Strategi perdagangan kuantitatif multi-sinyal berdasarkan Ichimoku

Ringkasan

Strategi ini mengintegrasikan indikator Ichimoku Kinko Hyo dan berbagai indikator teknis lainnya untuk menggabungkan berbagai sinyal perdagangan untuk memanfaatkan keunggulan sistem Ichimoku, dan masuk ke pasar melalui konfirmasi multi-sinyal, yang dapat secara efektif menyaring sinyal palsu, dan mengendalikan risiko dalam mengejar tingkat kemenangan yang tinggi.

Prinsip Strategi

Strategi ini terdiri dari beberapa bagian utama:

Perhitungan indikator Ichimoku Kinko Hyo, termasuk rumus perhitungan garis bergeser ((Tenkan-sen), garis acuan ((Kijun-sen), garis terdepan ((Senkou Span A), garis terbelakang ((Senkou Span B), overlap ((Kumo) dan lain-lain.

Berbagai pengaturan filter, termasuk Kumo cloud stack filter, Kijun baseline filter, MACD filter, RSI filter, Bill Williams ARGUMENTS fractals filter, SuperTrend filter, Parabolic SAR filter, dan ADX filter. Filter ini digunakan untuk mengkonfirmasi arah tren dan menghindari perdagangan yang dipengaruhi oleh pasar yang bergoyang.

Ada 23 sinyal perdagangan yang berasal dari Ichimoku, termasuk sinyal penembusan harga penutupan sebelumnya, sinyal hubungan antara Chikou dan harga atau overlap, sinyal hubungan antara garis pivot dan garis dasar atau overlap. Selain itu, ada banyak sinyal indikator teknis lainnya, seperti MACD, RSI, Fractals, dll.

Pengaturan filter dua tingkat untuk memfilter sinyal masuk. Dengan memilih satu filter masing-masing sebagai filter tingkat pertama dan kedua, sinyal palsu dapat dihindari secara efektif.

Pengaturan filter dua tingkat untuk memfilter sinyal keluar. Seperti filter masuk.

Multi-sinyal bekerja sama untuk masuk dan keluar dari sinyal akhir. Berdasarkan sinyal perdagangan tertentu yang dipilih oleh pengguna, sementara menggabungkan filter masuk dan keluar tingkat pertama dan kedua, membentuk keputusan perdagangan akhir.

Pengaturan Stop Loss. Anda dapat memilih apakah akan diaktifkan atau tidak dan lokasi Stop Loss spesifik.

Pengaturan siklus pengemasan. Anda dapat mengatur waktu mulai dan berhenti pengemasan.

Keunggulan Strategis

Strategi ini memiliki keuntungan sebagai berikut:

Menggunakan berbagai indikator Ichimoku dan berbagai sinyal perdagangan, serta trend tracking dan sinyal filter.

Pengaturan filter dua tingkat untuk menghindari penutupan dan pengendalian risiko yang efektif.

Berbagai sinyal trading tersedia untuk dipilih dan dapat dioptimalkan untuk berbagai kondisi pasar.

Berbagai jenis filter tersedia untuk dipilih, yang dapat dioptimalkan untuk karakteristik saham individu.

Stop loss point dapat diatur untuk membantu mengunci keuntungan dan mengendalikan risiko.

Anda dapat mengatur siklus pengujian yang berbeda untuk memverifikasi dan mengoptimalkan strategi.

Risiko Strategis

Strategi ini juga memiliki beberapa risiko:

Sistem Ichimoku lebih lambat dalam menilai sinyal jual beli, dan mungkin akan melewatkan peluang perdagangan garis pendek.

Filter ganda mungkin terlalu berhati-hati, menyebabkan ketidakpastian masuk. Anda dapat menguji dan menyesuaikan parameter filter.

Pengaturan titik stop tunggal tidak cukup fleksibel untuk menangani situasi yang rumit. Anda dapat mempertimbangkan stop dinamis.

Pengaturan siklus pengembalian tidak cukup akurat dan tidak dapat sepenuhnya mensimulasikan lingkungan disk nyata. Perlu beberapa kali menyesuaikan verifikasi.

Arah optimasi strategi

Strategi ini dapat dioptimalkan dengan:

Menyesuaikan parameter sistem Ichimoku, seperti mempersingkat siklus garis putar untuk menyesuaikan dengan perdagangan garis pendek.

Uji kombinasi sinyal perdagangan yang berbeda untuk mengidentifikasi pilihan sinyal yang paling cocok untuk setiap saham.

Mengoptimalkan parameter filter, menyeimbangkan efek filter dengan kepastian masuk.

Cobalah stop loss yang dinamis, agar stop loss lebih dekat dengan perubahan pasar.

Setel periode pengembalian yang lebih lama, atau gunakan data pengembalian tick untuk membuat simulasi lebih akurat.

Menambahkan modul manajemen posisi untuk mengoptimalkan efisiensi penggunaan dana melalui penambahan stok.

Menambahkan fungsi optimasi parameter otomatis untuk penyesuaian kebijakan yang lebih cerdas.

Meringkaskan

Strategi ini menggunakan berbagai indikator dan sinyal perdagangan yang disediakan oleh sistem Ichimoku, dan bekerja sama dengan menggunakan indikator teknis lainnya untuk memfilter dan mengkonfirmasi sinyal, untuk mencapai satu set strategi perdagangan kuantitatif yang menggabungkan pelacakan tren dan sinyal terobosan. Strategi ini memanfaatkan sepenuhnya keunggulan sistem Ichimoku, sambil merancang modul parametris untuk penyesuaian dan pengoptimalan, yang dapat beradaptasi dengan lebih baik dengan perubahan pasar.

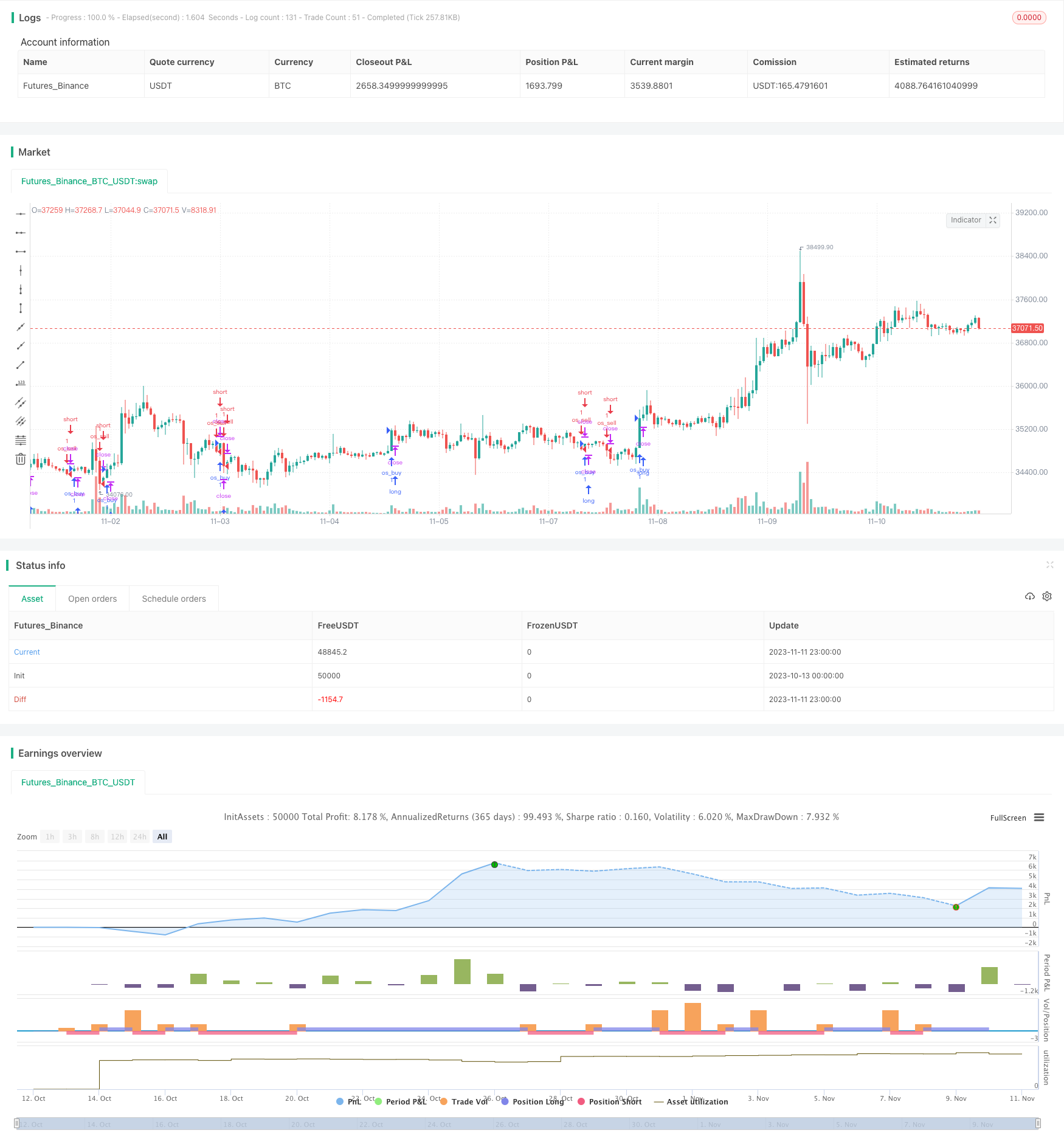

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ramsay09

//@version=4

strategy(title="The Strategy - Ichimoku Kinko Hyo and more",shorttitle="Strategy ", overlay=true)

backtest = input(title= "Backtest (no comment-string)", type= input.bool, defval= false)

entry_type = input("Both", title= "Long/Short Entry", options= ["Both", "Long", "Short"])

shared_param = input(false, title= " Shared Filter and Entry Parameters :", type= input.bool)

fr_period = input(2, title= "Fractals Period (Filter/Entry)", minval= 1)

rsi_period = input(14, title= "RSI Period (Filter/Entry)", minval= 1)

mult = input(2, type= input.float, title= "SuperTrend multiplier (Filter/Entry)", minval= 1)

len = input(5, type= input.integer, title= "SuperTrend length (Filter/Entry)", minval= 1)

start = 0.02//input(0.02, title= "PSAR Start (Filter/Entry)", minval= 0)

inc = 0.02//input(0.02, title= "PSAR Increment (Filter/Entry)", minval= 0)

max = 0.2//input(.2, title= "PSAR Maximum (Filter/Entry)", minval= 0)

adx_period = input(10, title= "ADX Period (Filter/Entry)", minval= 1)

adx_tres = input(25, title= "ADX threshold (Filter/Entry)", minval= 1)

X_opt = input("Price X Kumo sig", title="Signal", options= ["---", "Inside Bar sig", "Outside Bar sig", "Sandwich Bar sig", "Bar sig", "SMA50 sig", "RSI50 sig",

"Fractals sig", "Parabolic SAR sig", "SuperTrend sig", "Price X Kijun sig", "Price X Kumo sig", "Kumo flip sig",

"Price filtered Kumo flip sig", "Chikou X Price sig", "Chikou X Kumo sig", "Price X Tenkan sig", "Tenkan X Kumo sig",

"Tenkan X Kijun sig", "Kumo filtered Tenkan X Kijun sig", "CB/CS sig", "IB/IS sig", "B1/S1 sig", "B2/S2 sig"])

entry_f_1 = input("---", title="Entry filter 1", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

entry_f_2 = input("---", title="Entry filter 2", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

exit_f_1 = input("---", title="Exit filter 1", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

exit_f_2 = input("---", title="Exit filter 2", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

//-------------------- Ichimoku --------------------

TKlength = 9 //input(9, "Tenkan-sen length", minval= 1)

KJlength = 26 //input(26, "Kijun-sen length", minval= 1)

CSHSlength = 26 //input(26, "Chikouspan length/horizontal shift", minval= 1)

SBlength = 52 //input(52, "SenkouspanB length", minval= 1)

SAlength = 26 //input(26, "SenkouspanA length", minval= 1)

// calculation

TK = avg(lowest(TKlength), highest(TKlength))

KJ = avg(lowest(KJlength), highest(KJlength))

CS = close

SB = avg(lowest(SBlength), highest(SBlength))

SA = avg(TK,KJ)

kumo_high = max(SA[CSHSlength-1], SB[CSHSlength-1])

kumo_low = min(SA[CSHSlength-1], SB[CSHSlength-1])

//------------------------------------- Filters and entry signals --------------------------------------

//---------------------- Kumo filter ------------------------

kumo_buy = close > kumo_high

kumo_sell = close < kumo_low

//--------------------- Kijun filter ----------------------

kijun_buy = close > KJ

kijun_sell = close < KJ

//----------------------- macd filter -----------------------

[macdLine_f, signalLine_f, histLine_f] = macd(close, 12, 26, 9)

macd_buy = macdLine_f > signalLine_f

macd_sell = macdLine_f < signalLine_f

//---------------------- rsi filter and entry signal------------------------

rsi_f_buy = rsi(close, rsi_period) > 50

rsi_f_sell = rsi(close, rsi_period) < 50

//---------------- Bill Williams Fractals (filter and entry signal) -----------------

up_fr = pivothigh(fr_period, fr_period)

dn_fr = pivotlow(fr_period, fr_period)

fractal_up_v = valuewhen(up_fr, high[fr_period],0)

fractal_dn_v = valuewhen(dn_fr, low[fr_period],0)

fr_upx = high > fractal_up_v

fr_dnx = low < fractal_dn_v

//-------------------- SuperTrend filter and entry signal ---------------------

[SuperTrend, Dir] = supertrend(mult, len)

sup_buy = close > SuperTrend

sup_sell = close < SuperTrend

//--------------------- Heikin Ashi -----------------------

//heikin_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

//heikin_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

//h_buy = heikin_close[1] > heikin_open[1]

//h_sell = heikin_close[1] < heikin_open[1]

//----------------- Parabolic SAR Signal (pb/ps) and filter -------------------

psar_buy = high > sar(start, inc, max)[0]

psar_sell = low < sar(start, inc, max)[0]

//-------------------------- ADX filter ---------------------------

[diplus_f, diminus_f, adx_f] = dmi(adx_period, adx_period)

//-------------------------- SMA50 filter and entry---------------------------

sma50_buy = close[2] > sma(close, 50)

sma50_sell = close[2] < sma(close, 50)

//-------------------------- entry filter -------------------------------

//entry buy filter 1 options

entry_filter_buy_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_buy :

entry_f_1 == "RSI50 filter" ? rsi_f_buy :

entry_f_1 == "Fractals filter" ? fr_upx :

entry_f_1 == "SuperTrend filter" ? sup_buy :

entry_f_1 == "Parabolic SAR filter" ? psar_buy :

entry_f_1 == "Cloud filter" ? kumo_buy :

entry_f_1 == "Kijun filter" ? kijun_buy :

entry_f_1 == "SMA50 filter" ? sma50_buy :

entry_f_1 == "ADX filter" ? adx_f > 25 : true

//entry sell filter 1 options

entry_filter_sell_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_sell :

entry_f_1 == "RSI50 filter" ? rsi_f_sell :

entry_f_1 == "Fractals filter" ? fr_dnx :

entry_f_1 == "SuperTrend filter" ? sup_sell :

entry_f_1 == "Parabolic SAR filter" ? psar_sell :

entry_f_1 == "Cloud filter" ? kumo_sell :

entry_f_1 == "Kijun filter" ? kijun_sell :

entry_f_1 == "SMA50 filter" ? sma50_sell :

entry_f_1 == "ADX filter" ? adx_f > 25 : true

//entry buy filter 2 options

entry_filter_buy_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_buy :

entry_f_2 == "RSI50 filter" ? rsi_f_buy :

entry_f_2 == "Fractals filter" ? fr_upx :

entry_f_2 == "SuperTrend filter" ? sup_buy :

entry_f_2 == "Parabolic SAR filter" ? psar_buy :

entry_f_2 == "Cloud filter" ? kumo_buy :

entry_f_2 == "Kijun filter" ? kijun_buy :

entry_f_2 == "SMA50 filter" ? sma50_buy :

entry_f_2 == "ADX filter" ? adx_f > 25 : true

//entry sell filter 2 options

entry_filter_sell_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_sell :

entry_f_2 == "RSI50 filter" ? rsi_f_sell :

entry_f_2 == "Fractals filter" ? fr_dnx :

entry_f_2 == "SuperTrend filter" ? sup_sell :

entry_f_2 == "Parabolic SAR filter" ? psar_sell :

entry_f_2 == "Cloud filter" ? kumo_sell :

entry_f_2 == "Kijun filter" ? kijun_sell :

entry_f_2 == "SMA50 filter" ? sma50_sell :

entry_f_2 == "ADX filter" ? adx_f > 25 : true

//------------------------- exit filter -----------------------

//exit buy filter 1 options

exit_filter_buy_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "MACD filter" ? macd_buy :

exit_f_1 == "RSI50 filter" ? rsi_f_buy :

exit_f_1 == "Fractals filter" ? fr_upx :

exit_f_1 == "SuperTrend filter" ? sup_buy :

exit_f_1 == "Parabolic SAR filter" ? psar_buy :

exit_f_1 == "Cloud filter" ? kumo_buy :

exit_f_1 == "Kijun filter" ? kijun_buy :

exit_f_1 == "SMA50 filter" ? sma50_buy :

exit_f_1 == "ADX filter" ? adx_f > 25 : false

//exit sell filter 1 options

exit_filter_sell_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "MACD filter" ? macd_sell :

exit_f_1 == "RSI50 filter" ? rsi_f_sell :

exit_f_1 == "Fractals filter" ? fr_dnx :

exit_f_1 == "SuperTrend filter" ? sup_sell :

exit_f_1 == "Parabolic SAR filter" ? psar_sell :

exit_f_1 == "Cloud filter" ? kumo_sell :

exit_f_1 == "Kijun filter" ? kijun_sell :

exit_f_1 == "SMA50 filter" ? sma50_sell :

exit_f_1 == "ADX filter" ? adx_f > 25 : false

//exit buy filter 2 options

exit_filter_buy_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "MACD filter" ? macd_buy :

exit_f_2 == "RSI50 filter" ? rsi_f_buy :

exit_f_2 == "Fractals filter" ? fr_upx :

exit_f_2 == "SuperTrend filter" ? sup_buy :

exit_f_2 == "Parabolic SAR filter" ? psar_buy :

exit_f_2 == "Cloud filter" ? kumo_buy :

exit_f_2 == "Kijun filter" ? kijun_buy :

exit_f_2 == "SMA50 filter" ? sma50_buy :

exit_f_2 == "ADX filter" ? adx_f > 25 : false

//exit sell filter 2 options

exit_filter_sell_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "MACD filter" ? macd_sell :

exit_f_2 == "RSI50 filter" ? rsi_f_sell :

exit_f_2 == "Fractals filter" ? fr_dnx :

exit_f_2 == "SuperTrend filter" ? sup_sell :

exit_f_2 == "Parabolic SAR filter" ? psar_sell :

exit_f_2 == "Cloud filter" ? kumo_sell :

exit_f_2 == "Kijun filter" ? kijun_sell :

exit_f_2 == "SMA50 filter" ? sma50_sell :

exit_f_2 == "ADX filter" ? adx_f > 25 : false

//----------------------- i-o-s signals ------------------------

i_bar_buy = high[1] < high[2] and low[1] > low[2] and close > high[1]

i_bar_sell = high[1] < high[2] and low[1] > low[2] and close < low[1]

o_bar_buy = high[1] > high[2] and low[1] < low[2] and high > high[1]

o_bar_sell = high[1] > high[2] and low[1] < low[2] and low < low[1]

s_bar_buy = high[2] < high[3] and low[2] > low[3] and high[1] > high[2] and low[1] < low[2] and high > high[1]

s_bar_sell = high[2] < high[3] and low[2] > low[3] and high[1] > high[2] and low[1] < low[2] and low < low[1]

//----------------- Ichimoku Signal B1/S1 -----------------

buy_strong_B1 = (TK >= KJ) and close > kumo_high and CS > high[(26-1)] and CS > kumo_high[26-1] and SA > SB

sell_strong_S1 = (TK <= KJ) and close < kumo_low and CS < low[(26-1)] and CS < kumo_low[26-1] and SA < SB

var buy_sig = true

var sell_sig = true

B1_a = buy_strong_B1 and buy_sig

S1_a = sell_strong_S1 and sell_sig

if sell_strong_S1

buy_sig := true, sell_sig := false

if buy_strong_B1

sell_sig := true, buy_sig := false

//----------------- Ichimoku Signal B2/S2 -----------------

buy_strong_B2 = (TK >= KJ) and close > kumo_high and CS > high[26-1]

sell_strong_S2 = (TK <= KJ) and close < kumo_low and CS < low[26-1]

var buy_sig_B2 = true

var sell_sig_S2 = true

B2_a = buy_strong_B2 and buy_sig_B2

S2_a = sell_strong_S2 and sell_sig_S2

if sell_strong_S2

buy_sig_B2 := true, sell_sig_S2 := false

if buy_strong_B2

sell_sig_S2 := true, buy_sig_B2 := false

//---------------------------- Confluence Signal ----------------------------

long_short_trig = 7 //input(7, type= input.float, title= "Confluence signal trigger Level", step= 0.1)

trig_gap_cbcs = input(2, type= input.float, title= "CB/CS signal sesitivity", minval= 0, maxval= 6, step= 1)

//Indicators

// ma

sma1 = sma(close, 50)

sma2 = sma(close, 200)

ema1 = ema(close, 50)

ema2 = ema(close, 200)

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

rsi = rsi(close, 14)

[diplus, diminus, adx] = dmi(7, 7)

[superTrend, dir] = supertrend(2, 5)

//Klinger Oszillator

sv = change(hlc3) >= 0 ? volume : -volume

kvo = ema(sv, 34) - ema(sv, 55)

sig = ema(kvo, 13)

//Vortex Indicator

VMP = sum( abs( high - low[1]), 14 )

VMM = sum( abs( low - high[1]), 14 )

STR = sum( atr(1), 14 )

VIP = VMP / STR

VIM = VMM / STR

//Signals

var float sma_sig_w = na

var float ema_sig_w = na

var float p_kj_sig_w = na

var float tk_kj_sig_w = na

var float B1_S1_sig_w = na

var float B2_S2_sig_w = na

var float psar_sig_w = na

var float frac_sig_w = na

var float macd_sig_w = na

var float rsi_sig_w = na

var float p_tk_sig_w = na

var float dmi_sig_w = na

var float klin_sig_w = na

var float vort_sig_w = na

var float sup_sig_w = na

if sma1 > sma2

sma_sig_w := 1

else if sma1 < sma2

sma_sig_w := 0

if ema1 > ema2

ema_sig_w := 1

else if ema1 < ema2

ema_sig_w := 0

if close > KJ

p_kj_sig_w := 1

else if close < KJ

p_kj_sig_w := 0

if TK > KJ

tk_kj_sig_w := 1

else if TK < KJ

tk_kj_sig_w := 0

if buy_strong_B1

B1_S1_sig_w := 1

else if sell_strong_S1

B1_S1_sig_w := 0

if buy_strong_B2

B2_S2_sig_w := 1

else if sell_strong_S2

B2_S2_sig_w := 0

if high >= sar(start, inc, max)[0]

psar_sig_w := 1

else if low <= sar(start, inc, max)[0]

psar_sig_w := 0

if high > fractal_up_v

frac_sig_w := 1

else if low < fractal_dn_v

frac_sig_w := 0

if macdLine > signalLine

macd_sig_w := 1

else if macdLine < signalLine

macd_sig_w := 0

if rsi > 50

rsi_sig_w := 1

else if rsi < 50

rsi_sig_w := 0

if close[2] > TK

p_tk_sig_w := 1

else if close[2] < TK

p_tk_sig_w := 0

if diplus > diminus

dmi_sig_w := 1

else if diplus < diminus

dmi_sig_w := 0

if sig > 0

klin_sig_w := 1

else if sig < 0

klin_sig_w := 0

if VIP > VIM

vort_sig_w := 1

else if VIP < VIM

vort_sig_w := 0

if close > superTrend

sup_sig_w := 1

else if close < superTrend

sup_sig_w := 0

bs_conf_sig = sma_sig_w + ema_sig_w + p_kj_sig_w + tk_kj_sig_w + B1_S1_sig_w + B2_S2_sig_w + psar_sig_w + frac_sig_w + macd_sig_w +

rsi_sig_w + dmi_sig_w + klin_sig_w + vort_sig_w + sup_sig_w + p_tk_sig_w

long_c = bs_conf_sig > long_short_trig + trig_gap_cbcs //with +- signal is less fluctuating

short_c = bs_conf_sig < long_short_trig - trig_gap_cbcs

//---------------------------- Pure Ichimoku Confluence Signal ----------------------------

pic_l_s_trig = 4 //input(4, type= input.float, title= "Ichimoku confluence signal trigger Level", step= 0.1)

trig_gap_ibis = input(0, type= input.float, title= "IB/IS signal sesitivity", minval= 0, maxval= 3, step= 1)

//Signals

var float tkkh_sig_w = na

var float csh_sig_w = na

var float cskh_sig_w = na

var float pkj_sig_w = na

var float ptk_sig_w = na

var float tkkj_sig_w = na

var float sasb_sig_w = na

var float ckh_sig_w = na

if TK > kumo_high

tkkh_sig_w := 1

else if TK < kumo_low

tkkh_sig_w := 0

if CS > high[(26-1)]

csh_sig_w := 1

else if CS < low[(26-1)]

csh_sig_w := 0

if CS > kumo_high[26-1]

cskh_sig_w := 1

else if CS < kumo_low[26-1]

cskh_sig_w := 0

if close > TK

ptk_sig_w := 1

else if close < TK

ptk_sig_w := 0

if close > KJ

pkj_sig_w := 1

else if close < KJ

pkj_sig_w := 0

if TK > KJ

tkkj_sig_w := 1

else if TK < KJ

tkkj_sig_w := 0

if SA > SB

sasb_sig_w := 1

else if SA < SB

sasb_sig_w := 0

if close > kumo_high

ckh_sig_w := 1

else if close < kumo_low

ckh_sig_w := 0

bs_pic_sig = tkkh_sig_w + csh_sig_w + cskh_sig_w + ptk_sig_w + pkj_sig_w + tkkj_sig_w + sasb_sig_w + ckh_sig_w

long_pic = bs_pic_sig > pic_l_s_trig + trig_gap_ibis

short_pic = bs_pic_sig < pic_l_s_trig - trig_gap_ibis

//--------------------------- Entry Signal Options ---------------------------

var buy_sig_opt = true

var sell_sig_opt = true

// cross conditions for "Strong" bg's

var bool sasb_x = true

if crossover(SA, SB) and low > kumo_high

sasb_x := true

if crossunder(SA, SB) and high < kumo_low

sasb_x := false

var bool tkkj_x = true

if crossover(TK, KJ) and TK > kumo_high and KJ > kumo_high

tkkj_x := true

if crossunder(TK, KJ) and TK < kumo_low and KJ < kumo_low

tkkj_x := false

// buy signal options

opt_sig_buy =

X_opt == "---" ? na :

X_opt == "Inside Bar sig" ? i_bar_buy :

X_opt == "Outside Bar sig" ? o_bar_buy :

X_opt == "Sandwich Bar sig" ? s_bar_buy :

X_opt == "Bar sig" ? close > high[1] :

X_opt == "SMA50 sig" ? close[2] > sma(close, 50) :

X_opt == "Fractals sig" ? fr_upx :

X_opt == "RSI50 sig" ? rsi_f_buy :

X_opt == "Parabolic SAR sig" ? psar_buy :

X_opt == "SuperTrend sig" ? sup_buy :

X_opt == "Price X Kijun sig" ? close > KJ :

X_opt == "Price X Kumo sig" ? close > kumo_high :

X_opt == "Kumo flip sig" ? SA > SB :

X_opt == "Price filtered Kumo flip sig" ? sasb_x and low > kumo_high :

X_opt == "Chikou X price sig" ? CS > high[(26-1)] :

X_opt == "Chikou X Kumo sig" ? CS > kumo_high[26-1] :

X_opt == "Price X Tenkan sig" ? close > TK :

X_opt == "Tenkan X Kumo sig" ? TK > kumo_high :

X_opt == "Tenkan X Kijun sig" ? TK > KJ :

X_opt == "Kumo filtered Tenkan X Kijun sig" ? tkkj_x and TK > kumo_high and KJ > kumo_high and TK > KJ :

X_opt == "CB/CS sig" ? long_c :

X_opt == "IB/IS sig" ? long_pic :

X_opt == "B1/S1 sig" ? buy_strong_B1 :

X_opt == "B2/S2 sig" ? buy_strong_B2 : na

// sell signal options

opt_sig_sell =

X_opt == "---" ? na :

X_opt == "Inside Bar sig" ? i_bar_sell :

X_opt == "Outside Bar sig" ? o_bar_sell :

X_opt == "Sandwich Bar sig" ? s_bar_sell :

X_opt == "Bar sig" ? close < low[1] :

X_opt == "SMA50 sig" ? close[2] < sma(close, 50) :

X_opt == "Fractals sig" ? fr_dnx :

X_opt == "RSI50 sig" ? rsi_f_sell :

X_opt == "Parabolic SAR sig" ? psar_sell :

X_opt == "SuperTrend sig" ? sup_sell :

X_opt == "Price X Kijun sig" ? close < KJ :

X_opt == "Price X Kumo sig" ? close < kumo_low :

X_opt == "Kumo flip sig" ? SA < SB :

X_opt == "Price filtered Kumo flip sig" ? not sasb_x and high < kumo_low :

X_opt == "Chikou X price sig" ? CS < low[(26-1)] :

X_opt == "Chikou X Kumo sig" ? CS < kumo_high[26-1] :

X_opt == "Price X Tenkan sig" ? close < TK :

X_opt == "Tenkan X Kumo sig" ? TK < kumo_low :

X_opt == "Tenkan X Kijun sig" ? TK < KJ :

X_opt == "Kumo filtered Tenkan X Kijun sig" ? not tkkj_x and TK < kumo_low and KJ < kumo_low and TK < KJ :

X_opt == "CB/CS sig" ? short_c :

X_opt == "IB/IS sig" ? short_pic :

X_opt == "B1/S1 sig" ? sell_strong_S1 :

X_opt == "B2/S2 sig" ? sell_strong_S2 : na

if opt_sig_sell

buy_sig := true, sell_sig_opt := false

if opt_sig_buy

sell_sig := true, buy_sig_opt := false

//---------------------------- Take profit and stop loss ------------------------------

tp_en = input(title= "Enable take profit", type= input.bool, defval= false)

qty_tp = input(50, title= "Take profit - quantity of position (percent)", type= input.float, minval= 1, maxval= 100, step= 5)

tp_ticks = input(1000, title= "Take profit - ticks", type= input.integer, minval= 0, step= 10)

sl_en = input(title= "Enable stop loss", type= input.bool, defval= false)

sl_ticks = input(1000, title= "Stop loss - ticks", type= input.integer, minval= 0, step= 10)

//----------------------- Backtest periode --------------------------------

start_year = input(2018, "Start year")

start_month = input(1, "Start month", minval= 1, maxval= 12)

start_day = input(1, "Start day", minval= 1, maxval= 31)

period_start = timestamp(start_year, start_month, start_day, 0, 0)

stop_year = input(2021, "Stop year")

stop_month = input(12, "Stop month", minval= 1, maxval= 12)

stop_day = input(31, "Stop day", minval= 1, maxval= 31)

period_stop = timestamp(stop_year, stop_month, stop_day, 0, 0)

backtest_period() => time >= period_start and time <= period_stop ? true : false

//--------------------- strategy entry ---------------------

long = entry_type != "Short"

short = entry_type != "Long"

not_both = entry_type != "Both"

if not backtest

if long

strategy.entry("os_buy", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2,

comment= "")

strategy.close("os_buy", when = exit_filter_sell_1 or exit_filter_sell_2 or not_both ? opt_sig_sell : na

, comment= "")

strategy.exit("tpl", "os_buy", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if short

strategy.entry("os_sell",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2,

comment= "")

strategy.close("os_sell", when = exit_filter_buy_1 or exit_filter_buy_2 or not_both ? opt_sig_buy : na

, comment= "")

strategy.exit("tps", "os_sell", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if backtest_period() and backtest

if long

strategy.entry("os_buy", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2)

strategy.close("os_buy", when = exit_filter_sell_1 or exit_filter_sell_2 or not_both ? opt_sig_sell : na)

strategy.exit("tpl", "os_buy", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if short

strategy.entry("os_sell",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2)

strategy.close("os_sell", when = exit_filter_buy_1 or exit_filter_buy_2 or not_both ? opt_sig_buy : na)

strategy.exit("tps", "os_sell", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)