Purata pergerakan mengikut arah aliran dan strategi gabungan corak batang lilin

Gambaran keseluruhan

Strategi ini menggabungkan cara untuk menentukan arah trend dengan purata bergerak dan cara untuk menentukan titik balik dengan bentuk garis K. Strategi ini menggunakan purata bergerak untuk menentukan arah trend secara keseluruhan, dan kemudian mencari arah trend dengan bentuk garis K yang berpotensi berbalik sebagai isyarat masuk, untuk mengesan pergerakan trend.

Prinsip Strategi

Strategi menggunakan purata bergerak sederhana dengan panjang 10 hari untuk menentukan arah trend harga. Apabila harga lebih tinggi daripada purata bergerak, ia dianggap dalam trend naik; apabila harga lebih rendah daripada purata bergerak, ia dianggap dalam trend menurun.

Setelah menentukan arah trend, strategi akan menilai titik perubahan trend yang berpotensi berdasarkan serangkaian bentuk K-garis dan K-garis negatif. Bentuk garis positif yang biasa termasuk bintang terang, bintang pagi, tiga tentera putih, dan lain-lain. Bentuk garis negatif yang biasa termasuk bintang senja, tiga burung gagak, dan lain-lain.

Di samping itu, strategi ini juga menggabungkan tahap rintangan sokongan utama untuk menentukan harga masuk. Jika anda membeli di bawah trend menaik, anda akan membeli apabila anda menembusi tahap sokongan pertama.

Kelebihan Strategik

Kelebihan terbesar strategi ini adalah kombinasi penghakiman trend dan isyarat pembalikan pada masa yang sama, yang membolehkannya menangkap titik-titik perubahan trend tepat pada masanya, untuk menjalankan trend. Strategi ini dapat meningkatkan kebarangkalian keuntungan dengan ketara berbanding dengan strategi purata bergerak yang mudah.

Di samping itu, strategi untuk memasukkan penilaian K-line juga meningkatkan keupayaan untuk menangani kejadian yang tidak dijangka. K-line boleh berfungsi sebagai penapis untuk mengelakkan perdagangan yang salah apabila berlaku peristiwa probabiliti rendah yang menyebabkan penembusan palsu di pasaran.

Risiko Strategik

Risiko utama strategi ini terletak pada ketepatan penetapan parameter purata bergerak dan penghakiman bentuk garis K. Jika jangka masa purata bergerak ditetapkan dengan tidak betul, ia boleh menyebabkan kesalahan penghakiman trend; Jika penghakiman bentuk garis K berlaku, ia juga boleh menyebabkan kesalahan keputusan perdagangan.

Di samping itu, bentuk K-baris yang berbalik tidak menjamin 100 peratus bahawa trend akan berbalik, jadi strategi ini mempunyai risiko tertentu. Apabila pasaran berbalik secara lebih luas, ia mungkin membawa kerugian yang lebih besar kepada strategi.

Arah pengoptimuman

Ruang untuk pengoptimuman strategi ini agak besar. Sebagai contoh, parameter untuk menyesuaikan purata bergerak secara dinamik boleh dipertimbangkan, menggunakan kitaran purata bergerak yang berbeza pada peringkat pasaran yang berbeza.

Selain itu, anda juga boleh mempertimbangkan untuk memasukkan lebih banyak faktor untuk menilai trend dan kawasan panas, seperti perubahan jumlah perdagangan, indikator kadar turun naik, dan sebagainya, untuk menjadikan strategi lebih komprehensif dan kukuh.

ringkaskan

Strategi ini secara keseluruhan sangat sesuai untuk mengikuti trend pasaran saham dalam jangka masa sederhana, dan dapat memperoleh pulangan stabil yang tinggi. Jika dioptimumkan lebih lanjut, ia dijangka menjadi strategi kuantitatif yang berfungsi dengan baik. Jika pelabur menguasai penggunaan strategi ini, ia juga dapat digunakan untuk membina portfolio yang dipegang jangka panjang, untuk mengawal risiko saham individu sambil mendapatkan pulangan tambahan yang lebih baik.

/*backtest

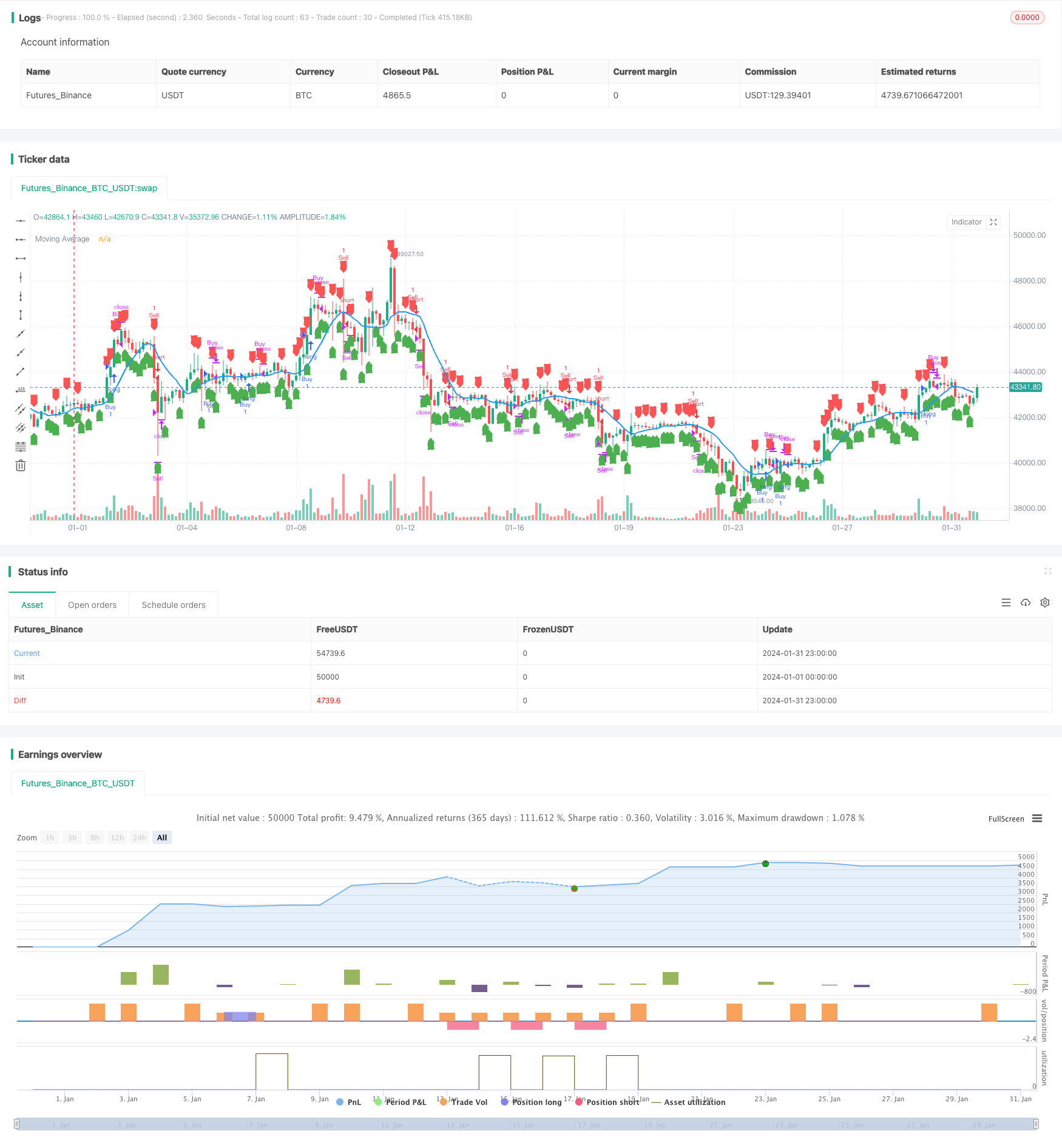

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Trend Following Strategy with Candlestick Patterns", overlay=true)

// Moving Average

ma_period = input(10, title="Moving Average Period")

moving_average = ta.sma(close, ma_period)

// Candlestick Patterns

// Custom Function

abs(x) => x >= 0 ? x : -x

// Candlestick Patterns

isDoji() =>

(close - open) <= (high - low) * 0.1

isMarubozuWhite() =>

close == high and open == low and close > open

isHammer() =>

(high - low) >= 3 * abs(open - close) and (close - low) / (0.001 + high - low) > 0.6 and (open - low) / (0.001 + high - low) > 0.6

isInvertedHammer() =>

(high - low) >= 3 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

isLongLowerShadow() =>

(low - close) > 2 * abs(open - close) and (low - open) / (0.001 + high - low) > 0.6

isUpsideTasukiGap() =>

close[1] < open[1] and open > close and open > close[1] and close < open[1]

isRisingWindow() =>

high[1] < low and close > open

isPiercing() =>

close[1] < open[1] and close > open and close > ((open + low) / 2) and close < open[1] and open < close[1]

isBullishEngulfing() =>

close[1] < open[1] and close > open and high > high[1] and low < low[1]

isTweezerBottom() =>

low == ta.valuewhen(low == ta.lowest(low, 10), low, 0) and low == ta.valuewhen(low == ta.lowest(low, 20), low, 0)

isBullishAbandonedBaby() =>

close[2] < open[2] and close[1] > open[1] and low[1] > ta.valuewhen(high == ta.highest(high, 2), high, 0) and open > close and close > ta.valuewhen(high == ta.highest(high, 2), high, 0)

isMorningStar() =>

close[2] < open[2] and close[1] < open[1] and close > open[1] and open < close[2] and open > close[1]

isMorningDojiStar() =>

close[2] < open[2] and close[1] < open[1] and isDoji() and close > open[1] and open < close[2] and open > close[1]

isDragonflyDoji() =>

isDoji() and (high - close) / (0.001 + high - low) < 0.1 and (open - low) / (0.001 + high - low) > 0.6

isThreeWhiteSoldiers() =>

close[2] < open[2] and close[1] < open[1] and close > open and open < close[2] and open < close[1] and close > open[1]

isRisingThreeMethods() =>

close[4] < open[4] and close[1] < open[1] and close > open and open < close[4] and open < close[1] and close > open[1]

isMarubozuBlack() =>

close == low and open == high and open > close

isGravestoneDoji() =>

isDoji() and (close - low) / (0.001 + high - low) < 0.1 and (high - open) / (0.001 + high - low) > 0.6

isHangingMan() =>

(high - low) >= 4 * abs(open - close) and (open - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

isLongUpperShadow() =>

(high - open) > 2 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6

isDownsideTasukiGap() =>

close[1] > open[1] and open < close and open < close[1] and close > open[1]

isFallingWindow() =>

low[1] > high and close < open

isDarkCloudCover() =>

close[1] > open[1] and close < open and close < ((open + high) / 2) and close > open[1] and open > close[1]

isBearishEngulfing() =>

close[1] > open[1] and close < open and high > high[1] and low < low[1]

isTweezerTop() =>

high == ta.valuewhen(high == ta.highest(high, 10), high, 0) and high == ta.valuewhen(high == ta.highest(high, 20), high, 0)

isAbandonedBaby() =>

close[2] > open[2] and close[1] < open[1] and high[1] < ta.valuewhen(low == ta.lowest(low, 2), low, 0) and open < close and close < ta.valuewhen(low == ta.lowest(low, 2), low, 0)

isEveningDojiStar() =>

close[2] > open[2] and close[1] > open[1] and isDoji() and close < open[1] and open > close[2] and open < close[1]

isEveningStar() =>

close[2] > open[2] and close[1] > open[1] and close < open[1] and open > close[2] and open < close[1]

isThreeBlackCrows() =>

close[2] > open[2] and close[1] > open[1] and close < open and open > close[2] and open > close[1] and close < open[1]

isFallingThreeMethods() =>

close[4] > open[4] and close[1] > open

isShootingStar() =>

(high - low) >= 3 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

doji = isDoji()

marubozuWhite = isMarubozuWhite()

hammer = isHammer()

invertedHammer = isInvertedHammer()

longLowerShadow = isLongLowerShadow()

upsideTasukiGap = isUpsideTasukiGap()

risingWindow = isRisingWindow()

piercing = isPiercing()

bullishEngulfing = isBullishEngulfing()

tweezerBottom = isTweezerBottom()

bullishAbandonedBaby = isBullishAbandonedBaby()

morningStar = isMorningStar()

morningDojiStar = isMorningDojiStar()

dragonflyDoji = isDragonflyDoji()

threeWhiteSoldiers = isThreeWhiteSoldiers()

risingThreeMethods = isRisingThreeMethods()

marubozuBlack = isMarubozuBlack()

gravestoneDoji = isGravestoneDoji()

hangingMan = isHangingMan()

longUpperShadow = isLongUpperShadow()

downsideTasukiGap = isDownsideTasukiGap()

fallingWindow = isFallingWindow()

darkCloudCover = isDarkCloudCover()

bearishEngulfing = isBearishEngulfing()

tweezerTop = isTweezerTop()

abandonedBaby = isAbandonedBaby()

eveningDojiStar = isEveningDojiStar()

eveningStar = isEveningStar()

threeBlackCrows = isThreeBlackCrows()

fallingThreeMethods = isFallingThreeMethods()

shootingStar = isShootingStar()

isBullishPattern() =>

(isMarubozuWhite() or isHammer() or isInvertedHammer() or isDoji() or isMorningStar() or isBullishEngulfing() or isThreeWhiteSoldiers() or isMarubozuBlack() or isHangingMan() or isDownsideTasukiGap() or isDarkCloudCover())

isBearishPattern() =>

(isMarubozuBlack() or isInvertedHammer() or isLongUpperShadow() or isTweezerTop() or isGravestoneDoji() or isEveningStar() or isBearishEngulfing() or isThreeBlackCrows() or isShootingStar())

isBullishCandle = isBullishPattern()

isBearishCandle = isBearishPattern()

// Calculate Pivot Points

pivotPoint(high, low, close) =>

(high + low + close) / 3

r1 = pivotPoint(high[1], low[1], close[1]) * 2 - low[1]

s1 = pivotPoint(high[1], low[1], close[1]) * 2 - high[1]

r2 = pivotPoint(high[1], low[1], close[1]) + (high[1] - low[1])

s2 = pivotPoint(high[1], low[1], close[1]) - (high[1] - low[1])

r3 = high[1] + 2 * (pivotPoint(high[1], low[1], close[1]) - low[1])

s3 = low[1] - 2 * (high[1] - pivotPoint(high[1], low[1], close[1]))

// Trend Identification

is_uptrend = close > moving_average

is_downtrend = close < moving_average

// Entry and Exit Conditions with Trend Identification

enterLong = is_uptrend and isBullishCandle and close > r1

exitLong = is_uptrend and (bearishEngulfing or doji or close < s1)

enterShort = is_downtrend and isBearishCandle and close < s1

exitShort = is_downtrend and (bullishEngulfing or doji or close > r1)

// Strategy Execution

if enterLong and strategy.position_size == 0 and strategy.position_size[1] == 0 and close > r1

strategy.entry("Buy", strategy.long, qty=1)

if exitLong and strategy.position_size > 0

strategy.close("Buy")

if enterShort and strategy.position_size == 0 and close < s1

strategy.entry("Sell", strategy.short, qty=1)

if exitShort and strategy.position_size < 0

strategy.close("Sell")

// Stop-Loss and Trailing Stop-Loss

stop_loss_pct = input(2.0, title="Stop Loss Percentage")

trailing_stop_loss_pct = input(1.0, title="Trailing Stop Loss Percentage")

trailing_stop_loss_active = input(true, title="Trailing Stop Loss Active")

// Stop-Loss

stop_loss_level = strategy.position_avg_price * (1 - stop_loss_pct / 100)

strategy.exit("Stop Loss", "Buy", loss=stop_loss_level)

// Trailing Stop-Loss

// Plotting Moving Average

plot(moving_average, color=color.blue, title="Moving Average", linewidth=2)

// Plotting Candlestick Patterns

plotshape(isBullishCandle, title="Bullish Candle", location=location.belowbar, color=color.green, style=shape.labelup)

plotshape(isBearishCandle, title="Bearish Candle", location=location.abovebar, color=color.red, style=shape.labeldown)

// Plotting Support and Resistance Levels

//hline(r1, "Resistance Level 1", color=color.red, linestyle=hline.style_dotted)

//hline(s1, "Support Level 1", color=color.green, linestyle=hline.style_dotted)