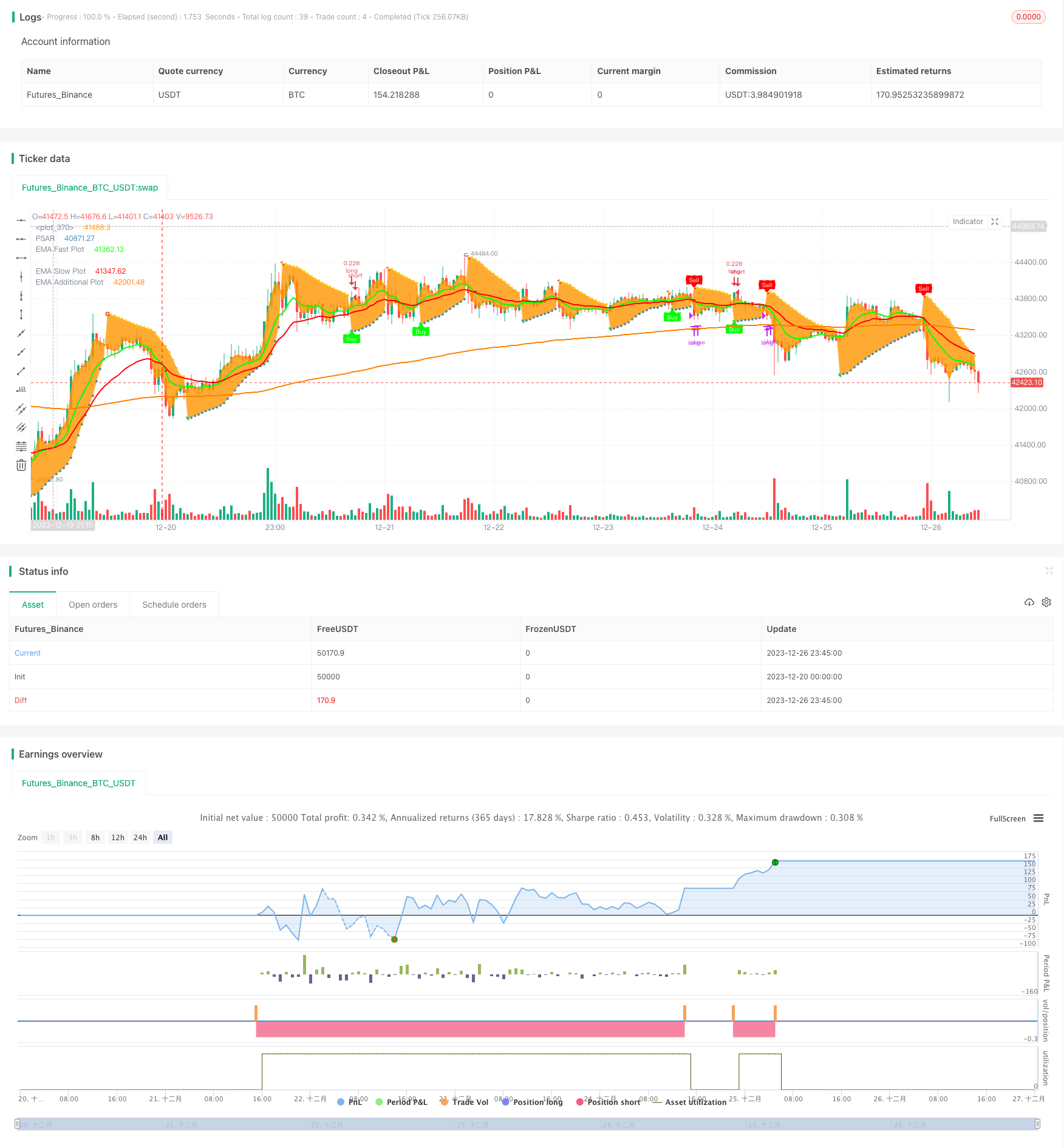

/*backtest

start: 2023-12-20 00:00:00

end: 2023-12-27 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//

// ██╗ █████╗ ███████╗ ██████╗██╗██╗ ██╗██╗ ██████╗ ██╗ ██╗███████╗ ███╗ ███╗ ██████╗ ███╗ ██╗██╗ ██╗

// ██║ ██╔══██╗██╔════╝██╔════╝██║██║ ██║██║██╔═══██╗██║ ██║██╔════╝ ████╗ ████║██╔═══██╗████╗ ██║██║ ██╔╝

// ██║ ███████║███████╗██║ ██║██║ ██║██║██║ ██║██║ ██║███████╗ ██╔████╔██║██║ ██║██╔██╗ ██║█████╔╝

// ██║ ██╔══██║╚════██║██║ ██║╚██╗ ██╔╝██║██║ ██║██║ ██║╚════██║ ██║╚██╔╝██║██║ ██║██║╚██╗██║██╔═██╗

// ███████╗██║ ██║███████║╚██████╗██║ ╚████╔╝ ██║╚██████╔╝╚██████╔╝███████║ ██║ ╚═╝ ██║╚██████╔╝██║ ╚████║██║ ██╗

// ╚══════╝╚═╝ ╚═╝╚══════╝ ╚═════╝╚═╝ ╚═══╝ ╚═╝ ╚═════╝ ╚═════╝ ╚══════╝ ╚═╝ ╚═╝ ╚═════╝ ╚═╝ ╚═══╝╚═╝ ╚═╝

// https://www.tradingview.com/u/LasciviousMonk/

// © LasciviousMonk

//

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This script provided freely. No guarantee of functionality is provided. You are welcome to use, revise, or modify

// this code in any way you wish. However, I kindly request that you publish any scripts originating from this code as

// 'Public'. Please do not use this code as a basis for "Protected" or "Invite Only" scripts.

//

//

// PSAR + EMA + TEMA combines Parabolic PSAR plus EMA and TEMA trendlines.

// - EMA and TEMA crossovers have an up or down triangle to indicate direction of cross. Please note

// that because these are Moving Averages (MAs), the triangle may not exactly line up with the crossover.

// - Added MESA Adaptive Moving Average (eMAMA). Crossovers of the fast and slow eMAMA may be used instead of

// EMA or TEMA.

// - Added third EMA line. May be used to filter entries. For example, set the additional EMA to 200. Buy signals

// wil only be sent if the price is greater than the additional EMA.

// - Added RSI and OBV as alternative PSAR confirmations.

//

// "Traffic Light" table: summarizes PSAR, RSI, SRSI, TEMA, EMA, eMAMA, MACD, OBV, and CMF indicators in a table.

// This is intended as a quick "heads up", not to replace the indicators themselves.

// - Arrows indicate direction of change since the last bar.

// - Moving average indicators are indicated as green if the fast MA > slow MA and fast [T]EMA is increasing, red otherwise.

// [T]EMA will be yellow if fast MA has increased over the last 2 periods but fast MA < slow MA.

// - PSAR is as green if the PSAR is increasing, red if it is decreasing.

// - RSI is indicated as green if RSI < oversold, red if RSI > overbought, yellow otherwise.

// - SRSI is indicated as green K < oversold, and red if K > overbought. If oversold < K < overbought,

// green if K > D and red if K < D.

// - MACD, OBV and CMF are green if bullish, red if bearish.

//

//

// Suggestions for use:

// - Use fast EMA crossing above slow EMA as a confirmation for PSAR signals.

// - TEMA or eMAMA can also be used for confirmation signals insead.

// - Instead of using a moving average (EMA, TEMA, etc) for confirmation, you may use RSI or OBV.

// - The "traffic light" table is intended as a "heads up" to call your attention to other indicators

// you may want to check. I suggest Cipher B/VMC Cipher_B, Neglected Volume, and/or CM_Ult_MacD_MTF

// as useful comparions.

//

// Please don't rely solely on the table. It is intended to alert you to look more closely at a plot, not to

// provide all the information you need to enter or exit a position. I find the table to be a nice companion

// to VMC Cipher_B, which can be overwhelming in its complexity.

//

// Code used:

// - TEMA With Alert by BerkSay

// - Parabolic SAR by Alex Orekhov (everget)

// - Ehlers MESA Adaptive Moving Average [LazyBear]

// - EMA, RSI and SRSI built-ins.

//@version=4

strategy(overlay=true, title="PSAR + EMA/TEMA/RSI/OBV", currency = 'USD', shorttitle="PSAR+",

pyramiding = 0, default_qty_type=strategy.percent_of_equity, default_qty_value=20,

initial_capital=5000, calc_on_every_tick=true, calc_on_order_fills=false,

commission_type=strategy.commission.percent, commission_value=0.1)

// ------------------------------------------------<[ Color Constants ]>----------------------------------------------

// Color values used from Pine Magic. https://www.tradingview.com/script/yyDYIrRQ-Pine-Color-Magic-and-Chart-Theme-Simulator/

var transparent = color.new(color.black, 100)

var darkpurple = #550055, dpurple = darkpurple // Alias for dark purple, Not recommended for use on "Dark Charts"

var purple = #990099

var fuchsia = #FF00FF

var violet = #AA00FF

var hanpurple = #6000FF

var blue = #0000FF

var cichlid = #0040FF

var azure = #0080FF

var skyblue = #00C0FF

var aqua = #00FFFF // Not recommended for use on "Light Charts" with 1px line thickness

var mint = #00FF80

var lime = #00FF00

var chartreuse = #80FF00

var yellow = #FFFF00 // Not recommended for use on "Light Charts"

var amber = #FFCC00

var orange = #FF8000

var redorange = #FF4000

var red = #FF0000

var hotpink = #FF0080

var pink = #FF80FF // Not recommended for use on "Light Charts"

// ------------------------------------------------<[ User Input ]>---------------------------------------------------

sourceGlobal = input(title="Source for indicator", defval=close, type=input.source, group="Global")

tradeLong = input(title="Create long positions?", defval=true, type=input.bool, group="Global")

tradeShort = input(title="Create short positions?", defval=false, type=input.bool, group="Global")

showPSAR = input(true, "Show PSAR?", group="PSAR")

psarStart = input(title="PSAR Start", type=input.float, step=0.001, defval=0.02, group="PSAR")

psarIncrement = input(title="PSAR Increment", type=input.float, step=0.001, defval=0.02, group="PSAR")

psarMaximum = input(title="PSAR Maximum", type=input.float, step=0.01, defval=0.2, group="PSAR")

psarConfirmation = input(title="Confirmation signal:", defval="EMA",

options=["EMA", "TEMA", "eMAMA", "RSI", "OBV"], group="PSAR")

psarHighlightStartPoints = input(title="PSAR Highlight Start Points?", type=input.bool, defval=true, group="PSAR")

psarShowLabels = input(title="PSAR Show Buy/Sell Labels?", type=input.bool, defval=true, group="PSAR")

psarHighlightState = input(title="PSAR Highlight State?", type=input.bool, defval=false, group="PSAR")

colorPSARLong = input(title="Long", type=input.color, defval=lime, group="PSAR", inline="colors")

colorPSARShort = input(title="Short", type=input.color, defval=red, group="PSAR", inline="colors")

useSL = input(defval=false, type=input.bool, title="Set stop loss to PSAR plot?")

showTEMA = input(false, "Show TEMA?", group="Triple EMA", inline="showTEMA")

showTEMAfill = input(title="Shade TEMA?", defval=false, type=input.bool, group="Triple EMA", inline="showTEMA")

lengthTEMAFast = input(title="TEMA Fast length", defval=13, minval=1, group="Triple EMA", inline="TemaFast")

colorTEMAFast = input(title="",type=input.color, defval=lime, inline="TemaFast", group="Triple EMA")

lengthTEMASlow = input(title="TEMA Slow length", defval=34, minval=1, group="Triple EMA", inline="TemaSlow")

colorTEMASlow = input(title="",type=input.color, defval=red, group="Triple EMA", inline="TemaSlow")

thicknessTEMA=input(title="Line thickness", defval=2, type=input.integer, minval=1, maxval=4, step=1, group="Triple EMA")

showEMA = input(defval=true, type=input.bool, title="Show EMA?", group="EMA", inline="showEMA")

showEMAfill = input(title="Shade EMA?", defval=false, type=input.bool, group="EMA", inline="showEMA")

lengthEMAFast = input(9, title='EMA Fast Length', step=1, type=input.integer, group="EMA", inline="EmaFast")

colorEMAFast = input(title="",type=input.color, defval=lime, inline="EmaFast", group="EMA")

lengthEMASlow = input(21, title='EMA Slow Length', step=1, type=input.integer, group="EMA", inline="EmaSlow")

colorEMASlow = input(title="",type=input.color, defval=red, group="EMA", inline="EmaSlow")

lengthEMA200 = input(200, title='EMA Additional Length', step=1, type=input.integer, group="EMA", inline="EMA200")

colorEMA200 = input(title="",type=input.color, defval=orange, group="EMA", inline="EMA200")

filterEMA200 = input(title="Use as filter?", defval=false, type=input.bool, group="EMA", inline="EMA200", tooltip="Buy and sell signals are filtered on the additional EMA line, commonly set to 200. This takes effect even if the PSAR confirmation is set to something other than EMA.")

thicknessEMA=input(title="Line thickness", defval=2, type=input.integer, minval=1, maxval=4, step=1, group="EMA")

lengthRSI = input(title="RSI Length", type=input.integer, defval=14, group="RSI")

rsiOverbought = input(title="Overbought Level", type=input.integer, defval=60, group="RSI", inline="levels")

rsiOversold = input(title="Oversold Level", type=input.integer, defval=40, group="RSI", inline="levels")

showeMAMA = input(defval=false, title="Show eMAMA?", type=input.bool, group="Ehler's MESA Adaptive Moving Average", inline="fill")

showEMAMAfill = input(title="Shade eMAMA?", defval=false, type=input.bool, group="Ehler's MESA Adaptive Moving Average", inline="fill")

fastlimitEMAMA=input(.5, title="Fast Limit", group="Ehler's MESA Adaptive Moving Average")

slowlimitEMAMA=input(.05, title="Slow Limit", group="Ehler's MESA Adaptive Moving Average")

thicknessEMAMA=input(title="Line thickness", defval=2, type=input.integer, minval=1, maxval=4, step=1, group="Ehler's MESA Adaptive Moving Average")

coloreMAMA = input(title="eMAMA",type=input.color, defval=lime, group="Ehler's MESA Adaptive Moving Average", inline="colors")

coloreFAMA = input(title="eFAMA",type=input.color, defval=red, group="Ehler's MESA Adaptive Moving Average", inline="colors")

lengthOBV = input(defval=20, title="OBV Length", type=input.integer, group="On Balance Volume")

emaOBV = input(defval=9, title="EMA length", type=input.integer, group="On Balance Volume")

lengthStoch = input(14, "Stochastic Length", minval=1, group="SRSI")

smoothK = input(3, "SRSI K Smoothing", minval=1, group="SRSI")

smoothD = input(3, "SRSI D Smoothing", minval=1, group="SRSI")

srsiOverbought = input(defval=80, title="Overbought level", type=input.integer, group="SRSI", inline="levels")

srsiOversold = input(defval=20, title="Oversold level", type=input.integer, group="SRSI", inline="levels")

lengthMACDfast = input(title="Fast Length", type=input.integer, defval=12, group="MACD")

lengthMACDslow = input(title="Slow Length", type=input.integer, defval=26, group="MACD")

lengthMACDsignal = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9, group="MACD")

lengthCMF = input(20, minval=1, group="Chaiken Money Flow")

showTable = input(defval=false, title="Show summary table?", type=input.bool, group="Summary Table")

tablePosition = input(title="Summary Table Position", defval=position.bottom_left,

options=[position.bottom_left,

position.top_left, position.bottom_right, position.top_right], group="Summary Table")

tableTextSize = input(title="Table Text Size", defval=size.tiny,

options=[size.auto, size.tiny, size.small, size.normal, size.large, size.huge], group="Summary Table")

useDateRange = input(defval=true, title="Limit backtesting by date", type=input.bool, group="Limit by date",

tooltip="Limit window for backtesting. This allows you to compare different TFs over the same period.")

rangeType = input(defval="30 Days", title="Date range:", options=["Custom", "30 Days", "90 Days", "180 Days", "Year to Date"], group="Limit by date")

startDate = input(title="Start Date (DD/MM/YYYY)", type=input.time,

defval=timestamp("1 Jan 2021 1:01 -0400"), group="Limit by date")

endDate = input(title="End Date (DD/MM/YYYY) ", type=input.time,

defval=timestamp("31 Dec 2100 19:59 -0400"), group="Limit by date", tooltip="You likely want to leave this far in the future.")

startDate := rangeType == "Custom" ? startDate :

rangeType == "30 Days" ? timenow - 2592000000 :

rangeType == "90 Days" ? timenow - 7776000000 :

rangeType == "180 Days" ? timenow - 15552000000 :

rangeType == "Year to Date" ? timestamp(syminfo.timezone, year(timenow), 01, 01, 00, 01) : na

inDateRange = (time >= startDate) and (time < endDate)

inDateRange := true

// ------------------------------------------------<[ Variable Declarations ]>----------------------------------------------

var bool psarConfirmationBuy = na

var bool psarConfirmationSell = na

var float eMAMA = na

var float eFAMA = na

var float historicalHigh = 0 // for OBV scaling

// -------------------------------------------------------<[ Functions ]>----------------------------------------------------

fDirection(series, length) =>

rising(series,length) ? "↑" : "↓"

fTEMA(sourceTEMA, length) =>

Tema1 = ema(sourceTEMA, length)

Tema2 = ema(Tema1, length)

Tema3 = ema(Tema2, length)

3 * Tema1 - 3 * Tema2 + Tema3

fMAMA(sourceEMAMA, slowlimitEMAMA, fastlimitEMAMA) =>

var float p = na

var float i2 = na

var float q2 = na

var float re = na

var float im = na

var float spp = na

sp = (4*sourceEMAMA + 3*sourceEMAMA[1] + 2*sourceEMAMA[2] + sourceEMAMA[3]) / 10.0

dt = (.0962*sp + .5769*nz(sp[2]) - .5769*nz(sp[4])- .0962*nz(sp[6]))*(.075*nz(p[1]) + .54)

q1 = (.0962*dt + .5769*nz(dt[2]) - .5769*nz(dt[4])- .0962*nz(dt[6]))*(.075*nz(p[1]) + .54)

i1 = nz(dt[3])

jI = (.0962*i1 + .5769*nz(i1[2]) - .5769*nz(i1[4])- .0962*nz(i1[6]))*(.075*nz(p[1]) + .54)

jq = (.0962*q1 + .5769*nz(q1[2]) - .5769*nz(q1[4])- .0962*nz(q1[6]))*(.075*nz(p[1]) + .54)

i2_ = i1 - jq

q2_ = q1 + jI

i2 := .2*i2_ + .8*nz(i2[1])

q2 := .2*q2_ + .8*nz(q2[1])

re_ = i2*nz(i2[1]) + q2*nz(q2[1])

im_ = i2*nz(q2[1]) - q2*nz(i2[1])

re := .2*re_ + .8*nz(re[1])

im := .2*im_ + .8*nz(im[1])

p1 = iff(im!=0 and re!=0, 360/atan(im/re), nz(p[1]))

p2 = iff(p1 > 1.5*nz(p1[1]), 1.5*nz(p1[1]), iff(p1 < 0.67*nz(p1[1]), 0.67*nz(p1[1]), p1))

p3 = iff(p2<6, 6, iff (p2 > 50, 50, p2))

p := .2*p3 + .8*nz(p3[1])

spp := .33*p + .67*nz(spp[1])

phaseEMAMA = atan(q1 / i1)

dphase_ = nz(phaseEMAMA[1]) - phaseEMAMA

dphase = iff(dphase_< 1, 1, dphase_)

alpha_ = fastlimitEMAMA / dphase

alpha = iff(alpha_ < slowlimitEMAMA, slowlimitEMAMA, iff(alpha_ > fastlimitEMAMA, fastlimitEMAMA, alpha_))

fOBV(src) =>

changeOBV = change(src)

cum(changeOBV > 0 ? volume : changeOBV < 0 ? -volume : 0*volume)

// -------------------------------------------<[ Variable Calculations ]>------------------------------------------

temaSlow = fTEMA(sourceGlobal, lengthTEMASlow)

temaFast = fTEMA(sourceGlobal, lengthTEMAFast)

shortTema = crossover(temaSlow, temaFast)

longTema = crossunder(temaSlow, temaFast)

fillTema = temaFast>temaSlow ? color.new(colorTEMAFast,80) : color.new(colorTEMASlow,80)

emaFast = ema(sourceGlobal, lengthEMAFast)

emaSlow = ema(sourceGlobal, lengthEMASlow)

ema200 = ema(sourceGlobal, lengthEMA200)

longEMA = crossover(emaFast, emaSlow)

shortEMA = crossunder(emaFast , emaSlow)

fillEMA = emaFast>emaSlow ? color.new(colorEMAFast,80) : color.new(colorEMASlow,80)

cumOBV = fOBV(sourceGlobal)

oscOBV = (cumOBV - ema(cumOBV,lengthOBV))

changeOBV = change(sourceGlobal)

shortOBV = ema(cumOBV, lengthOBV)

psar = sar(psarStart, psarIncrement, psarMaximum)

psarDir = psar < close ? 1 : -1

colorPSAR = psarDir == 1 ? color.new(#3388bb,0) : color.new(#fdcc02,0)

colorPSARFill = psarHighlightState ? (psarDir == 1 ? color.new(colorPSARLong,90) : color.new(colorPSARShort,90)) : na

psarChangeCond = psarDir != psarDir[1]

valueRSI = rsi(sourceGlobal, lengthRSI)

if psarConfirmation == "EMA"

if emaFast > emaSlow

psarConfirmationBuy := true

psarConfirmationSell := false

else if emaFast < emaSlow

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "TEMA"

if temaFast > temaSlow

psarConfirmationBuy := true

psarConfirmationSell := false

else if temaFast < temaSlow

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "eMAMA"

if eMAMA > eFAMA

psarConfirmationBuy := true

psarConfirmationSell := false

else if eMAMA < eFAMA

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "RSI"

if valueRSI < 40

psarConfirmationBuy := true

psarConfirmationSell := false

else if valueRSI > 60

psarConfirmationSell := true

psarConfirmationBuy := false

else if psarConfirmation == "OBV"

if oscOBV > 0

psarConfirmationBuy := true

psarConfirmationSell := false

else if oscOBV < 0

psarConfirmationSell := true

psarConfirmationBuy := false

psarBuySignal = psarDir == 1 and psarDir[1] == -1 and (filterEMA200 ? open > ema200 : true) and inDateRange

psarSellSignal = psarDir == -1 and psarDir[1] == 1 and (filterEMA200 ? open < ema200 : true) and inDateRange

eMAMA := fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA)*sourceGlobal + (1 - fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA))*nz(eMAMA[1])

eFAMA := .5*fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA)*eMAMA + (1 - .5*fMAMA(sourceGlobal, slowlimitEMAMA, fastlimitEMAMA))*nz(eFAMA[1])

longMAMA=crossover(eMAMA, eFAMA)

shortMAMA=crossunder(eMAMA,eFAMA)

fillEMAMA = eMAMA>eFAMA ? color.new(coloreMAMA, 80) : color.new(coloreFAMA, 80)

srsiK = sma(stoch(valueRSI, valueRSI, valueRSI, lengthStoch), smoothK)

srsiD = sma(srsiK, smoothD)

fastMACD = ema(sourceGlobal, lengthMACDfast)

slowMACD = ema(sourceGlobal, lengthMACDslow)

macd = fastMACD - slowMACD

signalMACD = ema(macd, lengthMACDsignal)

adCMF = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

mfCMF = sum(adCMF, lengthCMF) / sum(volume, lengthCMF)

// ================================== //

// ----> Conditional Parameters <---- //

// ================================== //

// ================================== //

// -------> Risk Mitigation <-------- //

// ================================== //

// ================================== //

// --------> Logical Order <--------- //

// ================================== //

// -------------------------------------------<[ Graphical Display ]>------------------------------------------

// TEMA plots

plotTemaSlow = plot(showTEMA ? temaSlow: na, color=color.new(colorTEMASlow,20), title="TEMA Slow plot", linewidth=thicknessTEMA)

plotTemaFast = plot(showTEMA ? temaFast: na, color=color.new(colorTEMAFast,20), title="TEMA Fast plot", linewidth=thicknessTEMA)

plotshape(showTEMA and longTema ? temaFast: na, style=shape.triangleup, location=location.absolute,

size=size.tiny, title="TEMA Cross Up", color=color.new(colorTEMAFast,10))

plotshape(showTEMA and shortTema ? temaSlow: na, style=shape.triangledown, location=location.absolute,

size=size.tiny, title="TEMA Cross Down", color=color.new(colorTEMASlow,10))

fill(plotTemaFast, plotTemaSlow, color=showTEMAfill ? fillTema : transparent, title="TEMA fill")

// EMA plots

plotEmaFast = plot(showEMA ? emaFast: na, title='EMA Fast Plot', color=colorEMAFast, linewidth=thicknessEMA)

plotEmaSlow = plot(showEMA ? emaSlow: na, title='EMA Slow Plot', color=colorEMASlow, linewidth=thicknessEMA)

plotEMA200 = plot(showEMA ? ema200: na, title='EMA Additional Plot', color=colorEMA200, linewidth=thicknessEMA)

plotshape(showEMA and longEMA ? emaFast : na, style=shape.triangleup, location=location.absolute, size=size.tiny,

title="EMA Cross Up",color=colorEMAFast)

plotshape(showEMA and shortEMA ? emaFast : na, style=shape.triangledown, location=location.absolute, size=size.tiny,

title="EMA Cross Down",color=colorEMASlow)

fill(plotEmaFast, plotEmaSlow, color=showEMAfill ? fillEMA : transparent, title="EMA fill")

// PSAR plots

psarPlot = plot(showPSAR ? psar: na, title="PSAR", style=plot.style_circles, linewidth=1, color=colorPSAR)

plotshape(showPSAR and psarBuySignal and psarHighlightStartPoints ? psar : na, title="PSAR Long Start", location=location.absolute,

style=shape.circle, size=size.tiny, color=colorPSARLong)

plotshape(showPSAR and psarBuySignal and psarShowLabels and psarConfirmationBuy ? psar : na, title="PSAR Buy Label", text="Buy", location=location.absolute,

style=shape.labelup, size=size.tiny, color=colorPSARLong, textcolor=color.white)

plotshape(showPSAR and psarSellSignal and psarHighlightStartPoints ? psar : na, title="PSAR Short Start", location=location.absolute,

style=shape.circle, size=size.tiny, color=colorPSARShort)

plotshape(showPSAR and psarSellSignal and psarShowLabels and psarConfirmationSell ? psar : na, title="PSAR Sell Label", text="Sell", location=location.absolute,

style=shape.labeldown, size=size.tiny, color=colorPSARShort, textcolor=color.white)

psarMidPricePlot = plot(ohlc4, title="", display=display.none, editable=false)

fill(psarMidPricePlot, psarPlot, title="PSAR Trade State Filling", color=colorPSARFill)

ploteMAMA = plot(showeMAMA ? eMAMA : na, title="Ehler's MAMA", linewidth=thicknessEMAMA, style=plot.style_line, color=coloreMAMA)

ploteFAMA = plot(showeMAMA ? eFAMA : na, title="Ehler's FAMA", linewidth=thicknessEMAMA, style=plot.style_line, color=coloreFAMA)

plotshape(showeMAMA and longMAMA ? eFAMA: na, style=shape.triangleup, location=location.absolute, size=size.tiny, title="eMAMA Cross Up",

color=color.new(coloreMAMA,10))

plotshape(showeMAMA and shortMAMA ? eFAMA: na, style=shape.triangledown, location=location.absolute, size=size.tiny, title="eMAMA Cross Down",

color=color.new(coloreFAMA,10))

fill(ploteMAMA, ploteFAMA, color=showEMAMAfill ? fillEMAMA : transparent, title="eMAMA fill")

// ---------------------------------------------------<[ Strategy Execution ]>-------------------------------------------------

strategy.entry(id="long", long=strategy.long, comment="enL", when=psarBuySignal and psarConfirmationBuy and tradeLong)

if useSL

strategy.exit(id="long", stop=psar, comment="SL")

strategy.close(id="long", comment="exL", when=psarSellSignal and psarConfirmationSell and tradeLong)

strategy.entry(id="short", long=strategy.short, comment="enS", when=psarSellSignal and psarConfirmationSell and tradeShort)

if useSL

strategy.exit(id="short", stop=psar, comment="SL")

strategy.close(id="short", comment="exS", when=psarBuySignal and psarConfirmationBuy and tradeShort)

// -------------------------------------------------------<[ Tables ]>---------------------------------------------------------

// Shows red for bearish signals, green for bullish signals.

var table summaryTable = table.new(tablePosition, 3, 3)

if (barstate.islast and showTable)

table.cell(summaryTable, 0, 0, "PSAR",text_size=tableTextSize, bgcolor = psarDir == 1 ? color.green : color.red)

rsiDirection = fDirection(valueRSI,1)

table.cell(summaryTable, 0, 1, "RSI " + tostring(round(valueRSI,0)) + rsiDirection,text_size=tableTextSize,

bgcolor = iff(valueRSI > rsiOverbought, color.red, iff(valueRSI < rsiOversold, color.green, color.yellow)))

srsiDirection = fDirection(srsiK,1)

table.cell(summaryTable, 0, 2, "K " + tostring(round(srsiK,0)) + srsiDirection, text_size=tableTextSize,

bgcolor=iff(srsiK > srsiOverbought, color.red, iff(srsiK < srsiOversold, color.green, srsiK > srsiD ? color.green : color.red)))

emaDirection = fDirection(emaFast,1)

table.cell(summaryTable, 1, 0, "EMA" + emaDirection,text_size=tableTextSize,

bgcolor = emaFast > emaSlow and emaFast > emaFast[1] ? color.green : color.red)

// See if emaFast has increased over the last two periods.

if rising(emaFast,2) and emaFast < emaSlow

table.cell_set_bgcolor(summaryTable, 1, 0, color.yellow)

directionTEMA = fDirection(temaFast,1)

table.cell(summaryTable, 1, 1, "TEMA" + directionTEMA,text_size=tableTextSize,

bgcolor = temaFast > temaSlow and temaFast > temaFast[1] ? color.green : color.red)

// See if temaFast has increased over the last two periods.

if rising(temaFast,2) and temaFast < temaSlow

table.cell_set_bgcolor(summaryTable, 1, 1, color.yellow)

directionMAMA = fDirection(eMAMA,1)

table.cell(summaryTable, 1, 2, "eMAMA" + directionMAMA,text_size=tableTextSize,

bgcolor = eMAMA > eFAMA and eMAMA > eFAMA[1] ? color.green : color.red)

// See if temaFast has increased over the last two periods.

if rising(eMAMA,2) and eMAMA < eFAMA

table.cell_set_bgcolor(summaryTable, 1, 2, color.yellow)

directionMACD = fDirection(macd,2)

table.cell(summaryTable, 2, 0, "MACD " + directionMACD, text_size=tableTextSize, bgcolor= macd > signalMACD ? color.green : color.red)

directionOBV = fDirection(shortOBV,2)

table.cell(summaryTable, 2, 1, "OBV " + directionOBV, text_size=tableTextSize, bgcolor= shortOBV > 0 ? color.green : color.red)

directionCMF = fDirection(mfCMF,2)

table.cell(summaryTable, 2, 2, "CMF " + directionCMF + tostring(mfCMF, "#.##"), text_size=tableTextSize, bgcolor= mfCMF > 0 ? color.green : color.red)

// ---------------------------------------------------<[ Alerts ]>-------------------------------------------------

if psarBuySignal and psarConfirmationBuy

alert("PSAR buy/long signal confirmed for {{ticker}} on {{interval}}.", alert.freq_once_per_bar)

if psarSellSignal and psarConfirmationSell

alert("PSAR sell/short signal confirmed for {{ticker}} on {{interval}}.", alert.freq_once_per_bar)

if psarChangeCond

alert("PSAR has changed direction for {{ticker}} on {{interval}}.", alert.freq_once_per_bar)