Strategi mengikuti tren multi-kerangka waktu dengan kombinasi indikator STOKER dan SMA

Ringkasan

Strategi ini menggunakan kombinasi indikator Stokke klasik dengan indikator SMA, untuk mencapai kemampuan pelacakan tren yang lebih kuat. Gagasan utama strategi ini adalah menggunakan indikator Stokke untuk mengidentifikasi sinyal arah tren, digabungkan dengan indikator SMA untuk memfilter untuk meningkatkan kualitas sinyal, menggunakan parameter indikator yang diatur dengan mode risiko yang berbeda, untuk mencapai penyesuaian dinamis risiko dan keuntungan.

Prinsip Strategi

- Strategi ini menggunakan Stoker yang diperkuat dengan modifikasi, parameter indikator termasuk% K siklus,% K siklus smoothing,% D siklus smoothing, dengan parameter pengaturan kontrol sensitivitas indikator.

- Parameter indikator SMA terdiri dari SMA titik tinggi dan SMA titik rendah, yang digunakan untuk memfilter sinyal, meningkatkan kualitas sinyal, dan menghindari false breakout.

- Bergantung pada preferensi risiko yang berbeda, strategi ini menawarkan pilihan mode risiko rendah, mode risiko menengah, dan mode risiko tinggi. Mode risiko mempengaruhi parameter silang Stoker, sehingga memungkinkan penyesuaian dinamis risiko dan keuntungan.

- Strategi menilai sinyal posisi panjang untuk penembusan nilai di atas indikator Stoker dan harga penutupan di bawah SMA rendah; menilai sinyal posisi pendek untuk penembusan nilai di bawah indikator Stoker dan harga penutupan di atas SMA tinggi.

- Strategi ini menggunakan modul penilaian dengan memperkenalkan beberapa frame waktu, memverifikasi sinyal dalam berbagai rentang waktu, dan memilih waktu masuk yang lebih optimal untuk mengendalikan risiko perdagangan.

Keunggulan Strategis

- Menggunakan modifikasi untuk memperkuat indeks Stoker, meningkatkan sensitivitas indikator, dan mampu menangkap perubahan pasar dengan cepat.

- Menambahkan mekanisme penyaringan dua jalur indikator SMA, yang dapat secara efektif menyaring sinyal palsu, meningkatkan kualitas sinyal.

- Berbagai model risiko tersedia untuk dipilih, dan pengguna dapat menyesuaikan parameternya secara fleksibel sesuai dengan preferensi risiko mereka sendiri.

- Menambahkan modul penilaian multi-frame time frame, mengoptimalkan pilihan waktu masuk, dan mengurangi risiko transaksi.

- Pengaturan parameter strategi yang masuk akal, penggunaan indikator alami, kerangka kerja keseluruhan yang ilmiah, stabilitas yang baik, dan kemampuan beradaptasi yang kuat.

Risiko Strategis

- Strategi itu sendiri tidak memiliki mekanisme stop loss, yang memerlukan pengaturan stop loss secara manual untuk mengontrol risiko kerugian.

- Sinyal-sinyal strategi sering terjadi, mudah untuk melakukan overtrading dan meningkatkan biaya transaksi.

- Strategi yang lebih sensitif terhadap parameter dan pengaturan modus risiko membutuhkan pengujian optimasi untuk menemukan parameter terbaik.

- Strategi penarikan mungkin lebih besar, tidak cocok untuk operasi penuh, perlu mengontrol ukuran dana perdagangan.

Metode yang sesuai:

- Untuk mengontrol kerugian, Anda harus mengatur stop loss rasio yang masuk akal sesuai dengan volatilitas pasar.

- Sesuai menyesuaikan parameter indikator Stoker untuk mengurangi frekuensi sinyal. Atau mengatur stop-loss minimum untuk mengurangi transaksi yang tidak perlu.

- Disarankan untuk memilih default low-risk mode dan menyesuaikan parameter lain berdasarkan data retrospektif.

- Mengontrol ukuran posisi, membangun posisi secara batch, mengurangi risiko transaksi tunggal.

Arah optimasi strategi

- Uji lengkap parameter Stoker dan SMA untuk menemukan kombinasi parameter optimal.

- Meningkatkan jumlah multiple time frame, memperkaya basis penilaian, dan mengoptimalkan pilihan waktu masuk.

- Masukkan kombinasi indikator stop loss seperti stop loss ATR, yang dapat secara dinamis melacak stop loss, mengurangi risiko.

- Membangun mekanisme penyaringan dan pengesahan sinyal indikator, seperti meningkatkan penilaian indikator volume transaksi, untuk menghindari kebocoran.

- Bergabunglah dengan modul manajemen posisi untuk secara proaktif menyesuaikan posisi Anda sesuai dengan kondisi pasar, mengurangi risiko transaksi satu kali.

Meringkaskan

Strategi ini menggabungkan keuntungan dari indikator Stoker dan indikator SMA, untuk mencapai efek pelacakan tren yang lebih kuat. Kerangka strategi ini masuk akal, indikator digunakan secara alami, dengan mengontrol parameter dan mode risiko mengembalikan sifat indikator, mengoptimalkan stabilitas strategi.

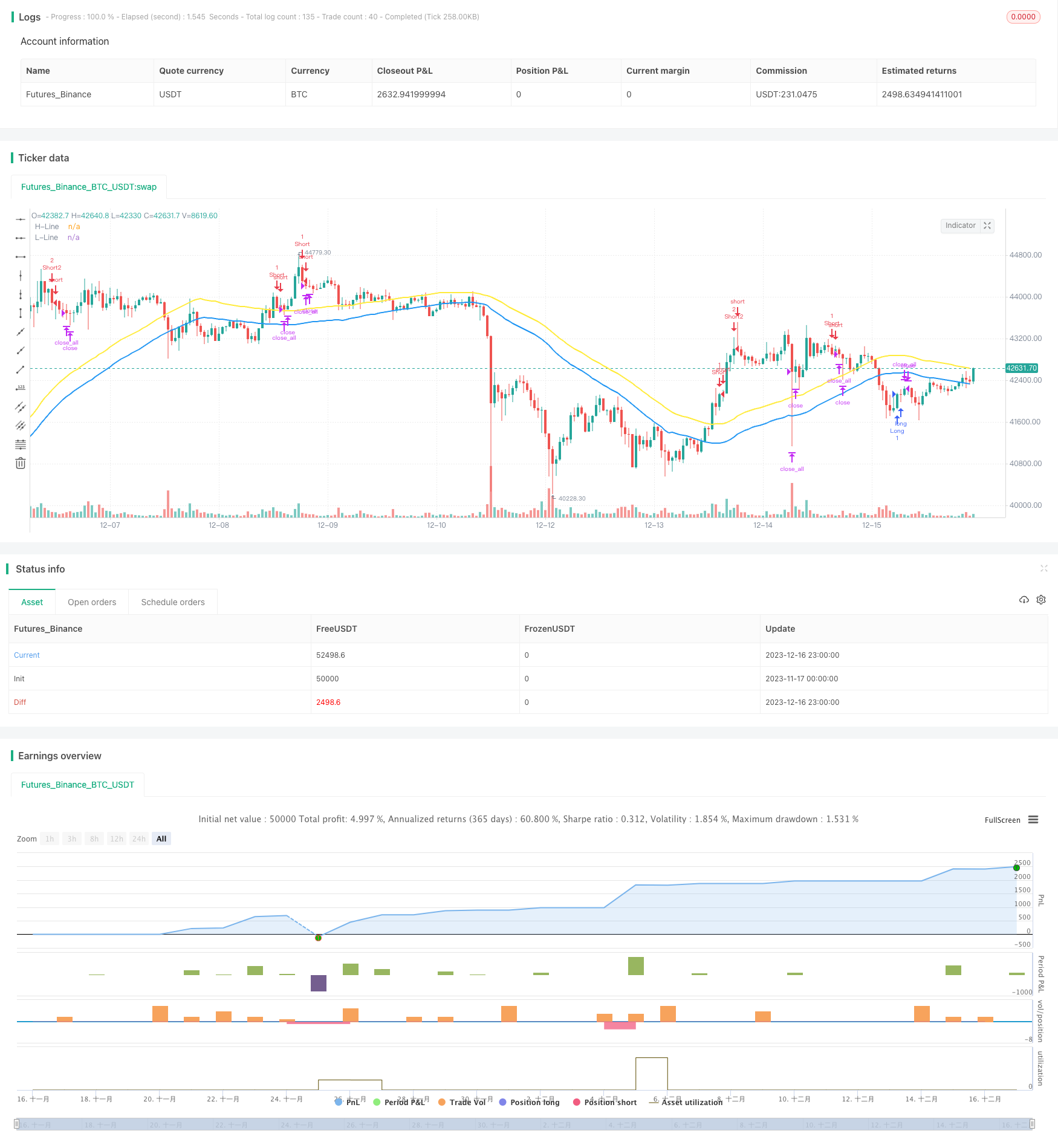

/*backtest

start: 2023-11-17 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//►►►► Description ►►►►

//1. The Original Pine Script

//- Stochastic

//- SMA

//1.1 Concepts

//- Stochastic crossover and crossunder with range 80/20 or 70/30 or 50/50 from your risk you can adjust it from config

//- Confirm Signal by SMA High and Low Original Range is 50 or you can adjust by your self in config Setting

//1.2 Condition

//- Buy Condition = Stochastic crossover Sto Signal Line and SMA Filter <= 20 or 30 or 50 from your risk

//- Sell Condition = Stochastic crossunder Sto Signal Line and SMA Filter >= 80 or 70 or 50 from your risk

//1.3 Idea For Trading

//- Trend Runing If you use "Trend" Mode is Martingale Your Position Until You Have a Profit

//- Scalping You Can Adjust TP for Little Profit and Increase Your Winrate

//►►►► Strategy results ►►►►

// ►► Use an account size ►►

// - For Newbie i recommend try to use 50$ you can test in MT4 Or MT5 Start With 50$ Leverage : 1000

// - For Some User Have a Exp. Trading : 500$ you can use martingale for help your trading

// - For Expert User : 5000$ or 5000$ (Cent) you can use martingale for help your trading

// ►► realistic commission AND slippage ►►

// - Some Broker Not Have a commission for Gold and Forex.

// - slippage : default i'm Setting is 350 point, (it's mean 35 pip) it's average or your account is ECN or Zero Spread You can Set = 0

// ►► Size For Trading ►►

// - This strategy is Start From 0.01 lot and use martingale for next position

// - This not perfect strategy. it's have equity drawdown. just try and test your config you like.

// ►► Sample size Dataset Trading ►►

// - This Strategy Recommend For Long-Term Trading Becuase It's Have Martingale Help Your Next Position

//►►►► strategy's default Properties ►►►►

// - From Default Setting : Slippage or Spread Set = 0 (Becuase I don't know your account spread) you can set in Properties

// ** Some Broeker Are 2 Digits or 3 Digit You Must Set By Your Self (like 35 point or 350 point from your account spread)

// - From Default Setting : commission = 0 (Becuase I don't know your account commission) you can set in Properties

// ** Some Broeker Are not commission for forex and gold

//@version=5

var int slippage = 0

strategy("X48 - DayLight Hunter | Strategy | V.01.03", overlay=true)

var int hedge_mode = 0

var int sto_buy = 0

var int sto_sell = 0

Trade_Mode = input.string(defval = "Trend", title = "⚖️ Mode For Trade [Oneway / Hedge / ⭐Trend]", options = ["Oneway", "Hedge", "Trend"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "Oneway = Switching Position Type With Signal\nHedge Mode = Not Switching Position Type Unitl TP or SL")

Risk_Mode = input.string(defval = "Low Risk", title = "⚖️ Risk Signal Mode [⭐Low / Medium / High]", options = ["Low Risk", "Medium Risk", "High Risk"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "[[Signal Form Stochastic]]\nLow Risk is >= 80 and <= 20\nMedium Risk is >= 70 and <= 30\nHigh Risk is >= 50 and <=50")

if Trade_Mode == "Oneway"

hedge_mode := 0

else if Trade_Mode == "Hedge"

hedge_mode := 1

else if Trade_Mode == "Trend"

hedge_mode := 2

if Risk_Mode == "Low Risk"

sto_buy := 20

sto_sell := 80

else if Risk_Mode == "Medium Risk"

sto_buy := 30

sto_sell := 70

else if Risk_Mode == "High Risk"

sto_buy := 50

sto_sell := 50

periodK = input.int(15, title="%K Length", minval=1, group = "Stochastic Setting", inline = "Sto0")

smoothK = input.int(3, title="%K Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

periodD = input.int(3, title="%D Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

GRSMA = "=== 🧮 SMA Filter Mode ==="

SMA_Mode = input.bool(defval = true, title = "🧮 SMA High and Low Filter Mode", group = GRSMA, tooltip = "Sell Signal With Open >= SMA High\nBuy Signal With Close <= SMA Low")

SMA_High = input.int(defval = 50, title = "SMA High", group = GRSMA, inline = "SMA1")

SMA_Low = input.int(defval = 50, title = "SMA Low", group = GRSMA, inline = "SMA1")

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

high_line = ta.sma(high, SMA_High)

low_line = ta.sma(low, SMA_Low)

plot(SMA_Mode ? high_line : na, "H-Line", color = color.yellow, linewidth = 2)

plot(SMA_Mode ? low_line : na, "L-Line", color = color.blue, linewidth = 2)

entrybuyprice = strategy.position_avg_price

var bool longcondition = na

var bool shortcondition = na

if SMA_Mode == true

longcondition := ta.crossover(k,d) and d <= sto_buy and close < low_line and open < low_line// or ta.crossover(k, 20)// and close <= low_line

shortcondition := ta.crossunder(k,d) and d >= sto_sell and close > high_line and open > high_line// or ta.crossunder(k, 80)// and close >= high_line

else

longcondition := ta.crossover(k,d) and d <= sto_buy

shortcondition := ta.crossunder(k,d) and d >= sto_sell

//longcondition_double = ta.crossover(d,20) and close < low_line// and strategy.position_size > 0

//shortcondition_double = ta.crossunder(d,80) and close > high_line// and strategy.position_size < 0

//=============== TAKE PROFIT and STOP LOSS by % =================

tpsl(percent) =>

strategy.position_avg_price * percent / 100 / syminfo.mintick

GR4 = "=====🆘🆘🆘 TAKE PROFIT & STOP LOSS BY [%] 🆘🆘🆘====="

mode= input.bool(title="🆘 Take Profit & Stop Loss By Percent (%)", defval=true, group=GR4, tooltip = "Take Profit & Stop Loss by % Change\n0 = Disable")

tp_l = tpsl(input.float(0, title='🆘 TP [LONG] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

tp_s = tpsl(input.float(0, title='🆘 TP [SHORT] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

sl = tpsl(input.float(0, title='🆘 Stop Loss % [All Mode / 1st Position]', group=GR4, tooltip = "0 = Disable"))

tp_pnl = input.float(defval = 1, title = "🆘 TakeProfit by PNL ($) eg. (0.1 = 0.1$)", group = GR4, tooltip = "All Mode TP by PNL")

spread_size = input.float(defval = 0.350, title = "🆘 Spread Point Size(Eg. 35 Point or 350 Point From Your Broker Digits)", tooltip = "Spread Point Form Your Broker \nEg. 1920.124 - 1920.135 or 1920.12 - 1920.13\nPlease Check From Your Broker", group = GR4)

GR5 = "===💮💮💮 Hedge / Martingale Mode 💮💮💮==="

//hedge_mode = input.bool(defval = true, title = "⚖️ Hedge / Martingale Mode", group = GR5)

hedge_point = input.int(defval = 500, title = "💯 Hedge Point Range / Martingale Range", group = GR5, tooltip = "After Entry Last Position And Current Price More Than Point Range Are Open New Hedge Position")

hedge_gale = input.float(defval = 2.0, title = "✳️ Martingale For Hedge Multiply [default = 2]", tooltip = "Martingale For Multiply Hedge Order", group = GR5)

hedge_point_size = hedge_point/100

calcStopLossPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else

na

calcStopLossL_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

calcStopLossS_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else

na

calcTakeProfitL_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitS_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

var stoploss = 0.

var stoploss_l = 0.

var stoploss_s = 0.

var takeprofit = 0.

var takeprofit_l = 0.

var takeprofit_s = 0.

var takeprofit_ll = 0.

var takeprofit_ss = 0.

if mode == true

if (strategy.position_size > 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_l := stoploss

else if sl <= 0

stoploss := na

if tp_l > 0

takeprofit := tp_l

takeprofit_ll := close + ((close/100)*tp_l)

//takeprofit_s := na

else if tp_l <= 0

takeprofit := na

if (strategy.position_size < 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_s := stoploss

else if sl <= 0

stoploss := na

if tp_s > 0

takeprofit := tp_s

takeprofit_ss := close - ((close/100)*tp_s)

//takeprofit_l := na

else if tp_s <= 0

takeprofit := na

else if strategy.position_size == 0

stoploss := na

takeprofit := na

//takeprofit_l := calcTakeProfitL_AlertPrice(tp_l)

//takeprofit_s := calcTakeProfitS_AlertPrice(tp_s)

//stoploss_l := calcStopLossL_AlertPrice(sl)

//stoploss_s := calcStopLossS_AlertPrice(sl)

//////////// INPUT BACKTEST RANGE ////////////////////////////////////////////////////

var string BTR1 = '════════⌚⌚ INPUT BACKTEST TIME RANGE ⌚⌚════════'

i_startTime = input(defval = timestamp("01 Jan 1945 00:00 +0000"), title = "Start", inline="timestart", group=BTR1, tooltip = 'Start Backtest YYYY/MM/DD')

i_endTime = input(defval = timestamp("01 Jan 2074 23:59 +0000"), title = "End", inline="timeend", group=BTR1, tooltip = 'End Backtest YYYY/MM/DD')

//////////////// Strategy Alert For X4815162342 BOT //////////////////////

Text_Alert_Future = '{{strategy.order.alert_message}}'

copy_Fu = input( defval= Text_Alert_Future , title="Alert Message for BOT", inline = '00' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It' ,tooltip = 'Alert For X48-BOT > Copy and Paste To Alert Function')

TimeFrame_input = input(defval= 'Input Your TimeFrame [1m, 15m, 1h, 4h, 1d ,1w]' , title="TimeFrame Text Alert", inline = '01' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It', tooltip = "[1m, 15m, 1h, 4h, 1d ,1w]")

string Alert_EntryL = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ll)+' $\n❌ SL : '+str.tostring(stoploss_l)+' $\n⏰ Time : {{timenow}}'

string Alert_EntryS = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ss)+' $\n❌ SL : '+str.tostring(stoploss_s)+' $\n⏰ Time : {{timenow}}'

string Alert_TPSL = '🪙 Asset : {{ticker}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💹 {{strategy.order.comment}}\n💸 Price : {{strategy.order.price}} $\n⏰ Time : {{timenow}}'

if true

if (longcondition and strategy.position_size == 0) or (longcondition and strategy.position_size < 0 and hedge_mode == 0)

strategy.entry("Long", strategy.long, comment = "🌙", alert_message = Alert_EntryL)

//if longcondition_double

// //strategy.cancel_all()

// strategy.entry("Long2", strategy.long, comment = "🌙🌙")

// //strategy.exit("Exit",'Long', qty_percent = 100 , profit = takeprofit, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L")

if (shortcondition and strategy.position_size == 0) or (shortcondition and strategy.position_size > 0 and hedge_mode == 0)

strategy.entry("Short", strategy.short, comment = "👻", alert_message = Alert_EntryS)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S")

//if shortcondition_double

// //strategy.cancel_all()

// strategy.entry("Short2", strategy.short, comment = "👻👻")

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 1

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 1

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

if longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 2

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 2

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

last_price_l = (strategy.opentrades.entry_price(strategy.opentrades - 1) + (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) + spread_size

last_price_s = (strategy.opentrades.entry_price(strategy.opentrades - 1) - (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) - spread_size

current_price = request.security(syminfo.tickerid, "1", close)

current_pricel = request.security(syminfo.tickerid, "1", close) + spread_size

current_prices = request.security(syminfo.tickerid, "1", close) - spread_size

//if mode == true

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚%L", comment_loss = "SL💚%L", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚LL", comment_loss = "SL💚L", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️%S", comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//else if strategy.position_size < 0 and strategy.opentrades > 1

// lastsize = (strategy.position_size) * -1

// lastprofitorder = strategy.openprofit

// if lastprofitorder >= 0.07

// strategy.close_all(comment = "TP❤️️SS", alert_message = Alert_TPSL)

//===================== เรียกใช้ library =========================

import X4815162342/X48_LibaryStrategyStatus/2 as fuLi

//แสดงผล Backtest

show_Net = input.bool(true,'Monitor Profit&Loss', inline = 'Lnet', group = '= PNL MONITOR SETTING =')

position_ = input.string('bottom_center','Position', options = ['top_right','middle_right','bottom_right','top_center','middle_center','bottom_center','middle_left','bottom_left'] , inline = 'Lnet')

size_i = input.string('auto','size', options = ['auto','tiny','small','normal'] , inline = 'Lnet')

color_Net = input.color(color.blue,"" , inline = 'Lnet')

// fuLi.NetProfit_Show(show_Net , position_ , size_i, color_Net )