개요

이 전략은 트렌드 추적 전략으로, RSI, CCI, 브린 벨트와 같은 여러 지표를 통해 다양한 시간 프레임에 대한 트렌드 방향을 판단하고, DCA를 단계적으로 입력하여 트렌드 수익을 추적합니다.

전략 원칙

- 5분, 15분, 30분 시간 프레임에 각각 RSI와 CCI를 계산한다.

- 짧은 주기의 RSI가 특정 값보다 낮으면 긴 주기의 RSI도 특정 값보다 낮을 때 과매매로 판단하고, 짧은 주기의 RSI가 특정 값보다 높으면 긴 주기의 RSI도 특정 값보다 높으면 과매매로 판단한다. CCI 지표 판단 논리는 RSI와 비슷하다.

- 브린띠는 가격의 중간 궤도에서 너무 멀리 떨어져 있는지 판단하는 보조적인 판단 지표입니다.

- 과매매할 때 점진적으로 더 많은 입장을 하고, 과매매할 때 점진적으로 공백 입장을 하고, DCA 효과를 달성한다.

우위 분석

- 다중 시간 프레임 밸런스 판단, 판단 정확도 향상

- DCA 전략, 구매 비용 절감

- 각 주식의 비율을 조정할 수 있고, 위험을 통제할 수 있습니다.

위험 분석

- 가장 좋은 입구를 놓칠 위험이 있습니다.

- 추세 반전 위험

- 잘못된 매개 변수로 인해 과도한 거래 위험

해결책:

- 최적화 변수, 지표 변수 일치 확인

- 더 많은 지표와 함께

- 각 개량 비율을 조정

최적화 방향

- 더 많은 조합을 테스트하여 최적의 조합을 찾습니다.

- 한 개당 양 비율에 최적화

- 더 많은 손실을 막는 전략

요약하다

이 전략은 다중 시간 프레임 RSI와 CCI를 통해 트렌드 방향을 판단하고, 과매매 할 때 단편적으로 DCA 입주를 하고, 시장 상황이 큰 방향성이 나타나면 트렌드 수익을 추적하는 효과가 좋습니다. 그러나 매개 변수 설정이 부적절할 경우 과도한 거래가 발생할 수 있습니다. 전체적으로 이 전략은 매개 변수 및 스톱 손실 최적화 공간이 크며, 최적화 된 후 더 나은 효과를 얻을 수 있습니다.

전략 소스 코드

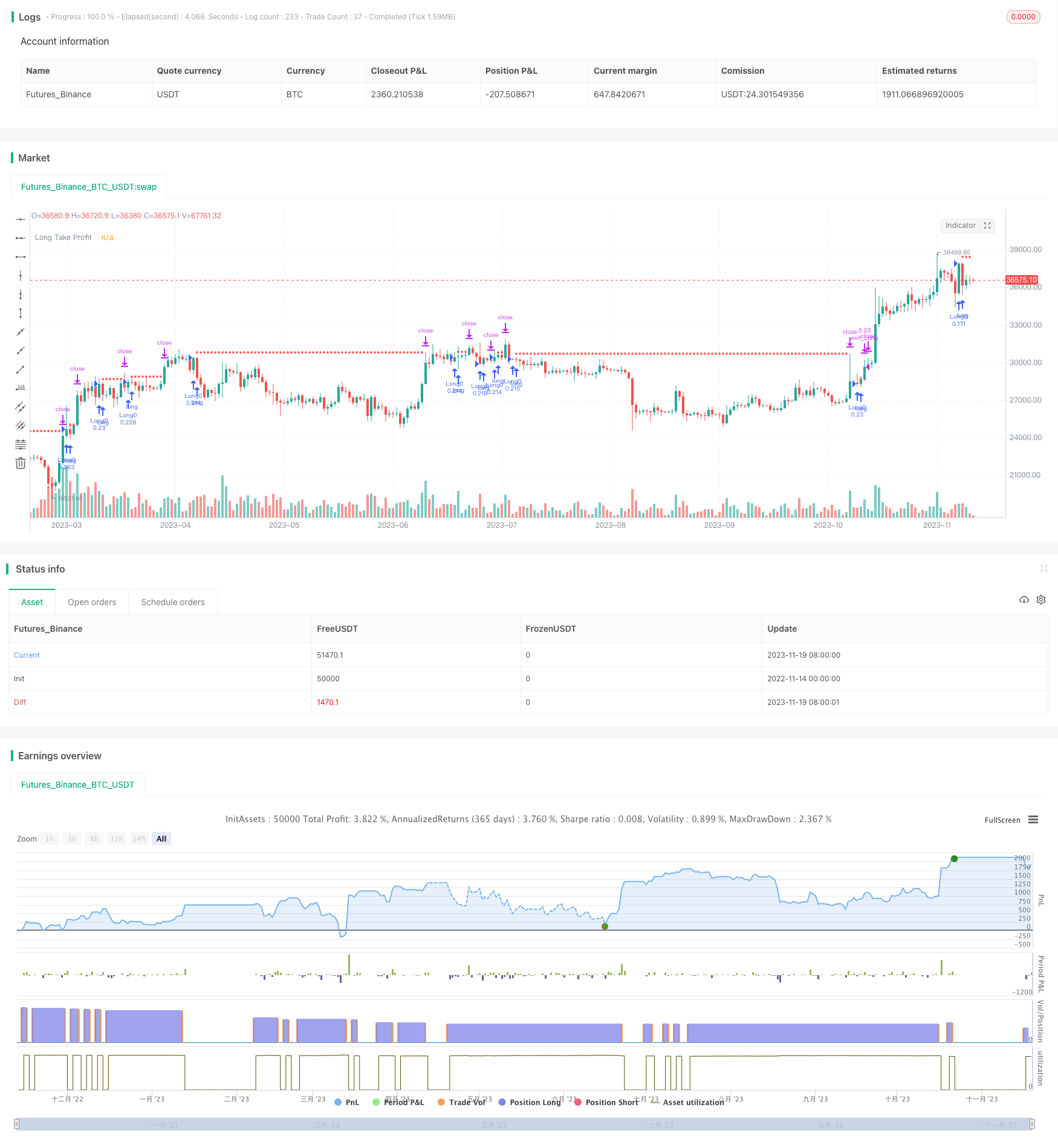

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rrolik66

//@version=5

strategy(title="3RSI 3CCI BB 5orders DCA strategy+", overlay=true )

start_time = input(defval=timestamp('01 January 2021 00:00'), title='Start Time')

end_time = input(defval=timestamp('01 January 2022 00:00'), title='End Time')

src_bot = input.source(close, 'Source Bot')

tradeDirection = input.string(title='Trade Direction', options=['Long Bot', 'Short Bot'], defval='Long Bot')

weight_order0 = input.float(13.03, title='1 order (%)', group='weight of orders in %', inline='Input 0') * 0.01

weight_order1 = input.float(14.29, title='2 order (%)', group='weight of orders in %', inline='Input 0') * 0.01

weight_order2 = input.float(17.19, title='3 order (%)', group='weight of orders in %', inline='Input 1') * 0.01

weight_order3 = input.float(22.67, title='4 order (%)', group='weight of orders in %', inline='Input 1') * 0.01

weight_order4 = input.float(32.80, title='5 order (%)', group='weight of orders in %', inline='Input 2') * 0.01

st_long_orders = input.float(title='Rate cover (%)', minval=1, defval=80, group='Long Bot', inline='Input 1') / 4 * 0.01

longTakeProfit = input.float(1.4, step=0.05, title='Take Profit (%)', group='Long Bot', inline='Input 1') * 0.01

entry_long_SL = input.bool(defval=false, title='StopLoss', group='Long Bot', inline='Input 2')

longStopLoss = input.float(80, step=0.1, title='for Long Bot (%)', group='Long Bot', inline='Input 2') * 0.01

st_short_orders = input.float(title='Rate cover (%)', minval=1, defval=500, group='Short Bot', inline='Input 1') / 4 * 0.01

shortTakeProfit = input.float(1.4, step=0.05, title='Take Profit (%)', group='Short Bot', inline='Input 1') * 0.01

entry_short_SL = input.bool(defval=false, title='StopLoss', group='Short Bot', inline='Input 2')

shortStopLoss = input.float(500, step=0.1, title='for Short Bot (%)', group='Short Bot', inline='Input 2') * 0.01

//inputs for indicators

src = input.source(close, 'Source', group='indicators')

rsi1_input = input.bool(defval=true, title='RSI-1', group='RSI-1', inline='Input 0')

rsi1_res = input.timeframe(title='resolution', defval='5', group='RSI-1', inline='Input 0')

rsi1_low = input.int(65, minval=0, maxval=100, title='long <', group='RSI-1', inline='Input 1')

rsi1_len_long = input.int(14, minval=1, title='Length', group='RSI-1', inline='Input 1')

rsi1_up = input.int(37, minval=0, maxval=100, title='short >', group='RSI-1', inline='Input 2')

rsi1_len_short = input.int(14, minval=1, title='Length', group='RSI-1', inline='Input 2')

rsi2_input = input.bool(defval=true, title='RSI-2', group='RSI-2', inline='Input 0')

rsi2_res = input.timeframe(title='resolution', defval='15', group='RSI-2', inline='Input 0')

rsi2_low = input.int(72, minval=0, maxval=100, title='long <', group='RSI-2', inline='Input 1')

rsi2_len_long = input.int(14, minval=1, title='Length', group='RSI-2', inline='Input 1')

rsi2_up = input.int(37, minval=0, maxval=100, title='short >', group='RSI-2', inline='Input 2')

rsi2_len_short = input.int(14, minval=1, title='Length', group='RSI-2', inline='Input 2')

rsi3_input = input.bool(defval=true, title='RSI-3', group='RSI-3', inline='Input 0')

rsi3_res = input.timeframe(title='resolution', defval='30', group='RSI-3', inline='Input 0')

rsi3_low = input.int(74, minval=0, maxval=100, title='long <', group='RSI-3', inline='Input 1')

rsi3_len_long = input.int(14, minval=1, title='Length', group='RSI-3', inline='Input 1')

rsi3_up = input.int(34, minval=0, maxval=100, title='short >', group='RSI-3', inline='Input 2')

rsi3_len_short = input.int(14, minval=1, title='Length', group='RSI-3', inline='Input 2')

cci1_input = input.bool(defval=true, title='CCI-1', group='CCI-1', inline='Input 0')

cci1_res = input.timeframe(title='resolution', defval='5', group='CCI-1', inline='Input 0')

cci1_low = input.int(190, step=5, title='long <', group='CCI-1', inline='Input 1')

cci1_len_long = input.int(20, minval=1, title='Length', group='CCI-1', inline='Input 1')

cci1_up = input.int(-175, step=5, title='short >', group='CCI-1', inline='Input 2')

cci1_len_short = input.int(20, minval=1, title='Length', group='CCI-1', inline='Input 2')

cci2_input = input.bool(defval=true, title='CCI-2', group='CCI-2', inline='Input 0')

cci2_res = input.timeframe(title='resolution', defval='15', group='CCI-2', inline='Input 0')

cci2_low = input.int(195, step=5, title='long <', group='CCI-2', inline='Input 1')

cci2_len_long = input.int(20, minval=1, title='Length', group='CCI-2', inline='Input 1')

cci2_up = input.int(-205, step=5, title='short >', group='CCI-2', inline='Input 2')

cci2_len_short = input.int(20, minval=1, title='Length', group='CCI-2', inline='Input 2')

cci3_input = input.bool(defval=true, title='CCI-3', group='CCI-3', inline='Input 0')

cci3_res = input.timeframe(title='resolution', defval='30', group='CCI-3', inline='Input 0')

cci3_low = input.int(200, step=5, title='long <', group='CCI-3', inline='Input 1')

cci3_len_long = input.int(20, minval=1, title='Length', group='CCI-3', inline='Input 1')

cci3_up = input.int(-220, step=5, title='short >', group='CCI-3', inline='Input 2')

cci3_len_short = input.int(20, minval=1, title='Length', group='CCI-3', inline='Input 2')

bb_input = input.bool(defval=false, title='BB', group='Bollinger Bands', tooltip='(for long trading) the price is below the lower band, (for short trading) the price is abowe the upper band, для лонга цена под нижней линией, для шорта цена над верхней линией', inline='Input 0')

bb_res = input.timeframe(title='resolution', defval='5', group='Bollinger Bands', inline='Input 0')

bb_dev = input.float(2.0, minval=0.1, maxval=50, step=0.1, title='Deviation', group='Bollinger Bands', inline='Input 2')

bb_len = input.int(20, minval=1, title='Length', group='Bollinger Bands', inline='Input 2')

cci_input = input.bool(defval=false, title='band CCI', group='band CCI', tooltip='this setting sets the trading range by the level of the "CCI" indicator, эта настройка задает диапазон торговли по уровню индикатора "CCI" (я не использую)', inline='Input 0')

cci_res = input.timeframe(title='resolution', defval='60', group='band CCI', inline='Input 0')

cci_len = input.int(20, minval=1, title='CCI Length', group='band CCI', inline='Input 1')

cci_low = input.int(-110, step=10, title='CCI >', group='band CCI', inline='Input 2')

cci_up = input.int(110, step=10, title='CCI <', group='band CCI', inline='Input 2')

show_signals = input.bool(defval=false, title='Show signals', inline='Input')

//Input to trading conditions

longOK = tradeDirection == 'Long Bot'

shortOK = tradeDirection == 'Short Bot'

within_window() => true

// get indicators

rsi1_sec_long = request.security(syminfo.tickerid, rsi1_res, ta.rsi(src, rsi1_len_long))

rsi1_sec_short = request.security(syminfo.tickerid, rsi1_res, ta.rsi(src, rsi1_len_short))

rsi2_sec_long = request.security(syminfo.tickerid, rsi2_res, ta.rsi(src, rsi2_len_long))

rsi2_sec_short = request.security(syminfo.tickerid, rsi2_res, ta.rsi(src, rsi2_len_short))

rsi3_sec_long = request.security(syminfo.tickerid, rsi3_res, ta.rsi(src, rsi3_len_long))

rsi3_sec_short = request.security(syminfo.tickerid, rsi3_res, ta.rsi(src, rsi3_len_short))

cci1_sec_long = request.security(syminfo.tickerid, cci1_res, ta.cci(src, cci1_len_long))

cci1_sec_short = request.security(syminfo.tickerid, cci1_res, ta.cci(src, cci1_len_short))

cci2_sec_long = request.security(syminfo.tickerid, cci2_res, ta.cci(src, cci2_len_long))

cci2_sec_short = request.security(syminfo.tickerid, cci2_res, ta.cci(src, cci2_len_short))

cci3_sec_long = request.security(syminfo.tickerid, cci3_res, ta.cci(src, cci3_len_long))

cci3_sec_short = request.security(syminfo.tickerid, cci3_res, ta.cci(src, cci3_len_short))

[basis, upper_bb, lower_bb] = request.security(syminfo.tickerid, bb_res, ta.bb(src, bb_len, bb_dev))

cci_sec = request.security(syminfo.tickerid, cci_res, ta.cci(src, cci_len))

// calculate indicators

float rating_long = 0

float rating_long_num = 0

float rating_short = 0

float rating_short_num = 0

float rsi1_long = na

float rsi1_short = na

if not na(rsi1_sec_long) and rsi1_input and longOK

rsi1_long := rsi1_sec_long < rsi1_low ? 1 : 0

if not na(rsi1_sec_short) and rsi1_input and shortOK

rsi1_short := rsi1_sec_short > rsi1_up ? 1 : 0

if not na(rsi1_long)

rating_long += rsi1_long

rating_long_num += 1

if not na(rsi1_short)

rating_short += rsi1_short

rating_short_num += 1

float rsi2_long = na

float rsi2_short = na

if not na(rsi2_sec_long) and rsi2_input and longOK

rsi2_long := rsi2_sec_long < rsi2_low ? 1 : 0

if not na(rsi2_sec_short) and rsi2_input and shortOK

rsi2_short := rsi2_sec_short > rsi2_up ? 1 : 0

if not na(rsi2_long)

rating_long += rsi2_long

rating_long_num += 1

if not na(rsi2_short)

rating_short += rsi2_short

rating_short_num += 1

float rsi3_long = na

float rsi3_short = na

if not na(rsi3_sec_long) and rsi3_input and longOK

rsi3_long := rsi3_sec_long < rsi3_low ? 1 : 0

if not na(rsi3_sec_short) and rsi3_input and shortOK

rsi3_short := rsi3_sec_short > rsi3_up ? 1 : 0

if not na(rsi3_long)

rating_long += rsi3_long

rating_long_num += 1

if not na(rsi3_short)

rating_short += rsi3_short

rating_short_num += 1

float cci1_long = na

float cci1_short = na

if not na(cci1_sec_long) and cci1_input and longOK

cci1_long := cci1_sec_long < cci1_low ? 1 : 0

if not na(cci1_sec_short) and cci1_input and shortOK

cci1_short := cci1_sec_short > cci1_up ? 1 : 0

if not na(cci1_long)

rating_long += cci1_long

rating_long_num += 1

if not na(cci1_short)

rating_short += cci1_short

rating_short_num += 1

float cci2_long = na

float cci2_short = na

if not na(cci2_sec_long) and cci2_input and longOK

cci2_long := cci2_sec_long < cci2_low ? 1 : 0

if not na(cci2_sec_short) and cci2_input and shortOK

cci2_short := cci2_sec_short > cci2_up ? 1 : 0

if not na(cci2_long)

rating_long += cci2_long

rating_long_num += 1

if not na(cci2_short)

rating_short += cci2_short

rating_short_num += 1

float cci3_long = na

float cci3_short = na

if not na(cci3_sec_long) and cci3_input and longOK

cci3_long := cci3_sec_long < cci3_low ? 1 : 0

if not na(cci3_sec_short) and cci3_input and shortOK

cci3_short := cci3_sec_short > cci3_up ? 1 : 0

if not na(cci3_long)

rating_long += cci3_long

rating_long_num += 1

if not na(cci3_short)

rating_short += cci3_short

rating_short_num += 1

float bb_long = na

float bb_short = na

if not(na(lower_bb) or na(src) or na(src[1])) and bb_input and longOK

bb_long := src < lower_bb ? 1 : 0

if not(na(upper_bb) or na(src) or na(src[1])) and bb_input and shortOK

bb_short := src > upper_bb ? 1 : 0

if not na(bb_long)

rating_long += bb_long

rating_long_num += 1

if not na(bb_short)

rating_short += bb_short

rating_short_num += 1

float cci_band = na

if not na(cci_sec) and cci_input

cci_band := cci_sec < cci_up and cci_sec > cci_low ? 1 : 0

if not na(cci_band)

rating_long += cci_band

rating_long_num += 1

rating_short += cci_band

rating_short_num += 1

//Buy Sell

Buy_ok = rating_long_num != 0 and longOK ? rating_long == rating_long_num : true

Sell_ok = rating_short_num != 0 and shortOK ? rating_short == rating_short_num : true

// Plotting

plotshape(Buy_ok and show_signals and longOK, title='Buy', text='Long', textcolor=color.new(color.white, 0), style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

plotshape(Sell_ok and show_signals and shortOK, title='Sell', text='Short', textcolor=color.new(color.white, 0), style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

strategy.initial_capital =50000

//Figure in entry orders price

longEntryPrice0 = src_bot

longEntryPrice1 = longEntryPrice0 * (1 - st_long_orders)

longEntryPrice2 = longEntryPrice0 * (1 - st_long_orders * 2)

longEntryPrice3 = longEntryPrice0 * (1 - st_long_orders * 3)

longEntryPrice4 = longEntryPrice0 * (1 - st_long_orders * 4)

longEntryqty0 = strategy.initial_capital * weight_order0 / longEntryPrice0

longEntryqty1 = strategy.initial_capital * weight_order1 / longEntryPrice1

longEntryqty2 = strategy.initial_capital * weight_order2 / longEntryPrice2

longEntryqty3 = strategy.initial_capital * weight_order3 / longEntryPrice3

longEntryqty4 = strategy.initial_capital * weight_order4 / longEntryPrice4

shortEntryPrice0 = src_bot

shortEntryPrice1 = shortEntryPrice0 * (1 + st_short_orders)

shortEntryPrice2 = shortEntryPrice0 * (1 + st_short_orders * 2)

shortEntryPrice3 = shortEntryPrice0 * (1 + st_short_orders * 3)

shortEntryPrice4 = shortEntryPrice0 * (1 + st_short_orders * 4)

shortcontracts = strategy.initial_capital / shortEntryPrice0

shortEntryqty0 = shortcontracts * weight_order0

shortEntryqty1 = shortcontracts * weight_order1

shortEntryqty2 = shortcontracts * weight_order2

shortEntryqty3 = shortcontracts * weight_order3

shortEntryqty4 = shortcontracts * weight_order4

long_entry_price = strategy.opentrades.entry_price (0)

short_entry_price = strategy.opentrades.entry_price (0)

longTP = strategy.position_avg_price * (1 + longTakeProfit)

longSL = long_entry_price * (1 - longStopLoss)

shortTP = strategy.position_avg_price * (1 - shortTakeProfit)

shortSL = short_entry_price * (1 + shortStopLoss)

plot(series=strategy.position_size > 0 and longOK ? longTP : na, color=color.new(color.red, 0), style=plot.style_circles, linewidth=3, title='Long Take Profit')

plot(series=strategy.position_size > 0 and entry_long_SL and longOK ? longSL : na, color=color.new(color.black, 0), style=plot.style_circles, linewidth=1, title='Long Stop Loss')

plot(series=strategy.position_size < 0 and shortOK ? shortTP : na, color=color.new(color.green, 0), style=plot.style_circles, linewidth=3, title='Long Take Profit')

plot(series=strategy.position_size < 0 and entry_short_SL and shortOK ? shortSL : na, color=color.new(color.black, 0), style=plot.style_circles, linewidth=1, title='Long Stop Loss')

// Submit entry orders

if strategy.opentrades == 0 and longOK and within_window()

strategy.order(id='Long0', direction=strategy.long, qty=longEntryqty0, limit=longEntryPrice0, when=Buy_ok)

strategy.order(id='Long1', direction=strategy.long, qty=longEntryqty1, limit=longEntryPrice1, when=Buy_ok)

strategy.order(id='Long2', direction=strategy.long, qty=longEntryqty2, limit=longEntryPrice2, when=Buy_ok)

strategy.order(id='Long3', direction=strategy.long, qty=longEntryqty3, limit=longEntryPrice3, when=Buy_ok)

strategy.order(id='Long4', direction=strategy.long, qty=longEntryqty4, limit=longEntryPrice4, when=Buy_ok)

if strategy.opentrades == 0 and shortOK and within_window()

strategy.order(id='Short0', direction=strategy.short, qty=shortEntryqty0, limit=shortEntryPrice0, when=Sell_ok)

strategy.order(id='Short1', direction=strategy.short, qty=shortEntryqty1, limit=shortEntryPrice1, when=Sell_ok)

strategy.order(id='Short2', direction=strategy.short, qty=shortEntryqty2, limit=shortEntryPrice2, when=Sell_ok)

strategy.order(id='Short3', direction=strategy.short, qty=shortEntryqty3, limit=shortEntryPrice3, when=Sell_ok)

strategy.order(id='Short4', direction=strategy.short, qty=shortEntryqty4, limit=shortEntryPrice4, when=Sell_ok)

// exit position

if (strategy.position_size > 0) and not entry_long_SL and longOK

strategy.exit(id='exit_Long', limit=longTP, qty=strategy.position_size, when=strategy.position_size[1] > 0)

if (strategy.position_size > 0) and entry_long_SL and longOK

strategy.exit(id='exit_Long', limit=longTP, stop=longSL, qty=strategy.position_size, when=strategy.position_size[1] > 0)

if (strategy.position_size < 0) and not entry_short_SL and shortOK

strategy.exit(id='exit_Short', limit=shortTP, qty=math.abs(strategy.position_size), when=strategy.position_size[1] < 0)

if (strategy.position_size < 0) and entry_short_SL and shortOK

strategy.exit(id='exit_Short', limit=shortTP, stop=shortSL, qty=math.abs(strategy.position_size), when=strategy.position_size[1] < 0)

// Cleanup

if ta.crossunder(strategy.opentrades, 0.5)

strategy.close_all()

strategy.cancel_all()