概述

该策略名称为RSI和随机RSI组合策略,它结合了相对强弱指标(RSI)和随机RSI指标的优点,旨在发现超买超卖的机会。该策略适用于5分钟线,在EOS/BTC和BTC/USDT品种效果较好,不适用于所有加密货币。

策略原理

该策略同时使用RSI指标和随机RSI指标。其中RSI长度为10周期,超买线为60,超卖线为20。随机RSI参数包括K线的平滑周期为3,D线的平滑周期为3,RSI计算周期长度为14,随机RSI计算周期长度为14。当随机RSI的K值和D值同时低于20时为超卖;当随机RSI的K值和D值同时高于80时为超买。策略在超买超卖时机发出交易信号。

优势分析

该策略结合RSI指标和随机RSI指标的优势。RSI指标能够有效识别超买超卖情况。随机RSI指标结合动量指标,能够更早地发现价格转折点。两者组合使用效果更好,既考虑了价格超买超卖信息,也考虑了动量因素,从而能够在较优时机发出交易信号。

风险分析

该策略可能存在交易次数过多、幅度不足的风险。解决方法是适当调整参数,降低交易频率,选择交易幅度大的品种。另外,交易费用也会影响最终盈利。建议选择手续费较低的交易平台,或适当放大交易位置规模。

优化方向

该策略的参数可以进一步优化,如调整RSI参数、随机RSI参数、超买超卖阈值等。此外,可以考虑结合其他指标过滤信号,例如EMA均线指标等,从而提高信号质量。也可以尝试多品种组合,利用不同品种之间的相关性,获得更稳定的整体收益。

总结

该策略整合RSI指标和随机RSI指标的优势,能够在相对超买超卖时发出交易信号。策略参数可进一步优化,交易规则可根据不同品种进行调整,也可以考虑与其他策略或指标组合使用。总体来说,该策略适用于发掘短线交易机会的量化交易者。

策略源码

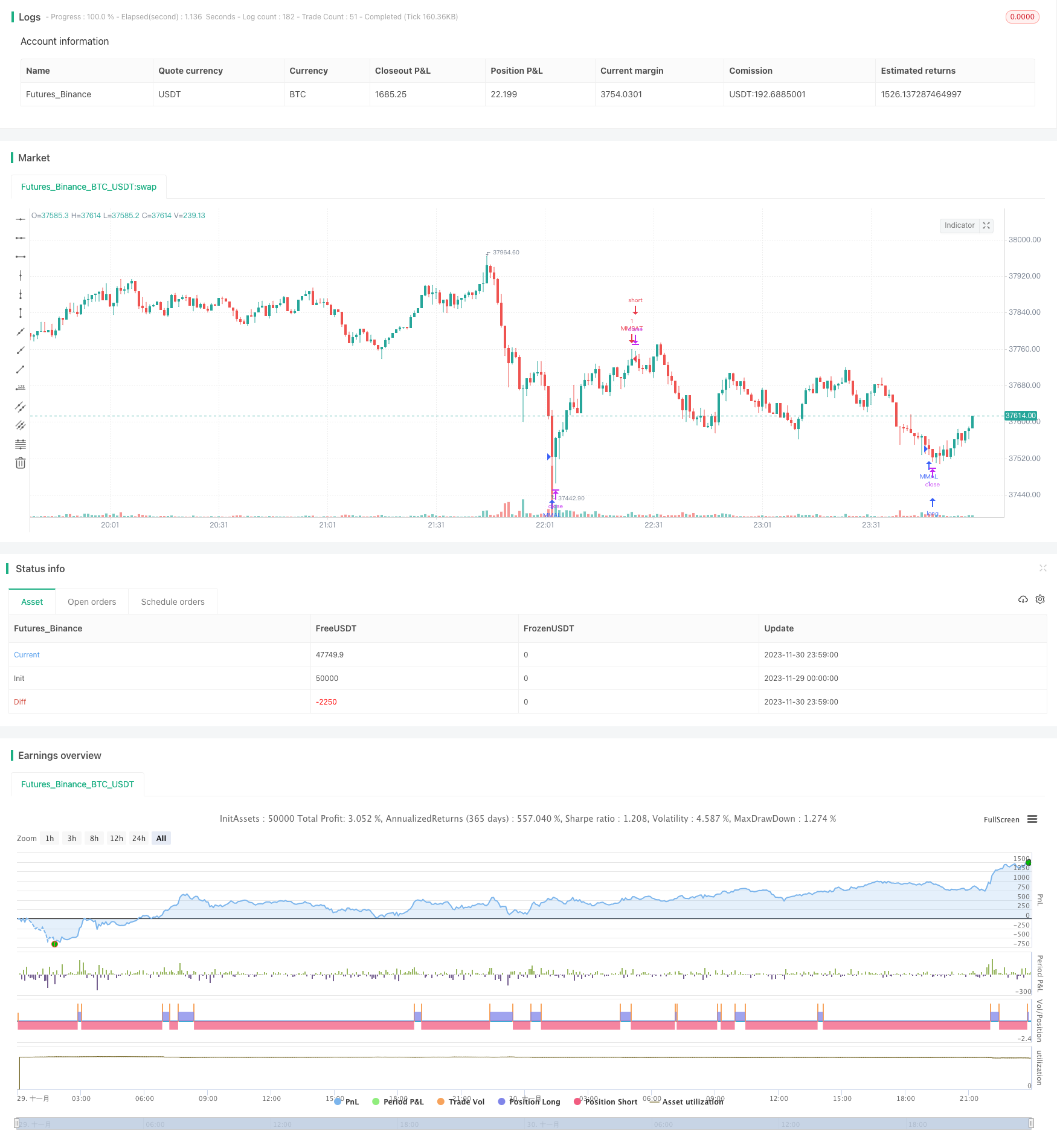

/*backtest

start: 2023-11-29 00:00:00

end: 2023-12-01 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("RSI+STOCHRSI", overlay=true)

length = input( 10)

overSold = input( 20 )

overBought = input( 60 )

price = close

vrsi = rsi(price, length)

smoothK = input(3, minval=1)

smoothD = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStoch = input(14, minval=1)

src = input(close, title="RSI Source")

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

srsilow=input(20)

srsiup=input(80)

sourceup = high

sourcelow = low

source=close

yearfrom = input(2018)

yearuntil =input(2019)

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

if ( (d<srsilow) and (k<srsilow) and (vrsi<overSold))

strategy.entry("MMAL", strategy.long, stop=close, oca_name="TREND", comment="AL")

else

strategy.cancel(id="MMAL")

if ( (d> srsiup ) and (k>srsiup ) and (vrsi >overBought) )

strategy.entry("MMSAT", strategy.short,stop=close, oca_name="TREND", comment="SAT")

else

strategy.cancel(id="MMSAT")