概述

本策略的核心思想是利用随机数模拟硬币掷色子等概率事件,根据事件结果决定做多头或空头,从而实现随机交易。这种交易策略可以用于模拟测试,也可以作为基础框架用于更复杂的策略开发。

策略原理

通过

flip变量模拟随机事件,根据coinLabel随机数大小决定做多或做空。利用

risk和ratio设置止损止盈线。按照设置的最大周期数随机触发下一次交易信号。

通过

plotBox变量控制是否显示平仓盒。stoppedOut和takeProfit变量用于检测止损或止盈。提供回测功能测试策略表现。

优势分析

代码结构清晰,易于理解和二次开发。

UI交互友好,各种参数都可以通过图形界面调整。

随机性强,不受市场波动影响,可靠性高。

可通过参数优化获得更好的收益回报率。

可作为其他策略演示或测试使用。

风险分析

随机交易无法对市场进行判断,存在一定盈利风险。

无法确定最佳参数组合,需要反复测试。

存在因随机信号过于密集而可能带来的超级相关风险。

建议结合止损止盈机制以控制风险。

可通过适当延长交易间隔来降低风险。

优化方向

结合更复杂因子产生随机信号。

增加交易品种,扩大测试范围。

优化 UI 交互,增加策略控制功能。

提供更多测试工具和指标,便于参数优化。

可作为交易信号或止损止盈组件加入到其他策略。

总结

本策略总体框架完整,基于随机事件产生交易信号,可靠性较高。同时提供了参数调整、回测以及绘图功能。既可以用来测试新手开发策略,也可作为其他策略的基础模块。通过适当优化,可以使策略表现更加突出。

策略源码

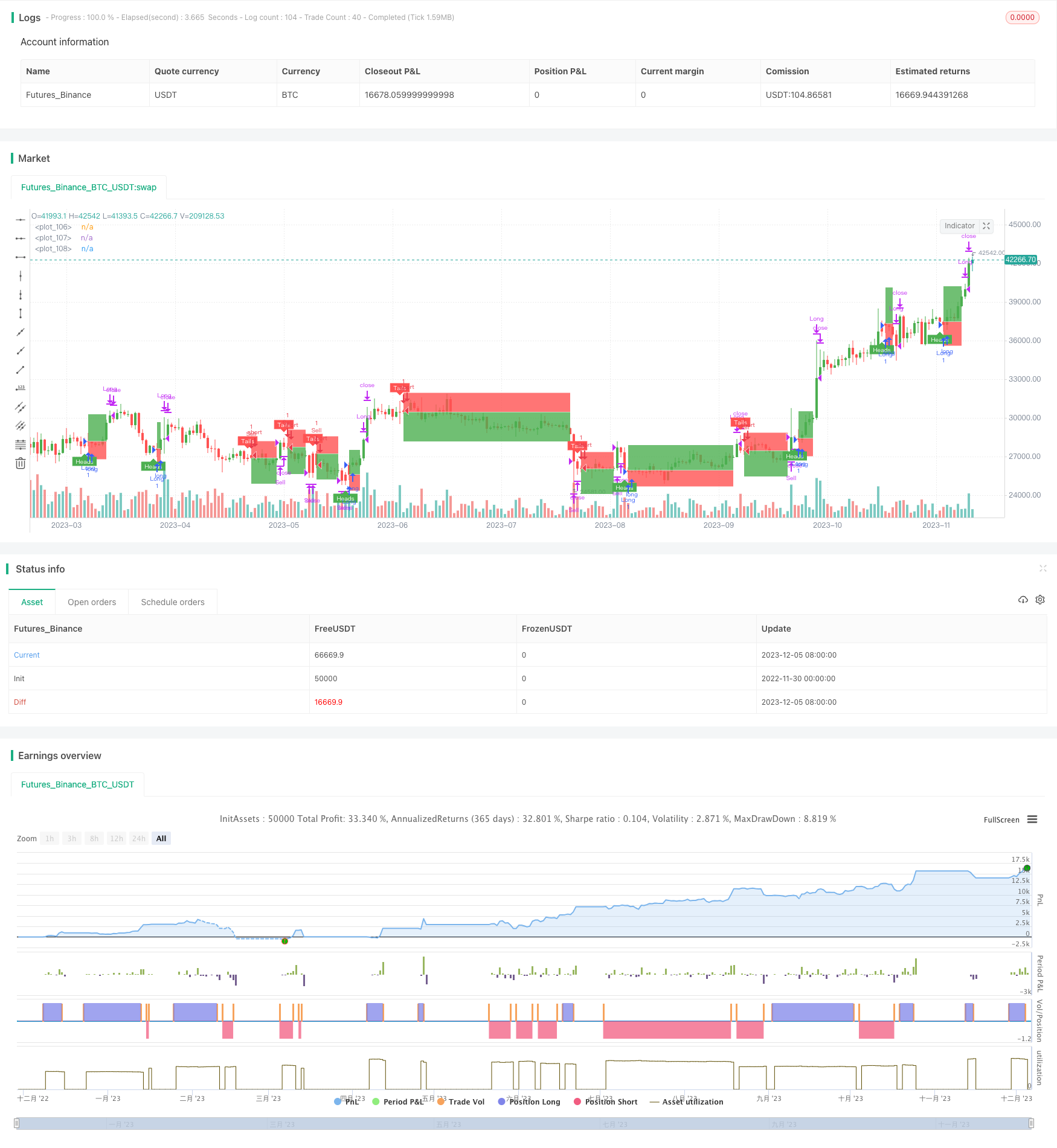

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © melodicfish

//@version=4

strategy("Coin Flipper Pro",overlay=true,max_bars_back=100)

// ======= User Inputs variables=========

h1=input(title="------- Trade Activity -------",defval=false)

maxBars=input(25.0,title="Max Bars between Coin Filps",step=1.0,minval=4.0)

h2=input(title="------- Position Settings -------",defval=false)

risk=input(defval=5.0,title="Risk in % ",type=input.float, minval=0.001 ,step=0.1)

ratio= input(defval=1.5,title="Risk to Reward Ratio x:1 ",type=input.float, minval=0.001,step=0.1)

h3=input(title="------- Plot Options -------",defval=false)

showBox=input(defval=true, title="Show Position Boxes")

h4=input(title="------- Back Testing -------",defval=false)

runTest=input(defval=true, title="Run Strategy Back Test")

customTime=input(defval=false, title="Use Custom Date Range for back test")

tsYear = input(2021,minval=1000,maxval=9999,title= "Test Start Year")

tsMonth = input(1,minval=1,maxval=12,title= "Test Start Month")

tsDay = input(1,minval=1,maxval=31,title= "Test Start Day")

start = timestamp(tsYear,tsMonth,tsDay,0,0)

teYear = input(2021,minval=1000,maxval=9999,title= "Test Stop Year")

teMonth = input(5,minval=1,maxval=12,title= "Test Stop Month")

teDay = input(1,minval=1,maxval=31,title= "Test Stop Day")

end = timestamp(teYear,teMonth,teDay,0,0)

// ======= variables =========

var barsBetweenflips=25

var coinFlipResult=0.0

var flip=true

var coinLabel=0.0

var stoppedOut= true

var takeProfit=true

var posLive=false

var p1=0.0

var p2=0.0

var p3=0.0

var plotBox=false

var posType=0

long=false

short=false

// ===== Functions ======

getColor() =>

round(random(1,255))

// ===== Logic ========

if barssince(flip==true)>barsBetweenflips and posLive==false

flip:=true

coinLabel:=random(1,10)

// Candle Colors

candleColor= flip==true and flip[1]==false and barstate.isconfirmed==false?color.rgb(getColor(),getColor(),getColor(),0):flip==false and close>=open?color.green:color.red

candleColor:= barstate.ishistory==true and close>=open?color.green: barstate.ishistory==true and close<open? color.red:candleColor

barcolor(candleColor)

if flip[1]==true and posLive==false

flip:=false

barsBetweenflips:=round(random(3,round(maxBars)))

posLive:=true

long:= flip[1]==true and coinLabel[1]>=5.0

short:= flip[1]==true and coinLabel[1]<5.0

// Calculate Position Boxes

if long==true and posType!=1

riskLDEC=1-(risk/100)

p1:= close[1]*(1+((risk/100)*ratio)) // TargetLine

p2:=close[1]

p3:= close[1]*riskLDEC // StopLine

plotBox:=true

posType:=1

if short==true and posType!=-1

riskSDEC=1-((risk*ratio)/100)

p1:= close[1]*riskSDEC // TargetLine

p2:=close[1]

p3:= close[1]*(1+(risk/100)) // StopLine

plotBox:=true

posType:=-1

// Check Trade Status

stoppedOut:= posType==1 and long==false and low<= p3? true: posType==-1 and short==false and high>=p3? true: false

takeProfit:= posType==1 and long == false and high>= p1? true: posType==-1 and short==false and low<=p1? true: false

if stoppedOut==true or takeProfit==true

posType:=0

plotBox:=false

posLive:=false

// ====== Plots ========

plot1=plot(plotBox and showBox? p1:na,style=plot.style_linebr,color=color.white, transp= 100)

plot2=plot(plotBox and showBox? p2:na,style=plot.style_linebr,color=color.white, transp= 100)

plot3=plot(plotBox and showBox? p3:na,style=plot.style_linebr,color=color.white, transp= 100)

fill(plot1,plot2,color= color.green)

fill(plot2,plot3,color= color.red)

plotshape(flip==true and flip[1]==false and coinLabel>=5.0,style=shape.labelup,location=location.belowbar, color=color.green,size=size.tiny,title="short label",text="Heads",textcolor=color.white)

plotshape(flip==true and flip[1]==false and coinLabel<5.0,style=shape.labeldown,location=location.abovebar, color=color.red,size=size.tiny,title="short label",text="Tails",textcolor=color.white)

if stoppedOut==true

label.new(bar_index-1, p3, style=label.style_xcross, color=color.orange)

if takeProfit==true

label.new(bar_index-1, p1, style=label.style_flag, color=color.blue)

if runTest==true and customTime==false or runTest==true and customTime==true and time >= start and time <= end

strategy.entry("Sell", strategy.short,when=short==true)

strategy.close("Sell", comment="Close Short", when=stoppedOut==true or takeProfit==true)

strategy.entry("Long", strategy.long,when=long==true)

strategy.close("Long",comment="Close Long", when= stoppedOut==true or takeProfit==true )